Jamie C. Smith is a Director, and Barton Edgerton is the Center for Board Matters Corporate Governance Research Leader at EY. This post is based on a piece completed by the EY Americas Center for Board Matters in collaboration with Corporate Board Member.

In an era marked by rapid change and increasing complexity, effective board oversight has never been more essential.

In brief

- Corporate boards can leverage their long-term outlook to help the company navigate, prepare for and adjust the strategy for future challenges.

- Strong alignment between directors and management on risks and risk appetite is a crucial part of strategic resilience and effective response to change.

- Board conversations on these key topics promote company agility: evolving strategy in a chaotic environment, aligning on risks and overcoming barriers to change.

![]() In uncertain times, executive teams are often focused on managing near-term challenges, centering their attention on what may change in the operating environment in the days, weeks or months ahead. Corporate boards bring a longer-term governance perspective and are uniquely positioned to help management think further into the future and prepare for risks and strategic opportunities beyond the immediate horizon.

In uncertain times, executive teams are often focused on managing near-term challenges, centering their attention on what may change in the operating environment in the days, weeks or months ahead. Corporate boards bring a longer-term governance perspective and are uniquely positioned to help management think further into the future and prepare for risks and strategic opportunities beyond the immediate horizon.

Directors recognize this imperative, according to a survey of nearly 200 public company directors conducted by Corporate Board Member and the EY Americas Center for Board Matters. Using the survey findings and insights gained from ongoing conversations with leading directors, we provide a look at what directors view as the keys to resilience and suggest four conversations boards can have to help management to take action.

Important takeaways from the survey

Dynamic strategy setting is necessary in a chaotic environment

Many boards recognize that strategies that have made their company successful in the past are unlikely to lead to the same results in the future. The world is moving quickly, and many anticipate that boards will face a significant transformation of their business. More than a third of the directors report that external factors beyond their control influence their organization’s decision-making more significantly than internal factors do. Perhaps not surprisingly, nearly three-fourths (73%) say that because of the constant state of unpredictable change, their strategy is constantly evolving—and six in 10 tell us that their strategy will need to change within 12 to 18 months.

Most directors surveyed report strong alignment on their board and with management on what the most pressing current challenges are. One interpretation of this is that boards and management are working well together. An alternative perspective is that boards may be relying uncritically on information from management and could benefit from the outputs of the conversations described in this report. A number of leading boards treat frequent consensus with healthy skepticism to ward off groupthink. These directors and their boards treat unanimity as a sign to take a closer look their alignment with management to help ensure that there are no unconscious biases at play.

Directors and management align on current risks—but some directors see opportunity in taking on more risk

Directors report strong consensus between the board and management on the risks the company faces and how much risk to take. A large majority of board members (87%) believe that their board and management team see eye to eye on risks. Furthermore, there appears to be strong alignment on risk appetite. Ninety-one percent of directors believe they clearly communicate risk appetite and 80% report that management displays evidence they have understood it. However, a third of directors would like management to take more risks at the present—to act more aggressively in alignment with risk appetite. Acting in an uncertain world can be difficult for many management teams. Even more challenging is determining how to act when new risks arise, strategy changes and the operating environment is unpredictable. As EY authors shared in How boards can reframe strategic resiliency in a time of uncertainty, directors at resilient companies (i.e., those that can respond, adapt and thrive in response to change) thrive by taking a strategic lens to resilience and incorporating it across their work.

Significant barriers exist to effectively respond to change

To support management teams as they adjust company strategy and respond to external events, boards can apply a longer-term perspective. This helps companies better predict change and become more resilient, more agile and better able to respond to challenges as they arise. When we asked board members about improving resilience and the response to external change, the two largest barriers mentioned were disruptions within their industry (50%) and disruptions to the greater economy (45%). Further, 32% reported that management’s focus on short-term financial performance created a substantial challenge to effective resilience. The longer-term view of boards can help management elevate their perspective so that response to change sets the organization up for sustainable future success. It can also help give executive teams confidence in long-term choices offering benefits that may not be realized in the near term.

