Lindsey Stewart is the Director of Investment Stewardship Research at Morningstar, Inc. This post is based on his Morningstar report.

Key Observations

- After new Securities and Exchange Commission guidance on environmental, social, and governance shareholder resolutions, the number of voted proposals fell 22% in the 2025 proxy year.

- However, average support for conventional ESG resolutions (excluding those by “anti-ESG” filers) has held steady for three years at around 26%–27%.

- The gap in voting support between governance and E&S proposals grew further. Average support for conventional governance proposals stood at 35% in the 2025 proxy year (36% in 2024), compared with 16% for conventional E&S proposals (20% in 2024).

- Despite new SEC curbs, poorly supported resolutions are taking up more space than ever. The proportion of E&S resolutions with less than 5% support has increased from 8% to 27% in five years.

- E&S proposals addressing topics that a significant proportion of shareholders view as material are becoming a rarity. There were only 30 significant E&S resolutions in the 2025 proxy year, compared with over 100 in each of the previous five years.

- In our view, these trends mean the market is losing useful signals on sustainability factors that are important to long-term investment decisions.

- The wide gap in voting support between US and European asset managers for significant E&S resolutions narrowed slightly in 2025.

- Average support for significant E&S resolutions for six large US asset managers (BlackRock, Dimensional, Invesco, J.P. Morgan, State Street, and Vanguard) was 18% in the 2025 proxy year, compared with 17% in 2024 and a peak of 46% in 2021.

- The same average in 2025 for six large European asset managers (Amundi, Fidelity International, Legal & General, NBIM, Schroders, and UBS) was 91%, having remained fairly stable over the prior five years.

Fewer Voted ESG Resolutions in 2025

After changes in SEC guidance on permissible shareholder resolutions, the number of voted proposals fell sharply in the 2025 proxy year.

Recent Stable Shareholder Support for ESG Resolutions Conceals Underlying Divergence

The US is the world’s largest capital market for publicly traded equity. It’s also the venue on which most of the world’s ESG shareholder proposals are voted. So, it has consistently provided useful signals as to which sustainability and governance topics are considered most material by institutional investors. Unfortunately, our research shows that those signals are becoming less clear, raising concerns over the market’s ability to transmit information on ESG topics that many institutional investors may consider useful for making sound long-term investment decisions.

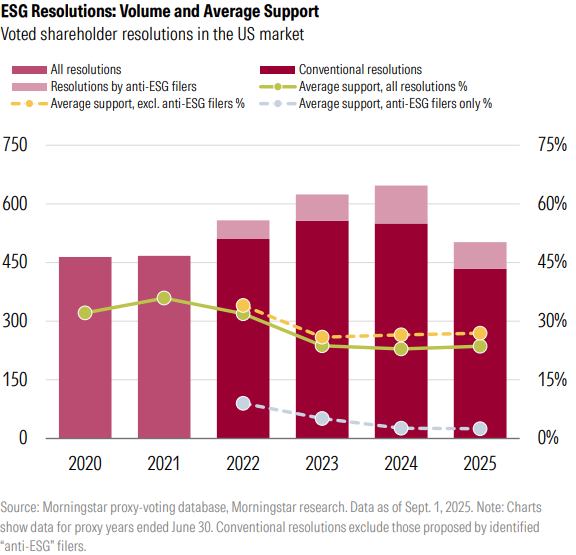

The SEC introduced new guidance in February permitting companies to exclude a wider range of shareholder resolutions from proxy ballots. Subsequently, the number of voted shareholder proposals in the US has fallen by 22% year on year, to 502 in the 2025 proxy year (ended June 30) from 647 in 2024. Average support for such shareholder proposals addressing governance and sustainability topics has been relatively stable since the two years of decline from 2021 to 2023, shown on the chart opposite.

Mean support for ESG shareholder resolutions in the US has stood at around 23%–24% for the last three proxy years. (That average increases to 26%–27% if we exclude resolutions filed by politically conservative proponents, often referred to as “anti ESG.” We have identified 280 such resolutions in the last four proxy years).

However, that apparent stability masks a divergence in shareholder support for governance proposals compared with proposals on environmental and social themes.

Robust Shareholder Support for Governance Proposals Offset by Falling Support for E&S Resolutions

As shown on the chart on the left below, resurgent support for shareholder resolutions on governance themes largely held up in the 2025 proxy year, as voted governance resolutions outnumbered E&S resolutions for the first time since 2021. Many governance proposals focused on bolstering what a sizable group of institutional investors considers to be fundamental shareholder rights. Average support for conventional governance resolutions stood at 35% in the 2025 proxy year, compared with 16% for conventional E&S proposals.

