Melissa Burek is founding partner, Eric Hosken is a partner, and Bonnie Schindler is a principal at Compensation Advisory Partners. This post is based on a CAP memorandum by Ms. Burek, Mr. Hosken, Ms. Schindler, and Whitney Cook. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

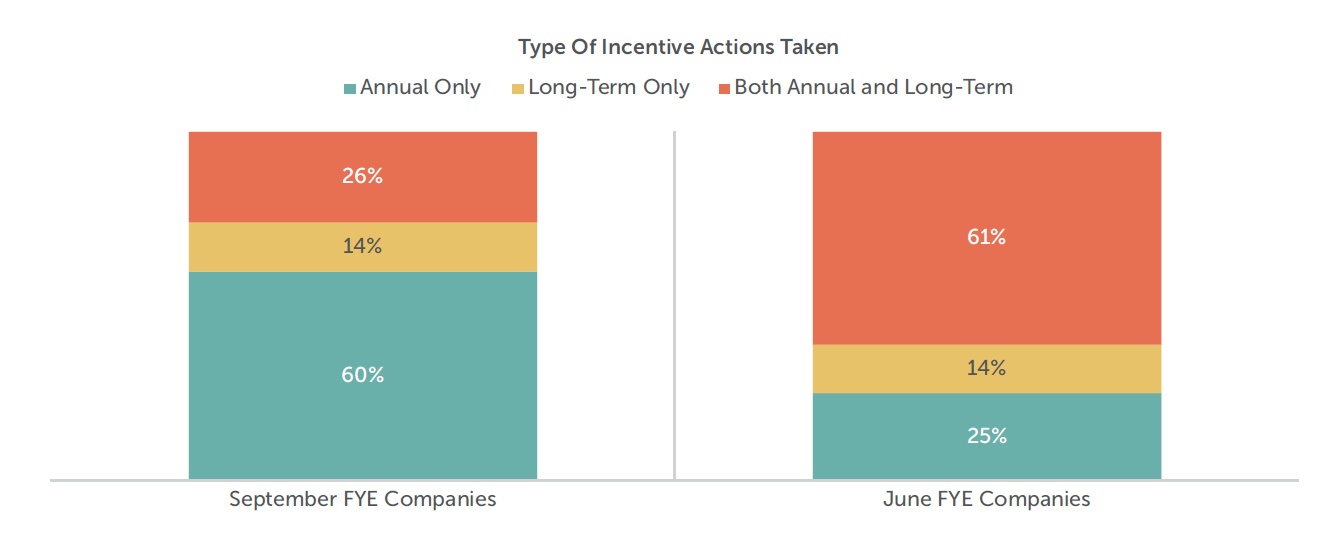

Compensation Advisory Partners’ analysis of approximately 100 S&P Composite 1500 companies found that annual incentive plan modifications are the most frequent recent executive pay action taken in response to COVID-19. The analysis is part of CAP’s ongoing efforts to track executive compensation and human capital actions related to COVID-19. Forty-two percent of the companies—which have fiscal year ends near September 30 and recently filed their proxies—made COVID-19-related changes to their incentive plans. Of the companies that made incentive changes, 60 percent made annual incentive changes, 14 percent made long-term incentive changes, and 26 percent changed both incentive plans. The most prevalent annual incentive actions were 1) adding or exercising discretion, 2) adding or changing the performance measures, and 3) adjusting the performance period.

Annual incentive changes are the most prevalent actions taken recently by public companies impacted by COVID-19, according to a Compensation Advisory Partners analysis of proxy filings of 101 S&P Composite 1500 companies with fiscal year ends (FYEs) near September 30. The CAP analysis—which is part of our ongoing efforts to track executive compensation and human capital actions related to COVID-19—shows that 42 percent—or 42 companies—made COVID-19-related changes to their executive incentive plans. Of the 42 companies, 60 percent made annual incentive changes, 14 percent made long-term incentive changes, and 26 percent changed both types of plans.

