David F. Larcker is the James Irvin Miller Professor of Accounting and Brian Tayan is a Researcher at the Stanford Graduate School of Business. This post is based on their recent working paper.

We recently published a paper on SSRN (“Boeing 737 MAX”) that examines the organizational, leadership, and cultural breakdowns that contributed to the failure of the Boeing 737 MAX aircraft.

In November 2018, a Boeing 737 MAX airplane crashed off the coast of Indonesia, killing all 189 passengers and crew members. Four months later, a second 737 MAX flying from Ethiopia to Nairobi crashed, killing 157 individuals. Government authorities around the globe grounded the aircraft. Approximately 400 737 MAX were in operation and over 4,000 in production or on order at the time.

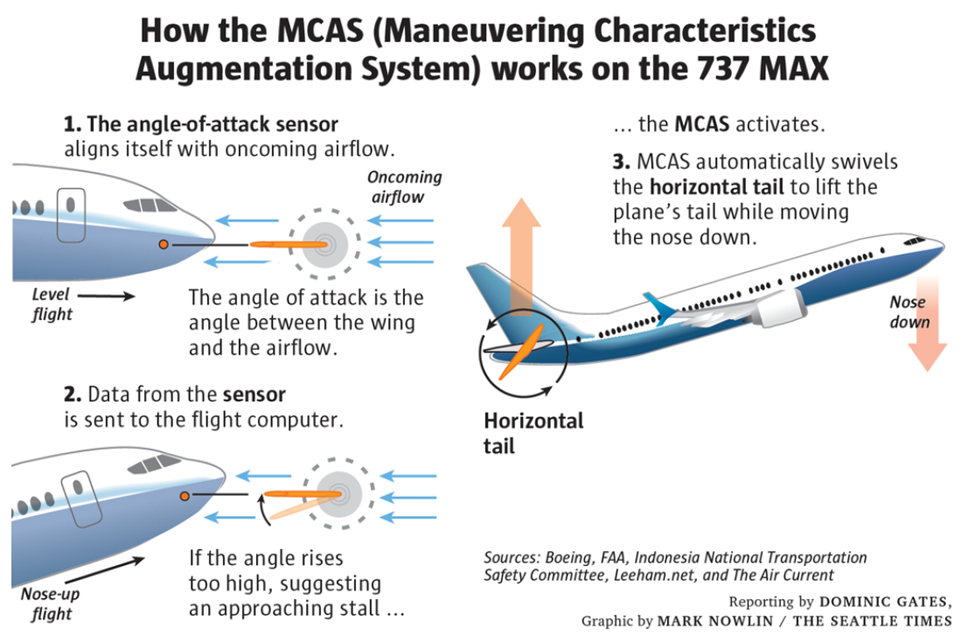

Boeing conceived of the 737 MAX as a cost-efficient means of competing with the Airbus A320neo, a recently introduced mid-sized aircraft that offered superior fuel-efficiency and was quickly taking market share. Rather than develop a competitive model from scratch, the company decided to redesign its flagship 737 model with larger engines. A redesign offered the advantages of simplified regulatory approval, reduced time-to-market, and less pilot training. To counter the risk that a more powerful engine could suddenly drive up the nose of the aircraft, the 737 MAX included an automatic stall-prevention system—a feature new to commercial aircraft—to force the nose of the plane downward. The stall-prevention system relied on an external sensor to measure the angle of the plane. If the sensor failed, a warning light would activate and the pilots were instructed to reduce power.

Investigators pinpointed a repeated failure of the external sensor as the cause of both crashes. In both cases, the automatic stabilization system activated multiple times based on erroneous data from the sensor about the plane’s angle. The crew of both aircraft were unable to successfully override the stabilization system, resulting in fatal accidents.

Complexity of Aircraft Manufacturing

Commercial aircraft are incredibly complex in design and construction. They are also rigorously tested throughout design and production and thoroughly maintained over their lifetime to ensure safety.

The complexity of commercial aircraft arises from the number and interaction of its parts. A typical aircraft has 4 million parts, the fuselage alone consisting of 350,000. While, in the case of Boeing, the fuselage is manufactured in the U.S., the company relies on major contractors to independently construct such components as the engine, wings, rudders, flaps, tail section and landing gear in separate locations around the world, which are then flown to the U.S. for final assembly.

