Adam Reilly is a National Managing Partner, and Barry Winer is a Head of Research at Deloitte LLP. This post is based on their Deloitte memorandum.

In an era of geopolitical change coupled with potential economic and regulatory policy shifts, the mergers and acquisitions landscape is set to be particularly challenging for the foreseeable future while also providing new opportunities. And according to our research, adaptability and agility in responding to these challenges are no longer just a nice-to-have skills for M&A leaders. They’re becoming core competencies and the “new normal.”

Deloitte surveyed 1,500 US-based corporate and private equity professionals in late 2024 to gauge their expectations for M&A activity in the following 12 months and learn more about their experiences with recent transactions (see methodology). Our research revealed four key pivots that leading M&A teams are using to capture value amid current risks and uncertainties.

The strategic pivot: Looking beyond traditional M&A

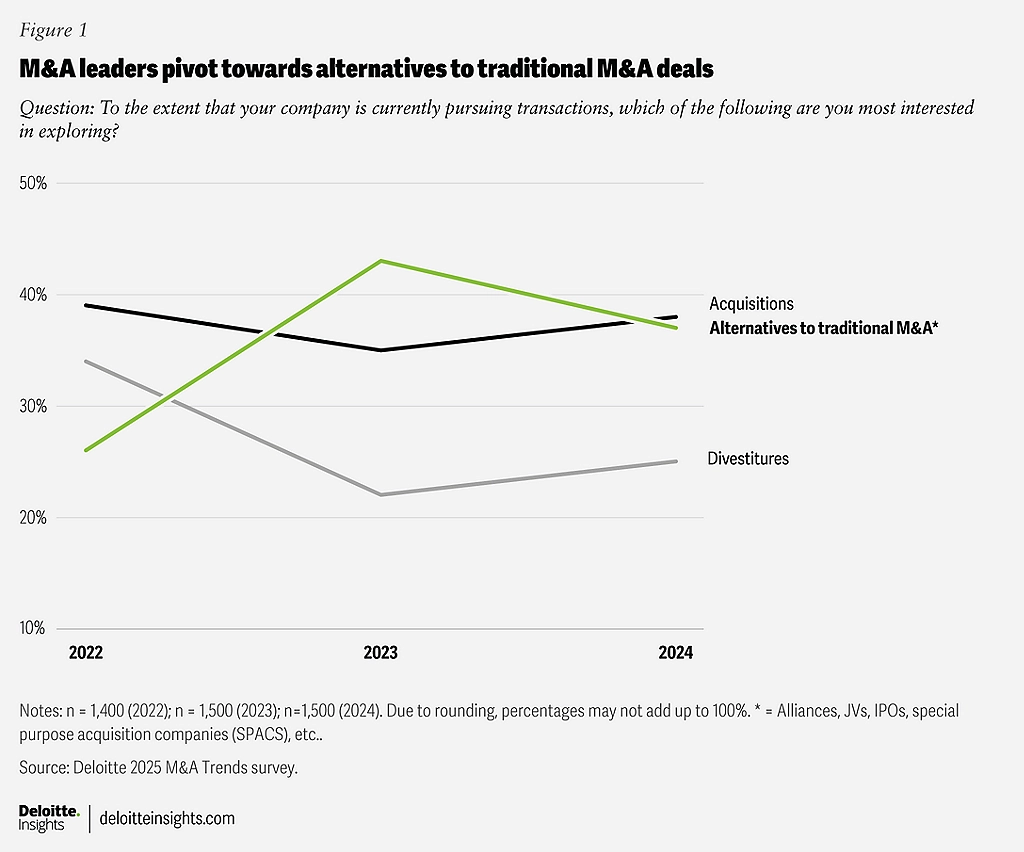

While M&A leaders are gearing up for future deals, our survey shows they’re also keeping their options open with strategic alternatives as a hedge, such as joint ventures, alliances, and initial public offerings as well as divestitures. Surveyed leaders say they’re currently pursuing alternative deals at a rate almost equal to traditional M&A. That marks a 42% increase in alternative M&A transactions between 2022 and 2024, indicating that organizations may be seeking more flexible and collaborative growth options (figure 1).

