Benjamin Finzi is the Global CEO Program Leader, Elizabeth Molacek is a Senior Manager, and Vincent Firth is a Managing Director at Deloitte LLP. This post is based on their Deloitte memorandum.

Survey methodology

69 CEOs representing 19 industries participated in this Fortune/Deloitte CEO Survey. 71% of respondents are United States-based organizations, and the remainder are from organizations based outside of the United States.

Fielded October 3-16, the 10-question survey explored CEO perspectives on the economy and artificial intelligence. The following pages present key findings.

Surveyed CEOs include Fortune 500 CEOs, Global 500 CEOs, and select public and private CEOs in the global Fortune community.

This Fall 2025 survey is the 16th edition of the Fortune/Deloitte CEO survey series. Information on previous surveys is available here.

CEO Outlook

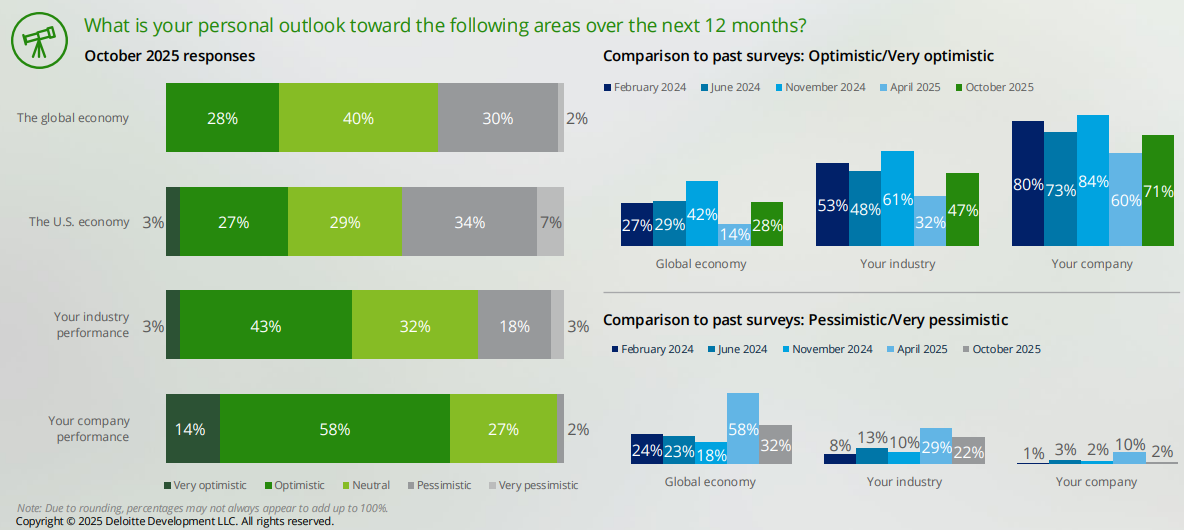

CEO outlook is rebounding from the more negative perspectives seen in the Spring 2025 survey. Pessimism over the global economy dropped to 32% from 58% in the spring while optimism has doubled to 28% from 14%. For the first time, the survey asked CEOs to share their outlook for the U.S. economy, with 41% holding a pessimistic or very pessimistic outlook. The difference in outlook for the US economy vs the global economy likely reflects uneven economic performance, with strong equity markets, thriving AI -driven companies, and high -end consumer spending contrasting with sectors holding back on investment amid weaker demand. While US economic growth is projected to cool amid mounting cost pressures linked to tariffs, [1] Europe appears poised for moderate growth, and economic conditions in Asia remain strong [2].

