Heidi Welsh is the Executive Director at the Sustainable Investments Institute (SI2). This post is based on her recent Si2 memorandum.

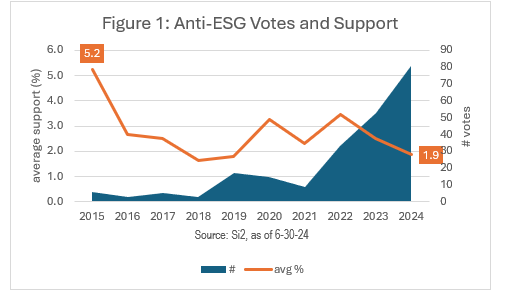

Shareholder proponents who do not support limiting corporate environmental impacts, promoting diversity, or providing investors with more ESG disclosure flooded this year’s corporate annual meeting agendas. They filed more than 100 shareholder proposals and 81 had gone to votes as of June 30, 2024. Support averaged only 1.9 percent, less than half what they earned just three years ago. In other words, 98 percent of shares cast on these proposals registered opposition. This stands in sharp contrast to all the other proposals from more mainstream shareholders; while pro-ESG support has diminished, it nonetheless remains at about 19 percent on average—ten times more than for anti-ESG.

The anti-ESG proposals continued to focus largely on disrupting the current business world consensus that diversity, equity, and inclusion improves companies and benefits investors. But they also continued to suggest that corporate political involvement favors liberals and took aim at efforts to mitigate climate change. A new batch of right-wing evangelical groups joined long-time proponents in 2024.

The main objective of anti-ESG campaigners in proxy season, however, is to rewrite the rules of shareholder engagement and fundamentally alter this process. This has been made clear in the Fifth Circuit suit NCPPR v. SEC, in which the National Association of Manufacturers has intervened; oral arguments occurred in early March 2024 but a ruling has yet to emerge. The National Law Journal reports two of three judges on the panel were skeptical.

Who might benefit from an end to shareholder proposals? Would it help companies by removing a feedback loop from investors who want the companies they own to consider all available information on risks and opportunities? Or would it simply aid and abet companies and allied politicians who want to quash dissent in both the political arena and the business world?

To shed light on the increasingly radical ideas presented by anti-ESG groups in proxy season, this post takes a close look at precisely what anti-ESG shareholder proposals seek and what most investors think about these ideas. We focus on shifts in the 2024 proxy season.

Key Takeaways

Many More Proposals, Much Less Support

As Figure 1 illustrates, the number of anti-ESG proposals voted in 2024 stands at 82 (with at least four still to come), a 13-fold increase from 2015 and fully 17 percent of all social and environmental proposal filings this year. Over the decade, support has fallen by almost a third and this year’s average was just 1.9 percent. Only four of the 81 votes in the first half of the year met the 5 percent resubmission threshold.

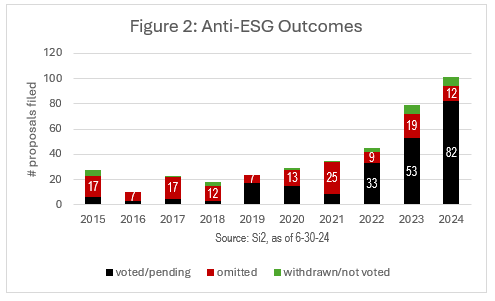

Fewer Omissions

Part of the increase in anti-ESG volume has occurred because proponents have gotten more proficient with the filing process, as Figure 2 illustrates. Just over 80 percent of these proposals have gone or will go to votes this year, compared with only about 20 percent a decade ago. Fewer are getting omitted after challenge under SEC rules—on both procedural and substantive grounds.

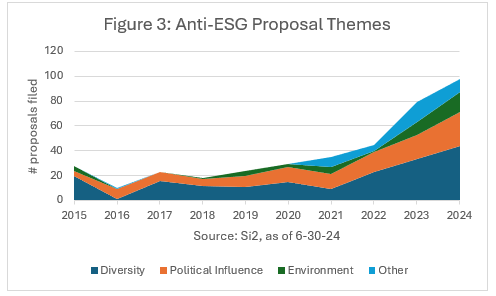

Diversity, Political Influence Continue to Dominate, Environment Grows

Figure 3 shows that about half of these proposals have expressed opposition in one way or another to current approaches to diversity, equity, and inclusion. This evergreen idea from the right has always dominated anti-ESG proposals (about half in each year except in 2016 and 2021, and 42 percent in 2024). These resolution also now explicitly posit that straight white men with right-wing political and/or religious viewpoints face disadvantages in corporate America, sometimes because they own guns or support gun owners, or because they oppose LGBTQ rights.

The second most common proposition is that companies in their interactions with the political world favor politicians and causes that have “woke ideas,” which allegedly hurt corporate profitability (30 percent over the decade, 25 percent this year). Thus, they say, companies are abrogating their fiduciary responsibility to investors.

Third, and in sharp contrast to shareholder proposals overall, anti-ESG proponents have been relatively uninterested in environmental issues and climate change (11 percent over 10 years, 15 percent this year. The key idea expressed in the recent uptick is that efforts to curb greenhouse gas emissions are too expensive, likely futile, and based on questionable science. This view flies in the face of widespread scientific and investor consensus that climate change poses the most disruptive set of risks and opportunities we have ever faced.

The remaining proposals this year ask about health benefits and those about corporate ties to the Chinese Communist Party. Most notable this year were particularly detailed objections to corporate benefits for transgender people but a strong animus against LGBTQ people cropped up elsewhere, too, regarding corporate and employee resource groups’ support for advocacy groups—with a case in point at Best Buy where a company lawyer promised to block support for The Trevor Project, a youth suicide prevention organization.

