Kübra Ergün is a Research Analyst, Cindy Blaney is a Lead Analyst, and Francis Opada is a Senior Analyst at Glass Lewis. This post is based on their Glass Lewis memorandum.

About ASE and the Quarterly Report

Investment stewardship is evolving and deepening globally, as asset owners and managers need to manage risks, meet their clients’ demands, and comply with expanding regulatory requirements and voluntary frameworks. Glass Lewis has developed and introduced a comprehensive suite of Stewardship Solutions, including our Active Stewardship Engagement (ASE) program, to better meet the needs of today’s investors. The Stewardship team, representing institutional investor clients subscribed to the ASE program, is dedicated to engaging with public companies to discuss the identified ESG issues and track performance toward addressing those issues. The team sets measurable objectives, shares them with a company it wants to engage, and diligently tracks progress. The team engages with companies through written communication and engagement meetings, ensuring accountability and transparency.

These ASE meetings are separate and distinct from meetings with the Glass Lewis Research team, the group responsible for producing Glass Lewis’ Proxy Paper research reports. The company-specific issues discussed in ASE meetings with companies are based on the needs and priorities of subscribing ASE clients. They may not necessarily overlap with Glass Lewis’ Research policies and guidelines, and Stewardship does not disclose ASE issues, meetings, or progress with the Research Team.

The Stewardship team issues a report to ASE subscribers following the conclusion of each quarter to communicate its activities and progress achieved during the period. The report following the fourth quarter serves as the annual report. Each publication includes an overview of the methodology applied, data visualisations, summaries of progress by pillar and theme, case studies, and a spotlight exploring one of our engagement themes, such as human rights, and its importance for investors. The Stewardship team also publishes an anonymised version of the quarterly report for public consumption.

1. Active Stewardship Engagement

Glass Lewis’ Active Stewardship Engagement allows institutional investors seeking to expand their stewardship activities to leverage our extensive global engagement activities. The Glass Lewis Stewardship team engages publicly-listed companies in dialogue on a range of material environmental, social, and governance (ESG) issues to encourage best practices and to promote greater transparency.

1.1 Focus List Selection Process

The Active Stewardship Engagement focus list comprises the companies for which we track issues based on our foundational engagement themes. While some focus lists address market-specific issues, others covering broader ESG themes are established on the same basis for multiple markets.

Focus List Company Selection

The focus list is created through a comprehensive and structured screening process carried out by our Glass Lewis Stewardship team, which also benefits from the insights of our 175-member Proxy Research team. This process begins with the Glass Lewis coverage universe, encompassing over 23,000 companies worldwide. Our Proxy Research team gathers a broad spectrum of ESG data for each company and conducts a thorough governance analysis.

The screening process depends on extensive analysis of ESG data in our database, Glass Lewis Controversy Alerts, Glass Lewis Proxy Reports and an AGM vote result analysis. Utilising our ESG database, the Glass Lewis Stewardship team identifies outlier companies based on market practices in their home markets, reviewing data including board characteristics, remuneration practices, and E&S metrics included in our ESG profile. In addition, the team reviews the issues highlighted by the over 500 Glass Lewis Controversy Alerts (GLCAs) issued between 2021 and the start of the program to identify a potential list of companies suitable for focus list inclusion. The screening process also entails analysing AGM vote results to pinpoint companies that have consistently shown unresponsiveness to significant shareholder opposition to AGM proposals over several years.

The team further filters the potential focus list of companies by considering the feasibility and effectiveness of engaging with them and their alignment with our clients’ investment portfolios. As a last step, the Glass Lewis Stewardship team refines the provisional focus list through further in-depth research on each company by incorporating external sources and specific sector and thematic research to identify companies where engagement can result in meaningful improvements.

Focus List Issues

Each company on our focus list is assigned at least one issue to be monitored. An issue represents an area where disclosure is lacking or company practices fall short of market best practices. We engage with companies to encourage them to address these shortcomings and measure specific, publicly disclosed progress by the company in addressing these issues. All assigned issues are linked to one of our engagement pillars or themes.

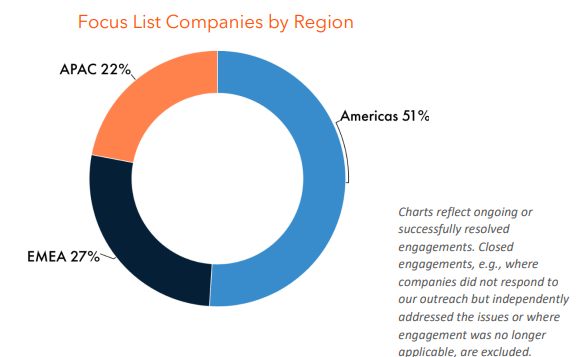

A company may be assigned multiple issues. We regularly review progress against issues until they are resolved, generally over the course of up to three years, or until the issue is no longer relevant. Since our engagement program was launched, we have initiated engagement with 191 companies, assigning 238 issues. Our review of the focus list has led to the closure of a number of engagements where companies did not respond to our outreach but independently addressed the issues, or engagement was no longer applicable, such as in cases of company delisting. In addition, we decided to pause engagement activity on diversity matters at U.S. companies in light of recent developments in the United States. As of the end of first quarter of 2025, our focus list comprises 219 issues, either ongoing or resolved after successful engagement efforts, across 180 companies.

1.2 How and Why the Stewardship Team Engages

Our Active Stewardship Engagement solution is dedicated to helping our clients identify and address ESG issues that can potentially affect long-term shareholder value at companies whose shares they own. Engagement on these issues is essential in fostering constructive dialogue and positive change.

