Jon Golinger is the Democracy Advocate with Public Citizen in Washington, D.C. This post is based on the results of a public opinion poll commissioned by Public Citizen and conducted by Lake Research Partners in November 2023.

Last summer, leaders of the U.S. House of Representatives declared July 2023 to be “ESG month.” They launched a series of seven Congressional hearings focused on fleshing out “key concerns” over environmental, social and governance investments and regulatory policies and then voted on a series of bills aimed at curbing such investments.

In the wake of seven of these “anti-ESG” bills advancing to the House Floor and moving to potentially become law, questions arose about what American voters thought generally about Congress legislating to restrict investor information and investment options for pension and retirement funds and specifically about some of the individual policies underlying the “anti-ESG” bills. To gain insight into public opinion in this area, Public Citizen engaged national polling firm Lake Research Partners to formulate a voter survey to ask these questions. With the House expected to take Floor votes on some of the “anti-ESG” bills this summer, it’s timely to review the voter survey results and consider its policy implications.

Key Takeaways

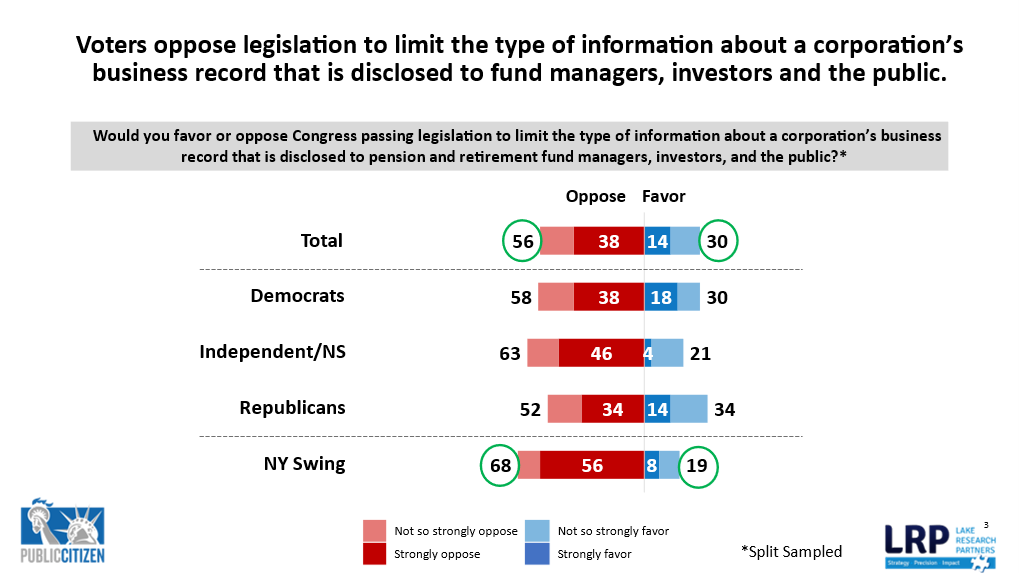

- The survey of 1,000 likely 2024 voters nationwide, including six House districts in New York State considered to be “swing” districts (NY-01, NY-03, NY-04, NY-17, NY-19, NY-22), found that more than half of voters (56%) oppose, while less than a third (30%) support, Congress passing legislation to limit the type of information about a corporation’s business record that is disclosed to pension and retirement fund managers, investors, and the public. This opposition crossed partisan lines – Democrats 58% oppose, 38% strongly oppose; Independents 63% oppose, 46% strongly oppose; Republicans 52% oppose, 34% strongly oppose.