The financing pivot: Private credit is gaining popularity

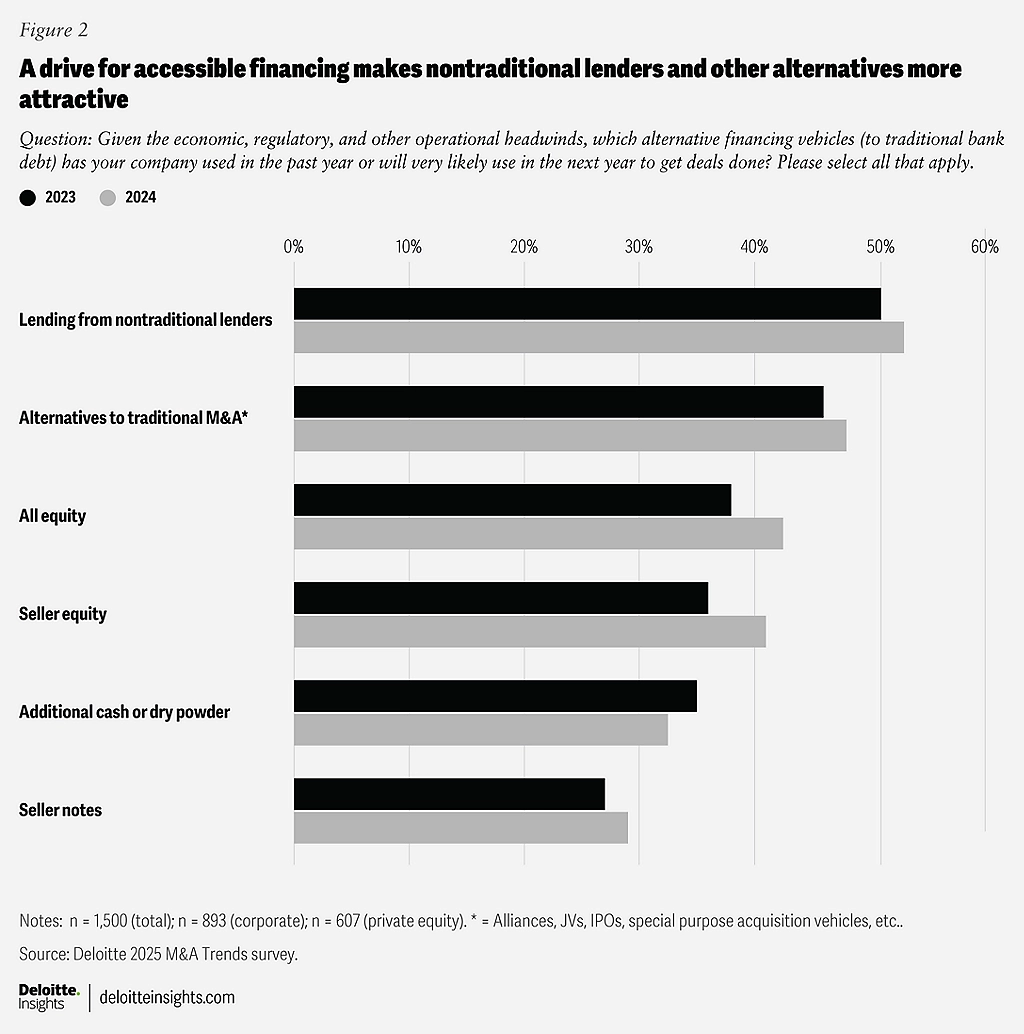

Given the current economic climate, with higher capital costs, limited commercial debt availability, and potentially longer pauses between further US interest rate reductions, survey respondents are pivoting toward nontraditional lenders to finance deals. Bank lending fell from 44% of all corporate borrowing in 2020 to 35% in 2023, while nonbank lending grew significantly.1 Assets under management and investment opportunities in private equity have grown by about 15% annually over the past 10 years and are expected to reach US$2.8 trillion by 2028.2 This shift toward the increased use of equity and private credit may be providing M&A leaders with more flexible and accessible financing options (figure 2), and ensuring that deals can still be executed despite more volatile M&A market conditions.