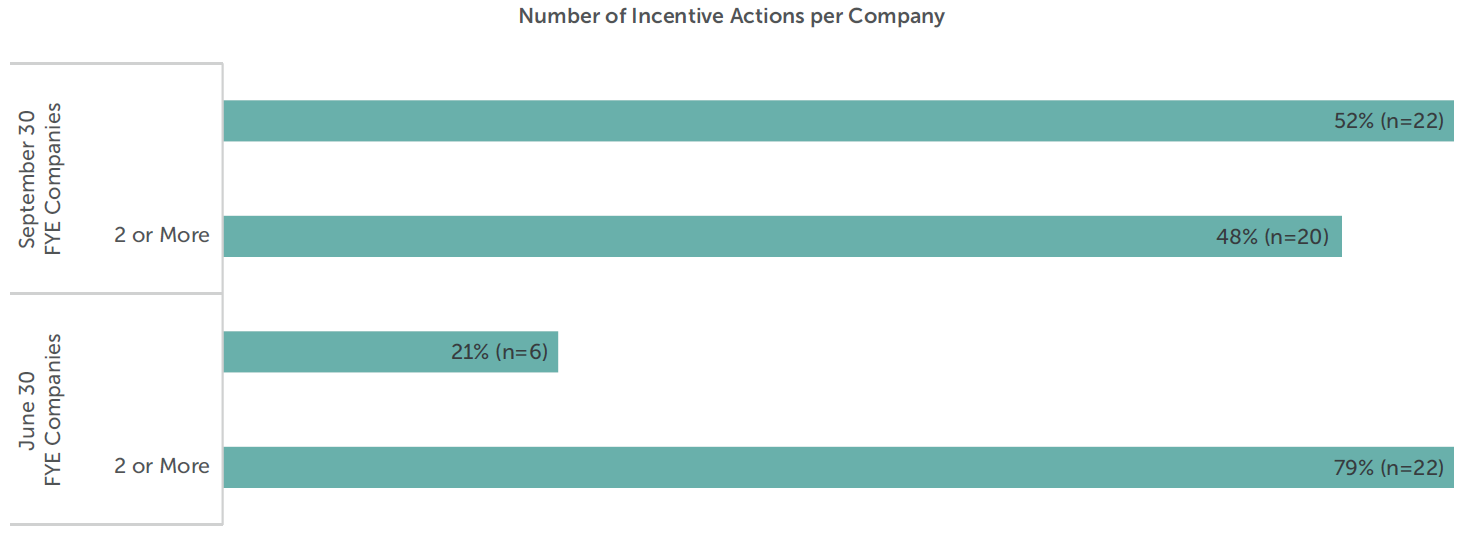

In our earlier research, most June FYE companies modified both their annual and long-term incentive plans, and the most common action was to exclude the three months of COVID-19 from their performance periods and calculations. In contrast, the September 30 FYE companies had to address the impact of COVID-19 during half of their fiscal years. Six months into the pandemic, companies knew that COVID-19 was a long-term disruption, and they may have had time to engage with investors and incorporate guidance from proxy advisors, who indicated that changes to long-term incentives would be scrutinized. As a result, changes to annual incentive actions are far more common for the September FYE companies. Of the 42 September FYE companies, 22 took only one incentive action, while 20 companies took two or more actions.

The September FYE companies show significant representation from the Capital Goods (23%), Materials (9%), and Health Care (9%) sectors. While not a completely representative sample, this group provides an interesting look at executive compensation responses to COVID-19.

