Suzanne Kounkel is the Chief Marketing Officer, Christine Davine is a Managing Partner, and Tanneasha Gordon is a Principal at Deloitte & Touche LLP. This post is based on a Deloitte memorandum by Ms. Kounkel, Ms. Davine, Ms. Gordon, David Cutbill, Bob Lamm, and Jamie McCall.

Why it matters

A review of business headlines offers numerous examples of how damage to a company’s brand can cast a long-shadow. This is a complex area of governance because it can include consideration of factors like corporate values, ethical standards, product reliability, and communication responsiveness to adverse events. Admittedly, integrating such a broad array of factors into oversight processes isn’t easy. But those who take on the challenge can better anticipate risks to the company’s image. And that may result in an outsized competitive advantage.

- Damage prevention: Building a reputation is hard, but not in comparison to restoring a damaged brand.

- Cross-functional: oversight Integrative approaches for oversight of the brand could be particularly useful.

- Span of control: It’s not possible to anticipate everything, but consider a focus on what’s controllable.

Introduction As stewards of long-term value for shareholders and other stakeholders, boards that effectively oversee the enterprise’s brand and reputation could see outsized benefit. [1] In the current business and economic landscape, the perception of a company’s image can rapidly shift. And regardless of the environment, building and maintaining a brand is rarely easy. But the challenge can pale in comparison to the expensive and lengthy process of repairing a tarnished corporate image.

This edition of On the Board’s Agenda offers strategies for boards to effectively navigate this aspect of their oversight responsibilities. When considering a strategic approach, directors will likely have to contend with a diverse array of factors—some of which may extend far beyond traditional board concerns. Because the impact of brand and reputation can affect the whole enterprise, these elements are interconnected. That’s one reason why a cross-functional oversight approach may offer outsized value:

Risks and opportunities

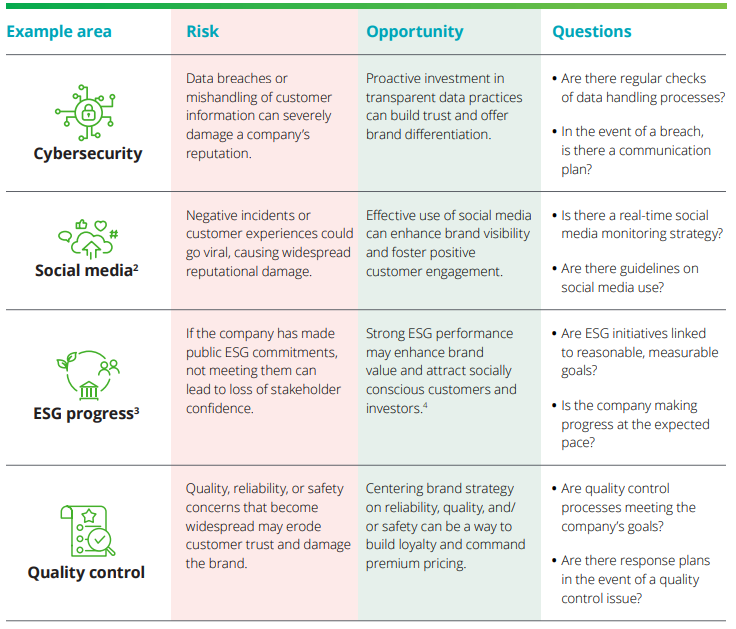

Some of the risks and opportunities around corporate image will vary by sector. But there are a few cross-cutting concerns that may be top of mind at any company. The following few illustrative examples might be worth considering:

Of course, just like other areas of board oversight, there are numerous risks and opportunities in this area. Some number of them could be difficult to anticipate, and others may exist outside the company’s span of control. This reality underscores the potential value of monitoring systems and agile response strategies. [5] While specific metrics and methods will vary by company, the following high-level examples could be applied by enterprises in any sector:

Oversight approaches

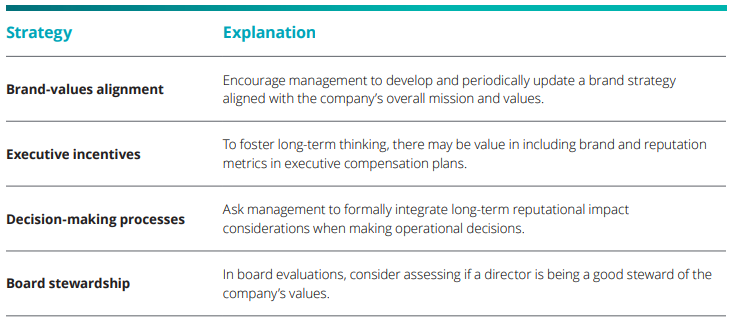

It isn’t easy to balance between addressing immediate concerns and nurturing long-term brand value. But it could be particularly important when it comes to the company’s image. [8] Short-term crises can lead to actions that solve the immediate problem but could be at the cost of the brand’s longer-term trust standing. [9] To navigate this tension, boards might consider approaches that encourage a proactive long-term strategy tilt. [10] The following strategies represent a few illustrative examples:

For boards seeking to enhance their oversight of brand and reputation, regular updates from the chief marketing officer (CMO) could be a valuable resource. To help integrate brand considerations across business functions, it could also be fruitful to encourage collaboration between the CMO and other executives.

Similarly, it could be worth seeing if current directors have backgrounds working as a CMO. If so, those individuals may offer a valuable perspective to governance discussions and help bridge the gap between marketing experience and strategic oversight. [12] If no sitting director has that skill set, it could be included as a desired factor in future searches.