Main Filers

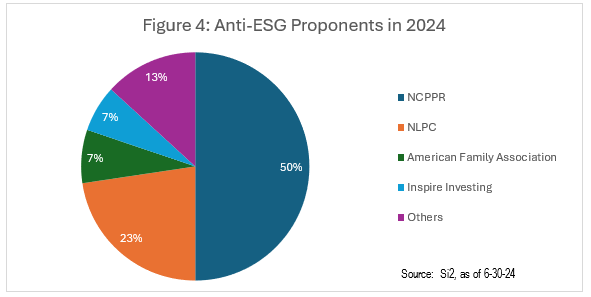

Just two right-wing policy advocacy shops—the National Center for Public Policy Research (NCPPR) and the National Legal and Policy Center (NLPC)—file three-quarters of anti-ESG shareholder proposals. (See Figure 4.) The two traded off filing similar proposals this year and appear to be working more closely together than in the past.

![]() New proponents this year include two organizations which support right-wing evangelical Christian aims. Eight proposals were filed by the American Family Association (AFA), formerly called the National Federation for Decency; the Southern Poverty Law Center includes AFA on its list of hate groups because of its work to oppose LGBTQ rights. Seven more proposals came from Inspire Investing, which promises “Inspiring transformation for God’s glory by empowering Christian investors through biblically responsible investing excellence and innovation.” Both posit religious viewpoints not shared by the vast majority of institutional investors or society at large.

New proponents this year include two organizations which support right-wing evangelical Christian aims. Eight proposals were filed by the American Family Association (AFA), formerly called the National Federation for Decency; the Southern Poverty Law Center includes AFA on its list of hate groups because of its work to oppose LGBTQ rights. Seven more proposals came from Inspire Investing, which promises “Inspiring transformation for God’s glory by empowering Christian investors through biblically responsible investing excellence and innovation.” Both posit religious viewpoints not shared by the vast majority of institutional investors or society at large.

Unpacking the Proposals

Diversity

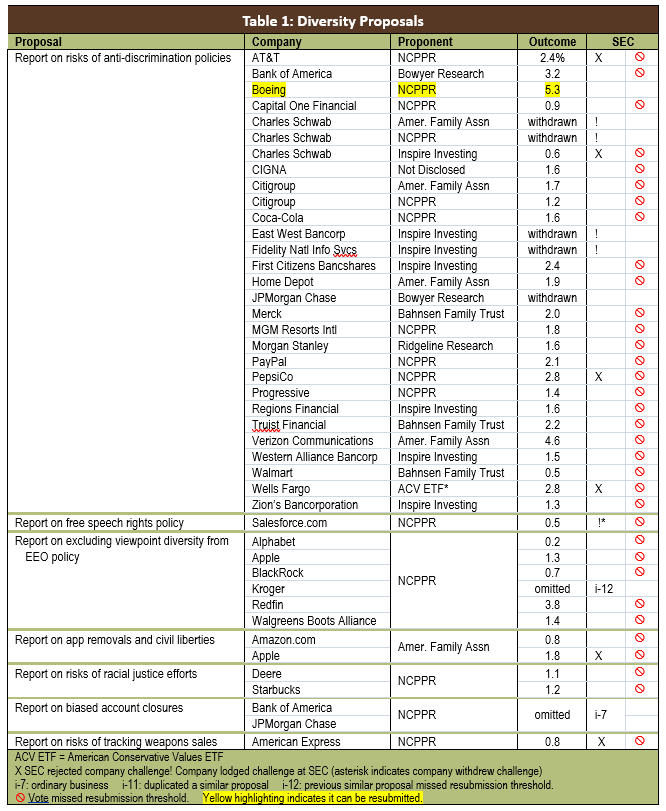

Most of the proposals about diversity suggest that corporate efforts to encourage diversity pose risks to companies because those who do not support such policies may feel victimized and sue—and that this could prove costly in financial and reputational terms. They repeatedly focus on stock price changes after controversies at a few companies but provide little evidence beyond right-wing opinion pieces. Only one of the 35 proposals about diversity earned enough support to qualify for resubmission.

Religion and Civil Rights

At seven companies—AT&T, Capital One Financial, Charles Schwab, Home Depot, Merck, PayPal, and Walmart—proponents included NCPPR, the American Family Association and Inspire Investing, with alleged religious discrimination a common thread. At AT&T, the proposal also expressed concern about discrimination on the basis of “social and environmental view[s].” These proposals sought reports “evaluating how [the company’s] policies and practices impact employees and prospective employees based on their race, color, religion (including religious views), sex, national origin, or political views, and the risks those impacts present to Company’s business” [emphasis added].

At JPMorgan Chase, Bowyer Research withdrew the proposal after it appeared in the proxy statement, claiming the bank will address what the proponent says is “politicized finance,” according to a May 21 Reuters story. This was a rare instance in which a company appeared to take on board anti-ESG criticism.

In slight contrast, the focus was on individual rights enshrined in the U.S. Constitution at 10 other companies (all but one a financial firm), with votes that in every case missed the resubmission threshold at:

| Bank of America

Citigroup First Citizens Bancshares Morgan Stanley |

Regions Financial

Truist Financial Verizon Communications Wells Fargo |

Western Alliance Bancorporation

Zion’s Bancorporation |

The proposal asked each company to explain its oversight of the same risks as the proposal noted above “and whether such discrimination may impact individuals’ exercise of their constitutionally protected civil rights” [emphasis added].