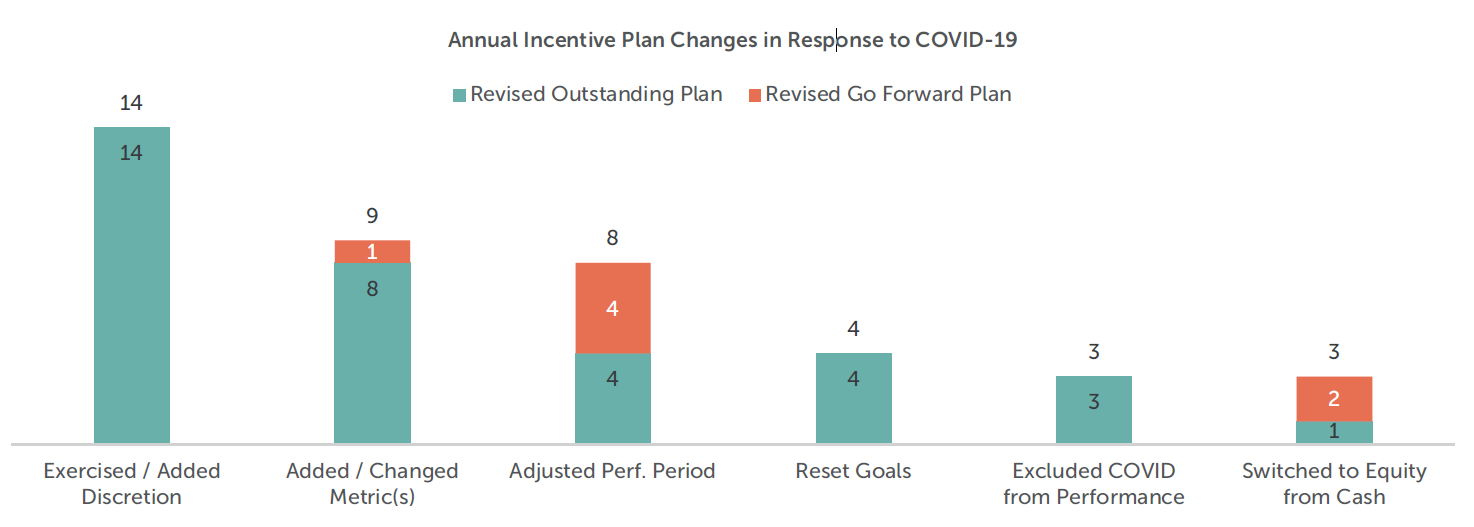

Annual Incentives

Of the 42 companies, 36 made changes to their outstanding and/or go-forward annual incentive plans. Now that companies have more information about the economic impact and disruption caused by the pandemic, they are exercising or adding discretion to the plan, adding or changing performance metrics, and adjusting the performance period. Other actions taken include resetting performance goals, excluding COVID from the performance results, and switching from cash to equity.

| Action | Examples | |||

|---|---|---|---|---|

| Company | Industry | Revenue ($mm) ↓ | Description of Action Taken | |

| Exercised / Added Discretion |

Walt Disney | Media and Entertainment |

$65,388 | Exercised Negative Discretion

Reduced bonus to 0% despite financial performance tracking at 21% of target. |

| Becton Dickinson | Health Care Equipment and Services | $17,117 | Exercised Positive Discretion

Adjusted awards to 75% of payout for most NEOs from the 18% of payout that would have resulted under the bonus funding formula. The company performed multiple sensitivity tests before making its decision. |

|

| WD-40 | Household and Personal Products | $435 | Discretionary Bonus to Reach Threshold Payout

Awarded a 15% supplemental cash compensation award. NEOs received 10% of target under the original plan, so with the supplemental award NEOs received 25% of their incentive opportunities. |

|

| Added / Changed Metric(s) |

Visa | Software and Services |

$21,479 | Increased Weight on Individual Performance

Increased emphasis on individual performance to 50% individual / 50% financial. Financial performance was well below target and funded at 0%. Provided detailed chart on individual performance and achievements in corporate initiatives scorecard and funded individual performance at 160% of target. |

| Hill-Rom Holdings | Health Care Equipment and Services | $2,881 | Adjusted Business Unit Goals to Align with Corporate Goals

Included all participants (including all NEOs) in the corporate pool and did not include any participants in the individual business unit pools. Focusing all participants on the corporate pool enabled HillRom to coalesce around one set of company goals. |

|

| Adjusted Performance Period | Walgreens Boots Alliance |

Food and Staples Retailing | $141,505 | Bifurcated Bonus Plan and Adopted Scorecard for Second Half

Considered an average of the pre-COVID results for the first six months of FY20 and the results of a balanced scorecard for the final six months of FY20, resulting in a payment of 84% of target. |

| Helmerich & Payne |

Energy | $1,775 | Bifurcated Bonus Plan for Financial Metrics Only

Financial performance metrics for FY21 will be evaluated based on two six-month periods, with criteria established at the beginning of each period. Bonuses for operational and strategic objectives will be determined based on full-year performance. |

|

| Great Western Bancorp | Banks | $298 | Bifurcated Bonus Plan and Established Performance Hurdle for Second Half

Measured FY20 in two halves with a qualifier in the second half in which Non-Performing Assets (NPA)/Capital must meet a minimum of 40% for any incentive to be earned in that half of the year. The minimum threshold was not met, resulting in no payment for the second half of the year. |

|

| Reset Goals | Visa | Software and Services | $21,479 | Reset Individual Goals

Adjusted NEO individual performance goals for fiscal year 2020 in April 2020. Corporate performance goals were not modified. |

| Maximus | Software and Services | $3,462 | Lowered Threshold Goals

Threshold performance level of achievement for a financial metric was lowered to increase the possibility of a minimum reward. |

|

| Excluded COVID from Performance |

Plexus | Technology Hardware and Equipment | $3,368 | Excluded Impact of Pandemic from Payout Calculation