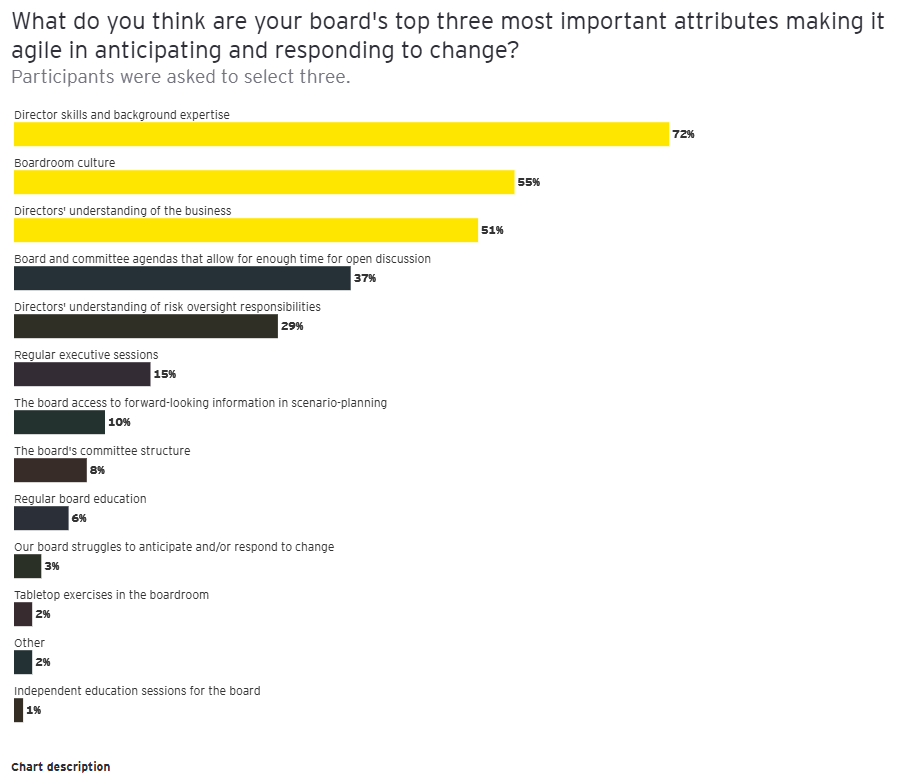

Directors point to leadership composition and culture as critical success factors

We also asked directors about the keys to success, and several factors stood out (see chart below ). These focus on the right combination of skills and experience, the right culture and a deep understanding of the business. Having directors and management with the right skills in place (72%) is viewed as the most important attribute of effectively responding to predicted and unpredicted change. Simply put, directors tell us that experience matters. Critically, this experience must be actualized through the board’s structure (37%) and how it gets work done. A boardroom culture of constructive disagreement (55%) and director understanding of both the business (51%) and their oversight responsibilities (29%) frame the way directors transform skills into action. To ensure that boards remain ready for action, it is often helpful to periodically refresh and renew the board’s perspective on long-term strategic resiliency.

Key conversations to jump-start company action

It is clear that directors’ experience and long-term perspective are critical components of anticipating and responding to change which was the top resilience enabler in our survey. However, it’s not enough to simply assemble a board composed of highly experienced directors. Leading boards engage in several critical conversations to ensure that experience is turned to action. To improve resilience and better respond to disruption, CEOs and directors cannot wait until strategy is formally on the boardroom agenda, once a year. Rather, strategy needs to be embedded in conversations year-round. The principles for each of these conversations are drawn from the practices of leading directors and their boards. Each board should determine which conversations it needs to have and where on the agenda and in the meeting cadence they fit best.

Conversation 1: Build board consensus on strategic resilience

Confirm that all board members start from a common understanding of the company’s current state and needs. This can help ensure that the skills and experience directors rate as so important to resilience can be applied to company challenges. Sometimes directors use the same words to mean different things. For example, “cyber” could mean “cybersecurity,” “cybersecurity risk” or “cybersecurity strategy” to different directors. Similarly, “resilience” can mean the ability to bounce back to a baseline state—or the ability to respond in a way that transforms the company and shapes future markets.

