Paul Hodgson is a Senior Advisor at ESG data analytics firm ESGAUGE. This post relates to a report authored by Mr. Hodgson based on data published by The Conference Board and ESGAUGE.

The Supreme Court’s decision to side with Students for Fair Admission in Students for Fair Admissions v. Harvard, [1] which struck down the use of “affirmative action” in college admissions, caused concern among compensation committee members, compensation consultants and the executives and managers incentivized to enhance diversity, equity, and inclusion (DE&I) at their employers about the risk of litigation and activism associated with corporate DE&I programs and metrics.

While the decision only relates to the educational sector, corporate DE&I programs could be affected in several ways, including:

- Increased challenges to workplace DE&I programs.

- Increased legislation against DE&I programs, especially from the Republican-led House and red states.

- Increased litigation challenging corporate DE&I programs.

- Increased challenges to diversity recruitment.

Many companies have been increasing their disclosures about DE&I programs and incentive metrics—either in SEC filings or on their websites. (See the box “DEI Disclosures at US Companies Continue to Expand”). While investors welcome these disclosures, they can also be used to accuse companies of discriminatory hiring practices. In fact, an organization named America First Legal has already filed cases with the U.S. Equal Employment Opportunity Commission (EEOC) at 33 companies. [2] In addition, the National Center for Public Policy Research has made several attempts at suing Starbucks over its DE&I policies. [3]

The Students for Fair Admissions v. Harvard decision has undoubtedly increased the risks associated with DE&I programs. But companies should continue to recognize the benefits of such programs while partnering with legal counsel to ensure that DE&I initiatives, goals, and decisions comply with applicable laws.

DE&I Disclosures at US Companies Continue to Expand

In the last few years, companies have been expanding their DE&I disclosures and become more inclined to share information on gender diversity in management, the presence of minorities in the workforce, and the pay gap observed across all employees.

According to ESG data analytics firm ESGAUGE, which tracks this information in proxy filings and CSR or Sustainability reports, the percentage of Russell 3000 companies disclosing the presence of women in their management has risen from 26.5% in 2021 to 50.5% in 2023 and is projected to reach 61.3% this year.

While in 2021 only 8.6% of Russell 3000 companies provided information on the representation of other minorities across the workforce, as much as 30% did so in 2023 (with a 30.5% projection for 2024).

To foster equity and inclusion, about 30% of Russell 3000 companies report having conducted an analysis of adjusted pay gap across their workforce. Two-thirds of those, however, do not disclose the findings.

Shortly after the SCOTUS decision, the EEOC issued a statement noting that the ruling does not address corporate DE&I programs: “It remains lawful for employers to implement diversity, equity, inclusion, and accessibility programs that seek to ensure workers of all backgrounds are afforded equal opportunity in the workplace,” said the chair of the Commission. [4]

Legal commentators confirmed the position that companies can lawfully pursue their vision for a more diverse and inclusive workplace, especially if they abstain from tying their efforts to rigid, quantitative metrics. For example, in a post on the Harvard Law School Forum on Corporate Governance, law firm Orrick stated: “While there are few cases in this area to date, in light of the recent Supreme Court decision, companies who incorporate DEI metrics into executive compensation programs should do a privileged evaluation of their programs to determine whether their goals actually impact individual employment decisions, which can be problematic, or merely inspire broader initiatives, such as improvements in outreach and in the composition of candidate and interview pools or evaluation techniques, which is legally permissible. In other words, rewarding executives for their overall efforts on DEI rather than for achieving targeted metrics will mitigate some of the legal risk.”

Undoubtedly, however, investors are far more interested in seeing quantitative metrics than qualitative ones. This tension has created a conundrum for many companies and appears to be leading to a shift in the messaging of their DE&I disclosures.

ESGAUGE examined the increasing use of DE&I metrics in executive compensation plans of US public companies. According to our proxy statement analysis, in 2023, 75.8% of S&P 500 companies integrate metrics related to diversity and inclusion into the pay structure of CEOs and senior executives. The figure compares to 52.1% in 2021 and (based on preliminary data from proxy filings made as of early June) 65.5% in 2024. In the same index, a smaller percentage of companies (7% according to filings for 2023, down to 4.2% in 2024) also use incentives meant to promote higher pay equity across employees.