Board composition: CMO experience gap

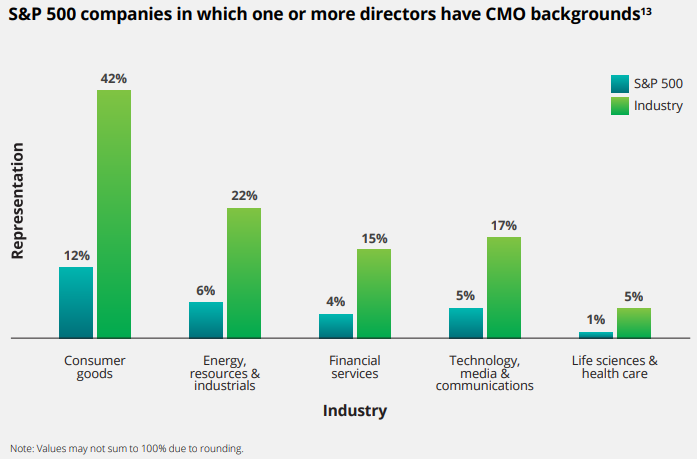

Current and former CMOs have experience developing and executing on brand strategy. That skill set could be useful in overseeing brand and reputation. But according to a recent analysis by Deloitte, many companies may not be leveraging CMO experience on their boards. Just 28% of companies in the S&P 500 have at least one director with CMO experience.

As might be expected, this does vary by industry. About 42% of all consumer goods companies in the S&P 500 have CMO representation on the board. That’s 12% of the total S&P 500 index. On a relative basis, that’s notably high compared to sectors like energy (22% within industry, 6% of S&P 500) or financial services (15% within industry, 4% of S&P 500).

Creating a competitive advantage

As the business landscape becomes ever more volatile, brand and reputation oversight may appear more frequently on the board’s agenda. Boards with a proactive governance approach in this area can help their companies avoid costly short-term reputational crises and position them for long-term growth. Because while building and maintaining a strong reputation is a challenging endeavor, it pales in comparison to restoring a damaged brand.

Brand and reputation governance is undoubtedly a complex task. Doing it effectively means balancing competing pressures, anticipating risks outside the company’s span of control, and leveraging hard-to-see opportunities. Yet for boards that rise to the challenge, the resulting competitive advantage could be substantial.

Conversation starters

For those interested in improving their governance of brand and reputation, the following questions can serve as boardroom conversation starters:

- How does the company’s current brand strategy align with its long-term business objectives?

- How does the company currently measure and monitor its brand health and reputation? Are any current metrics providing actionable insights?

- In what ways might the company’s current corporate culture have an impact on brand reputation, both positively and negatively?

- Is the board effectively leveraging the CMO’s experience in brand and reputation governance discussions?

- What processes are used by management to incorporate brand and reputational considerations into major business decisions?

- How well-equipped is the company’s crisis management plan to handle a significant reputational threat?

- How prepared is the company to adapt its brand strategy in response to significant market disruptions or societal changes?

- How effectively is the company communicating its brand values and reputation management efforts to investors and other stakeholders?

1Alison Rankin Frost and Chris Cooke, “Brand v reputation: Managing an intangible asset,” Journal of Brand Management 7 (November 1999): pp. 81–87.(go back)

2Deborah DeHaas and Diana O’Brien, “Managing brand risk in an age of social media,” On the board’s agenda, Deloitte Center for Board Effectiveness, June 2017.(go back)

3Paul D’Aloia et al., “Make or break: Delivering on your brand promise,” Deloitte, 2020.(go back)

4Monica O’Reilly and Jim Eckenrode, “How financial services can use ESG initiatives to help build a brighter future for all,” Deloitte Center for Financial Services, 2021, pp. 1–9.(go back)

5Diana O’Brien and Deborah DeHaas, “Why marketing should matter to boards,” Director Advisory, National Association of Corporate Directors (NACD), March/April 2017.(go back)

6Net promoter score (NPS) asks clients/customers to rate the likelihood that they would recommend the company, product, or service to others on a scale from 0 to 10. Scores are categorized based on the response into Promoters (9–10), Passives (7–8), and Detractors (0–6). Exact calculations of NPS vary by company. One method involves subtracting the percentage of Detractors from the percentage of Promoters. See Deepak Sharma, Jagjeet Gill, and Anne Kwan, “Customer-centric digital transformation: Making customer success integral to the organization,” Deloitte, September 4, 2019.(go back)

7Brand equity score quantify the strength of a brand as perceived by consumers and/or clients. It encompasses dimensions like perceived quality and associations with other brands. The components for the score can include sources like customer surveys, market data, and/or focus groups. The weight of each data input varies based on the company’s industry and operations. The resulting value reflects the overall impact of the brand on consumer behavior and may indicate the company’s competitive standing in the market. When done correctly, a higher brand equity score could also indicate a higher resiliency level for corporate image. See Ashley Reichheld and Amelia Dunlop, “Challenging the orthodoxies of brand trust,” Deloitte Insights Magazine, no. 31 (January 31, 2023): pp. 46–96.(go back)

8Edmund R. Gray and John M.T. Balmer, “Managing corporate image and corporate reputation,” Long Range Planning 31, no. 5 (October 1998): pp. 695–702.(go back)

9Deloitte, “The future of trust: A new measure for enterprise performance,” 2021.(go back)

10Čedomir Ljubojević and Gordana Ljubojević, “Building corporate reputation through corporate governance,” Management 3, no. 3 (2008): pp. 221–33.(go back)

11Jennifer Barron and Deborah DeHaas, “How to bring brand into the boardroom, Deloitte’s Risk & Compliance Journal for the Wall Street Journal, November 29, 2016.(go back)

12Transmission and Newton X, Building the board-ready CMO in B2B, 2024.(go back)

13Based on a July 2024 Deloitte analysis of board member data from BoardEx.(go back)

Print

Print