Matteo Tonello is the Head of Benchmarking and Analytics at The Conference Board, Inc. This post is based on a Conference Board memorandum by Mr. Tonello, Greg Arnold, Blair Jones, Deborah Beckmann, and Jason Schloetzer.

Chief executive succession rates have dropped after a peak during the pandemic, but an impending wave of retirements among older CEOs underscores the need for boards to focus on long-term planning. This report offers comprehensive data on current trends in CEO succession among US public companies, along with best practices for leadership transitions.

Key Insights

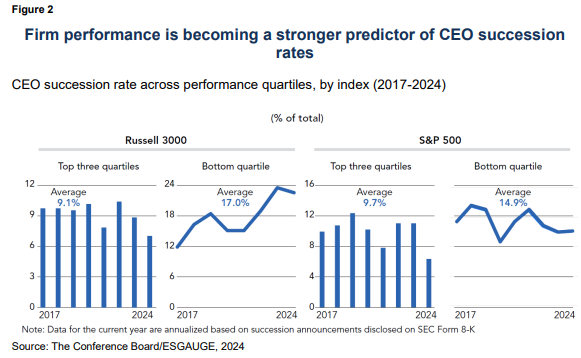

- While the overall rate of CEO succession is decreasing and normalizing to prepandemic levels, total shareholder return is playing a larger role than usual in predicting turnover.

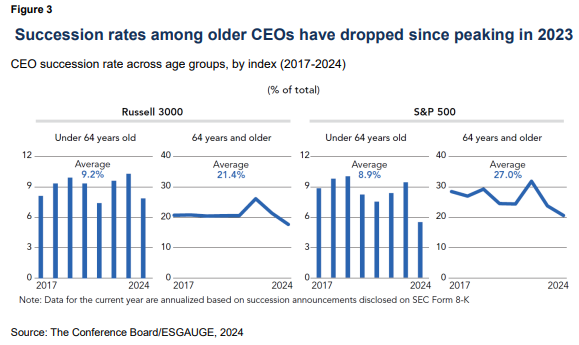

- Succession rates among CEOs aged 64 years and older have steadily dropped in recent years, likely reflecting boards’ preference for stability amid uncertainty, but signaling a potential surge in successions as these CEOs eventually retire.

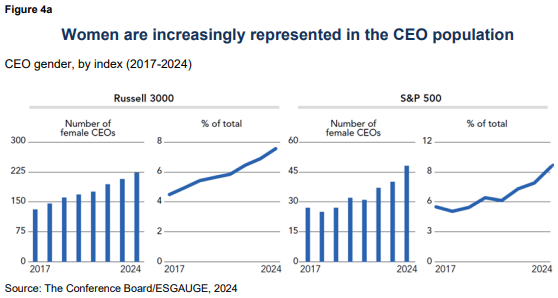

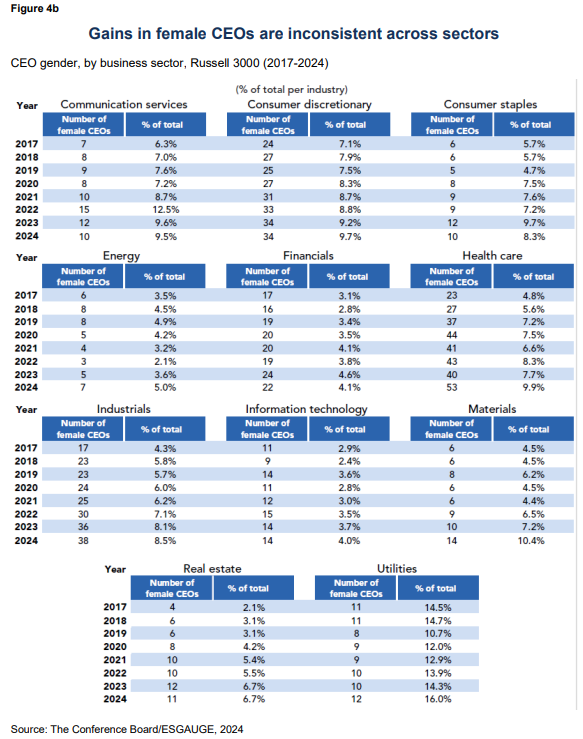

- Despite a 70% increase in female CEOs among Russell 3000 companies since 2017, women CEOs still represent just 8% of the total index, while in the S&P 500, the figure is slightly higher at 10%, highlighting slower progress compared to the faster rise in female board representation.