Aircraft complexity has increased significantly in recent years because of the greater use and interconnectivity of software-based systems. While these systems improve performance, they increase the complexity of design, making failure more difficult to predict and requiring additional verification and testing. The use of software-based systems also requires collaboration across engineering disciplines among individuals with different training, backgrounds, and expertise.

Commercial aircraft rely on multiple layers of protection and the redundancy of critical systems to ensure their safety. The public perception of safety is just as critical as the safety record itself. To this end, the design and production of every aspect of the aircraft must be approved by government regulators before introduction into use. In the United States, the primary regulator is the Federal Aviation Administration (FAA). The FAA is responsible for certifying aircraft design, engines, propellers and parts; approving manufacturing and production processes; certifying the airworthiness of each individual aircraft; approving maintenance operations; and approving the return to service of each aircraft after maintenance.

The reliability of the safety review process is evidenced by the safety record of the commercial airline industry. In the U.S., a fatal accident occurs less than one out of every 45 million flights. Based on its performance record, the FAA has determined that commercial air travel is the safest mode of mass transportation.

A History of Innovation

Boeing has a long history of engineering excellence. The company launched Model 80 in 1928, which included a fully enclosed, welded steel fuselage in place of open-air seats. With a 12-person capacity, the plane included forced air ventilation, leather seats, and hot and cold running water. In the 1930s, Boeing introduced the 307 Stratoliner with a pressurized cabin (adopting technology from the company’s own B-17 bomber) enabling flights at an altitude of up to 20,000 feet.

In the 1950s came the 707, which replaced propeller engines with jet engines and was capable of carrying up to 200 passengers in cross-country and trans-Atlantic flight. Next came the 737 in the 1960s, with 6 seats to a row and engines mounted under the wings to reduce vibration and noise. The plane’s versatile design (still in use today, although modified) has led it to become the most widely used model in commercial aircraft history.

In 1970, Boeing introduced the 747. With a 400-passenger capacity, the 747 was the first “jumbo jet” featuring a wide-body design, twin aisles, and second level of seating in the first-class cabin—features that made it ideal for long-haul international flights. Boeing innovation continued in subsequent decades, including the introduction of composite materials to replace aluminum in the frame and tail sections, resulting in a design that is lighter, more durable, and more fuel-efficient.

Merger with McDonnell Douglas

Despite Boeing’s engineering success, the company faced continuous competitive pressure—first from McDonnell Douglas of the United States and later Airbus of France and Germany. Airlines encourage competition among manufacturers because it accelerates innovation, improving aircraft design and performance while at the same time steadily driving down the cost per passenger mile.

In the late 1990s, financial weakness at McDonnell Douglas gave Boeing an opening to acquire its main U.S. rival (see Exhibit 1 for a timeline of key events). Boeing CEO Phil Condit became CEO of the combined company, while former McDonnell Douglas CEO Harry Stonecipher was named president and COO. Stonecipher briefly retired from the company in 2002 but returned the following year to become CEO following Condit’s retirement. In 2005, Stonecipher resigned due to a breach of company ethics rules, and Boeing recruited former 3M CEO and former General Electric executive Jim McNerney to serve as CEO.

Despite the fact that Boeing was the acquiring company, the merger with McDonnell Douglas brought organizational and cultural change. The companies had different organizational heritages, with McDonnell Douglas emphasizing financial performance and Boeing prioritizing engineering quality. With Stonecipher assuming key leadership roles and a former McDonnell Douglas executive appointed CFO, Boeing’s internal focus shifted. While engineering quality continued to be valued, that objective was run through a stricter filter of financial discipline. In the words of Stonecipher, “When people say I changed the culture of Boeing, that was the intent, so it’s run like a business rather than a great engineering firm. It is a great engineering firm, but people invest in a company because they want to make money.” McNerney, coming from General Electric, continued this discipline.

Cultural change also came from the company’s decision to relocate its corporate headquarters from Seattle, Washington—where its commercial aircraft division is located—to downtown Chicago. For the first time, the senior-most executives of the company were no longer in close proximity to engineers who oversaw aircraft design and production. An executive who led the relocation process explained, “In the course of [our strategic growth plan], it became apparent that our headquarters needed to be in a neutral location, one not directly associated with one of the major units of the company.” This was intended to signal to the external world that the company was not solely a commercial aircraft manufacturer but also had major lines of business in defense, fighter jets, and helicopter manufacturing. At the same time, it had the effect of decreasing communication between the senior executive team and the leaders of the commercial aircraft division.