Proponents pointed to the Viewpoint Diversity Index, which they said in 2023 “found rampant corporate discrimination by religion, viewpoint and other characteristics, and that 78% of scored companies discriminated against religious nonprofits, and 63% supported legislation undermining fundamental First Amendment freedoms.” The Alliance Defending Freedom (ADF) launched the Index in 2022. In 2024, it assessed 85 companies on 43 indicators. ADF says it “advances the God-given right to live and speak the Truth.” The group posts on its website its long track record of litigating to support school prayer and to restrict or ban reproductive healthcare choices and LGBTQ rights.

“De-banking”: Several proposals also highlighted what they called “recent evidence of religious and political discrimination by companies in the financial services industry,” as articulated in the March 2023 Statement on Debanking and Free Speech,” signed by 57 individuals who include the anti-ESG proponents. Former Kansas Governor Sam Brownback published an op-ed in Newsweek in March 2023 about the statement, explaining his view that ESG initiatives seek to “coerce banks to cut ties with politically disfavored industries like oil companies and firearms manufacturers,” while trying to “cancel…political and religious views that activists disfavor.” Brownback was a roving ambassador in the Trump administration of “religious liberty and now heads the National Committee for Religious Freedom, a social welfare organization he founded in January 2022 to “replace elected officials at every level who are hostile to religious freedom for all Americans.” The proponents contended company efforts to combat hate speech are an “affront to public trust, [would] destabilize the market, and threaten the ability of American citizens to live freely and do business according to their deeply held convictions.”

Misinformation: A similar proposal from NCPPR at Salesforce earned a scant 0.5 percent after a procedural challenge was resolved in favor of the proponent. It asked for an evaluation of risk oversight about “denying or restricting service to users or customers—due to their viewpoints being classified as ‘hate speech,’ ‘misinformation’ or other related terms, or due to related content management policies” and the impacts on the company and “the constitutionally protected civil rights of users or customers.” It criticized CEO Marc Benioff’s statements supporting company diversity policies.

“Viewpoint Diversity”

NCPPR continued proposals from previous years that question the absence of an explicit mention of “viewpoint diversity” in corporate EEO statements, saying this poses risks. As before, very low votes resulted—in all but one case less than 2 percent—at Alphabet, Apple, BlackRock, Redfin, and Walgreens Boots Alliance.

This proposal was omitted at Kroger this year where it earned 1.9 percent last year—not enough support to qualify for resubmission. It appeared in the 2023 proxy statement even though the company successfully challenged the proposal at the SEC, whose staff had opined it was an ordinary business matter because it was about workforce management and employee policies. Following the staff’s response, NCPPR sued the SEC and claimed left-wing regulatory bias; the SEC filed a response refuting the claim and noting the no-action letter process is not a final agency action, thus giving no basis for a suit. The National Association of Manufacturers (NAM) filed a brief in support of NCPPR and argued for an end to the inclusion of ESG shareholder resolutions that are “unrelated” to company business. Oral arguments in the continuing NAM intervention occurred on March 3, 2024; the panel appeared to side with the agency’s view, according to the National Law Journal. (Also see June 2023 Cooley Pub Co discussion of the original case.)

Racial Justice Audits

Two proposals questioned the benefits of corporate racial justice audits, but votes were 2 percent or less at Deere and Starbucks. At Deere, it asked for an audit of DEI policies “on civil rights, non-discrimination and return to merit, and the impacts of those issues on the Company’s business,” with work to be “conducted by an independent and unbiased third party with input from civil rights organizations, public-interest litigation groups, employees and shareholders of a wide spectrum of viewpoints and perspectives.” NCPPR argued that DEI efforts discriminate and violate the “merit principle.” Implicit is that white people are being displaced and disadvantaged by under- or unqualified people of color—particular women.

The Starbucks proposal asked for an audit and report “to determine if and to what extent its programs and practices direct systemic discrimination against groups or types of employees, including ‘non-diverse’ employees.” It asked that the company review its “the mechanism or restrictions on setting up” employee affinity groups, “and the protections against reprisal for the actions or recommendations of any such groups.” The company’s Partner Networks serve diverse sets of employees but NCPPR contends they are exclusionary and do not focus enough on performance. It wants to see support groups for “non-diverse” people because it believes they experience disadvantage. In a related legal development, in August 2023 a federal judge in Washington State dismissed as frivolous an NCPPR lawsuit that claimed investor harm from Starbucks’ diversity programs. NCPPR has filed a proposal at Starbucks annually since 2019, resulting in three votes of less than 3 percent.

Politics and Guns

Two of the country’s biggest financial institutions—Bank of America and JPMorgan Chase—continue to attract the ire of right-wing proponents and both faced additional “de-banking” proposals, on top of the anti-DEI proposals noted above. But SEC staff agreed that the proposal could be omitted on ordinary business grounds, following what one of the companies’ noted is a long line of precedent about excluding proposals about specific products and services, as well as customer relationships. The resolution had asked for a review and justification on “whether and to what extent” the banks ask their clients to “deny their products or services to certain customers or categories of customers, or has demanded such restrictions as a condition of Company’s continuing to do business with said clients.” Proposals in 2023 that also claimed financial institutions closed accounts because they were biased against people with right-wing views also were omitted at Chase and Wells Fargo, on the same grounds.

