Richard Alsop, Doreen Lilienfield, and Gillian Moldowan are partners at Shearman & Sterling LLP. This post is part of the 19th Annual Corporate Governance Survey publication prepared by Shearman & Sterling LLP, by Mr. Alsop, Ms. Lilienfield, Ms. Moldowan, Lona Nallengara, and Kristina Trauger. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

The Survey

The Survey consists of a review of key governance characteristics of the Top 100 Companies, including a review of key ESG matters.

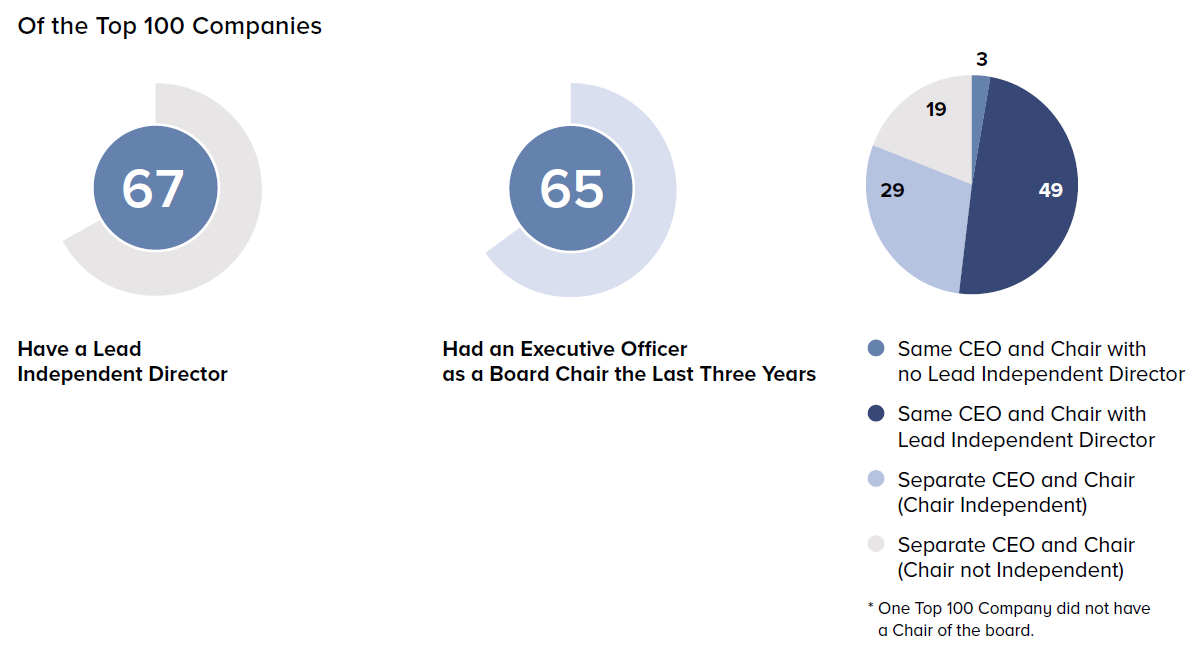

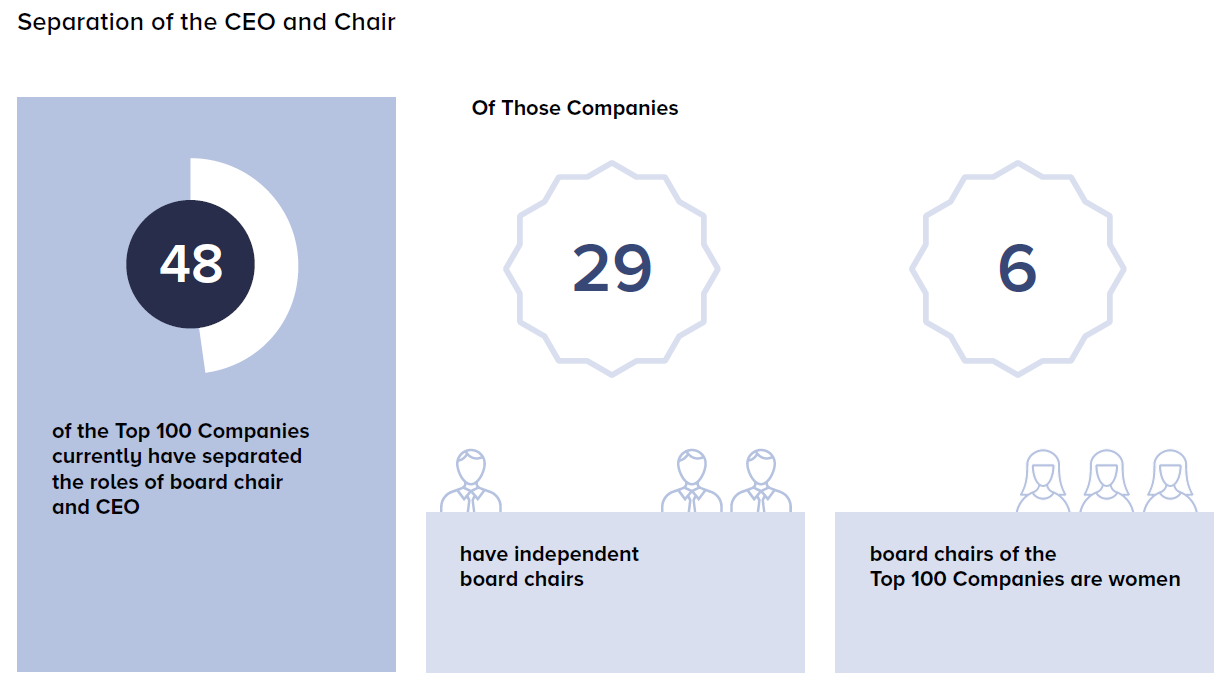

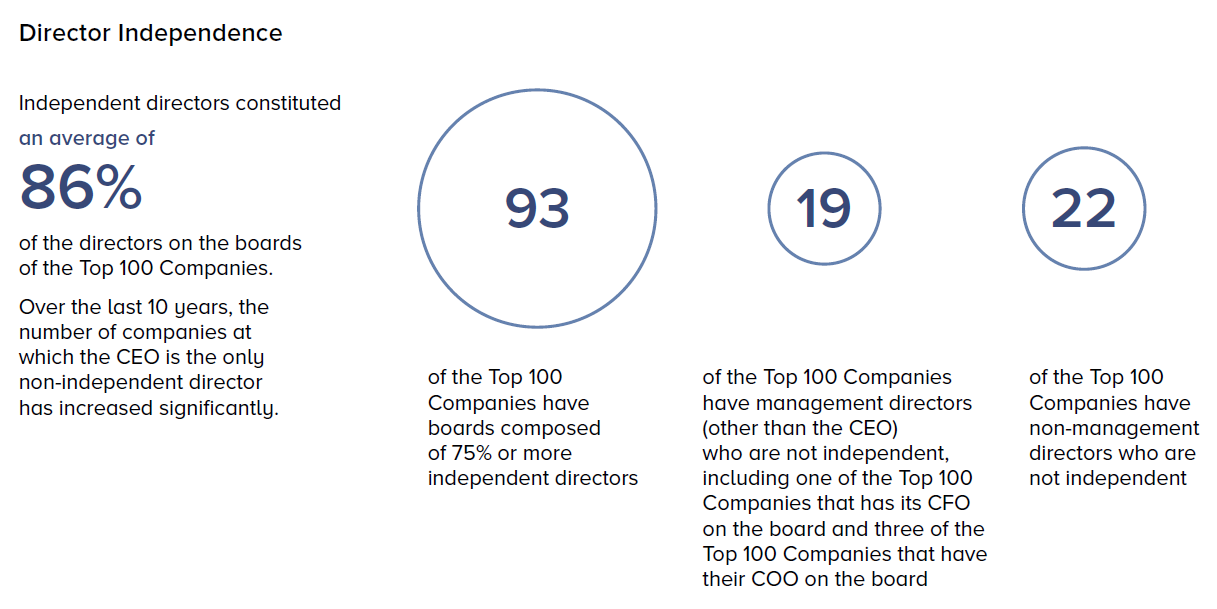