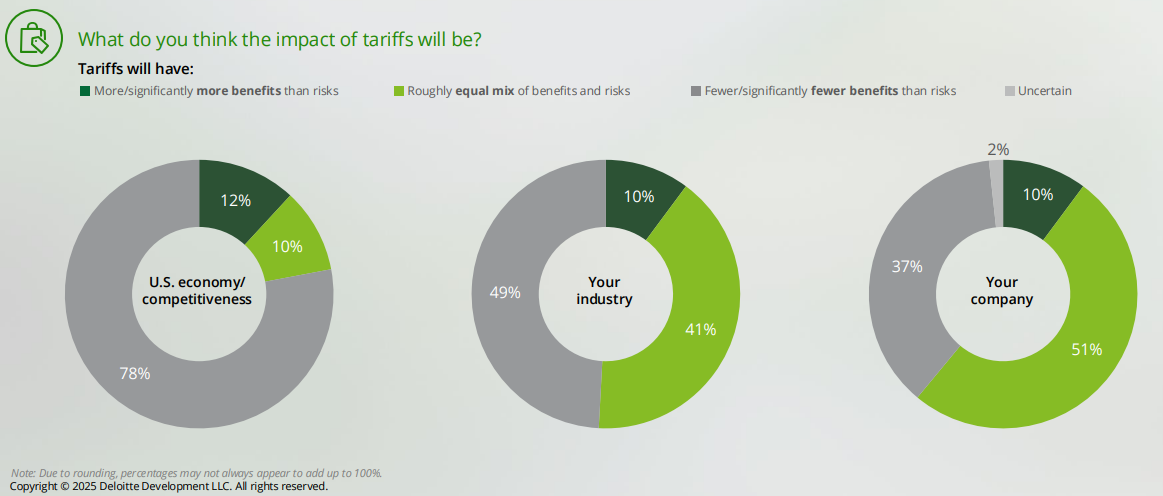

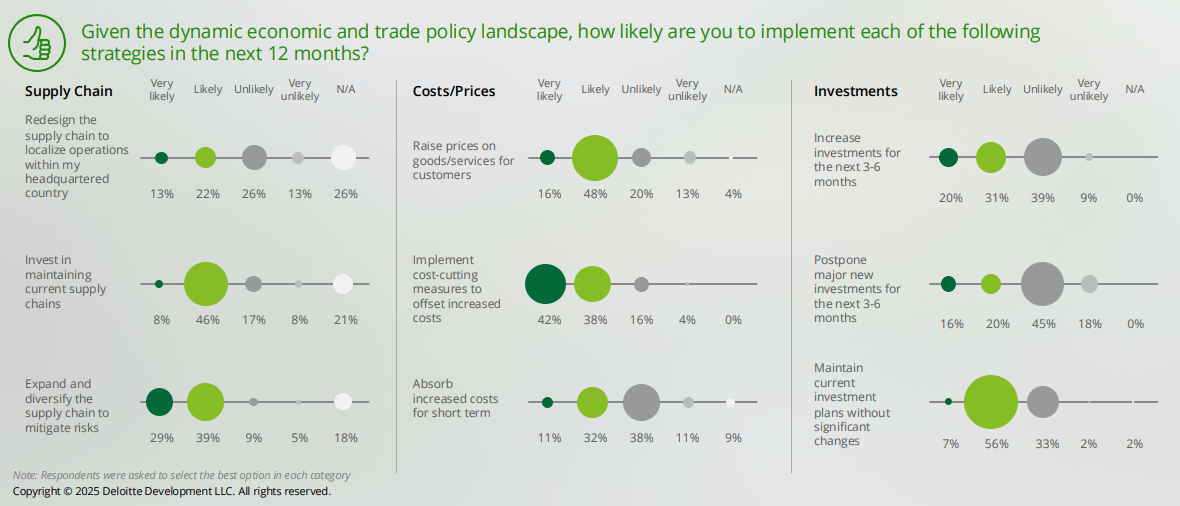

Despite these mixed signals, CEOs continue to show growing optimism about their industries and company performance, with optimism rising to 71% from 60% for company performance and to 47% from 32% for their industries. As tariffs continue to make headlines months after the reciprocal tariff announcement in April, CEOs are reacting, adjusting, and continuing to refine their strategy. Most surveyed CEOs (78%) expect tariffs to have fewer benefits than risks for the US economy. Yet, over half surveyed see an equal mix of benefits and risks for their organizations. CEOs are continuing to feel the effects of new policy measures on supply chains, costs, and prices: a majority (80%) say they are likely to implement cost -cutting measures over the next 12 months, while 64% are likely to raise prices.