In similar mien, weapons sales were at issue at American Express, but SEC staff rejected the company’s ordinary business challenge and the proposal earned 0.8 percent support. NCPPR sought an explanation about using a new merchant category code “for standalone gun and ammunition stores,” plus “the risk associated with its position.” NCPPR noted a 2022 Wall Street Journal article about the new merchant code that said it was “a win for gun-control advocates,” despite pushback from gun advocates.

Corporate Political Influence

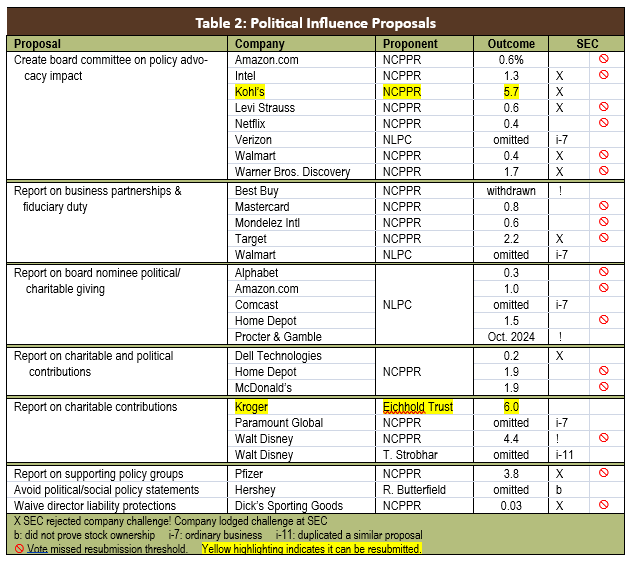

Proposals this year about political influence from anti-ESG proponents continued past assertions that corporations support left-wing public policy ideas, politicians, and groups. There was a new emphasis on board nominees’ personal political and charitable contribution records and a remarkably low score—0.03 percent—for a suggestion to allow critics to sue directors for taking “politically divisive” stands.

Board Oversight

NCPPR filed most of the proposals that asked for a new board committee at eight companies, but just one earned enough to be resubmitted, at the department store Kohl’s (5.7 percent).

Outsider ties: One proposal suggested that boards are abrogating their fiduciary duty if they maintain ties to certain outside groups. At Amazon.com, Intel, Kohl’s, Levi Strauss, and Walmart, the proposal was for a “board committee on corporate financial sustainability to oversee and review the impact of the Company’s policy positions, advocacy, partnerships and charitable giving on social and political matters, and the effect of those actions on the Company’s financial sustainability,” with a report by December.

At two entertainment companies, the resolution was similar but asked only about the impacts of “policy positions and advocacy” on each company’s financial stability; the votes were just 0.4 percent at Netflix and 1.7 percent at Warner Bros. Discovery.

A slightly different proposal from the NLPC went to Verizon Communications, where SEC staff said it was ordinary business even though the company actually had argued it was moot. The proposal asked for a board committee to “examine the consequences of the company’s positions and advocacy on immaterial social policy issues as they affect the company’s growth or decline, and ultimately its sustainability.” It asserted that corporate actions supporting LGBTQ people and racial justice are “immaterial” and create business risks. This mention of “materiality” versus “social and political” was the key difference between this and the Netflix version.

Business Partnerships

Five retailers received similar proposals questioning corporate connections to outside organizations, producing three more low votes. Last year three similar proposals also earned less than 2 percent.

LGBTQ antipathy: Threaded through all these proposals was a strong aversion to LGBTQ people. NCPPR withdrew a proposal that asked Best Buy to list and analyze “voluntary partnerships and the congruency of those partnerships with the Company’s fiduciary duty to shareholders.” Outside the resolved clause, it highlighted the company’s support for “organizations and activists that promote the practice of gender transition surgeries on minors and evangelize gender theory to minors” and claimed such support funds “the proliferation of an ideology seeking to mutilate the reproductive organs of children before they finish puberty.” This is simply not true. It said LGBTQ controversies in 2023 at Bud Light, Target and Disney show the financial folly of supporting rights for gay people, noting impacts on stock price after the controversies. Yet companies have long argued such efforts support their employees and help to attract talent.

Best Buy had challenged the proposal at the SEC, which did not issue a response given the withdrawal. But the commission did post, as is routine practice, a copy of related correspondence between the company and proponent after the withdrawal. The post included an NCPPR letter asking the company to bar contributions from its employee resource groups to several LGBTQ organizations, including The Trevor Project that works to prevent suicide by transgender youth. While a company lawyer said such contributions would be “screened,” Best Buy appeared to backtrack after NBC News published an in-depth article on the letters; A company representative said it would continue to support LGBTQ people. However, the advocacy group GLAAD said, “Executives at Best Buy ought to be ashamed of how they turned their backs on their LGBTQ and ally employees and consumers. They know what they did was wrong, or they would not have tried to hide this cowardly, toxic corporate takeover inside an ordinary SEC filing.”

Two of these proposals did go to votes. At Mondelez International, which did not lodge an SEC challenge, the request was to study and report on “associations with external organizations, to determine whether they threaten the growth and sustainability” of the company; it earned 0.6 percent. Walmart did lodge a challenge which was successful when SEC staff agreed it was ordinary business. NLPC criticized Walmart for selling LGBTQ-friendly clothing and books, its support for the Human Rights Campaign, and its partnership with PFLAG—both LGBTQ supporting organizations which NLPC said are “divisive.” The company argued the proposal’s focus on specific groups made it ordinary business, a view the SEC has affirmed for years regarding corporate charitable contributions.