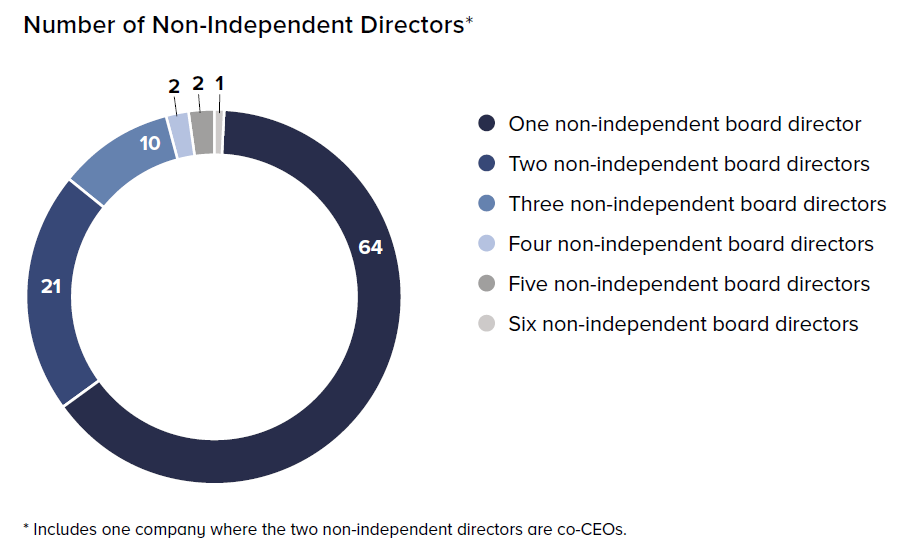

Board Size and Leadership

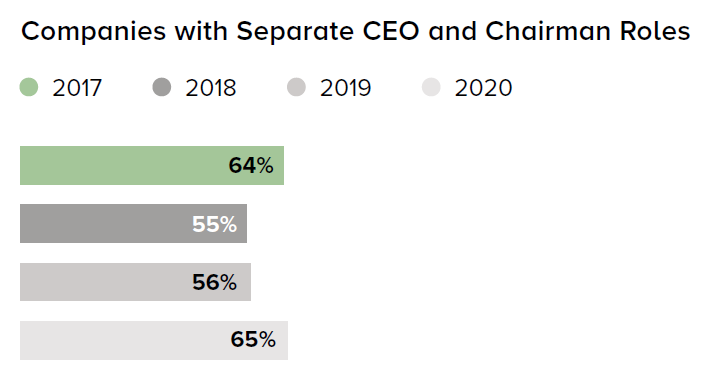

The average size of the board of the Top 100 Companies has decreased from 12.5 directors in 2015 to 11.6 directors in 2020, and 39 of the Top 100 Companies have split the CEO and board chair positions.

