Ray Garcia is a Leader, Paul DeNicola is a Principal, and Matt DiGuiseppe is a Managing Director at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum.

Proxy season at a glance

Just 26 companies in the Russell 3000 stock index failed to gain majority support for their compensation plans. In addition to overall pay and performance alignment, to comply with new disclosure rules, companies have begun reporting new compensation information that gives investors a deeper understanding of these plans.

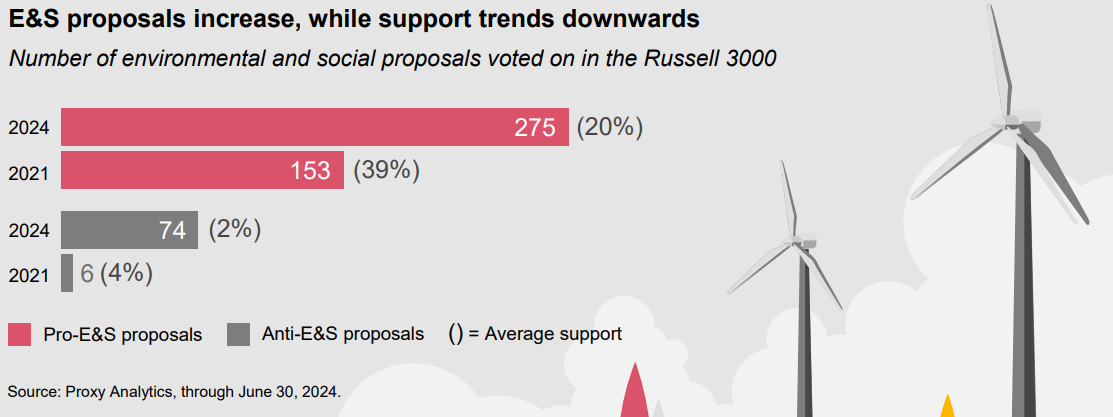

Average support for shareholder proposals advocating for positive action on environmental and social issues continued to decline from a high of 39% in 2021, dropping to 20% this year. New regulations that are triggering expanded disclosures combined with ongoing market forces explain the trend.

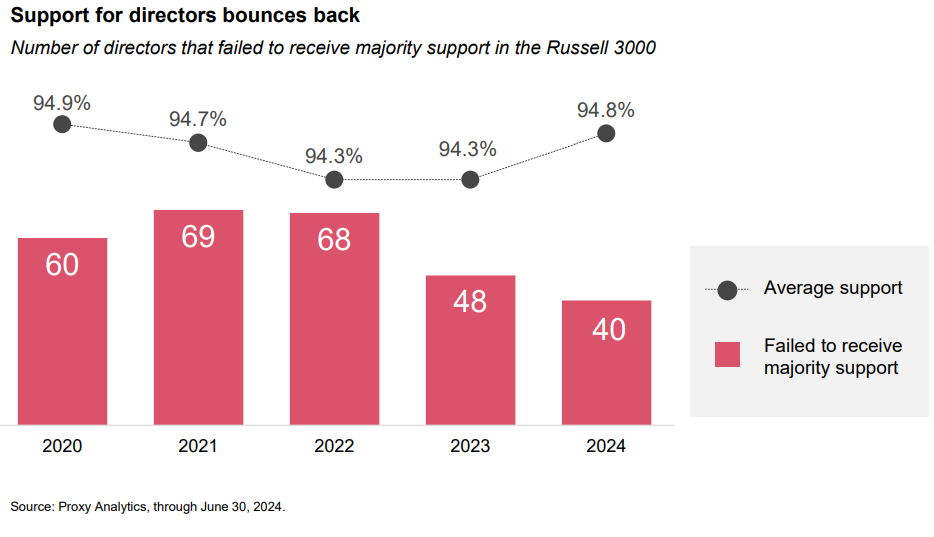

Average director support at Russell 3000 companies was 94.8%, the highest level since 2020. Some of the increase can likely be attributed to the increasing quality of proxy statement disclosures.

Management slates won out in 14 of the 16 proxy contests that went to a vote. One impact of universal proxy cards may be limiting votes to situations when there are irreconcilable differences between the two sides rather than differing opinions on the margins.