DE&I metrics applicable to CEOs often also apply to other senior executives; in some cases, however, metrics for other executives may focus on stakeholder engagement within their functional areas, such as employee satisfaction for HR executives.

What becomes apparent from the analysis of the broader Russell 3000 index is a direct correlation between company size and the practice of integrating diversity & inclusion performance metrics in executive incentive plans: in 2024, only 21.2% of companies with annual revenue under $100 million reported using such metrics, but the percentage grows to 73.2% among companies with annual revenue of $50 billion and over. All these figures show a slight dip in the use of diversity & inclusion metrics in 2024, but we should note that the 2024 numbers are not yet definitive.

ESG performance metrics are very common in Russell 3000 companies in the utilities (89.1%) and energy (72.7%) sectors, but less so in information technology (28.3%), consumer staples (33.3%), and communication services (35.7%).

To better appreciate changes in messaging, we then manually reviewed 280 records of DE&I metric use for CEOs only from 2023 and 315 from 2024 (for a total of 595 cases across the two year-series). Some 38 companies (12.5%) of those in our manual review reported using DE&I metrics in their incentive plans for the first time in 2024.

Cases of no change in the fundamentals of metrics. The largest group in this subsample of manually reviewed filings, or 197 companies (64.5%), described their DE&I metrics using the same or very similar language in 2024 as compared to 2023.

For example, while the language surrounding DE&I metrics at American Axle & Manufacturing Holdings, Inc. changed slightly, the fundamentals of metrics remained the same. (The company assigns to a blend of ESG/Sustainability metrics, including DE&I metrics, a total weight of 10% of annual awards).

Specifically, the company’s 2024 proxy disclosure stated:

Demonstrated meaningful progress along our DEI strategy roadmap, including the early achievement of our 2030 U.S. workforce BIPOC goal in 2023, launching the first regional DEI Steering Committee in Mexico and a new associate resource group in Europe, and winning six Forbes Best Employers awards including Best Employer for diversity, new graduates, veterans and women. Certain AAM associates were also recognized with Women of Color and Black Engineer of the Year awards.

While the 2023 edition stated:

Demonstrated meaningful progress along our DEI strategy roadmap, including hiring AAM’s first Director of DEI, launching AAM’s 2+1 global DEI program, conducting an associate engagement survey and creating action plans in response to the results and adding three new associate resource groups. Our progress earned AAM recognition by being placed on the Forbes list of Best Employers for Diversity.

Cases of additional precision in target description. According to the ESGAUGE analysis, some 44 companies (14.5%) increased the precision of the language describing their targets, typically through the inclusion of quantitative metrics, but also by adding a more detailed description of actions achieved.

For example, PepsiCo gave a more precise description of metrics in 2024:

Facilitated important progress toward our diversity, equity, and inclusion goals by improving diversity of representation at the managerial level, maintaining pay equity, and developing inclusive leaders. We achieved 45% women in management roles globally. In the U.S., we achieved 9.2% Black managerial representation and 10.3% Hispanic managerial representation. In 2020, we announced our aspirational representation goals to increase the U.S. Black and Hispanic managerial population to 10% by 2025 to mirror the workforce availability of the communities where we work. We remain on track to meet this goal with respect to U.S. Black managerial representation, and we will strive to maintain our U.S. Hispanic managerial representation to mirror workforce availability.

While in 2023, it said:

Advanced our people agenda by continuing our legacy of leading with diversity, equity, and inclusion as we rely on the diversity of our teams to innovate and build our brands, reinforced by increased representation across all key demographics, including the increase of Black and Hispanic representation at the managerial level, at 9.0% and 10.1%, respectively, as we remain on track to meet our goal of improving managerial representation in the U.S. to 10% by 2025.

The PepsiCo disclosures are an example of greater precision both in quantitative metrics and in types of actions.

Cases of vaguer metrics or reduced target difficulty. According to ESGAUGE, only 2 companies (less than 1%) increased the difficulty of the targets associated with their metrics, while 23 companies (7.5%) used vaguer language (in fact reducing the target difficulty). Of course, some metrics were vague in the first place, referring only to “DE&I metrics….”

