Courtney Mathes is an Associate at Wilson Sonsini Goodrich & Rosati. This post is based on a WSGR memorandum by Ms. Mathes, Tamara Brightwell, Shannon Delahaye, Lauren Lichtblau, Jose Macias, and Lisa Stimmell.

A Survey of the SV150

Wilson Sonsini is pleased to present Insider Trading Policies: A Survey of the SV150, which analyzes the insider trading policies of Silicon Valley’s largest public companies.

This report summarizes the results of our review of the insider trading policies filed by 145 companies in the Lonergan SV150, which ranks the top 150 companies with headquarters in the Silicon Valley by annual sales. [1] For more information on the methodology used to prepare the Lonergan SV150, please visit the Lonergan Partners website. Please see the Appendix for a list of the SV150 companies.

In December 2022, the U.S. Securities and Exchange Commission (SEC) adopted final rules that require, among other things, public companies to file their insider trading policies and procedures as an exhibit to their annual report (2022 rules). [2] This report examines certain key elements in these insider trading policies such as:

- persons subject to the insider trading policy;

- quarterly blackout periods (or trading windows) [3] and timing;

- pre-clearance requirements;

- gifts; and

- restricted activities including hedging, pledging, and margin accounts.

We would like to thank the team that conducted the research and provided editorial input for this report, including partners Richard Blake, Tamara Brightwell, Shannon Delahaye, Lauren Lichtblau, Jose Macias, Lisa Stimmell, and practice support lawyer Courtney Mathes.

APPLICABILITY

Insider Trading Policies

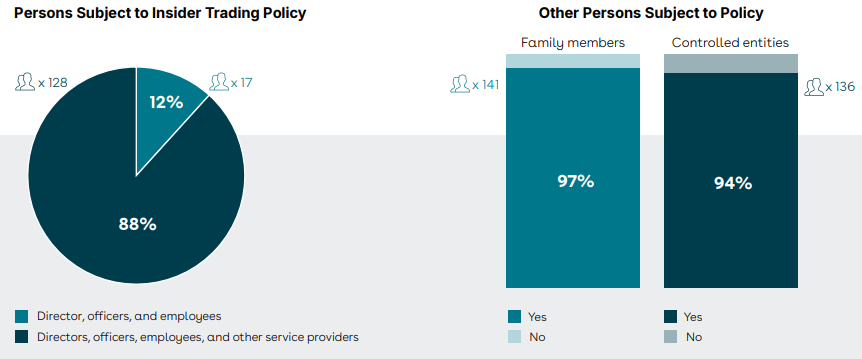

Insider trading policies generally apply to all directors, officers, and employees of the company, and a significant majority also apply to other service providers such as contractors, consultants, agents, and advisors. Family members and controlled entities of these individuals are also generally covered. The applicability of the insider trading policy to family members and controlled entities varies and can be nuanced. [4] Note that typically, the insider trading policy will continue to apply to former employees until they no longer have MNPI.

Quarterly Blackout Periods

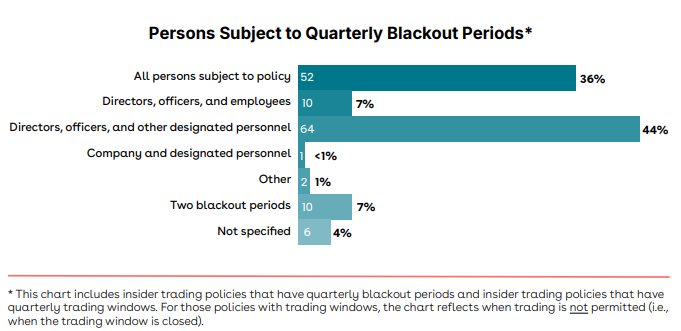

Quarterly blackout periods are designated times during which company insiders are prohibited from transacting in the company’s securities regardless of whether they are aware of MNPI. Quarterly blackout periods generally apply to all directors and Section 16 officers, and either all or some subset of employees and other service providers with regular access to MNPI, as determined by the company.