Introduction of the 737 MAX

Competition did not abate following the acquisition of McDonnell Douglas. Instead, a newly invigorated Airbus kept pressure on Boeing with an aggressive commercial marketing campaign that ate away at Boeing’s market share. Whereas Boeing sold approximately 7 out of 10 airplanes in the early-1990s, its share of new orders fell below 50 percent at the end of the decade and in the early 2000s. Through Airbus’ successful marketing of its A320 (a single-aisle model that competed with the 737) and the introduction of the A380 (a superjumbo model to compete with the 747), Boeing’s leadership was threatened in both single-aisle and wide-body aircraft.

In December 2010, Airbus made an announcement that further scrambled the competitive landscape. With oil prices at relative highs, Airbus introduced the A320neo—a modified version of the A320 with more powerful engines that improved fuel efficiency by 15 percent. (The suffix “neo” stands for “new engine option.”) Boeing did not have a plane that could compete with its size and capacity at comparable fuel use. Because of structural differences in the 737 and A320, Boeing could not offer a comparably powerful engine option with the 737 to match the A320neo in terms of efficiency. The 737, which was designed two decades before the A320, had shorter landing gear and was situated lower to the ground; it lacked sufficient ground clearance under the wing to accommodate larger engines. The A320, by contrast, sat higher off the ground so larger engines could be added without significant redesign.

In the airline industry, fuel efficiency is essential. Many travelers are willing to change carriers at very minor ticket-price differences. With fuel representing 15 to 20 percent of an airline’s total expenditures, small changes in efficiency can have a significant impact on the economics of the airline. The gravity of the economic advantage that the A320neo brought was made clear when American Airlines, which had historically purchased from Boeing, informed the company that it intended to buy hundreds of A320neos from Airbus unless Boeing could come up with a comparable offering.

Boeing had two options. It could either design an entirely new model or make modifications to the 737 to improve efficiency. A new model would give the company freedom to introduce state-of-the-art innovation to gain a technological advantage over the A320neo. The company would have the opportunity to completely redesign all aspects of the aircraft–fuselage, engine design, instrument panel, and in-flight technology–that would leapfrog existing offerings. This choice would require extensive investment, new coordination across engineering disciplines, risky design choices, and major organizational effort. Any miscalculation on the specifications acceptable to the market would lead Boeing to write off very large capital investment. The regulatory approval process for a completely new aircraft is also significantly longer. Design, build, and certification of a new aircraft can take between 5 and 9 years, while modification through an amended certification process can take between 3 and 5 years. In the intervening years, Airbus would in all likelihood take significant market share.

Because of the structural limitations of the 737 model, though, a modification would not be a straightforward process. Nevertheless, Boeing decided to pursue a modification because of the severity of the competitive threat that the A320neo posed. The new model—publicly announced in August 2011—would be called the 737 MAX.

Design Choices for the 737 MAX

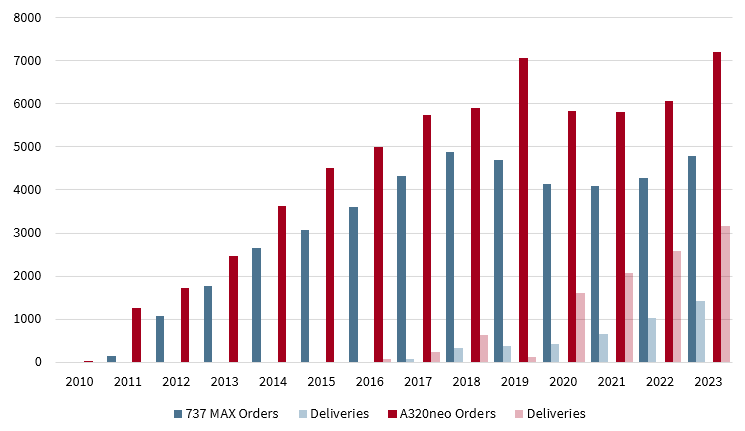

From the beginning, Boeing operated under several constraints. One was a compressed timeline. Airbus announced over 1200 orders for the A320neo in 2011, the year following its introduction. (See Exhibit 2 for order and delivery statistics for the A320neo and 737 MAX). Boeing had to move aggressively to bring the 737 MAX to concept and market in order to remain competitive.