The targeting pivot: More focused sector approaches

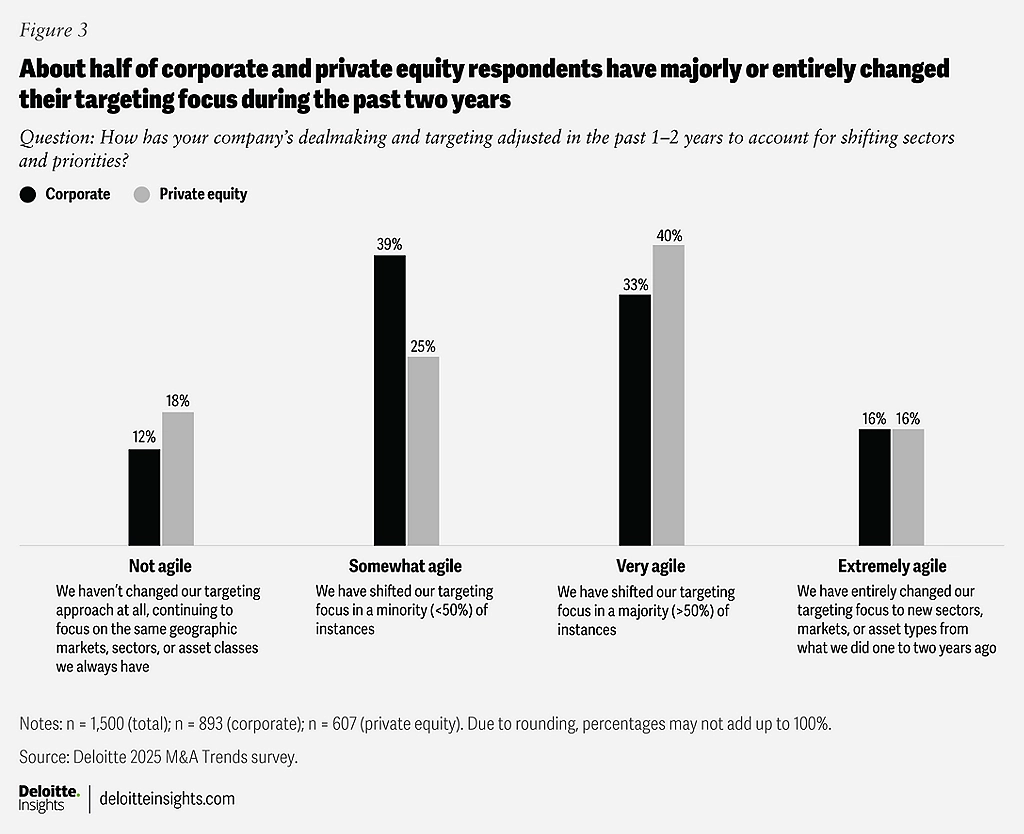

Continuing the “pivoting as the new normal” theme, 88% of corporate respondents and 81% of private equity respondents in this year’s survey report that they’ve made shifts in their deal targeting strategies in the past two years (figure 3). Most notably, these shifts—for both corporations and private equity firms—involved narrowing the focus to a smaller number of sectors. This could be an important pivot, as US tariffs and reciprocal tariffs from other economies play out and have varied effects across sectors.

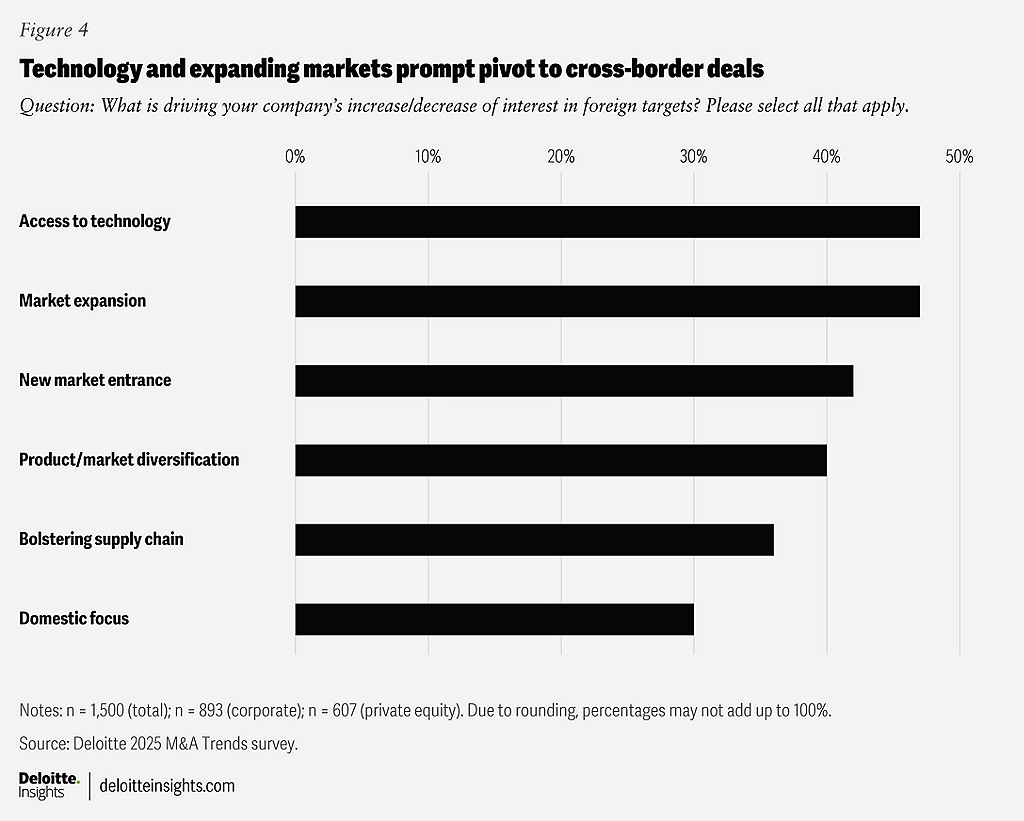

The geographic pivot: Expanding across borders

Methodology

Deloitte’s 2025 M&A Trends survey polled 1,500 US-based corporate and private equity professionals between September and October 2024 to gauge their expectations for M&A activity in the next 12 months and explore their experiences with recent transactions. All survey participants work either for private or public companies with revenues in excess of US$250 million, or for private equity firms (75% of the private equity respondents work for firms that have primary funds in excess of US$1 billion). Three-quarters of the survey respondents (74%) were C-suite executives, 26% of whom were CEOs. Private equity firms represent 40% of the overall sample. Corporate respondents represent a variety of industries, including technology, media, and telecommunications; consumer; energy and resources; financial services; and life sciences and health care.

Print

Print