Strategic resilience requires a shift from centering on responding, recovering and resuming to embracing an enterprise-wide holistic approach to resilience across key business areas and operations. Scott McCowan, EY Global Risk Markets Leader, notes that “in today’s volatile business environment, boards that treat resilience as a strategic capability rather than a defensive posture will differentiate themselves in the market. The most effective boards aren’t just identifying risks—they’re actively stress-testing their strategic assumptions and building organizational agility that turns uncertainty into competitive advantage.” The purpose of this conversation is to make certain that all directors share a common understanding of how the company views resilience and its current state of readiness.

Keys to frame the conversation:

- How do board members describe the company’s current state of resilience?

- What clarity or additional information is needed about these issues?

- What are directors’ levels of confidence that the company has what it will need to succeed in these efforts?

- How has the board explored its potential for groupthink or confirmation bias, on the part of either management or the board, in assessments of resiliency?

Conversation 2: Evaluate evolving strategy discussions

Leading companies take advantage of disruption by transforming it from a challenge to be overcome into an opportunity to take strategic advantage. However, under conditions of disruption and uncertainty, it can be easy to take a wait-and-see approach to making large decisions. Because of its ability to focus on the longer term, the board can help management identify the right opportunities for action. This can be in response to external pressures or internal changes. To accomplish this, leading companies seek ways to engage with strategy at key points across the year, rather than waiting for annual strategy retreats or planning discussions. They can ask management to evaluate the costs of inaction and help build management’s confidence to act.

Keys to frame the conversation:

- What is the right frequency for reviewing company strategy with management?

- How does the board and management approach strategic options and different scenarios?

- How does the board know if the company is overly cautious in times of uncertainty?

- What are the costs of waiting to long too take strategic action?

Conversation 3: Identify single points of failure and the risk tolerance for their failure

Clearly identifying the most important single points of failure and clarifying the risk tolerance for each helps the company prioritize where to allocate resources for resilience and readiness. Leading boards understand not just the top risks the company faces but also where the company is most vulnerable.

Articulating a risk tolerance for each threat helps management prioritize actions for both the upside of risk and risk mitigation. For example, this knowledge is an important input to knowing if a piecemeal or all-in approach is the right choice for a critical product launch. Further, it may make sense for a critical piece of software to come from a single source, as may be the case with some cybersecurity defenses deep in an operating system. A small failure every three years may be tolerable, while a monthly failure may not be. A critical piece of the supply chain may have a single source and a stoppage might be unacceptable, suggesting a low risk tolerance and a need for management to diversify this element of the supply chain. Connecting a risk tolerance to high-priority choke points is a critical tool in building a company that is resilient to shocks, which can then be shared with management.

Keys to frame the conversation:

- Which of the company’s single points of failure surprise the board the most?

- How has the company set a risk tolerance level for each of these?

- What is the board’s level of satisfaction with management’s plans to mitigate the failure?

Conversation 4: Understand assumptions and prepare for those assumptions to change

Identifying what must be true for a strategy to succeed can help identify threats and how the company might respond. Many of these are the external forces that directors reported as affecting their shifts in strategy. One way to do this is to look critically at the assumptions that underlie the strategy. This may include inputs to models or scenario planning but also should include logical relationships that are unstated but must be true for a strategy to succeed. For example, a growth strategy might rely on a particular customer behavior that is expected to continue. This might be unstated, but necessary. Understanding the most important assumptions and what is critical for a strategy to succeed can help a company determine where to place its resources to find and prepare for competitive threats. The company can then create strategies to respond to threats to these assumptions or responses when what must be true for a strategy to succeed no longer is.

Keys to frame the conversation:

- What must be true for the company strategy to succeed?

- How would the company know when these assumptions are no longer true or if they are in danger of becoming untrue?

- What could the company do if the assumptions are no longer true?

- When should concerns be elevated to the board?

Print

Print