Second, Boeing was constrained by pilot training considerations. The FAA, which oversees pilot training, specifies the conditions under which new training is required when modifications are made to an aircraft. Minimal changes (Levels A and B) require notification to the flight crew or classroom/computer-based tutorials. By contrast, extensive changes (Levels C through E) require training in a simulator or in-flight. Because of the significant cost of simulator training, airlines were much less receptive to design modifications that required Level C training. In fact, the first customer to sign up for delivery of the 737 MAX, Southwest Airlines, contractually required Boeing to reduce the cost of each aircraft by $1 million if the FAA required simulator-based training.

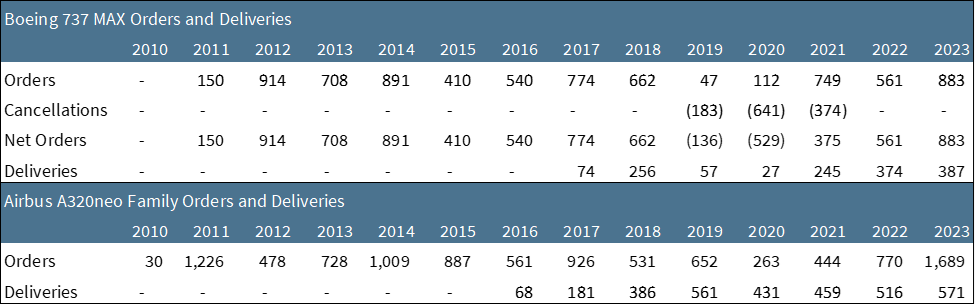

The third, and most significant constraints, were structural. The 737, situated lower to the ground than the Airbus A320, did not offer sufficient ground clearance to allow larger, more powerful engines to be mounted under the wings in the same placement in a redesigned 737 MAX. One option was to redesign the landing gear to make it longer. This would allow the plane to stand higher on the ground, giving the engines more room for clearance, but would in turn trigger a redesign of the wings (where the landing gear is situated) and the fuselage (into which the landing gear would fold during flight). Such modifications would be costly, extensive, and require pilot training.

Boeing instead elected to move the engines forward, mounting them slightly in front of the wings rather than below (see Exhibit 3 for a comparison of wing placements). This placement change gave the 737 MAX a propensity to pitch upward under the thrust of more powerful engines. During takeoff and ascent, when the plane is already positioned at a steep angle, a further upward pitch has the potential to stall the plane. Rather than make structural changes to the airframe to reduce this risk, Boeing opted for a software fix with a system called the “Maneuvering Characteristics Augmentation System” (MCAS, pronounced “em-cass”).

MCAS was a stall-prevention system that relied on input from external sensors (located on both sides of the fuselage near the airplane’s nose) to measure the angle of the plane (called the “angle of attack” or AOA). (See Exhibit 4 for a visual overview of MCAS). In a situation where a sensor detected that the airplane’s AOA was too high, the MCAS system would automatically force the nose of the plane downward. The 737 MAX had two sensors to measure the angle of the plane, but readings from only one sensor were fed into the computer system at any one time.

Boeing filed preliminary certification documentation for the 737 MAX with the FAA in June 2012, listing 201 modifications to the previous model of 737. The configuration for the 737 MAX was finalized in 2013, and the first prototype flown in January 2016. The FAA ultimately certified the 737 MAX for flight in March 2017. The 737 MAX went into commercial service in May 2017.

Prior to the plane’s completion, in 2015, Jim McNerney retired as CEO and was succeeded by Dennis Muilenberg, chief operating officer and former head of the company’s military defense business.

Launch and Crash of the 737 MAX

The 737 MAX became the fastest selling plane in Boeing’s history, with 1,700 orders the year following its announcement and more than 4,000 by the time it entered service. (The Airbus A320neo had nearly 6,000 cumulative orders at that time).

The celebration of the plane’s commercial success was interrupted in November 2018, when Lion Air Flight 610 crashed off the coast of Indonesia. Minutes after takeoff, the plane experienced problems with its airspeed indicator. MCAS fired more than 20 times before the aircraft plunged into the ocean. All 189 passengers and crew members were killed. Investigators discovered that a faulty AOA sensor had been installed on the aircraft the day before the crash. The plane had flown that day and experienced problems with the sensor during flight, but the pilot did not fully report the issue to the ground crew. Investigators also concluded that the crew of Flight 610 did not follow proper procedures in response to the airspeed indicator alert.