Nineteen percent of no-action requests were granted based on micromanagement, up from 8% last year. While requests on such grounds may have seemed futile in recent years, the increasing specificity of shareholder proposals may have reached a tipping point.

In boardrooms across the US, directors are in the process of interpreting the results of this year’s proxy season as part of their annual governance reviews. As we predicted in our proxy season preview, a series of trends from the last several years has continued to shape voting. That makes it difficult to point to a single common denominator that can explain why some shareholder proposals garnered majority support while others failed to gain traction. But boards would be well served to focus on a burgeoning driver of shareholder support that deserves more attention: corporate disclosures are finally catching up with investor expectations on a number of matters.

For more than a decade, there have been increased calls for companies to disclose greater information about how they operate. Starting with Dodd Frank and culminating more recently with Europe’s Corporate Sustainability Reporting Directive (CSRD), California’s climate disclosure regulations, and the SEC’s new cyber, climate-related and other disclosure rules, these requirements mandate corporate reporting on a range of governance topics such as executive compensation, board oversight, social issues and impact, emerging technologies, and the strategic approaches to and related risks of climate change. The rationale behind many of these regulations was twofold: provide investors with the information they need to accurately price the securities in which they invest and, in some cases, influence business behavior.

We are starting to see this new era of transparency impact proxy voting, particularly when it comes to support for say on pay, thematic proposals (environmental and social) and director elections.

Say on pay

New regulations have helped evolve the proxy statement from a legalese-driven disclosure to a blend of legal document and communication tool. That transformation is readily apparent when looking at disclosures related to executive compensation. New SEC rules require companies to adopt clawback compensation policies and describe executive pay in the context of financial performance benchmarks such as total shareholder return. This information is on top of what companies are already disclosing about executive compensation.

The improved reporting potentially impacted voting. This proxy season we saw fewer failed say on pay votes. Just 26 companies in the Russell 3000 stock index failed to gain majority support for their plans, down from 81 in 2022. Average support for say on pay was 91%, the highest level in five years.

This may signal that companies are getting better at aligning pay and performance (an issue during the pandemic years), selecting rigorous performance goals and articulating the rationale for nonperformance-based equity, grants and special awards. We hear this in our conversations; investors tell us they are more interested in why compensation programs make sense than picking apart the structures. Together this means that boards are being provided with more flexibility to craft compensation programs when their decisions are supported by effective disclosure.

Environmental and social shareholder proposals

Shareholder proposals addressing environmental and/or social (E&S) issues represented nearly two-thirds of all shareholder proposals that were voted on during the 2024 proxy season. This includes both proposals that ask companies to increase disclosure or take actions to mitigate perceived risks, “pro-E&S” proposals, and those that ask companies to consider alternative impacts or roll back activities that are perceived as not linked to financial impacts, “anti-E&S” proposals. The 349 combined E&S proposals represented more than double the total in 2021. Despite the growth in numbers, we continued to see support for both types of proposals plummet.

Average support for pro-E&S proposals was just 20%, down from 39% in 2021. Interestingly, support for antiE&S proposals also trended downward to 2%, despite a record number of proposals filed. We continued to see proposals that were likely too prescriptive and specific with their requests. After similar submissions failed in 2023, we expected shareholder proponents to listen to the market and file broader policy-based proposals. They didn’t and the results were predictable. But that is not the only factor that drove the results.

The diminished support may also be due to disclosures catching up with investor expectations in this area. As companies comply with Europe’s CSRD and the California climate disclosure requirements (the SEC rules are stayed, pending legal challenges), they are reporting more sustainability data than ever before, giving investors a clearer picture of the impact of climate-related and other sustainability-related issues on the business. In many cases, this has allowed companies to proactively address investor concerns.

We saw that in several instances. For example, the same proposal focused on adopting emissions reduction targets was submitted at separate companies in the consumer cyclical and energy sectors. The proposals failed to gain meaningful support at the energy companies in part because they had fairly robust disclosures on the topic, even though the proposals were asking for additional disclosure. But there was significant support for the proposals at the consumer cyclical companies likely because of their limited disclosures.