At Target (2.2 percent), the proposal was a little more detailed. It asked about the congruency between supported groups and company policies. NCPPR wanted a report “examining the risks to the financial sustainability and reputation of the Company arising from its partnerships with, charitable contributions to, and other support for divisive social and political organizations and causes,” saying there are risks associated with the company’s “continued participation in and striving for high scores on the Human Rights Campaign’s Corporate Equality Index.” SEC staff rejected the company’s assertion that the proposal had procedural flaws, was ordinary business issue since it named specific groups and related to matters in litigation, and also was false and misleading.

Target noted America First Legal also filed a books-and-records request in June 2023 and the proponent sued it about selling LGBTQ-friendly merchandise in August. Four similar proposals were omitted in 2023 and three went to votes but none earned more than 1.5 percent support. (Despite the low vote from investors, the company shifted June Pride month products from stores to online sales, the Star Tribune of Minneapolis reported this year.)

War in Gaza: At Mastercard, the resolved clause was less specific, asking only about the “analyzing the congruency of the Company’s charitable contributions and voluntary partnerships with its Human Rights Statement.” But elsewhere in the proposal, NCPPR excoriated the company for giving to a wide range of well-regarded international disaster relief groups, saying they all supported Hamas, “propagandize for Jew-hating terrorists,” and “assist terrorists who slaughter, rape and kidnap innocent Jews.” It listed as examples UNWRA, UNICEF, Red Cross, Islamic Relief, Amnesty International, Save the Children, WHO, WFP, Care, Elevate, International Rescue Committee and Mercy Corps. The vote was just 0.8 percent.

Charitable and Political Ties

New resolutions on corporate and board nominee charitable and political contributions also decried ties to LGBTQ groups, but like the others noted above earned very little support.

Board nominees: The NLPC asked five companies to report years of board nominee charitable and political contributions, in a new type of proposal. There have been three votes so far—0.3 percent at Alphabet, 1 percent at Amazon.com, and 1.5 percent at Home Depot. In the spring, Comcast was the only one to challenge the resolution at the SEC and it was successful in arguing the resolution raises ordinary business issues by dint of micromanagement. The company also noted a long legal record of no required disclosure for director activities. The proposal is pending at Procter & Gamble, which usually has its meeting in October, but faces a challenge at the SEC using the Comcast approach and may not see a vote.

The resolution asked each to report at the time the proxy statement is issued, providing:

- a list of his or her donations to federal and state political candidates, and to political action committees, in amounts that exceed $999 per year, for each of the preceding 10 years;

- a list of his or her donations to nonprofit (under all IRS categories) and charitable organizations, in amounts that exceed $1,999 per year, for each of the preceding five years.

The proposals reiterated the view that companies should not engage on issues “unrelated to their core businesses” that raise “social and cultural issues” given the potential for damage to “relationships with customers, employees, and investors” as well as “material risks to companies’ reputation and sustainability.” The Bud Light, Disney and Target examples were again deployed.

Other examples touched on different topics—alleged corporate support for “lenient criminal justice policies that have destroyed many U.S. inner cities,” support for “the widespread vilification of police officers,” and concern about the “rise in crime across the country.” The Pew Research Center reports, however, that crime has been declining since the 1990s, despite public perceptions to the contrary. All these concerns are among current talking points for presumptive Republican presidential nominee Donald Trump, however.

Corporate charitable and political contributions: NCPPR asked Dell Technologies, Home Depot, and McDonald’s to report on both charitable and political contributions from the companies (as opposed to board nominees) but all the votes were less than 2 percent. The resolution asked for a list of “any recipient of material donations, excluding employee matching gifts,” to include “all recipients of $5,000 or more,” or an explanation “of why such donations are not material to the company but still appropriate for the company to undertake.” In the supporting statement, the proposal criticized contribution to groups it characterized as promoting “a divisive and controversial agenda,” just as NLPC did, mentioning GLSEN, which advocates for LGBTQ students, and the Lawyers Committee for Civil Rights Under Law, a civil rights organization. It also mentioned yet again the LGBTQ controversies at Bud Light, Target, and Walt Disney last year.

Two narrower proposals just about charitable giving went to votes, earning 6 percent at Kroger and 4.4 percent at Walt Disney. At the former, the resolution asked for a report on the company website on “any recipient of $10,000 or more of direct contributions, excluding employee matching gifts.” At Disney the proposal did not mention employee groups but did seek information on contributions of $5,000 or more, while also asking about “any material limitations or monitoring of the contributions.”

The proposals mentioned groups from all political persuasions at Kroger and called for “a system of accountability and transparency.” At Disney, however, it noted disclosed contributions to LGBTQ groups including The Trevor Project and GLSEN and said such support “is antithetical to Disney’s own guidelines” because the groups support gender affirming care—which “really means…dangerous puberty blockers and genital mutilation.” It claims such support undergirds a “radical agenda” not widely supported by customers and thus threatens the company’s fiduciary duty to its shareholders, pressing home this point.

Two charitable contributions proposals were omitted—one from long-time anti-abortion proponent Thomas Strobhar at Walt Disney, where SEC staff agreed the proposal duplicated the NCPPR proposal that the company received first. The other was at Paramount Global and had the same resolved clause as at Disney, but was omitted on ordinary business grounds after NCPPR took issue outside the resolved clause with contributions to specific nonprofits supporting both racial justice and LGBTQ people.