Boeing issued a statement following the crash, expressing “heartfelt condolences and sympathies to the families and loved ones of those on board.” The company issued a bulletin to airlines explaining MCAS functionality and reiterating procedures for responding to faulty AOA sensor data. The FAA issued a directive, ordering airlines to update flight manuals with additional procedures.

Pilots around the world expressed surprise over the existence of MCAS, with some saying they were unaware of the system: “It’s pretty asinine for them to put a system on an airplane and not tell the pilots who are operating it,” said a representative for the Allied Pilots Association, the largest labor union in the U.S. representing 15,000 pilots. A few weeks later, Boeing issued another statement, saying “We are confident in the safety of the 737 MAX. Safety remains our priority and is a core value of everyone at Boeing.”

Four months after the crash of Lion Air 610, in March 2019, a second 737 MAX flying from Ethiopia to Nairobi crashed during takeoff. During ascent, the MCAS fired three times. The pilots turned off the system in accordance with flight manual instructions but were unable to level the plane by pulling the manual trim because of the high force acting on the plane’s tail. All 157 on board died.

Government authorities around the world acted swiftly, with U.S., European, Chinese, and other regulators grounding the aircraft. Approximately 400 737 MAX were in operation at the time. Major U.S. carriers that used the plane were forced to cancel thousands of flights. Deliveries of new planes halted, and hundreds of orders were canceled. “Our passengers, psychologically, they don’t trust flying with the MAX anymore,” said one airline spokesperson.

CEO Dennis Muilenberg expressed remorse over the deaths of the passengers and crews. For legal and financial reasons, he was limited in what he could say publicly: “’We at Boeing are sorry for the tragic loss of lives in both of these accidents, and these lives lost will continue to weigh heavily on our hearts and on our minds for years to come.” He stressed that Boeing was “taking actions to fully ensure the safety of the 737 MAX,” adding that, “Safety is at the core of who we are at Boeing.” He did not, however, acknowledge that anything was wrong with the design of the MAX, saying instead:

We’ve confirmed that [the MCAS system] was designed per our standards, certified per our standards, and we’re confident in that process. So, it operated according to those design and certification standards. So, we haven’t seen a technical slip or gap in terms of the fundamental design and certification of the approach.

He estimated a software fix would allow the MAX to resume operation within a few months.

The MAX did not return to service for nearly two years. In the intervening period, deeper investigation—by regulators, lawmakers, engineers, and journalists—uncovered significant failures in the design and testing process, in communication with the FAA, and in corporate supervision and oversight. The depths of these problems greatly increased not only the time it took for the MAX to return to the market but also the financial and reputational cost to Boeing.

Organizational Failures in the 737 MAX

Outside observers have pinpointed the following factors as contributing to the failure of the MAX.

One was the initial decision to pursue certification of the MAX as a modification rather than a new model. This decision—made by senior executives for competitive reasons—compelled engineers and managers to consider each technological choice through the lens of its impact on the certification process rather than its technological merit. In the words of one Boeing engineer: “There was a lot of interest and pressure on the certification and analysis engineers in particular to look at any changes to the MAX as minor changes.”

Second and related to this decision was the constraint (contractually agreed to with Southwest Airlines) of minimizing the training requirements for carriers that ordered the MAX. By committing to producing an aircraft that would not trigger simulation-based training, engineers were restricted in design choices that would have improved safety. Boeing employees that interfaced with the FAA were compelled to lobby against the inclusion of information about technological changes in training manuals that would have enhanced pilot understanding of the MAX’s functionality, for fear that the addition of language would have required more extensive training.

Third, the redesign and certification process of MAX was made in an environment of intense organizational pressure and a demanding production schedule. Illustrative of this, the business executive in charge of the MAX established “countdown clocks” tied to major production milestones: one counting down to the deadline for powering on the first airplane in the factory and another to the plane’s scheduled first test flight. These clocks were located in conference rooms where business performance reviews and technological reviews took place. Engineers were also very aware of the economic cost of delay. As one engineer later explained, “There was always talk about how delays of even one day can cost substantial amounts.” According to others, “The timeline was extremely compressed. It was go, go, go.” … “The company was trying to avoid costs and trying to contain the level of change. They wanted the minimum change to simplify the training differences, minimum change to reduce cost, and to get it done quickly.” Engineers reported producing technical drawings and designs at roughly double the normal pace.