Board Refreshment

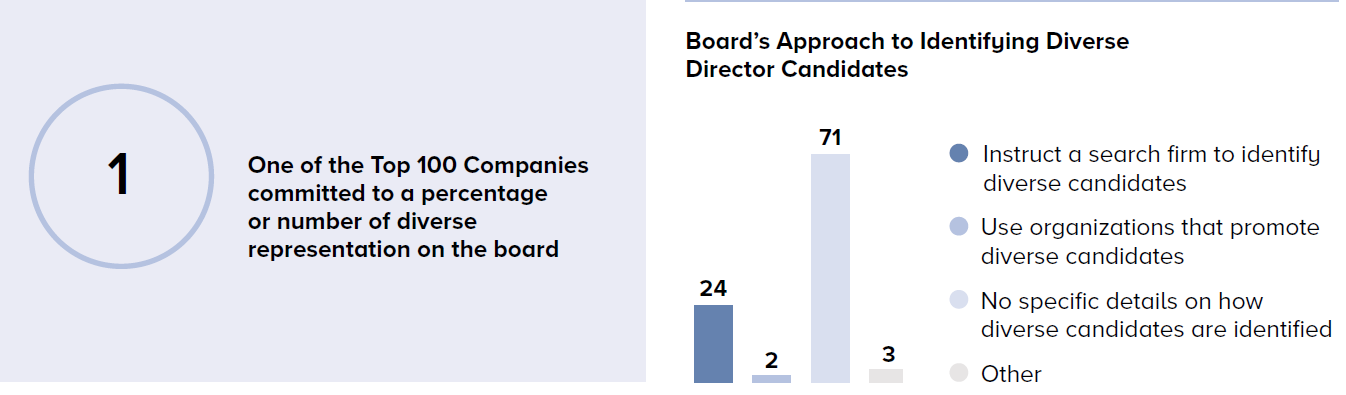

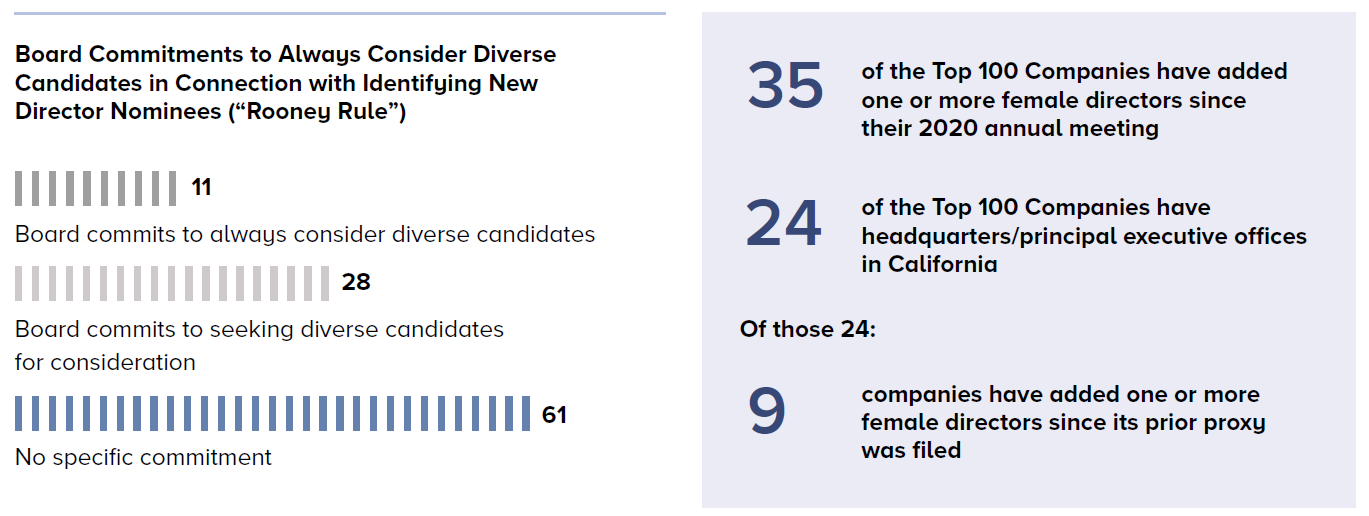

Board refreshment continues to be one of the key issues facing nominating and governance committees, and boards as a whole, as they are increasingly under pressure to change the face of the boardroom by re-examining topics such as director tenure, experience, performance and diversity, with gender and ethnic diversity at the forefront.