Public policy groups: Pfizer also received a request similar to NCPPR’s at Disney, proposing a report on contributions of $5,000 or more to “third-party public policy or nonprofit organizations,” and information on “any material limitations or monitoring of the contributions.” Like the others, it took aim at the company’s support for the Human Rights Campaign, which it said “indoctrinates children as young as 5-years-old with radical gender ideology and instruction on sexual orientation by pushing books and lesson plans in schools.” This “divisive agenda” threatens the bottom line, in NCPPR’s view. The company mounted an unsuccessful challenge, arguing it was ordinary business. The vote was 3 percent, not enough for resubmission.

Neutrality? A final proposal from an individual investor asked Hershey not to make any policy statements but it was omitted on procedural grounds. Raymond Butterfield said the company “shall not promote political or social causes in any of its activities, advertising or candy wrappers. If any of these activities are promoted the company shall immediately recall these products and advertising.” In the body of the resolution, he noted Fox News criticized the company for using LGBTQ-themed candy wrappers during Pride month in June—or what he called “bizarre candy wrappers advocating sex change operations.” (The company’s employee resource group for LGBTQ employees is one of many affinity groups including one for veterans; the group remains a key player in the company’s congoing work on the issue.)

Director liability: In the same vein at Dick’s Sporting Goods, NCPPR asked for a bylaw amendment to allow company critics to sue directors if they take “politically divisive” stands. NCPPR argued that the company hurt its bottom line when it stopped selling personal firearms in response to mass shootings. The company unsuccessfully challenged the proposal at the SEC, which disagreed the proposal would be illegal, could not be implemented, and was too vague. The vote was 0.03 percent—the lowest of 2,520 votes on environmental and social issues in the last ten years.

Environmental Issues

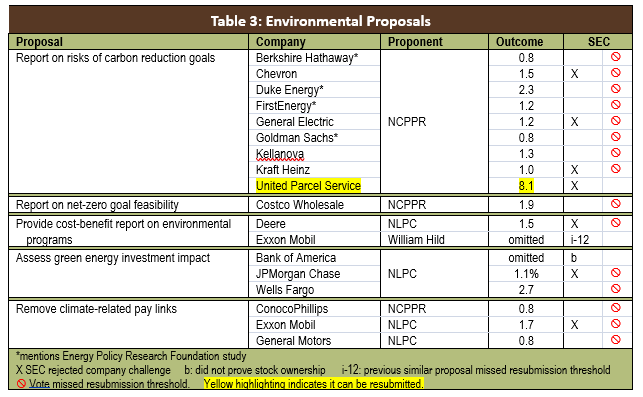

In the last two years, anti-ESG proponents have started to file more proposals about environmental issues and 2024 is the highwater mark to date. Just one earned enough support to be resubmitted and 13 of the 16 votes were less than 2 percent. All questioned efforts to mitigating climate change risks.

Voluntary carbon reduction goals: At a mix of five companies NCPPR asked simply for a report “analyzing the risks arising from voluntary carbon-reduction commitments.” In each case, it quoted GHG emission reductions goals companies have set but said their need and feasibility are questionable, producing a panoply of investment risks. The proposal survived procedural challenges lodged by Chevron, General Electric, Kraft Heinz, and United Parcel Service and went to votes but the highest vote and the only one to qualify for resubmission was 8.1 percent at UPS. Another low vote occurred at Kellanova.

A more specific version went to four more companies—Berkshire Hathaway, Duke Energy, FirstEnergy, and Goldman Sachs, asking for an audited report by next February,

assessing how applying the findings of the Energy Policy Research Foundation [EPRF] would affect the assumptions, costs, estimates, and valuations underlying its financial statements, including those related to long-term commodity and carbon prices, remaining asset lives, future asset retirement obligations, capital expenditures and impairments.

The resolution said EPRF found in 2023 “that net zero advocates have misconstrued the [International Energy Agency’s] position on new oil and gas investment, and that the IEA has made questionable assumptions and milestones for NZE [Net Zero Energy] about government policies, energy and carbon prices, behavioral changes, economic growth, and technology maturity.” It noted EPRF’s conclusion that “Oil and gas play irreplaceable roles in modern civilization that are not reproducible with low-carbon alternatives. The attempt to substitute them with inferior, less efficient, energy sources will have enormous micro- and macroeconomic consequences and profound geopolitical implications.”

At Duke Energy and FirstEnergy, NCPPR said the retirement of coal plants may have been unwise and expensive solar energy investments may be lost if “reverting back to reliable energy sources such as coal” becomes necessary. The proposals backed up assertions with opinion pieces from right-wing media outlets, as well, calling theories about stranded assets “nonsensical.”

Costco: An even more detailed audit proposal at Costco specified the report should evaluate

material factors relevant to decisions about whether a 2050 net-zero carbon goal, or other similar decarbonization targets, is appropriate, including factors that mitigate against the feasibility of such goals. These factors might reasonably include technological feasibility (or its absence), the economic consequences of adoption, the possibility that the climate models that underlie such goals are incorrect, the possibility that failure to adopt such goals in other countries will render adoption by Costco meaningless, the possibility that U.S. governments will not mandate such decarbonization — thereby upending adoption-favoring “stranded asset” assumptions, and relevant considerations.

A 2022 net-zero commitment from the company was “driven by a radical climate catastrophist agenda” before sufficient due diligence, according to the proposal. It said the need for carbonization is likely inaccurate, but even if needed, it is too late to have any impact given the unlikelihood of all countries sticking to decarbonization commitment. Decarbonization efforts would be too expensive and hurt the very people they are supposed to help—billions of the world’s poorest people, said NCPPR. The vote was 1.9 percent.