Fourth, engineers made design choices that compromised the safety of the aircraft. Chief among these was the reliance of MCAS on input from a single AOA sensor rather than two sensors. This decision violated long-standing safety protocols that call for redundancy in critical systems. The error of relying on a single sensor was compounded by the fact that AOA sensors were known to have poor reliability. Other errors include the failure to ensure that AOA sensor failure lights in the cockpit were properly working, the failure to include an MCAS indicator light to signal that MCAS was activated, and the decision to allow MCAS to fire rapidly in succession in response to AOA sensor readings. Internal messages among engineers suggest that some engineers working on the design were not comfortable with the safety level of their work. According to one: “Would you put your family on a MAX simulator trained aircraft? I wouldn’t.” Others wrote, “This airplane is ridiculous.” … “Sometimes you have to let big things fail so that everyone can identify a problem. … Maybe that’s what needs to happen.”

Fifth, Boeing’s lack of candor with the FAA compromised the ability of regulators to rigorously and independently review key features of the MAX during the certification process. (The FAA has similarly been criticized for being overly acquiescent to Boeing on technological matters during the certification process.) One example of Boeing’s lack of candor was the company’s decision to deemphasize the importance of MCAS and to position the technology as a modification to the speed trim system rather than a new system. In another instance, Boeing failed to relate information about the difficulty Boeing’s own test pilot faced responding to MCAS. In 2012, a test pilot took 10 seconds to respond to an uncommanded MCAS activation in a flight simulator. This result was considered “catastrophic” (FAA terminology for an outcome expected to result in fatality) but Boeing did not report this information to the FAA. An engineer responsible for gaining FAA approval of the 737 MAX manuals said he “basically lied to the regulators (unknowingly).” In addition, the FAA has been criticized for deferring too much of the certification work to Boeing representatives (including safety documentation related to MCAS), and these representatives did not relay important safety information to the FAA despite a regulatory obligation to do so.

Finally, Boeing senior leadership contributed to the failure of the 737 MAX failure by instituting cultural change that emphasized financial performance at the expense of engineering quality. After the company’s acquisition of McDonnell Douglas, the senior-most leaders of the company reoriented Boeing around stricter financial discipline. While CEO Muilenberg was an engineer by training, his predecessor McNerney was not, nor were any other members of the C-suite besides Muilenberg during the development of the MAX. According to one observer, “Where previous generations of Boeing leaders prided themselves on knowing everything about the aircraft they built—they were deeply engaged in precisely the ‘how-do-you-design-an-airplane stuff’—its new leaders were judged by their performance in meeting financial metrics.”

Separation between senior executives and members of the aircraft division was intentional and dated back to the company’s 2001 decision to relocate headquarters to Chicago. As Boeing’s then-CEO Phil Condit explained: “When the headquarters is located in proximity to a principal business—as ours was in Seattle—the corporate center is inevitably drawn into day-to-day business operations.” The effects of this distance were noted by employees of the commercial aircraft division. According to one engineer, “It wasn’t just technical knowledge that was lost. It was the ability to comfortably interact with an engineer who in turn feels comfortable telling you their reservations, versus calling a manager 1,500 miles away. … It’s a very different dynamic.”

Boeing also subordinated engineering quality through its reporting structure. The engineers responsible for designing the MAX reported to their business unit heads and not to the chief project engineer responsible for signing off on and approving key decisions on the project. (According to the chief project engineer, “you could say that none of them worked for me but all of them worked for me.” One result of this structure is that, under sworn testimony, the chief engineer claimed to be unaware of key features of MCAS, including its reliance on a single AOA sensor and that it could activate repeatedly.

The Boeing board of directors, too, lacked basic mechanisms to oversee aircraft safety. Boeing’s board did not have a standing committee responsible for safety, and safety was not a regular discussion item on the agenda. The board committee most closely responsible for safety was the audit committee. Furthermore, the board did not have mechanisms to receive internal complaints about safety, nor did it require management to review employee communication on internal message boards to identify concerns about quality. Any internal complaints were instead directed to Boeing’s Safety Review Board, which consisted of chief engineers, but this board did not have direct reporting channels to the board. According to one board member, “Safety was just a given.”