Lower support for proposals at companies with more robust disclosure may indicate that shareholders are more interested in how the company is managing the risks and opportunities associated with the E&S issues that are most important to the company than parsing which metrics are being disclosed. However, boards and management should be prepared for more metric level scrutiny as the first tier of companies file their CSRD reports next year, and many large US companies following the year after.

Director elections

Director elections often offer investors a chance to use their votes to voice dissatisfaction with the strategic direction of the company, the response to a recent crisis, lapses in oversight or the lack of progress on issues such as boardroom diversity and climate change. A no vote sends a clear message to management that investors aren’t happy.

Over the past few years, investors have appeared to be more comfortable registering their dissatisfaction, with average director support falling steadily. This year the trend reversed and average director support at Russell 3000 companies was 94.8%, the highest level since 2020. This increase in support also translated into a decrease in the number of directors failing to receive majority support. The 40 directors that failed to hit the 50% support threshold was also a new low-water mark for the current decade.

While investors use a range of factors to evaluate a director, the depth and breadth of disclosures of key issues facing the company can give them greater confidence that the board has the composition to steer the company in the right direction. Proxy statements have evolved to become a key source of this information. Director profiles and skills matrices demonstrate that the boards’ profile is appropriate for the strategy. Robust executive summaries and expanded narrative discussions of committee work help shareholders understand how the board functions. In addition to meeting shareholder expectations, these elements can also get ahead of activist criticisms.

Activism

The number of activist campaigns reached a recent high in 2022, with shareholders launching 137 campaigns in the US that year. That represented a return to pre-pandemic levels following a significant decrease during the COVID-19 pandemic. Activity of activist campaigns through the first half of 2024 shows that rebound held. Proxy contests have rebounded too after the lull that followed the SEC’s universal proxy rule becoming effective in August 2022.

As we mentioned in our proxy season preview, it is crucial for boards to be aware of the evolving landscape of shareholder activism. Behind the scenes, there is significant capital deployed and a flurry of activity, with settlement emerging as the easiest path due to the uncertainty surrounding universal proxy.

Early predictions of the impact of universal proxy were focused on activists having an easier path to win board seats through proxy contests. The thinking was that the combined effects of activists targeting underperforming companies, honing their ability to message alternative strategies, and selecting high-quality nominees would secure at least a partial win. However, as we highlighted in our 2024 governance trends, the introduction of universal proxy does not guarantee that management will lose one or more seats in every contest that goes to a vote. In fact, of the 16 proxy contests this year, management slates received majority support in 14 of them, a sign that many investors are not satisfied with the case for change being laid out by proponents.

The no-action process continues to evolve

Heading into the proxy season, we suggested keeping an eye on the evolution of the no-action process, which companies use to validate that shareholder proposals conform to the SEC’s rules. Following an SEC interpretive bulletin issued in 2021, it became less likely that companies would be successful when challenging a shareholder proposal, and fewer companies sought relief using the process. This year, companies submitted 253 no-action requests, up nearly 30% from 198 the previous year.

The rate of no action requests granted remained steady at about 50% of requests, but there was an interesting shift in the basis on which the relief was granted. The rule governing shareholder proposals, 14a-(8), includes several reasons that a proposal could be excluded from the ballot, including if the proposal deals with the company’s ordinary business or would be a form of micromanagement. Following the SEC’s interpretive bulletin, it was unlikely that companies would get relief to exclude a proposal based on micromanagement. However, this year micromanagement was the basis for 19% of the requests granted, up from 8% last year. Companies should consider this when deciding if they will seek no-action relief for proposals submitted in the coming months.

What to expect as we look to 2025

We anticipate the quality and breadth of disclosures to continue to be a differentiator in future proxy seasons as a greater universe of companies comply with different regulatory deadlines over the next few years. Look for this reporting to be a way for investors to gain a greater understanding of strategic insights that can affect financial results. But boards should also be prepared for the scrutiny that comes with greater transparency: activists and other external stakeholders may use this information to monitor progress (or the lack of it) against any goals a company has set, particularly with regard to climate-related issues.

Print

Print