Excluded the impact of COVID-19 from the determination of whether the shared individual objectives were achieved. |

| Valvoline | Materials | $2,353 | Excluded Impact of Pandemic from Payout Calculation

For FY20, modified the EBITDA incentive metric to exclude $2.6M related to the adjusted payouts for COVID-19 for certain employees, resulting in 133.8% achievement instead of 0%. |

|

| Switched to Equity from Cash | Enerpac Tool Group | Capital Goods | $466 | Implemented Ability to Earn 25% of Bonus in RSUs

Given the challenges of implementing effective incentives during the pandemic, bonus participants will have the opportunity to earn RSUs equal to 25% of the value of their annual target bonus opportunity based on achievement of an approved sales target. |

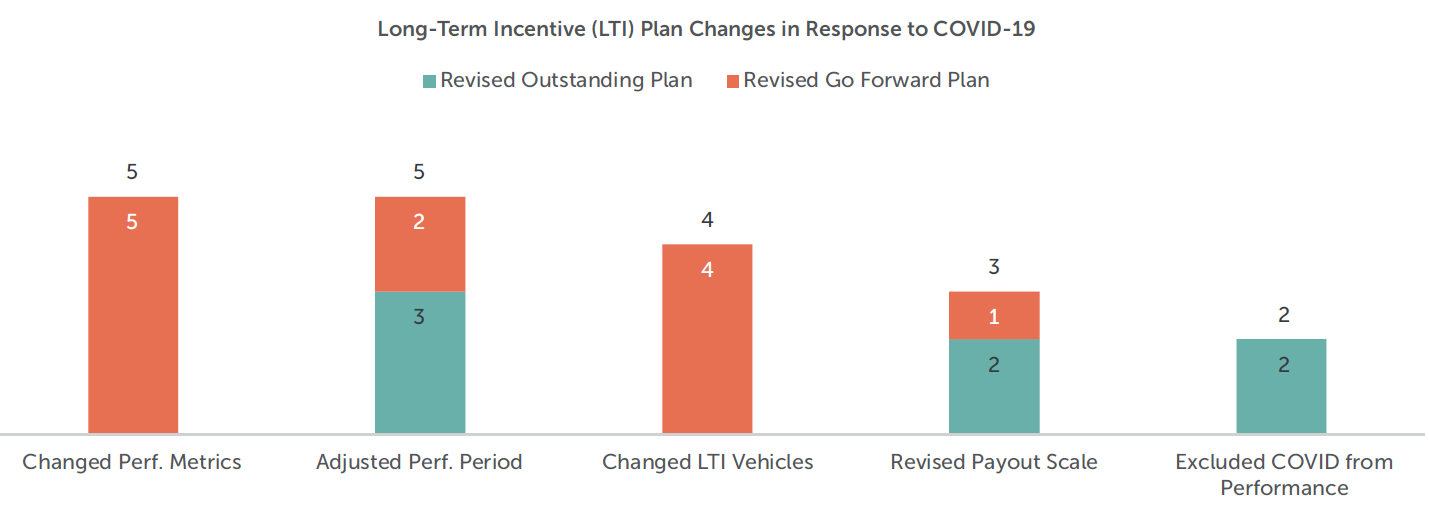

Long-Term Incentives

Of the 42 companies, 17 made changes to their outstanding and/or go-forward long-term incentive plans. Eleven of the 17 companies also adjusted annual incentive plans. The most common adjustments were changing metrics for performance awards, changing the long-term incentive vehicle mix, and modifying the performance period.