- CEOs are typically promoted rather than hired, and the chief operating officer role remains the most common path to the top, although companies with declining performance are more likely to hire externally.

CEO Succession Rates Are Below Historical Averages After a Postpandemic Spike

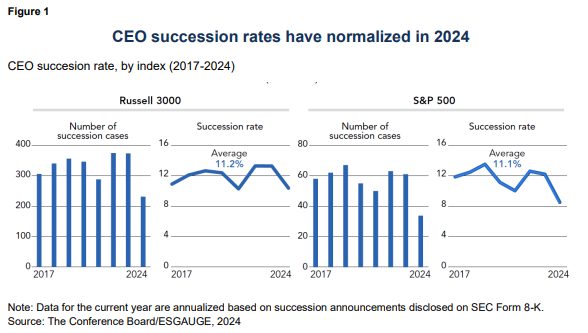

- According to public disclosure data, 10% of Russell 3000 and 8% of S&P 500 companies will hire new chief executives in 2024, which is a notable decrease since a peak during the pandemic. That said, underperforming companies are seeing higher turnover than what might normally be expected in the circumstances.

There was a notable decrease in the number of CEO succession cases for both the Russell 3000 and S&P 500 in 2024, after an uptick in CEO turnover cases in 2022 and 2023 following the pandemic. The decline in 2024 likely reflects boards’ preference for stability amid ongoing economic and political uncertainties.

In 2024, nearly half (45%) of Russell 3000 companies that changed CEOs had one-year total shareholder return (TSR) below the 25th percentile, which has gradually increased from 30% in 2017. The S&P 500 displayed a similar pattern, with 42% of succession cases occurring at lower-performing companies—increasing from 29% in 2017. It’s hardly surprising that lower-performing companies might seek new leadership more often than their higher-performing peers, but the gap in succession rates grew in 2024. For companies in the lowest-performing quartile of the Russell 3000, the succession rate is 11 percentage points higher than the rest of the index. This gap has widened significantly since prepandemic days, when the difference was in the single digits, indicating there is increased pressure on executives when TSR is down.

CEO Succession Rates Have Fallen for Older CEOs

- The succession rate among older CEOs dropped significantly in 2023, indicating potential retirements on the horizon. Boards should act now to refine their succession plans, ensuring they are well-prepared for leadership transitions that will support both continuity and long-term value creation.

CEOs are also staying on longer than ever before, which could contribute to 2023’s softening succession rate among older CEOs. Across the Russell 3000, the rate of CEOs with over 15 years of tenure has gradually increased from 11% in 2019 to 18% in 2024. In tandem, the proportion of CEOs aged 60 years and older has also steadily grown, to a current high of 40%. In 2024, the succession rate among CEOs aged 64 and over dropped by 3% in the Russell 3000 and nearly 4% in the S&P 500. This may suggest a potential “cliff” of retirements on the horizon, increasing the need for boards to plan for future leadership transitions now.

The Number of Women CEOs Has Increased in Last Five Years, but Gains Are Inconsistent

- While the prevalence of female CEOs has risen to a historical high of 9.5% in the S&P 500 and 7.6% in the Russell 3000, this growth has been uneven across sectors. Nearly all female CEO appointments in 2024 were also at companies with less than $5 billion in revenue. Companies should aim to mirror in the C-Suite the recent surge of women on boards by building robust pipelines and succession plans that foster diversity at the highest levels of leadership.