Fallout

Boeing suffered extreme reputational and financial damage as a result of the MAX. The public release of messages among engineering staff relating their concerns about the safety of the aircraft, the conditions under which it was developed, the lack of transparency with the FAA, and the seeming indifference of senior executives put the company in the novel position of having to publicly defend its commitment to safety, a value critical to its existence. One public relations specialist observed: “The way [the story] took off in the press and social media is not something that Boeing is used to.”

Many members of the senior executives were caught up in the fallout. Muilenberg was stripped of his chairman title in October 2019, and in December he was terminated. The head of the company’s commercial aircraft division resigned, as did the general counsel. The company’s chief technical pilot was indicted by the Department of Justice for providing false, inaccurate, and incomplete information to the FAA. (In trial, he was found not guilty.)

Boeing took a major financial hit. The company paid $100 million to compensate families of those deceased in the crashes. It settled fraud charges with the Department of Justice for $2.5 billion, as well as charges brought by the SEC for making materially misleading statements (including the statement that the 737 MAX was “as safe as any airplane that has ever flown the skies”). It compensated airlines $8.3 billion for lost sales as a result of the grounding. Furthermore, it incurred an additional $4 billion in costs as a result of shutting down and restarting the production facilities for the 737 MAX, and estimated that future production costs would be $2.7 billion higher than previous estimates. These costs were in addition to the foregone revenue of canceled orders over a nearly two-year period.

The board of directors did not escape either. In September 2021, a federal judge denied the board’s motion to dismiss a shareholder lawsuit for failure to properly review the safety of the 737 MAX. The judge determined that the failure of Lion Air Flight 610 was a “red flag” that the board “should have heeded but instead ignored.” In unusually harsh language, the judge stated that the board “publicly lied about if and how it monitored the 737 MAX’s safety.” Rather than defend the suit, the board settled for $225 million.

Commitment to Change

Boeing made technological, organizational, and procedural changes in the aftermath of the 737 MAX to improve the safety of the aircraft and the company’s operating standards. MCAS functionality was redesigned to rely on information from both AOA sensors before activating. MCAS was also redesigned to only activate a single time in response to sensor data and the force it provided in correction was limited so that a single pilot could manually overcome it. The FAA approved these and other changes in November 2020, and commercial flights for the MAX resumed in 2021.

Based on the recommendations of a committee of independent safety experts, Boeing’s board adopted the following changes:

- Created a standing committee on aerospace safety within the board

- Created a product and services safety group within management to review all aspects of product safety

- Realigned the engineering function so that engineers across the company report directly to the chief engineer rather than division heads

- Established a formalized process to incorporate historical design information (including best practices and lessons learned) in the product development process to institutionalize continuous improvement

- Updated existing operational safety programs to require the chief engineer to review all safety reports

- Updated the company’s anonymous safety reporting system both within Boeing and to include its suppliers.

FAA Expert Panel

In 2024, the FAA issued the results of an independent report conducted by a review panel comprised of engineering experts and labor representatives. The report identified multiple organizational breakdowns as contributing to the failure of the 737 MAX, including a disconnect between senior management and other members of the organization, inadequate implementation of a safety culture, inadequate training on safety, and lack of pilot input in aircraft design and operation. The agency gave Boeing 90 days to propose a plan to fix quality-control issues.

Why This Matters

- The Boeing Corporation has a long history of technological and engineering innovation, and yet in the case of the 737 MAX, the company made fundamental mistakes in design, development, and testing. How did competitive pressures contribute to these mistakes? How did organizational and leadership failures contribute? Why did the board not recognize these failures?

- Many of Boeing’s design, development, and testing choices were constrained by the decisions to certify the 737 MAX as a modified aircraft (rather than a new aircraft) and to minimize pilot training requirements. Was Boeing’s senior leadership wrong to make these two decisions? From a competitive perspective, could Boeing have afforded to cede the market to Airbus for the additional years required to make more significant design changes? What role did the board of directors play in this strategic choice? Was the board informed of this choice?

- The design flaws of the 737 MAX were in part a byproduct of the competitive pressure that Boeing felt to modify the aircraft under a compressed time schedule. What “red flags” indicated that the company’s development schedule was too aggressive? Who within the organization should have detected these red flags? What organizational and communication failures prevented the escalation of these concerns to senior leadership and the board?