CEO outlook for the global and US economy is mixed

Optimism for their industry and company performance rebounds compared to April 2025.

CEOs believe tariffs could pose more risks than benefits to the US economy

However, half of CEOs surveyed see roughly an equal mix of benefits and risks from tariffs for their own company.

CEOs are prioritizing supply chain resilience and cost management amid economic uncertainty

Over 60% of CEOs are maintaining current investment plans without significant changes.

Strategy and Workforce Models in the Age of AI

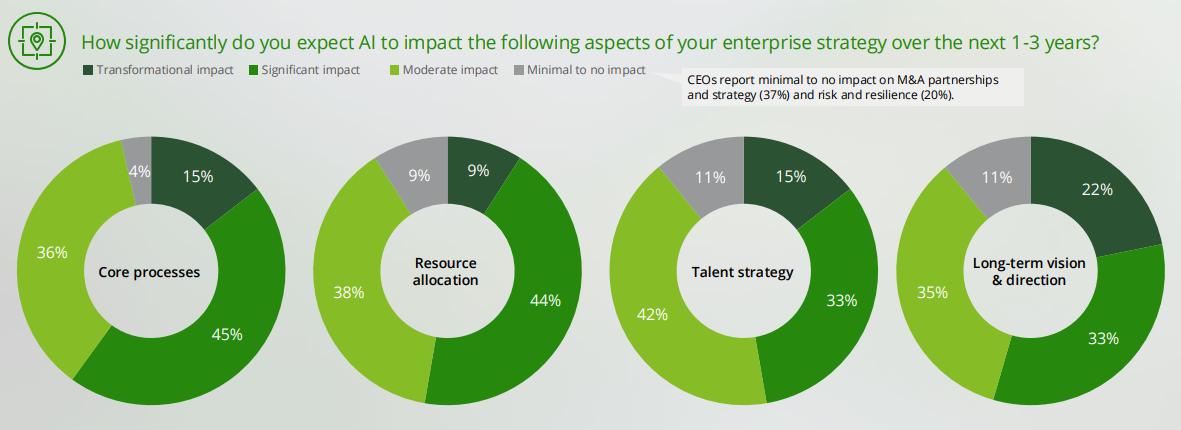

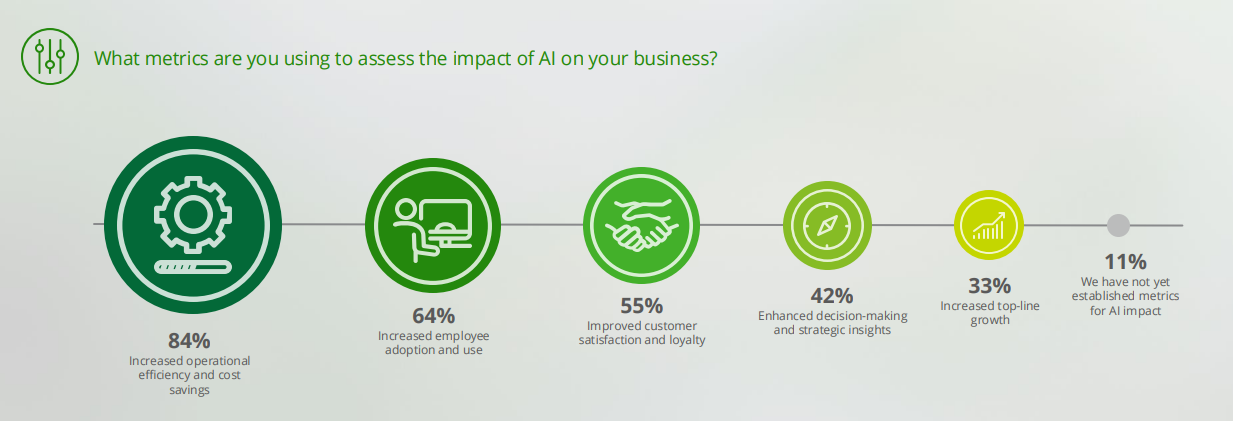

As AI adoption continues, surveyed CEOs expect the greatest impact on core processes and resource allocation, followed by talent strategy and long -term vision and direction. Nearly a quarter see opportunities for transformational impact in shaping long -term vision and direction. CEOs anticipate the least impact on M&A partnerships and strategy and on risk and resilience. When assessing AI’s impact, CEOs are looking across multiple dimensions. Most are tracking cost savings and operational efficiency measures (84%) and employee adoption and use (64%), while one in three CEOs say they are assessing AI’s impact through top -line growth measures.

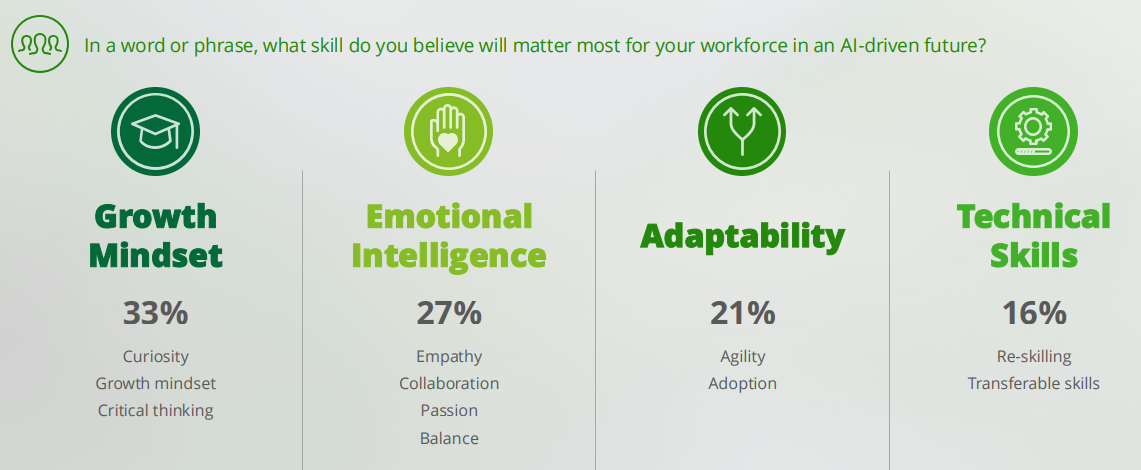

At the same time, leaders are setting expectations for responsible AI use and governance from the top: 69% are developing clear AI usage policies, and 56% are working to cultivate a culture of ethical AI. As AI becomes more embedded in strategy and operations, CEOs are also considering implications for their talent strategies. When asked about the desired skills in an AI -driven future, most CEOs cited human – centered skills such as agility, curiosity, and continuous learning.

CEOs anticipate moderate to significant impact on core processes and strategy due to AI

Core processes, resource allocation, talent strategy and long-term vision & direction are the key activities expected to have a significant impact due to AI.

CEOs are measuring AI’s impact through efficiency

Operational improvements and employee adoption emerge as leading success metrics for AI initiatives.

A majority of CEOs are emphasizing clear policies and guidelines for AI use

Over half of leaders surveyed are building cultures around responsible AI.

CEOs see “growth mindset” as a top skill in an AI-driven future

Curiosity and adaptability are also top skills, according to CEOs.

CEO Reflections

The top challenges for CEOs centered on the pace and degree of change; one CEO shares “unprecedented degree of unprecedented changes” while another is concerned about “employees coping with the level of change.” Uncertainty also remains top of mind for surveyed CEOs, especially regarding the policy and geopolitical landscape. CEOs also shared concerns for talent as another top challenge, including gaps in skillsets.

“Pace of Change” emerges as a top challenge for CEOs

Uncertainty across the geopolitical, regulatory, and economic landscapes continues to be top of mind.

1Source: https://www.cbo.gov/publication/61236(go back)

2Source: https://economy-finance.ec.europa.eu/publications/european-economic-forecast -spring-2025_en(go back)

Print

Print