Mechanisms to Encourage Board Refreshment

Three of the principal board refreshment mechanisms are mandatory retirement age, term limits and the board self-evaluation process. While the use of a mandatory retirement age mechanism continues to be high and term limits continue to be low, use of the board self-evaluation process mechanism appears to be increasing.

Mandatory Retirement Age

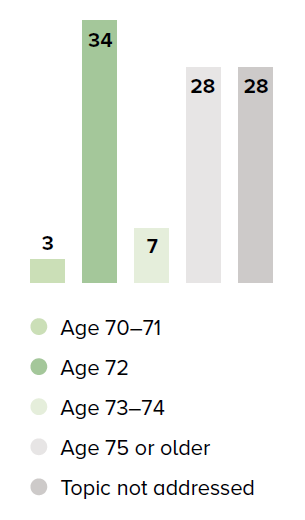

Although not required by either the NYSE or Nasdaq listing standards, 72 of the Top 100 Companies have disclosed a mandatory retirement age for their non-management directors. Of these, 43 companies expressly permit the board or a committee of the board to make exceptions to the retirement age policy. Age 72 continues to be the most common age set for mandatory retirement.

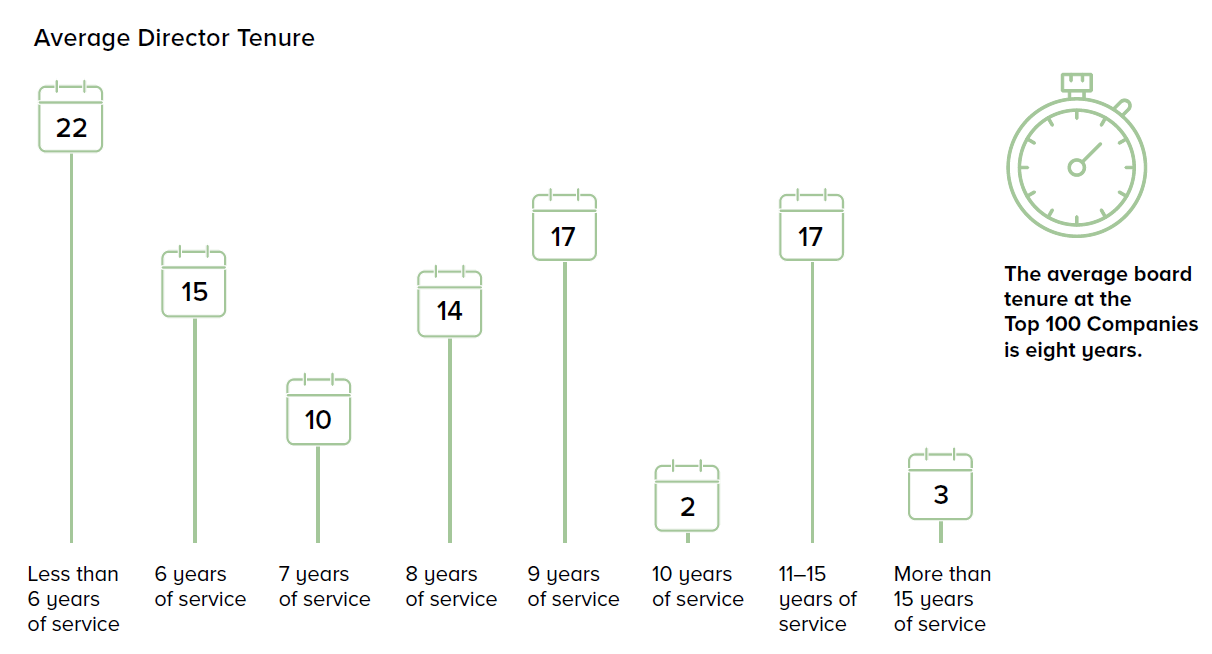

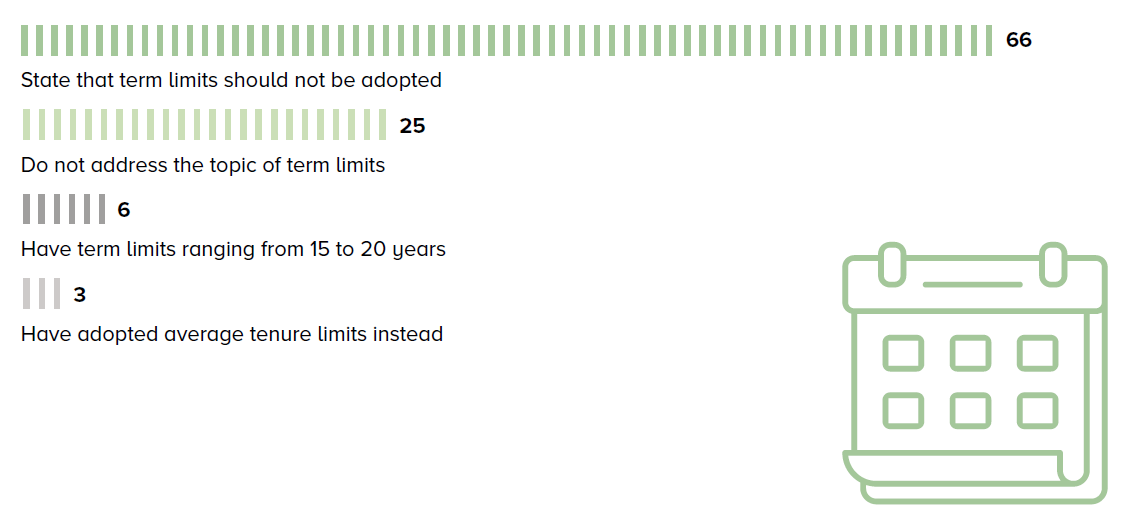

Term Limits

Six of the Top 100 Companies have adopted mandatory term limits for their directors, a slight decrease from eight in 2020. The mandatory term limits apply only to non-management directors at four of these companies. 66 of the Top 100 Companies specifically state that term limits have not been adopted, most citing the value of the insight and knowledge that directors who have served for an extended period of time can provide about the company’s business. Many of these companies also state that periodic reviews by the board or a board committee of each director’s performance serve as an appropriate alternative to mandatory term limits. Of the sixty-six Top 100 Companies that specifically state that term limits have not been adopted, two adopted average tenure limits of 10 years and one adopted an average tenure limit of nine years.