Since 2017, the prevalence of female CEOs has risen by nearly 3 percentage points in the S&P 500 and 4 percentage points in the Russell 3000. In actual terms, this represents a 70% increase in the total number of Russell 3000 companies with a female CEO in eight years, and 77% increase for the S&P 500, albeit from a low starting baseline. At the same time, the election of female board members increased at a much faster rate during the same interval, over 10 points in both indexes.

Digging deeper into the data, we find that the rise in female CEOs is largely influenced by a few specific industries. In 2024, incoming female CEOs in the Russell 3000 were predominantly in the health care (26%), consumer discretionary (24%), and materials (18%) sectors.

There is also a gender discrepancy based on company size. Over 75% of incoming female CEOs in the Russell 3000 in 2024 were hired at companies with less than $5 billion in revenue. Only one appointment was to a company with over $25 billion in revenue.

In-House Experience Widely Valued in Incoming CEOs, but It’s Important to Know When Seeking External Candidates Makes Sense

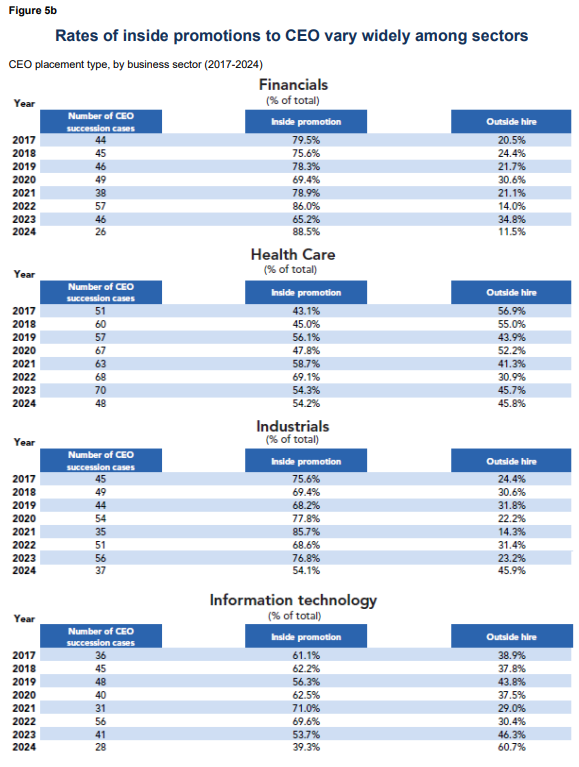

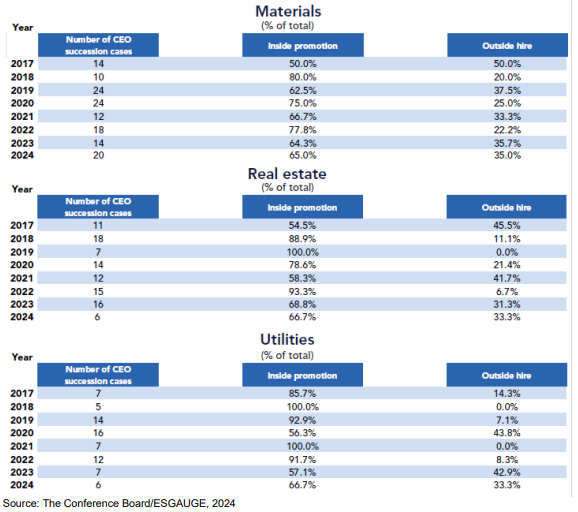

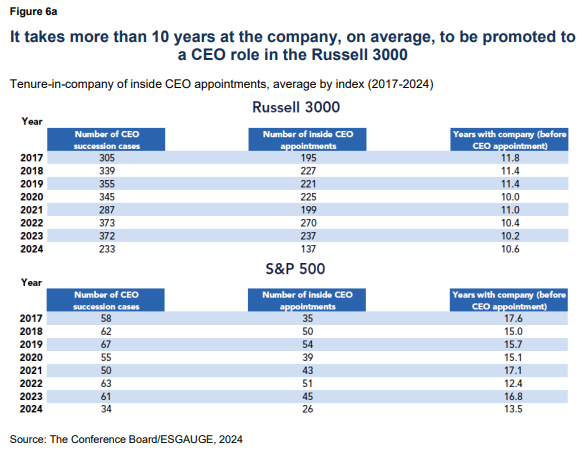

- In 2024, 59% of new Russell 3000 CEOs and 77% of S&P 500 CEOs were promoted from within. Internally promoted CEOs offer deep company knowledge and cultural alignment, with an average tenure of 14 years in the S&P 500. The COO role remains the most common path to CEO, emphasizing its importance in succession planning. However, companies with declining performance are more likely to hire externally. Boards should focus on internal CEO promotions to maintain strategic continuity, but also recognize when external hires may be necessary to drive change.