The Glass Lewis Stewardship team, representing institutional investor clients who subscribe to this solution, engages with public companies to discuss the identified ESG issues and track progress towards addressing them. The meetings between the Stewardship team and companies are separate and distinct from meetings with Glass Lewis’ Proxy Research team, the team responsible for producing Glass Lewis’ Proxy Paper research reports. The company-specific issues discussed in Active Stewardship Engagement meetings with companies are based on the needs and priorities of our subscribing clients. They may not necessarily overlap with Glass Lewis’ Proxy Research policies and guidelines.

Updates related to these engagement efforts are delivered via the Engagement Management Platform, a software tool that gives clients visibility into engagement progress with full written summaries of each engagement meeting, details of written communications with companies, and a record of outcomes when engagements are resolved.

Engagement Process

1. Initial outreach

- The Stewardship team sends an email to notify the company of the engagement issue(s) identified

2. Engagement meeting scheduled to discuss issues, where necessary

- The Stewardship team seeks to schedule a meeting with the appropriate company representatives to discuss the issues detailed in the initial outreach

3. Recurring follow-ups, at least twice per year

- Additional communications, via email or meeting, are conducted at least twice per year until resolution of the issue(s)

1.3 Monitoring Progress

Once our team notifies a company regarding the assigned focus list issue(s), we start tracking its progress on four consecutive milestones (“Engagement”, “Understanding”, “Action taken” and “Action completed”), as well as three statuses (“Progress”, “Neutral” and “Insufficient progress”). This approach allows us to monitor each company’s direction of progress on the engagement milestones compared to their previous evaluation. Each milestone (i.e. stage of progression) and status that can be assigned to the companies are detailed below.

Q1 2025 Company Progress Report

As of the first quarter of 2025, we contacted 191 companies about 238 focus list issues. Our review of the focus list has led to the closure of a number of engagements where companies did not respond to our outreach but independently addressed the issues, or engagement was no longer applicable, such as in cases of company delisting. In addition, we paused engagement activity on diversity matters at U.S. companies in light of recent developments in the U.S..

As such, our focus list currently comprises 219 issue across 180 companies. Of these 180 companies, approximately half (53%, 95 companies and 121 issues) were responsive to our engagement outreach.

The milestones of most of these 219 issues (74%) were set at “engagement”. These include instances where companies were unresponsive or responded only to acknowledge receipt or express interest in arranging a call without commenting on the concerns raised in our outreach. These may also include instances where companies do not express any intention to consider our concerns. On the other hand, in the cases where companies indicated their intention to consider the concerns raised in our outreach, their engagement milestone was set at “understanding” (12%). Additionally, 5% of the issues were classified as “action taken,” where public disclosures reveal concrete steps towards addressing the issue, and 9% as “action completed,” where the companies satisfactorily addressed our concerns through enhanced disclosure or practices.

In examples where the direction of travel was positive (e.g. moving up from “engagement” to “understanding”), the status of the engagements was categorised as “progress” (19%, excluding the completed engagements). Conversely, the status of 1% of the issues was set at “insufficient progress” in instances where we observed deteriorating performance. The status of the remaining issues was classified as “neutral” (i.e. their progress on engagement milestones remained the same).

Over the period between January 1, 2025 and March 31, 2025, we have tracked progress at 180 companies and against 219 issues:

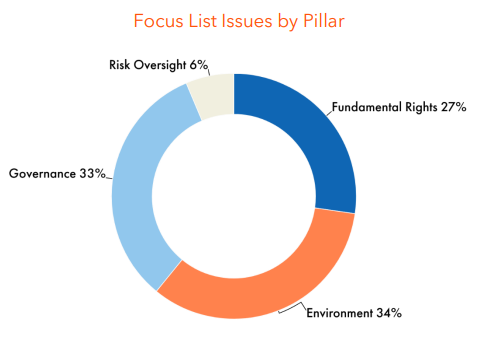

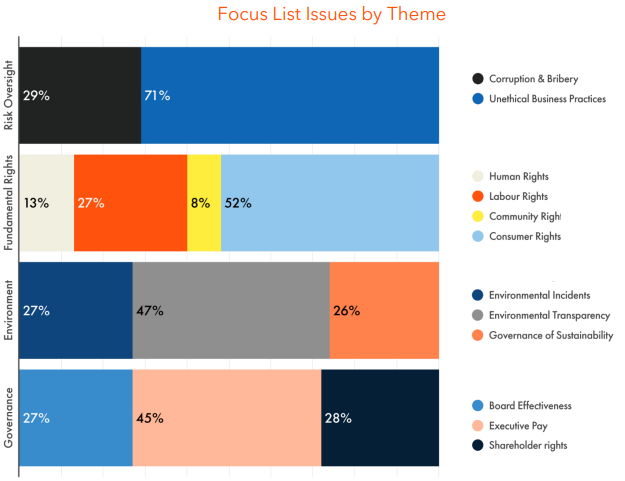

2. Foundational Engagement Themes

We track and report the relevant engagement topics discussed across all the companies we engage with. Each pillar we identified in our engagement plan is broken into a number of themes, which allow us to report more granularly on the status and results of our engagement plan.

Governance

- Board Effectiveness

- Executive Pay

- Shareholder Rights

Environment

- Environmental Incidents

- Environmental Transparency

- Governance of Sustainability

Fundamental Rights

- Human Rights

- Labour Rights

- Community Rights

- Consumer Rights

Risk Oversight

- Board Oversight of Policies and Procedures

- Corruption & Bribery

- Unethical Business Practices

Print

Print