Cost-benefit analysis: In years past, a few proposals have asked companies to provide cost-benefit analyses of environmental policies the proponents disfavor. One such proposal from the NLPC went to a vote this year at Deere, earning 1.5 percent support. It sought a report “analyzing the congruency of the Company’s policies in support of greenhouse gas reduction and renewable energy use, with those priorities’ effects on the ongoing viability of the industries that constitute the vast majority of the Company’s revenue base—and therefore Deere’s own future.” Deere unsuccessfully challenged the proposal at the SEC, which disagreed it was moot and ordinary business.

The proposal said “alarmist pressure groups” result in “nothing beneficial environmentally or economically,” but nonetheless Deere “embraces their hostile agenda both in rhetoric and in action” by pursuing GHG reduction projects and renewable power purchases, and by setting goals validated by the Science Based Targets Initiative (SBTi), which aims to keep global warming to 1.5 degrees Celsius. NCPPR asserted the company’s approach is “deeply flawed” and will damage the industries on which Deere depends—farming, forestry, construction, and mining. The 1.5-degree goals has been “established by political operatives and sycophantic media, not scientific expertise.” (Some 5,000 companies globally have set such targets, however, and SBTi’s board chair is the CEO of ENEL, an Italian utility company with global operations.)

Emerging nation concerns: Three banks receive an NLPC proposal that, like the NCPPR resolution about carbon commitments, contends that green energy investments will hurt emerging economies. The proposal to Bank of America was omitted on procedural grounds. It earned 1.1 percent at Chase after SEC staff rejected a challenge that argued it was ordinary business and too vague, and 2.7 percent at Wells Fargo.

The resolved clause was similar to the audit request noted above, asking for analysis of “the impacts, both adverse and beneficial, of JPM’s climate transition policies regarding the economic and humanitarian effects on emerging nations, which rely heavily on — but have limited access to — fossil fuels and other non-’renewable’ sources of power, such as nuclear.” It said the audit should have input not just from those with “one-sided political or viewpoint bias” but also those whose views “may rebut prevailing corporate media- and government-driven narratives on climate and energy.” It suggested several prominent climate science skeptics should be consulted.

End executive pay links: Energy and auto companies should not tie any executive pay to climate-related goals, both NCPPR and the NLPC said, but votes were low. The resolutions were slightly different. At ConocoPhillips and Exxon Mobil, it asked each board “to revisit its incentive guidelines for executive pay, to emphasize legitimate fiduciary goals and consider eliminating greenhouse gas reduction targets and other scientifically dubious goals from compensation inducements.” (SEC staff disagreed with Exxon’s assertion that the proposal was materially false and misleading.) At General Motors, the proponent also said the board should “consider eliminating EV production metric goals from compensation inducements,” saying EVs are plagued by costly problems.

Other Topics

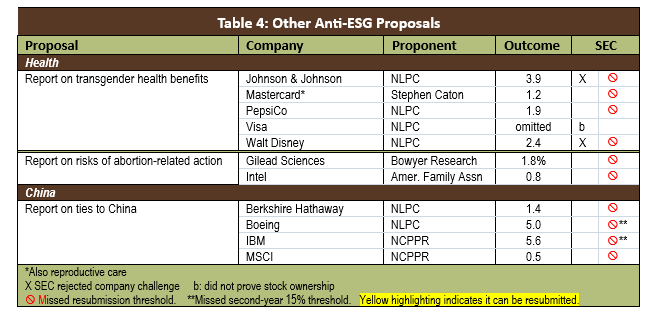

As we have seen, the overwhelming majority of anti-ESG proposals contest the mainstream idea that diversity, equity, and inclusion are material to business and a valid subject for corporate attention; many also view corporate boards and political spending as infected by left-wing bias. A few more also raised explicit concerns about health issues. Some of were about benefits for transgender people while others were about abortion. A couple also questioned business ties to Communist China, but far fewer than in 2023.

Health

Transgender benefits: Four proposals tried to draw a connection between equitable compensation and benefits for transgender people and cisgender employees. At Johnson & Johnson (3.9 percent support), PepsiCo (1.9 percent), and Walt Disney (2.4 percent), the resolution from the NLPC asked for a report on “compensation and health benefit gaps,” which should include how they “address dysphoria and de-transitioning care across gender classifications, including associated reputational, competitive, operational and litigative risks, and risks related to recruiting and retaining diverse talent.” At Mastercard (1.2 percent), the proposal from an allied individual specified “reproductive and gender dysphoria care” but otherwise was the same. The resolved clauses mirror proposals from mainstream shareholder proponents about identifying and mitigating racial and gender pay gaps, highlighted in the annual Racial and Gender Pay Scorecard from Arjuna Capital and Proxy Impact, how in its seventh iteration. None of the three transgender proposals earned enough to qualify for resubmission and the NLPC version was omitted on procedural grounds at Visa.

The proposal asserted, “benefit inequities persist across employee gender categories, and pose substantial risk to companies and society at large,” given that federal labor laws mandate equitable treatment for all employees. It contended that because each of the companies provides transgender health benefits, it is possible that this creates risks, saying that transgender surgery is harmful and “often” exacerbates health problems, and that people undergoing surgery may be “permanently mutilated.” Hence they might sue “those who misled or harmed them,” possibly including the company. The solution is to provide a benefit for reversing transgender care, or “de-transitioning,” in the proponents’ view.

Investors clearly did not agree with these proposals. The Human Rights Campaign points out, “A concerted disinformation campaign is not only behind discriminatory laws but is fueling threats and violence against providers of gender-affirming care, preventing them from supporting the communities they are meant to serve.” HRC notes a nationwide campaign to eliminate gender-affirming care even though it is “supported by every major medical association.” HRC notes that transgender people choose different healthcare options for transitioning and seeks to protect all of them.

