Subodh Mishra is Global Head of Communications at ISS STOXX. This post is based on an ISS-Corporate memorandum by Sandra Herrera Lopez, Vice President, Data Analytics; and Kevin Kim, Associate, Compensation & Governance Advisory at ISS-Corporate. Related research from the Program on Corporate Governance includes The Perils and Questionable Promise of ESG-Based Compensation (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita.

Environmental, Social and Governance (ESG) concerns have become some of the top issues for corporate America in recent years. However, discussions surrounding these initiatives have become highly politicized and polarized, with anti-ESG shareholder proposals on the rise, certain companies rolling back their DEI initiatives, and falling shareholder vote support for various environmental and social proposals in recent years. At the same time, some shareholders are pushing companies to take more ambitious actions. [1] The U.S. Supreme Court’s June 2023 ruling to significantly limit the use of race status in college admissions has also emboldened investors challenging Diversity, Equity, and Inclusion (DEI) initiatives at public companies.

Many public companies have been incorporating ESG considerations including DEI into compensation programs to incentivize their executives to achieve sustainability and DEI goals as well as financial objectives. Now, some are re-evaluating their approach given the recent shifts in the political and legal landscape. Against this backdrop, ISS-Corporate examined the incentive pay data for S&P 1500 companies to determine the prevalence, usage and payout levels of DEI metrics as well as changes these metrics measure.

KEY TAKEAWAYS

- ESG metrics experienced a period of rapid adoption among S&P 1500 companies, with more than 50% now incorporating at least one in their incentive program compared with 29% in 2021. 41% S&P 500 companies utilize a diversity related metric in their incentive programs. That’s significantly above the mid-cap S&P 400 at 18% and the small-cap S&P 400 at 12% in 2024.

- Diversity, equity and inclusion metrics to assess performance have lost momentum after a boost from 2021 to 2023.

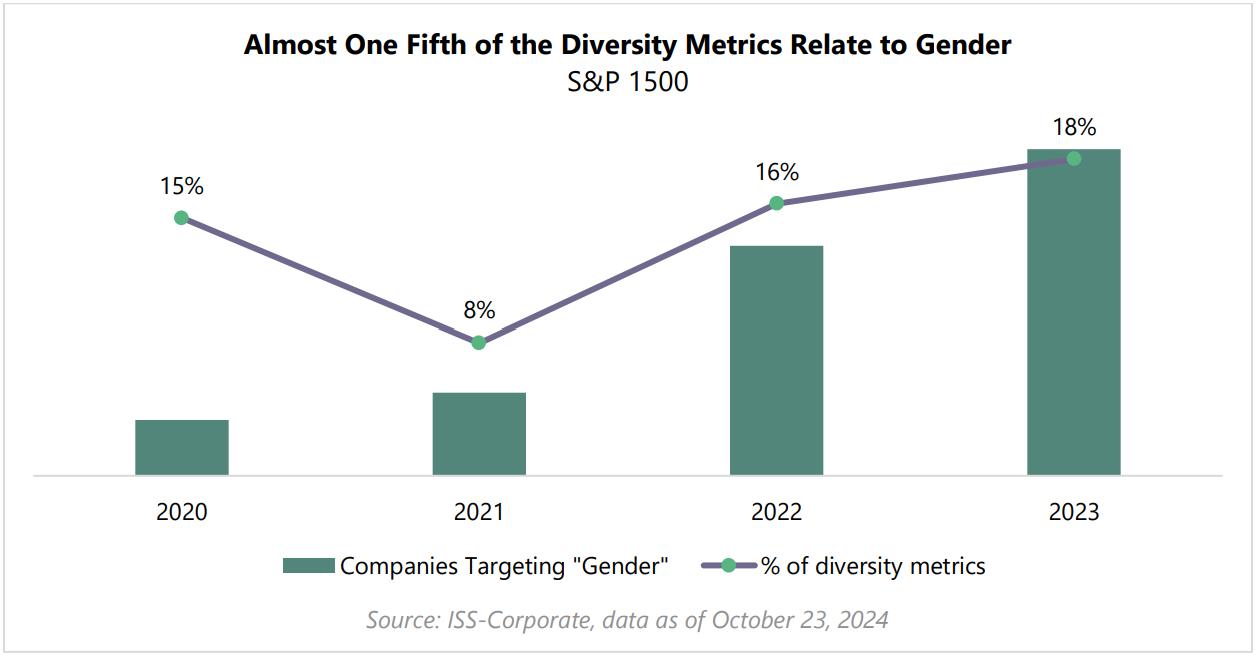

- Gender diversity metrics are more prevalent than ethnic considerations. 18% of diversity metrics in 2023 mentioned gender, while only 10% refer to ethnicity.

- Diversity metrics are 7% more likely to be achieved and yield payout than financial metrics.

- Disclosures pertaining to DEI metrics have become more transparent. Approximately 61% of S&P 1500 companies now provide complete disclosure of their DEI metrics. This represents a sharp increase from 34% in 2019.

ESG Metrics in Executive Pay Have Spread Quickly, but Adoption is Slowing

The practice of incorporating ESG considerations into executive incentives has seen a rapid growth until recently. In 2021, 29% of S&P 1500 companies included at least one ESG metric in either their short-term incentive (STI) or long-term incentive (LTI) program, while by 2023, 58% of the S&P 1500 had ESG metrics in their executive incentives. S&P 500 companies has led the change for increased ESG metric usage in STI or LTI, with 61% adoption by 2024, representing an almost a three-fold increase compared to 2021. Adoption of ESG metrics is less common for smaller companies but has almost tripled between 2021 and 2024. However, the rate of increase appears to be decelerating, potentially as a result of the adoption level reaching a natural saturation point or due to increased pushback against ESG practices.