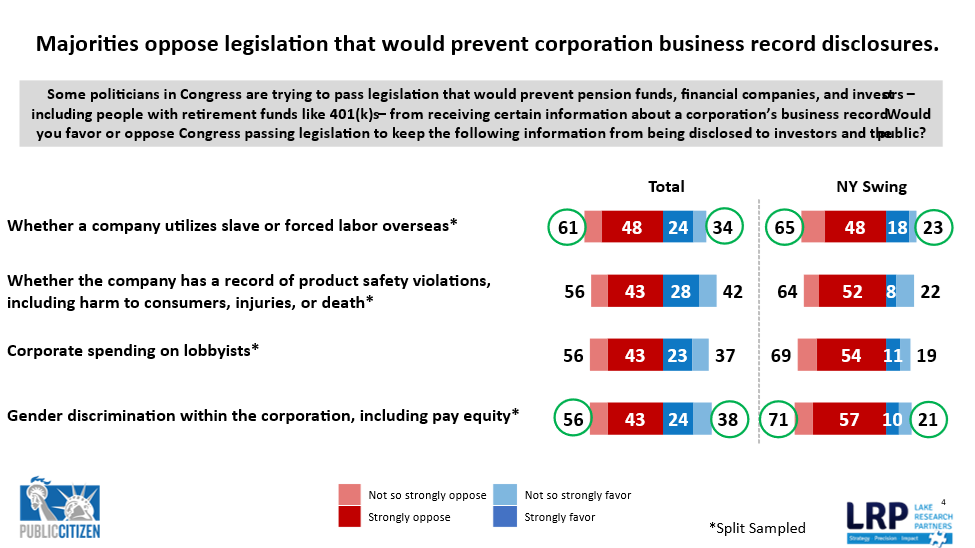

- When it comes to specific information that Congressional legislation could keep from being disclosed to investors and the public, a plurality of voters strongly opposed not disclosing information about whether a company utilizes slave or forced labor overseas; whether the company has a record of product safety violations, including harm to consumers, injuries, or death; corporate spending on lobbyists; and gender discrimination within the corporation, including pay equity.

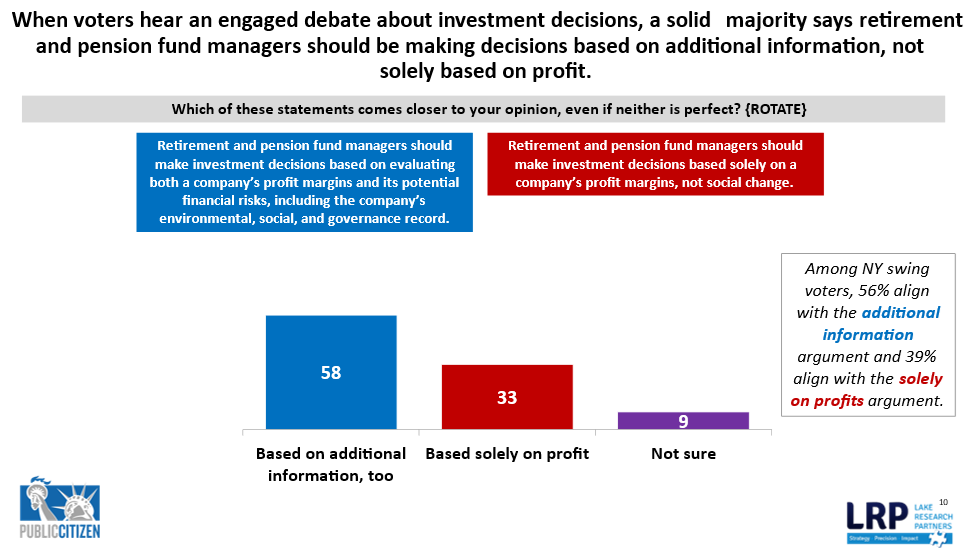

- When voters heard an engaged debate of statements on both sides, a strong majority of voters came down on the side of making decisions based on additional information and not solely based on profit. Fifty-eight percent of voters said investment managers should make investment decisions on both a company’s profit margins and potential financial risks, including the company’s environmental, social, and governance record. A third of voters said that investment managers should make these decisions based solely on profit margins, not social change.