Ten companies in the SV150 have established two overlapping quarterly blackout periods. Generally, a longer blackout period that begins earlier in the quarter applies to directors, officers, and a subset of designated personnel. All other personnel are subject to a shorter blackout period that begins later in the quarter. These two blackout periods are operative each quarter throughout the year.

Pre-Clearance Requirements

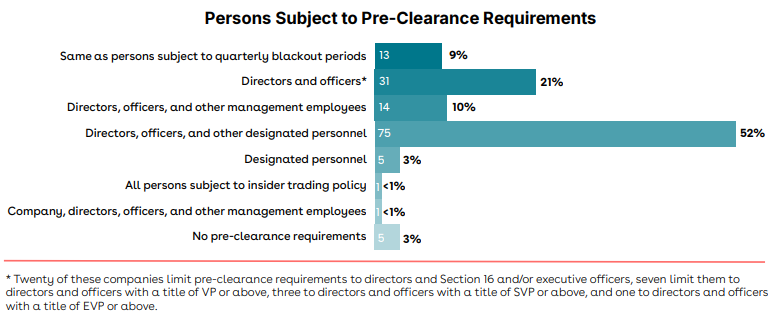

Many public companies also include pre-clearance requirements in their insider trading policies mandating that certain company insiders pre-clear their transactions in company securities with the company’s compliance officer or another designated individual even during an open trading window. Persons subject to pre-clearance requirements typically include directors and Section 16 officers, in part, because of the risk for insider trading and the higher visibility of trades by persons who file Section 16 reports, as well as short swing liability under the federal securities laws. [5] Pre-clearance requirements also typically apply to other officers or management-level employees, employees with regular access to MNPI such as finance or legal staff, and other designated employees or service providers of the company.

TIMING OF QUARTERLY BLACKOUT PERIODS

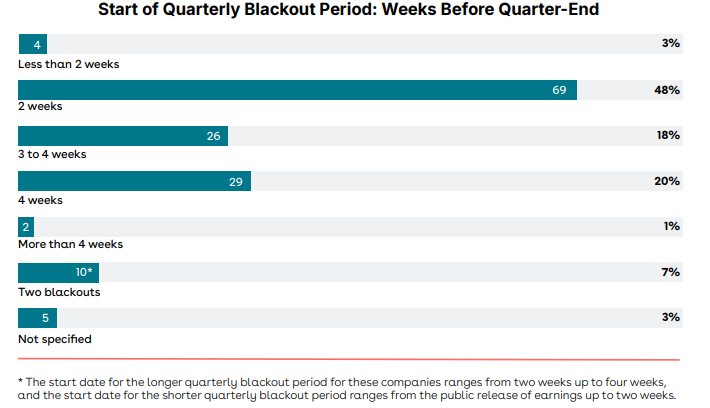

Given the importance of quarterly earnings results to many public companies and their investors, insider trading policies typically provide for quarterly blackout periods during which company insiders must refrain from transacting in the company’s securities. The timing of quarterly blackout periods is a company-specific decision and often is dictated by the timing of availability of information regarding a company’s financial results for the quarter, a company’s quarter-end processes, timing of revenue earned during the quarter, whether a company is pre-revenue, how widely covered a company is by research analysts, and other factors.

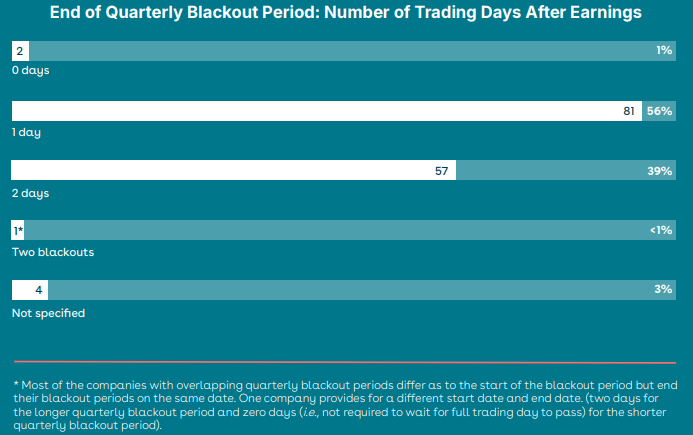

The start of quarterly blackout periods ranges from four or more weeks prior to the end of the then-current fiscal quarter to the end of the fiscal quarter (or later for some pre-revenue companies), and the end of quarterly blackout periods is typically either one or two trading days following quarterly earnings, often depending on how broadly covered the company is by research analysts and the media, and thus how quickly the information is absorbed by the market.