Diversity, Equity, and Inclusion Metrics

Following the Black Lives Matter movement in 2020-2021, DEI metrics increased sharply within incentive programs. 41% of the companies in the S&P 500 have set a diversity-related goal, much higher than compared to companies in the S&P 400 (18%), and S&P 600 (12%).

Although the prevalence of ESG metrics in incentive programs remains high, enthusiasm for DEI appears to be dwindling, as shown by the trend moving slightly downwards in all indices during 2024. As the prominence of anti-ESG shareholder proposals continues to rise, particularly those with a social agenda, [2] the use of DEI metrics in incentive programs may now be losing steam with corporate issuers. Further, the Supreme Court ruling on affirmative action may provide another point of uncertainty for many companies going forward. The legal ramifications of the ruling on corporate America are not entirely clear yet. However, activist investors and political groups may now have a stronger legal basis to challenge DEI initiatives at corporations citing concern of “reverse discrimination”. As the potential costs and risks may begin to outweigh the benefits of DEI metrics in incentive programs, compensation committees may now be shifting their focus to other ESG related issues.

Quality of Disclosure

While the use of DEI metrics in incentive programs remains relatively uncommon outside of the S&P 500, the quality of disclosure has improved over the years. As more and more companies started incorporating ESG metrics in compensation plans, concerns emerged among investors over what was being measured, what success would look like, and whether the metric in question is relevant or material to the company. Often the details disclosed in proxy statements are broad, such as “Culture, Diversity, and Inclusion” without being more specific. However quality improved as DEI adoption spread and as more companies became more accustomed to measuring and reporting it. Over 60% of companies with DEI metrics are providing detailed disclosure on what is measured, such as certain demographic group (i.e. ethnic minorities or female) and specific action (pay, recruitment, education).

Language Matters

What is measured under a DEI metric in executive compensation can vary greatly. Compensation committees may craft goals or targets according to the stage of the company’s DEI programs and their objectives, their consumer or employee demographics, or various stakeholder demands. In 2021, DEI metrics that explicitly focused on ethnicity and/or race increased sharply, reflecting rising concerns over racial equity after George Floyd’s death and the social justice movement that followed it. In just one year, DEI metrics measuring race and/or ethnicity increased from almost none to 12%. While metrics on race/ethnicity continued to increase in absolute terms, they steadily declined as a percentage of the total as metrics measuring gender gained in volume.

Almost one in every five diversity metrics expressly mentioned gender as their demographic focus in FY2023. This is a ninefold increase in absolute terms since FY2020, but does not represent a significant increase as a percentage of companies with DEI metrics, as diversity metrics in general have also grown during the same period.

Payout Achievement

In general terms, DEI targets are more consistently achieved than financial goals. Over the past four years, only 5% of DEI metrics among S&P 1500 companies resulted in below threshold performance, resulting in no payout, and 73% achieved target performance. By comparison, 12% of financial metrics resulted in below threshold performance and 66% resulted in target achievement. [3]

This apparent gap between the ease of achieving DEI targets and the greater difficulty achieving financial goals may lead to greater investor scrutiny and pushback against DEI measures. Some investors may view inclusion of diversity metrics, especially those that are highly qualitative or lacking in quantifiable goals, as a mechanism to pad executive pay.

DEI Metrics in the Spotlight

Moving forward, close attention is warranted regarding the use, design, and disclosure of DEI metrics in incentive programs. While DEI metrics appear to be here to stay and continue to display increased prevalence year-over-year, many companies may now begin to shy away from incorporating or using them altogether due to the potential legal risks. DEI initiatives within incentive programs may take a turn in coming years as many issuers become hesitant to use outright diversity targets. However, diversity, especially at the executive and board level, remains an important topic for many issuers and institutional investors, and ESG metrics in executive compensation programs appear to be resilient and likely will remain a part of executive incentives. Continued monitoring of broader market trends within incentive programs may shed light on how corporations respond to changing societal dynamics while remaining responsive to shareholder demands.

Scrutiny over the use of DEI metrics is expected to intensify, both from those who are skeptical of DEI initiatives as well as from those who believe they should be more rigorous. Discontinuation of DEI metrics could lead to questions over the company’s commitment to diversity. To navigate sometimes conflicting stakeholder demands and design incentive program that appropriately rewards and incentivizes executives, compensation committees should closely monitor market practice, benchmark their pay design against peers, and proactively engage with multiple stakeholders.

1Papadopopulos K., Frank J., Parikh P. (2024, October 31). U.S. shareholder proposals: A decade in motion. ISS-Corporate. Retrieved from https://www.iss-corporate.com/library/us-shareholder-proposals-a-decade-in-motion/(go back)

2Papadopopulos K., Frank J., Parikh P. (2024, October 31). U.S. shareholder proposals: A decade in motion. ISS-Corporate. Retrieved from https://www.iss-corporate.com/library/us-shareholder-proposals-a-decade-in-motion/(go back)

3ISS-Corporate’s analysis suggests that incentive goals set by some companies may not be sufficiently rigorous. For more on this, refer to Saliba, R. and Herrera S., Annual Incentive Payouts: Are Target Goals Too Modest?, September 2023.(go back)

Print

Print