Companies often prefer to promote from within rather than seek an outside CEO: internal candidates have prior business knowledge, strong alignment with corporate culture, established in-house relationships, and the ability to step into the role with minimal disruption. That said, the rate of internal hires softened in 2023 compared to historical norms. In the Russell 3000, internal hires of new CEOs in 2023 were at their lowest rate since 2017; in the S&P 500, the rate was slightly below the historical 78% average.

Much like the differences in hiring female CEOs, these rates are markedly different across different business sectors. In 2024, communication services, consumer staples, energy, financials, materials, real estate and utilities companies reported rates of internal promotions above the average rate of 59% for the Russell 3000 as a whole.

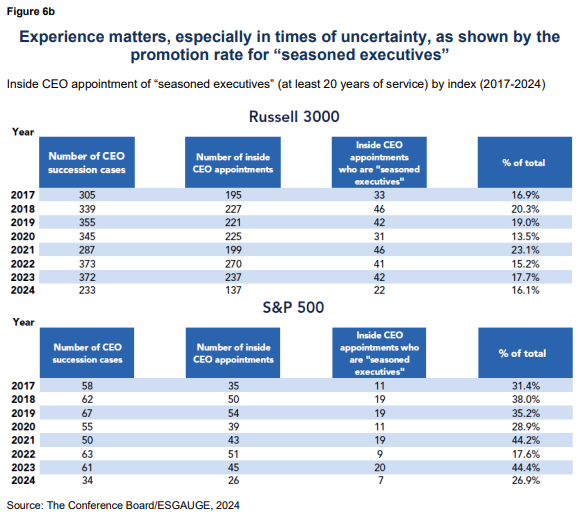

Companies clearly value long-term, in-house experience for internal CEOs. This year, the average tenure-in-company of internally promoted CEOs was 14 years in the S&P 500 and 11 years in the Russell 3000, which aligns with historical averages since 2017. The share of CEO promotions given to “seasoned executives,” those with at least two decades of company service, remains strong for both the Russell 3000 (16%) and the S&P 500 (27%), demonstrating the clear value of experience when it comes to internal promotions.

