Dan Carroll is the Vice President, David Pahlic is the Director, and Bruce Freed is the President at Center for Political Accountability. This post is based on the 2025 CPA-Zicklin Index.

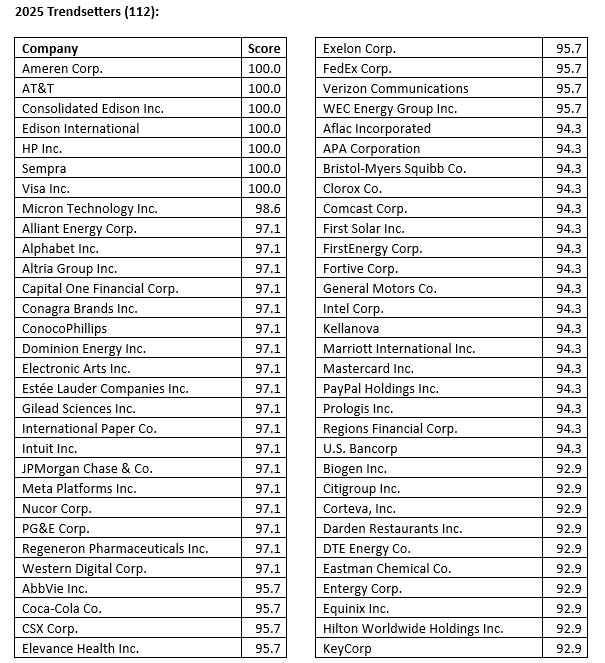

The number of leading U.S. companies with the most robust policies for transparency and accountability around their political spending increased significantly from 103 in 2024 to 112 this year, according to the recently released 2025 CPA-Zicklin Index.

These public companies scoring 90 percent or above in the benchmarking study, designated Trendsetters, comprised more than 22 percent of all S&P 500 companies evaluated. This reflected a continuing trend “despite [companies] facing the greatest pressures of a lifetime,” in a period of turmoil and national division, the study said.

The 2025 CPA-Zicklin Index of Corporate Political Disclosure and Accountability, the annual benchmarking of the political disclosure and accountability policies of the Russell 1000, was released at an event at the Wharton School of the University of Pennsylvania. It is a joint effort of the Center for Political Accountability, a Washington, DC based non-profit, and The Wharton School’s Zicklin Center for Governance and Business Ethics.

For the first time, representatives of five major U.S. public companies – all of them Trendsetters – participated in the announcement event. From the telecommunications, payments technology, and utilities sectors, the companies in attendance were Visa Inc. (Index score of 100.0 percent); Comcast Corp. (94.3 percent); Consolidated Edison Inc. (100.0 percent); Sempra (100.0 percent); and FirstEnergy Corp. (94.3 percent). Each were awarded certificates for earning Trendsetter status; all other Trendsetter companies are receiving the recognition digitally.

![]()

![]() Company representatives made strong statements about how important their Trendsetter status was and how adoption of robust political disclosure and accountability policies changed how they approach and communicate to stakeholders about political spending.

Company representatives made strong statements about how important their Trendsetter status was and how adoption of robust political disclosure and accountability policies changed how they approach and communicate to stakeholders about political spending.

In a foreword to the Index, Prof. John Coates of Harvard Law School emphasized the importance of disclosure today. “Corporate managers, armed with corporate wealth, can influence politicians, and politicians, armed with political power, can influence, reward, tempt and divert managers from a healthy focus on consumers and markets. Disclosure makes it less likely that more capital will chase and produce corruption,” wrote the former General Counsel and Acting Director of the Corporate Finance Division at the U.S. Securities and Exchange Commission.

Coates also noted in his foreword that “fundamentals of the economics of disclosure and investment underlie the work of the Center for Political Accountability — a nonprofit that perfectly represents another [Justice Louis] Brandeis precept, that the ‘most important political office is that of the private citizen.’ The health of a democracy, Brandeis wrote, depends on active engagement by the communities that compose it, both as they emerge organically from the past, and as newly organized with intent and purpose. CPA exemplifies this spirit, as does its partnership with the Carol and Lawrence Zicklin Center for Governance and Business Ethics of the Wharton School of the University of Pennsylvania in producing the CPA-Zicklin Index.”

The Index included in its appendix the CPA-Zicklin Framework for Corporate Political Spending, a structure for companies to approach and govern their political spending and evaluate more broadly its impact and risks.

The annual Index was released a year and a day before high-spending midterm U.S. elections. The Index focuses on S&P 500 companies, the largest source of corporate political money, and it also examines 489 companies belonging to the Russell 1000 that are not S&P 500 components. Here are some of the major findings:

TRENDSETTERS: This Index first began evaluating all companies in the S&P 500 for transparency and accountability in political spending in 2015. After a decade of progress, the number of Trendsetters has increased fourfold from the 28 companies that received scores of 90 percent or higher in 2015.

TOP-TIER MILESTONES: 205 companies in the overall S&P 500 placed in the first Index tier (scoring from 80 percent to 100 percent). This is more than double the 76 top-tier companies in 2015.

BOTTOM-TIER DECLINE: The number of S&P 500 companies scoring lowest for disclosure and accountability – in the bottom 20 percent – has continued to decline. From 204 bottom-tier companies in 2015 it has dropped to 88 this year.

BOARD OVERSIGHT: Increases in company adoption of board oversight continue. In the full S&P 500, 328 companies (more than two-thirds) had general board oversight of company political spending, up from 319 last year and from 214 in 2015.

BOARD COMMITTEE REVIEW: 291 companies in the full S&P 500 have board committee review of direct political contributions and expenditures, up from 282 last year and 168 in 2015.

MOST-IMPROVED COMPANIES: Rated most-improved for gains in their overall scores of 50 percentage points or more from last year are four companies in the full S&P 500. They are Dollar Tree Inc.; Workday Inc.; Micron Technology Inc.; and Global Payments Inc.

REPEAT BASEMENT-DWELLERS: 18 companies received Index scores of zero last year and again this year, including such well-known companies as Berkshire Hathaway Inc.; Blackstone Inc.; Garmin Ltd.; Palantir Technologies Inc.; Tesla Inc.; and Williams-Sonoma Inc.

Following are the top scoring companies in the Index:

Print

Print