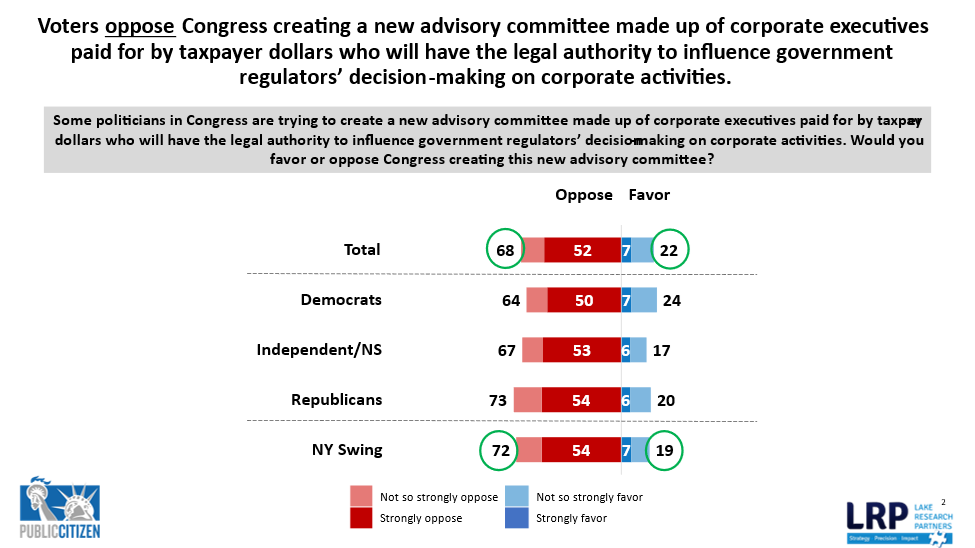

- Voters strongly oppose Congress creating a new advisory committee made up of corporate executives paid for by taxpayer dollars who will have the legal authority to influence government regulators’ decision-making on corporate activities, as one of the bills (H.R. 4790) would do. Over two-thirds of voters oppose the creation of this committee (68%), with 52% strongly opposed (22% favor, 7% strongly). Republicans are even more opposed to the creation of this committee (73% oppose, 54% strongly) but Democrats and Independents are also overwhelmingly opposed (64%, 50% for Democrats; 67%, 53% for Independents).

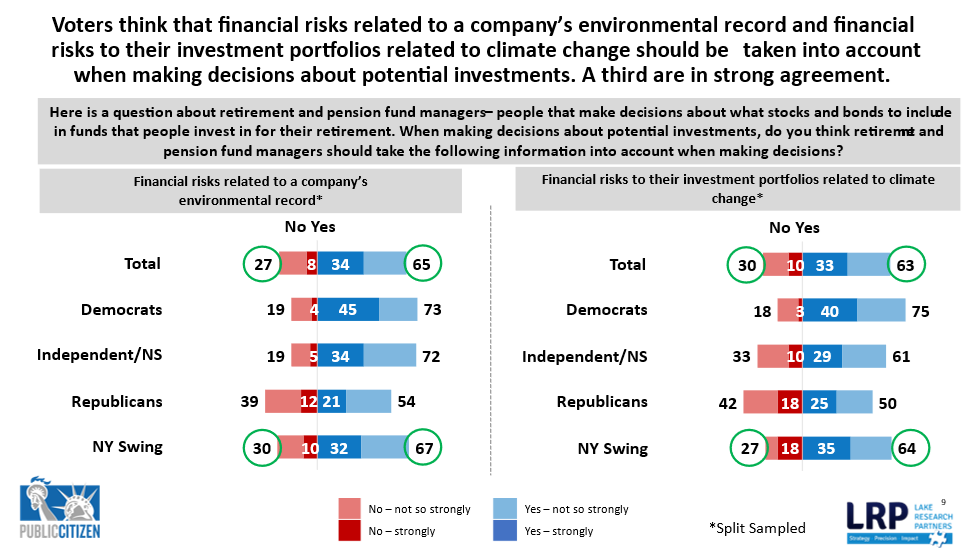

- By a 2-to-1 margin, voters in the survey said that financial risks related to a company’s environmental record (65% yes to 27% no) and financial risks to their investment portfolios related to climate change (63% yes to, 33% no) should be taken into account when making decisions about potential investments.

Read the full voter survey findings analysis memo by Lake Research Partners here.

Print

Print