Reduction in Resolution Volume Hits E&S Proposals the Hardest

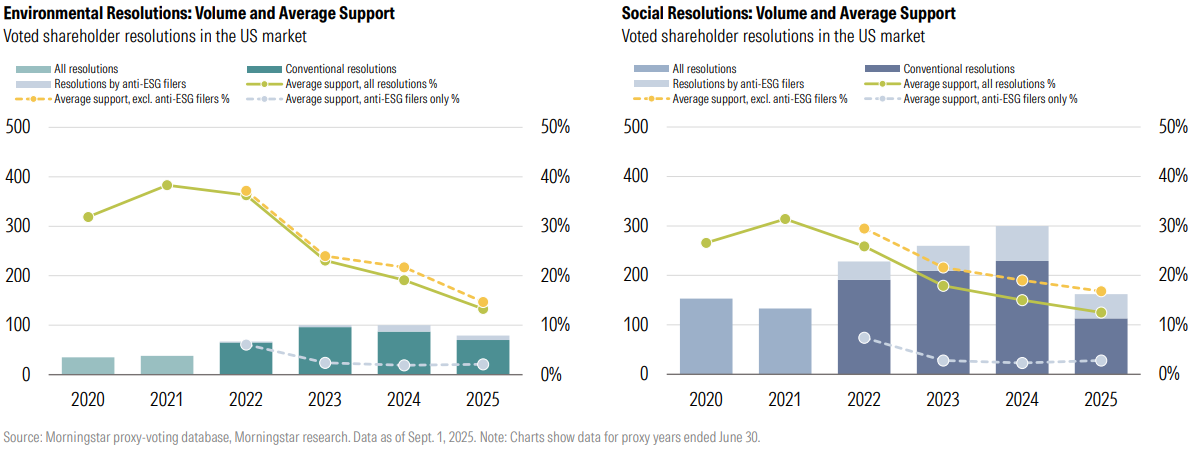

Despite the volume of voted ESG resolutions being down over one-fifth, the number of voted governance resolutions increased slightly year on year in 2025. Not so for E&S proposals, which fell 40% in number in the 2025 proxy year. Average support for E&S proposals has fallen considerably from its 2021 peak of 33% to just 13% in the 2025 proxy year (or 16% if we include conventional proposals only).

Resolutions Addressing Social Topics Enter a New Phase

The number of voted shareholder proposals addressing environmental themes fell 21% year on year in 2025 to 79, while the number of social proposals fell more steeply: a 46% decline to 162. It is noteworthy that for the first time in the 2020s, conventional social resolutions achieved higher average support in the 2025 proxy year (17%) than environmental resolutions (15%). Average support levels for these proposals in the 2024 proxy year were 19% for social resolutions and 22% for environmental resolutions.

E&S Resolutions: Less Signal, More Noise

Despite a shrinking cohort of resolutions, the proportion of poorly supported proposals reached a high in 2025, obscuring market signals on sustainability.

Plethora of Poorly Supported Proposals Obscures Signal From Significant Ones

The absolute number of poorly supported resolutions (those that failed to reach the 5% support threshold that permits a proposal to be resubmitted) has fallen year on year in 2025, to 64 from 100 in 2024. But the proportion of poorly supported proposals has increased to 27% in the 2025 proxy year, from 25% in the previous year and from a 2021 low of 7%. Meanwhile the number of resolutions we class as significant (those with 30% adjusted support, which is support by shareholders independent of the company) has fallen from 107 in the 2024 proxy year, to just 30 in 2025. Overall, the data shows that the signal coming from shareholder resolutions on sustainability is nowhere near as clear as it once was.

Proposals on Political Spending Transparency Dominate the 2025 Cohort of Significant Resolutions

Of the 30 significant resolutions in the 2025 proxy year, 12 were requests for greater transparency on corporate political spending—the largest proportion (40%) of such resolutions since 2020. Only five proposals in 2025 were in the “gold tier” of resolutions supported by a majority of independent shareholders, shown on the chart on the left below. All five were on political spending. Given that political spending resolutions have a strong governance tilt to them, it means we only have 18 significant resolutions in 2025 on which to ascertain investor views on core environmental and social topics. In our opinion, that’s not enough to be able to draw any firm conclusions.

Significant E&S Resolutions: The Transatlantic Gulf Remains

The gap in support between US and European asset managers for significant resolutions remains wide but is stabilizing.

Asset Manager Voting on Sustainability

Our January 2025 deep dive into asset manager voting records on significant E&S resolutions was titled “Voting on ESG: A Gap Becomes A Gulf,” recognizing the widening gap in sustainability voting preferences between the largest US asset managers and the European counterparts. That gap in average support levels for significant E&S resolutions has been growing since the 2021 proxy year. It remains large, but, as the chart opposite shows, it is beginning to stabilize.

The chart shows unweighted mean support for significant E&S resolutions for six large US asset managers (BlackRock, Dimensional, Invesco, J.P. Morgan, State Street, and Vanguard) and six large European asset managers (Amundi, Fidelity International, Legal & General, NBIM, Schroders, and UBS). The results from this limited selection of asset managers is consistent with those from the more extensive studies we have conducted previously.

Over the course of the 2020s so far, European asset managers have demonstrated consistently high support for significant E&S resolutions, with an average in the low 90s in percentage terms (91% in the 2025 proxy year). Meanwhile, average support by the US firms has dropped from a peak of 46% in 2021 to just 17% in 2024, and it is holding relatively steady at 18% in 2025.

So, the gap appears to be stabilizing, but with a much smaller population of significant proposals in 2025, and fewer still on core sustainability topics like climate change, labor relations, and human rights, it’s difficult to draw firm conclusions on each firm’s stance.

Link to the full report can be found here.

Print

Print