- Some people blame the 737 MAX on a cultural shift that took place within Boeing, whereby an engineering orientation was supplanted by a focus on financial results. Is this criticism valid? How much engineering talent does an engineering company require in the C-Suite, the CEO position, and on the board? Can “business” executives oversee the development of advanced technological products? What role did the board play in allowing these cultural shifts to take place?

- People also blame the 737 MAX in part on communication breakdowns that occurred following the company’s decision to relocate headquarters from Seattle to Chicago. What role does geographic proximity have on communication and risk oversight? Does organizational risk increase as companies expand into new geographies and as operations become more dispersed? If so, how can senior leadership and the board counter these trends? Should the compliance function have been redesigned as the organizational structure of Boeing evolved?

- Boeing’s board appears to have failed on multiple dimensions, including inadequate oversight of objective setting, failure to monitor tone at the top, risk management, and internal controls. Could the tragedy of the 737MAX have been averted if Boeing’s board had performed better on these basic duties? Did the board have the necessary information to effectively evaluate and monitor management choices?

Link to SSRN: https://ssrn.com/abstract=4840833.

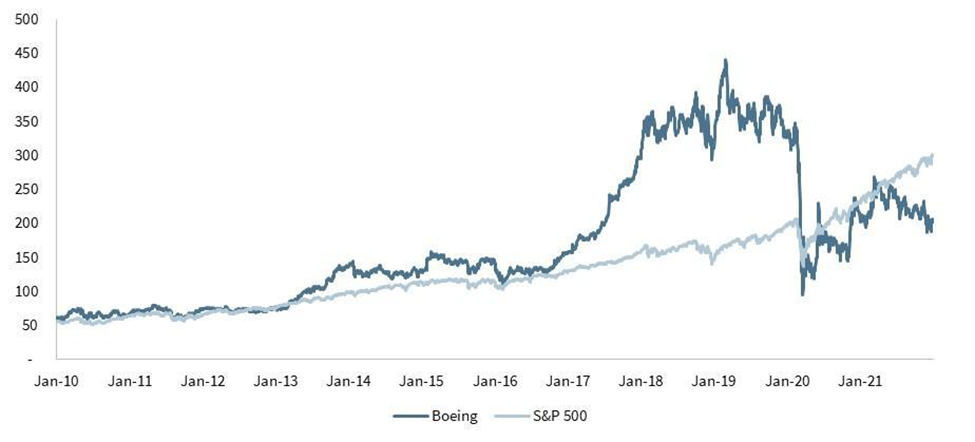

Exhibit 1: Boeing Stock Price History and Selected Events

- Aug 1997 – Boeing acquires McDonnell Douglas

- Dec 2003 – Condit retires as CEO of Boeing, replaced by Stonecipher.

- March 2005 – Stonecipher resigns as CEO, replaced by outside board member McNerney.

- December 2010 – Airbus announces A320neo

- August 2011 – Boeing announces 737 MAX

- July 2013 – Boeing completes firm configuration of 737 MAX

- July 2015 – McNerney retires as CEO; Replaced by COO Muilenberg

- January 2016 – Boeing completes first test flight of 737 MAX

- March 2017 – FAA certifies 737 MAX

- May 2017 – First commercial delivery of 737 MAX

- October 2018 – Lion Air Flight 610 crashes

- March 2019 – Ethiopian Airlines Flight 302 crashes. 737 MAX is grounded around the world.

- December 2019 – Muilenberg resigns as CEO, replaced by outside board member Calhoun.

- March 2020 – COVID-19-related shutdowns

- December 2020 – 737 MAX reenters commercial service

Exhibit 2: Orders and Deliveries of 737 MAX and A320neo

Cumulative Data

Annual Data

Note: Order and delivery data for A320neo includes statistics for the entire family of aircraft, including A319neo, A320neo, A321neo which differ in length (number of seats).

Source: Wikipedia.

Exhibit 3: A Comparison of the Engine Placement of 737 and 737 MAX

Source: Gregory Travis, “How the Boeing 737 Max Disaster Looks to a Software Developer,” IEEE Spectrum (April 18, 2019).

Exhibit 4: Visual Overview of MCAS

Source: Dominic Gates and Mike Baker, “The inside story of MCAS: How Boeing’s 737 MAX system gained power and lost safeguards,” The Seattle Times (June 22, updated June 24, 2019).

Print

Print