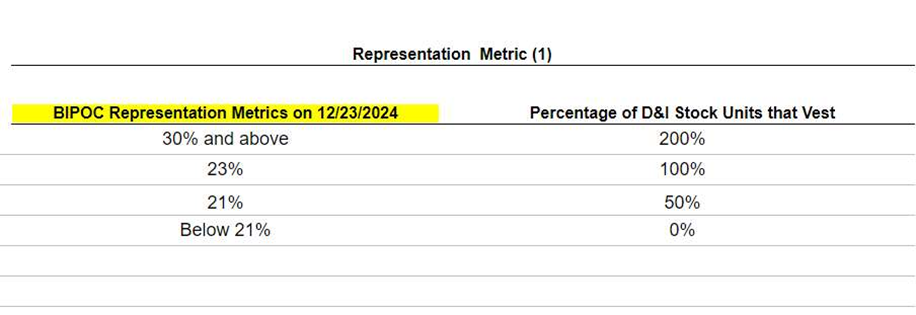

At Alaska Air, for example, while the vesting of its long-term incentives is precisely described, the metrics are less so:

The PSU awards granted in 2022 are scheduled to vest at the end of the January 1, 2022 through December 31, 2024 performance period and are based 80% on the Company’s TSR performance relative to the same airline peer group that was used for the 2020 awards and 20% on the Company’s progress towards advancing BIPOC representation at the senior leadership level.

However, an example of a company becoming vaguer about its metrics can be found at Apple.

- 2023 Select Highlights were:

- Double-digit increase in female leadership hiring and overall female leadership representation increases in all categories.

- Strong employee engagement scores across all genders globally and race/ethnicities in the 2023 US corporate survey.

- 2022 Select Highlights were:

- 47% of open leadership roles filled with women during calendar 2021.

- Record number of female, Black, and Hispanic/Latinx employees hired during calendar 2021.

The word “belonging” also started to creep into DE&I metrics, as if a vaguer way of describing such programs were needed. This was the case at real estate firm Redwood Trust. Also, at payments and data company Deluxe Corporation, its 2024 proxy statement included leader performance goals: “which includes, but is not limited to, items such as creating a “belonging culture,” building a diverse talent pipeline, and promoting ERGs.”

Most companies trumpeted their executives’ achievements, but some admitted to missing targets. This was the case, for example, at investment firm State Street, which reported missing its targets for two years in a row. The disclosures from the 2023 proxy are given below:

Conclusion

In the wake of the Supreme Court’s ruling in Students for Fair Admissions v. Harvard, the landscape for DE&I programs within corporations is undoubtedly shifting. The increased scrutiny and potential legal challenges underscore the need for companies to carefully navigate their DE&I initiatives. Despite the heightened risks, it is essential for businesses to continue promoting diversity, equity, and inclusion, recognizing the substantial benefits these programs offer in fostering innovation, improving employee morale, and enhancing corporate reputation.

To mitigate legal risks, companies should focus on qualitative, broader initiatives that support a diverse workplace without tying outcomes to rigid, quantitative metrics. By working closely with legal counsel and being transparent in their disclosures, companies can maintain their commitment to DE&I while ensuring compliance with evolving legal standards. This balanced approach not only protects companies from litigation but also demonstrates a genuine commitment to creating inclusive workplaces that can adapt to the challenges posed by new legal landscapes. As DE&I initiatives continue to evolve, it is imperative that corporations remain steadfast in their efforts, ensuring that progress in diversity and inclusion remains a core component of their strategic objectives.

Link to ESGAUGE can be found here.

Endnotes

1Students for Fair Admissions v. Harvard, 600 U.S. 181 (2023).(go back)

[ref no=2] See, for example, the complaint against Shake Shack, Inc., filed in April 2024. [/ref]

3See, for example, the NCPPR lawsuit filed in Washington State in 2022 (alleging that Starbucks’ policies violate state and federal civil rights laws, creating material corporate liabilities), which was dismissed by the US District Court in September 2023. (go back)

4Statement from EEOC Chair Charlotte A. Burrows on Supreme Court Ruling on College Affirmative Action Programs, U.S. Equal Opportunity Commission, June 29, 2023 .(go back)

Print

Print