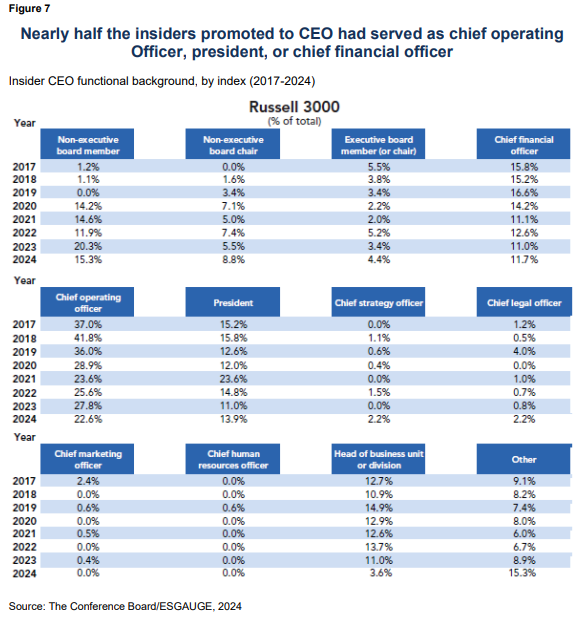

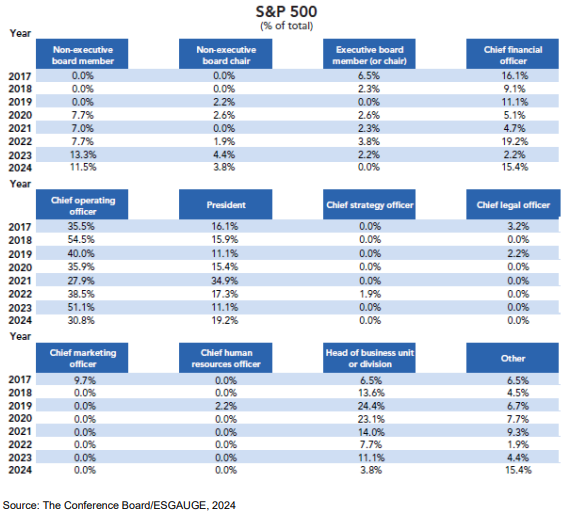

The chief operating officer role is often used as a “training ground” for future CEOs and is a useful stepping stone role to consider in succession planning. The median tenure for COOs is only two years; over half of companies (57%) dissolved the COO role entirely after promoting a new chief executive, reflecting that this is often a temporary position used specifically for succession planning. Often, a COO is stepping up from a business unit head role, showcasing a tiered pipeline for promising talent.

Chief financial officers are another important source of talent, representing 12% of incoming insider CEOs in the Russell 3000 and 15% in the S&P 500 in 2024. Presidents and nonexecutive board members are also a common pathway.

Though promoting from within remains the most common way to ensure strategic and cultural continuity, there are several reasons why a company might want to look outside its walls for new leadership. A common reason is to correct poor performance. When companies are struggling, they are far more likely to look outside for new CEOs, a fact borne out in the data. In 2023, the previous year’s median one-year TSR was down 8% for companies that hired external CEOs and up 2% for those who promoted internally.

Businesses may also need fresh ideas and new thinking, either to respond to a changing market or pivot away from failing strategies. Similarly, aiming for a big or splashy new goal might require a bigger, splashier hire to achieve it. Out of 102 external hires by Russell 3000 companies in 2024, less than half (45%) had previous experience as a CEO, highlighting that companies are often willing to take a risk with external hires to bring in new perspectives or skills. In 2024, over 60% of external CEO appointments in the Russell 3000 were also made in three sectors: health care (24%), consumer discretionary (23%), and information technology (17%).

Compensation and Employment Contract Considerations for Inside vs. Outside CEO Hires

An incoming CEO is paid (at median) about 15% less than the departing CEO across both the S&P 500 and Russell 3000. On average, externally hired CEOs are paid 33% more than internal CEOs. This is frequently because internal candidates are new to the job, and thus come in at a discount; often, the long-term plan is to increase the individual’s pay as they gain skills in the role. Moreover, internal candidates have already accumulated significant equity in the company, whereas outside hires usually require substantial upfront grants to replace the equity they had in their previous organization.

The apparent discrepancy in pay may also be a function of “who” is hiring external candidates. When looking at the largest companies in our data set (the top 15%), we found that over threequarters of them hired CEOs from outside the company, likely raising their average compensation since incoming CEOs may need to be offered stronger incentives to switch companies.

Still, there are many reasons why external hires may be paid more than internal hires, including having more experience, being paid a “risk premium” to uproot their lives and families, or because of the need to be comparably compensated to the outgoing CEO. Some incoming CEOs may also need to be “made whole” for equity lost when leaving another company. While paying for all of an incoming CEO’s unvested equity is not always necessary, boards will want to factor in the potential cost when searching, and make sure to understand what an executive might be leaving on the table.