Noteworthy Long-Term Incentive Actions

| Action | Examples | |||

|---|---|---|---|---|

| Company | Industry | Revenue ($mm) ↓ | Description of Action Taken | |

| Changed Performance Metrics | Walgreens Boots Alliance | Food and Staples Retailing | $141,505 | Adopted Growth-Oriented Metrics with One-Year Goals

For FY21, changed metrics to 70% earnings per share (EPS) growth and 30% revenue growth – both based on three one-year growth targets. Prior measure was cumulative EPS over three years. |

| Matthews International | Commercial and Professional Services | $1,520 | Switched to Stock Price Metric from EPS

For FY21, changed metrics to 50% stock price growth and 50% return on invested capital (ROIC) from 50% EPS and 50% ROIC. The use of stock price is temporary in consideration of the pandemic. |

|

| Changed LTI Vehicles | Enerpac Tool Group | Capital Goods | $466 | Increased Proportion of RSUs in Long-Term Incentive Mix

For FY21, increased weighting of RSU awards to NEOs. CEO awards will have a higher proportion of PSUs vs. RSUs than that of other NEOs. In prior years, the allocation was 50% to PSUs and 50% to RSUs. |

| Adjusted Performance Period | Walgreens Boots Alliance | Food and Staples Retailing | $141,505 | Revised Outstanding Performance Period

For FY18 awards, reviewed progress against performance goals considering performance through the pre-COVID period (the first 30 of 36-month performance period) as well as the performance in the last 6 months that was impacted by COVID. Projected performance pre-COVID would have resulted in a Performance Share payout at 101.7%, while Company performance for the full period would have resulted in no payout. Final payout was 101.7%. |

| Nordson | Capital Goods | $2,121 | Goals to be Determined each Fiscal Year

Modified goals for the FY20 performance period. Performance metrics and attainment for 2021 and 2022 will be determined at the beginning of each fiscal year. At the end of the three-year period, each year’s attainment will be averaged to determine the payout for the cycle. |

|

| Revised Payout Scale | Meritor | Capital Goods | $3,044 | Revised Payouts between Threshold and Target

For the FY19 award (based on EBITDA margin and EPS), lowered the threshold and certain other payout targets. Did not adjust the targets for these performance metrics for payments at or above 100% of target. |

| PTC | Software and Services | $1,531 | Lowered Goals and Threshold Achievement

For the FY21 tranche of the FY19 PSUs, lowered threshold and target Adjusted Free Cash Flow goals and lowered threshold achievement to 25% (from 50%). For the FY21 and FY22 tranches of the FY20 PSUs, adjusted downward the threshold and target Annual Run Rate metrics for FY21 and FY22. |

|

| Excluded COVID from Performance | Jabil | Technology Hardware and Equipment | $27,593 | Excluded COVID-19 Costs from EPS Calculation

Excluded costs associated with COVID-19 from the EPS calculation for outstanding performance equity (including FY18 grants). Adjusted EPS was $8.86, resulting in vesting at 108% of target. Had the Committee not exercised discretion, vesting would have occurred at 90% of target. |

Special Awards

Some September FYE companies have provided special awards to NEOs in addition to other incentives because of the impact of COVID-19. The special awards are designed to achieve different goals: retain top talent, reward leadership through a difficult period, and incentivize future performance.

Noteworthy Special Awards

| Company | Industry | Revenue ($mm) ↓ | Description of Action Taken |

|---|---|---|---|

| Becton Dickinson | Health Care Equipment and Services | $17,117 | Special, one-time grant of stock appreciation rights in FY21 to associates who received 2018 or 2019 Performance Units, including each NEO, except the CEO. Recognizing that the lower value of these awards was not solely related to COVID-19 and because the board did not want to fully protect associates from the impact of the pandemic, the value of the one-time SAR award was limited to 50% of the decline in the value of the 2018 and 2019 Performance Unit awards. |

| Hologic | Health Care Equipment and Services |

$4,536 | For fiscal 2020, $500k cash bonus paid to the Division President, Diagnostics in recognition of his outstanding leadership and performance during the COVID-19 pandemic. |

| PriceSmart | Food and Staples Retailing |

$3,395 | In July 2020, granted special restricted stock awards to the NEOs, with a 15-month vesting schedule, in recognition of the extraordinary efforts and sacrifices they made in leading the company during the COVID-19 pandemic. The Company also awarded a $500K bonus to the CEO in recognition of leading the company through the pandemic. |

| PTC | Software and Services | $1,531 | Canceled a 2018 special award and entered into a new, three-year agreement with the CEO that consists of 400K RSUs (same number as issued for 2018) with a grant date value of $32M. Award vests ratably over three years. The new award adds three 1-year Annual Run Rate measure (weighted at 50%), resets the existing Adjusted Free Cash Flow measures (50%), has an upside feature capped at 10%, and does not contain a catch-up feature as included in the 2018 award. |

Print

Print