TREATMENT OF GIFTS

As part of the 2022 rules, the SEC also amended Exchange Act Rule 16a-3 to require that dispositions of gifts by Section 16 filers be reported within two business days on a Form 4. Previously, dispositions of gifts were permitted to be reported on a delayed basis on a Form 5 or voluntarily on a Form 4 (often companies reported a gift on the next Form 4 that reported a required transaction). In the proposing and adopting release, the SEC indicated that this amendment was intended to address concerns relating to the potential for “problematic practices involving gifts of equity securities, such as making stock gifts while in possession of MNPI, or backdating stock gifts in order to maximize the tax benefits associated with such gifts.” Further emphasizing these concerns, the SEC stated its position that “a donor of securities violates Section 10(b) if the donor gifts a security of an issuer in fraudulent breach of a duty of trust and confidence when the donor was aware of MNPI about the security or issuer, and knew or was reckless in not knowing that the donee would sell the securities prior to the disclosure of such information.”

As a result of the amendment to Exchange Act Rule 16a-3, and the concerns expressed by the SEC in the proposing and adopting releases, some companies reconsidered the treatment of gifts of company securities in their insider trading policies. Based on our review of the SV150 companies, most insider trading policies contain limitations on making gifts when in possession of MNPI or during blackout periods, some treat gifts as an exception to the policy, and some do not mention gifts at all.

RESTRICTED ACTIVITIES

Hedging

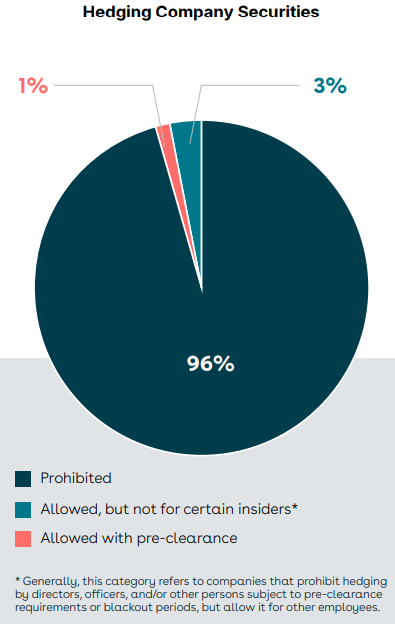

SEC rules require public companies to disclose in proxy or information statements for the election of directors any practices or policies regarding the ability of employees or directors to engage in certain hedging transactions with respect to company equity securities. Specifically, public companies must describe any practices or policies that they have adopted regarding the abili

ty of employees (including officers) and directors to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market

ty of employees (including officers) and directors to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market

value of company equity securities granted to the individual by the company as part of their compensation or held, directly or indirectly, by the individual. If a company does not have any such practices or policies, then it is required to disclose that fact or state that the transactions described in the

foregoing sentence are generally permitted. [6]

Nearly all (96 percent) of the insider trading policies prohibit hedging transactions relating to company securities. Although hedging transactions are generally prohibited, not all policies explicitly address or prohibit each of the types of transactions identified in Regulation S-K Item 407(i). For example, four companies allow exchange funds subject to pre-clearance, two companies allow exchange funds subject to the fund being broadly diversified, and two companies allow exchange funds but only for certain insiders.