Beyond compensation, boards should also be aware of a broader shift in CEO employment contracts, regardless of where the candidate comes from. Of the 80 companies we sampled, only 50% disclosed some form of offer letter/employment agreement for their incoming CEO. Of the companies that did disclose, 30% of them utilized an employment agreement. This is in line with our own experience, as companies move away from contracts for CEOs, opting instead for offer letters.

CEO Succession Plans Are a Good Time to Reevaluate Broader Business and Compensation Goals

When hiring a new CEO, the pay program may also need to evolve to support changing business priorities. This is especially true when the company is pivoting or changing strategy. Boards should holistically consider new company objectives and strategies and then revise incentive plans accordingly. Compensation plans are a great way to reinforce new priorities and align the company under new leadership. They should be discussed in tandem with any strategic changes. Some considerations include:

- Does the company need to realign broader incentive programs to fit the new CEO’s strategy, culture, and business objectives? If the company is changing directions, the compensation structure should reflect new priorities. A new CEO may want to reorganize the corporate structure or culture to help achieve their vision.

- In addition to financial goals, would additional operational and strategic goals help signal priorities or support achieving target outcomes? Succession is a good time to add to or revisit these goals and consider whether they are critical to new strategic priorities.

- How do you retain high-level talent during the transition? Often, the “losers” of a succession plan might look elsewhere for opportunities. Boards should have a strategy for retaining essential talent without hamstringing the incoming CEO, who may want to build their own team. While companies should be judicious, performance-based retention grants can help hold on to top employees.

Additionally, CEO succession is a convenient time to revisit the effectiveness of the succession planning process and to help identify things that went right or things that could be improved for next time.