Abortion: Two proposals took aim at abortion care and both earned less than 2 percent. At Gilead Sciences, Bowyer Research asked for a report about

the known and reasonably foreseeable risks and costs to the Company caused by opposing or otherwise altering Company policy in response to enacted or proposed state policies regulating abortion, and detailing any strategies beyond litigation and legal compliance that the Company may deploy to minimize or mitigate these risks.

This construction mirrored language in proposals that seek to protect access to abortion and miscarriage care, in a campaign coordinated by Rhia Ventures. But Bowyer said the report is needed because of the company’s opposition to the June 2022 Dobbs decision in which the U.S. Supreme Court struck down Roe v. Wade and its federal protections for reproductive health rights. The proposal noted Gilead also opposed limits to mifepristone, used for both abortions and miscarriage care, in a case the court threw out on June 13 because it found the plaintiffs had no standing to sue. The shareholder said opining against abortion opponents undercuts the company’s assertion that it is committed to supporting diversity, and “can only serve to alienate consumers, employees, and investors and impact the Company’s bottom line.” Like the political spending proposals, the resolution said the company is violating its fiduciary duty “by engaging in politically divisive rhetoric and/or actions.” Investors registered support of only 1.8 percent.

The American Family Association made the same points at Intel, where it also noted the company “remains one of the biggest corporate donors” to Planned Parenthood and has pledged to support access to abortion where it can do so, while also extending coverage for transgender care for employees and their dependents, which AFA says is harmful and risky. The vote was a scant 0.8 percent.

Communist China

For four years, right-wing proponents have been expressing the same concerns about human rights in China as mainstream shareholder proponents. An early version expressing general concern about Walt Disney’s work with the government in China with regard to filming a live-action version of Mulan received lots of support—36.8 percent in 2022. But none of the 20-odd votes since has come anywhere close. This evisceration in support came after the proposals started to explicitly reference ties to “the Chinese Communist Party.”

The most common Communist China proposal asked for a report on “which corporate operations involve or depend on Communist China, which is a serial human rights violator and a geopolitical threat and adversary to the US,” to provide shareholders “with a basic sense of” each company’s “reliance on activities conducted within, and under control of the Communist Chinese government. Steven Milloy filed the first two resolutions in 2022; 13 went to votes in 2023 from Milloy, the NLPC, and NCPPR. One this year earned just 1.4 percent at Berkshire Hathaway.

Another iteration surfaced last year, asking two companies if their “activities and expenditures related to doing business in China align with” either current ESG or human rights commitments, earning a resubmission-qualifying 7.1 percent at but falling IBM short at Intel with 4.4 percent. The resubmitted IBM proposal dropped to 5.6 percent this year, missing the resubmission threshold. It earned 5 percent this year at Boeing this year, where in 2023 the “Chinese Communist Party” version got 7.5 percent. As a result, neither Boeing nor IBM can be resubmitted.

A much longer proposal asked MSCI about its indices that might include companies which “supply goods or services to the Chinese military,” in violation of U.S. laws aimed at supporting the persecuted Uyghur people. The proposal also asked about investments in “Chinese companies specializing in quantum information technologies, artificial intelligence, and microelectronics.” The vote was just 0.5 percent.

Child Labor Overlap

There is overlap between right-wing and mainstream proponents on the issue of child labor in the Democratic Republic of Congo, although the former in other fora express opposition to electric vehicles, while the latter do not. Given the overlap, Si2 has not included these resolutions in “anti-ESG” proposals, but they are noted here for context.

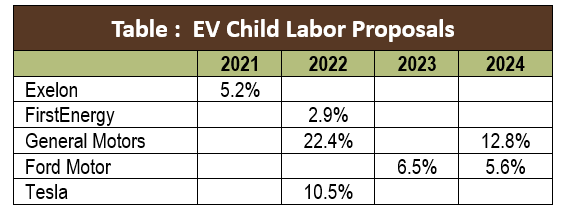

Starting in 2021, Steven Milloy asked for a report about whether “business plans with respect to electric vehicles and their charging stations may involve, rely or depend on child labor outside the United States.” Votes were 5.2 percent at Exelon and 2.9 percent at FirstEnergy and they have not been resubmitted since. Milloy referenced his “junk science” website that questions the validity of the consensus about global warming and other environmental hazards. He also noted that the main source of cobalt, used in EVs, comes from the Democratic Republic of Congo (DRC), which has longstanding and serious problems regarding child labor that remain largely unmitigated despite international efforts.

Since 2022, the focus of these proponents has been on vehicle makers and votes supporting the above proposal (mostly minus the reference for charging stations) have fallen from 22.4 percent at General Motors in 2022 to 12.8 percent this year. At Ford Motor, where votes are always lower given the founding family’s stake, the votes were about 6 percent in 2023 and 2024. These proposals have been from the NLPC, NCPPR, and a private entity known as “New Breeze.” None of them reference Milloy’s website but they do use his language about child labor in the DRC. Since both 2024 proposals earned less than 15 percent, neither can be resubmitted.

Similar concerns about child labor in the DRC came in 2022 from the Sisters of the Good Shepherd, a member of the Interfaith Center on Corporate Responsibility. Their proposal asked Tesla for a report on if and how its “policies and practices governing the sourcing of battery minerals and progress towards cobalt-free battery goals will put the Company on course to eradicate child labor in all forms from its battery supply chain by 2025. The vote was 10.5 percent.

Print

Print