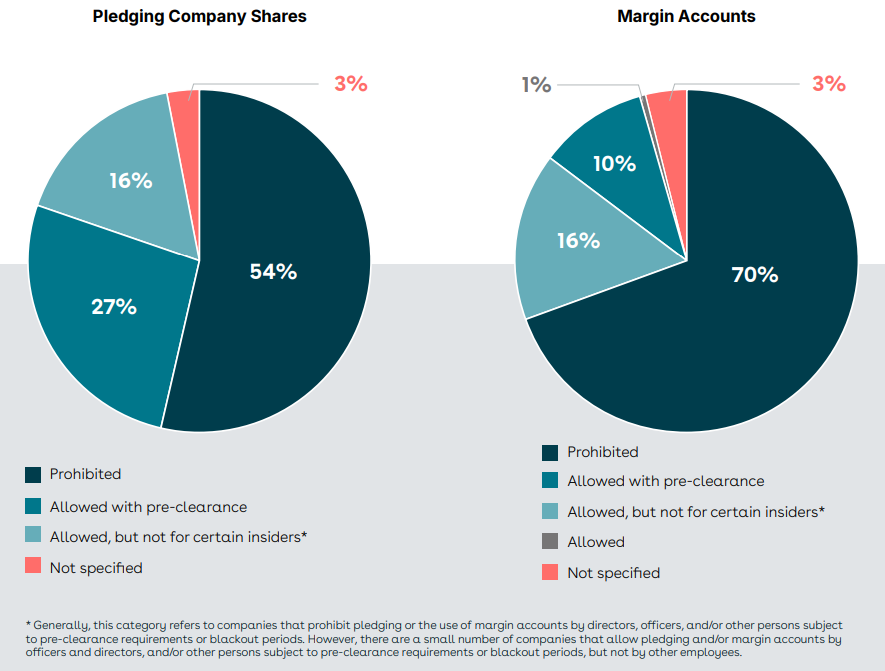

Pledging and Margin Accounts

In addition to hedging transactions, many insider trading policies address the ability of company insiders to pledge company securities as collateral for a loan and to hold company securities in margin accounts. Securities pledged as collateral for a loan may be sold without the person’s consent by the lender if the person defaults on the loan. Similarly, in a typical margin arrangement, if the person fails to meet a margin call, the broker may be entitled to sell securities held in the margin account without the person’s consent. Since sales under these circumstances may occur at a time when the person is aware of MNPI or is otherwise not permitted to trade in the company’s securities, some insider trading policies prohibit pledging and/or holding shares in margin accounts. [7]

While a significant minority of policies allow pledging, a much smaller percentage allow insiders to hold company stock in margin accounts.

Link to the full report can be found here.

1Wilson Sonsini reviewed the insider trading policies of 145 companies. Three of the SV150 companies were acquired prior to filing their insider trading policy and two of the SV150 companies were delisted prior to filing their insider trading policy. Accordingly, all percentages provided in this report that relate to the entire SV150 are based on “n=145” unless otherwise stated.(go back)

2Insider Trading Arrangements and Related Disclosures, Release Nos. 33-11138; 34-96492 (Dec. 14, 2022), available at sec.gov/files/rules/final/2022/33-11138.pdf.(go back)

3Some companies use the term “trading window” rather than “blackout period.” A “trading window” refers to the time period during which company insiders may transact in company securities, assuming they do not have material nonpublic information about the company or its securities.(go back)

4For example, with respect to family members, the policies often include one or more of the following categories: immediate family members (sometimes specifically defined), family members living in the insider’s household, family members not living in the insider’s household but whose transactions in securities are directed or influenced by the insider, and economic dependents.(go back)

5Under Section 16 of the Securities Exchange Act, officers and directors must disgorge any profits received if they purchase and sell, or sell and purchase, securities within a six-month period.(go back)

6Item 407(i) of Regulation S-K [17 CFR 229.407(i)].(go back)

7See Compliance and Disclosure Interpretations, Exchange Act Rules, Question 120.08 available here, discussing pledging of company stock as collateral for a loan, and the unavailability of the Rule 10b5-1(c)(1)(i)(B)(3) defense in the circumstances described therein. See also Compliance and Disclosure Interpretations, Exchange Act Rules, Question 120.09 available here, discussing the placement of company stock in a margin account, and the unavailability of the Rule 10b5-1(c)(1)(i)(B)(3) defense in the circumstances described therein. In both cases, the relevant C&DI notes that the person retains some discretion with respect to the loan or margin account.(go back)

Print

Print