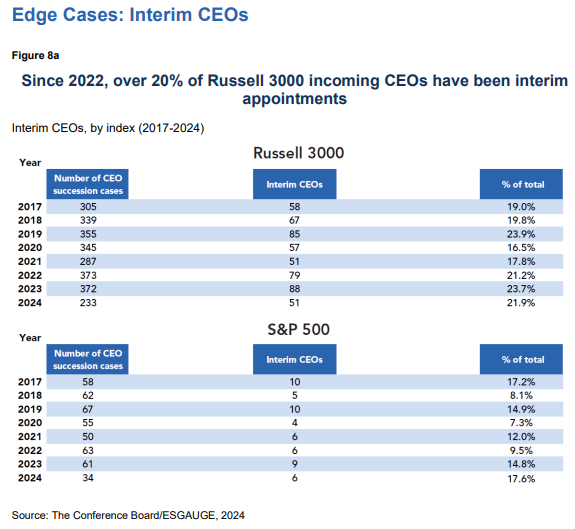

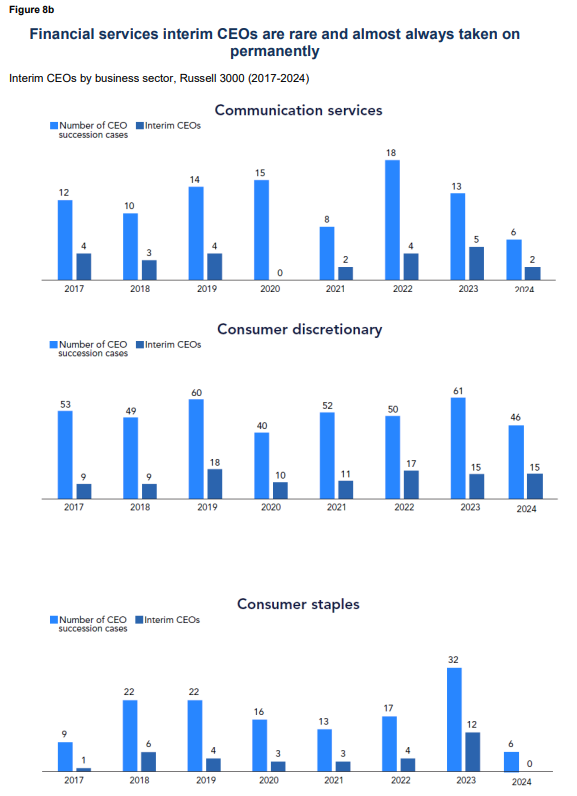

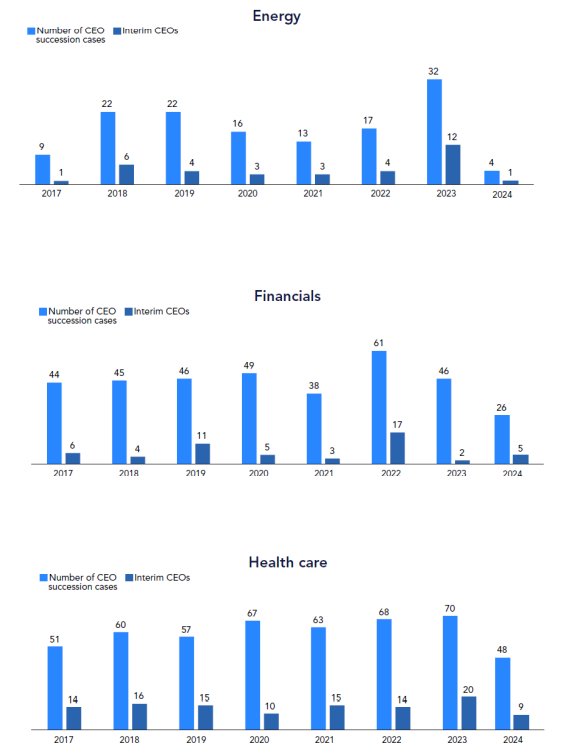

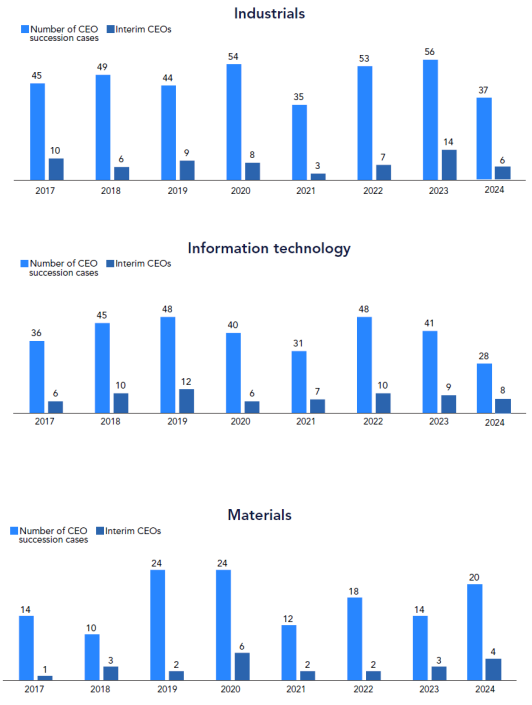

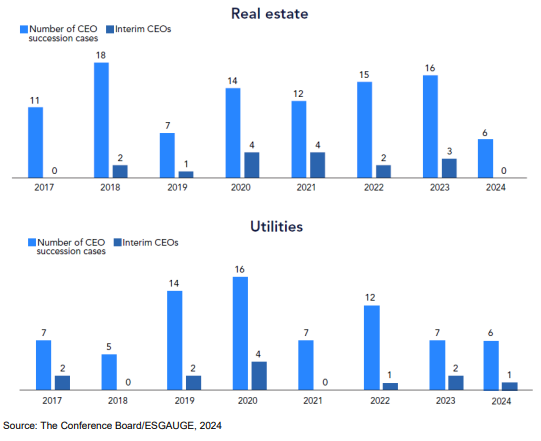

Interim CEOs are often used for short-term leadership issues, like when a CEO leaves unexpectedly for health reasons or a company crisis. There is a slight bias by sector, and interim positions are more common in the communication services (33% of incoming CEOs) consumer discretionary (33%), and information technology (29%) industries.

Interim roles typically last between two and 10 months and are frequently filled by board members. Approximately one-third of interim CEO appointments at Russell 3000 companies in 2024 were former board directors, although only one transitioned to the permanent CEO role. Overall, just 9% of interim CEOs at Russell 3000 firms secured a permanent position in 2024, reinforcing the role’s primary function as a short-term solution.

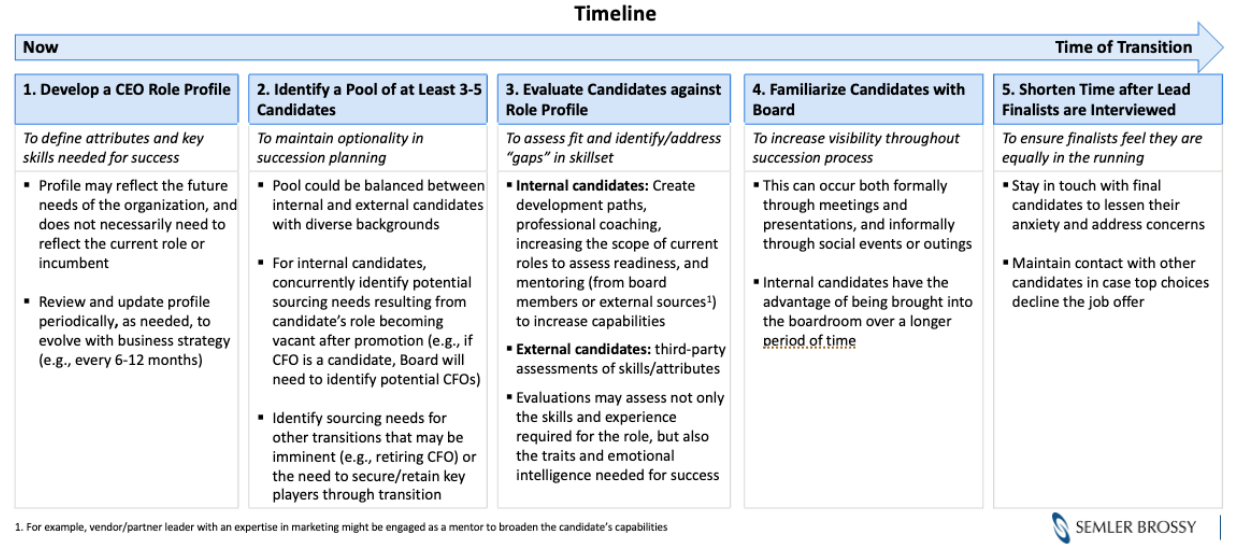

Thinking About Succession Now Is the Best Way to Ensure a Smooth Transition Later

No matter your new CEO’s experience level, prior company, or background, the best way to ensure a successful succession is to take proactive steps long before a new leader is necessary. This involves cultivating and assessing promising talent, retaining internal candidates through well-designed incentive programs, and regularly evaluating company priorities and desired leadership qualities. We suggest that boards review their succession plans annually to ensure they are still aligned with the company’s changing priorities and strategies.

Once a new CEO has been selected, boards should also be proactive stewards of the transition and consider the talent challenges and possibilities1 that come with high-level leadership changes. This may involve re-evaluating compensation goals and incentives, navigating the outgoing CEO’s role at the company, and managing candidates who were “passed over” for the job. Since pay programs and incentives may change during the transition, boards should be ready to supply the rationale for succession choices to internal and external stakeholders.

Ultimately, a broader understanding of the CEO market and common succession practices can help steer boards toward more well-informed, forward-thinking leadership planning, setting their companies up for sustained success and continuity. While the landscape of incoming CEOs is changing, the need to stay ahead of the curve remains as vital as ever.

Print

Print