Board Diversity

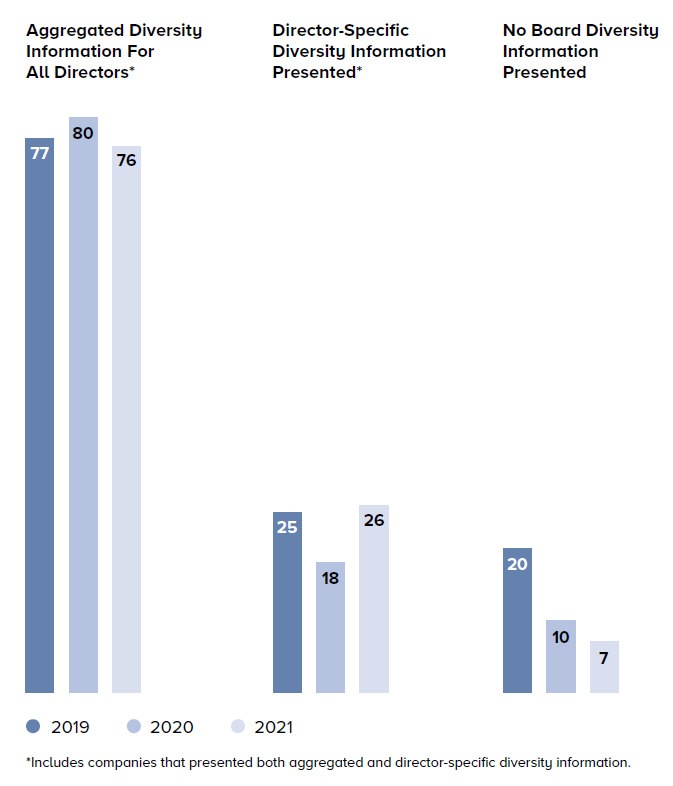

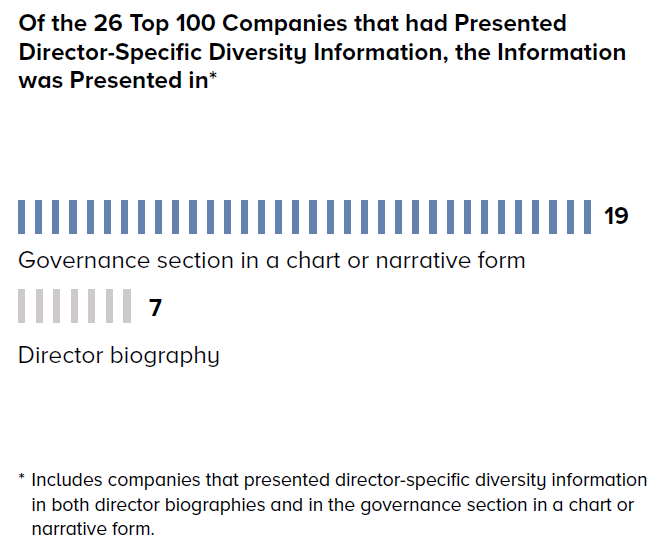

Companies vary considerably in how they present information regarding board diversity in their proxy statements. In 2021, the number of Top 100 Companies that presented information about the diversity of their boards on a director-specific basis increased to 2019 levels from 18 companies in 2020 to 26 companies in 2021.

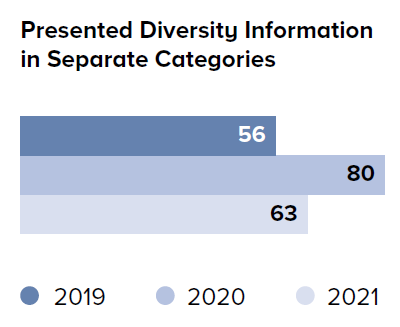

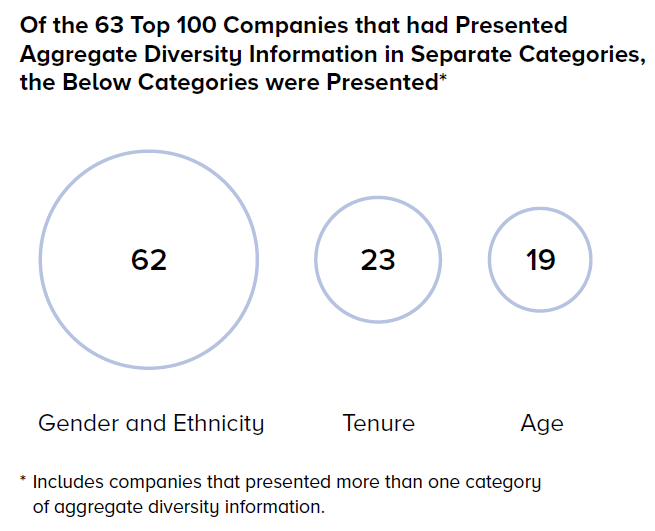

Sixty-three Top 100 Companies that have presented aggregated diversity information in 2021 had presented diversity information in separate categories.

Nasdaq’s new disclosure requirements on board diversity includes a requirement to present diversity information in a prescribed matrix.

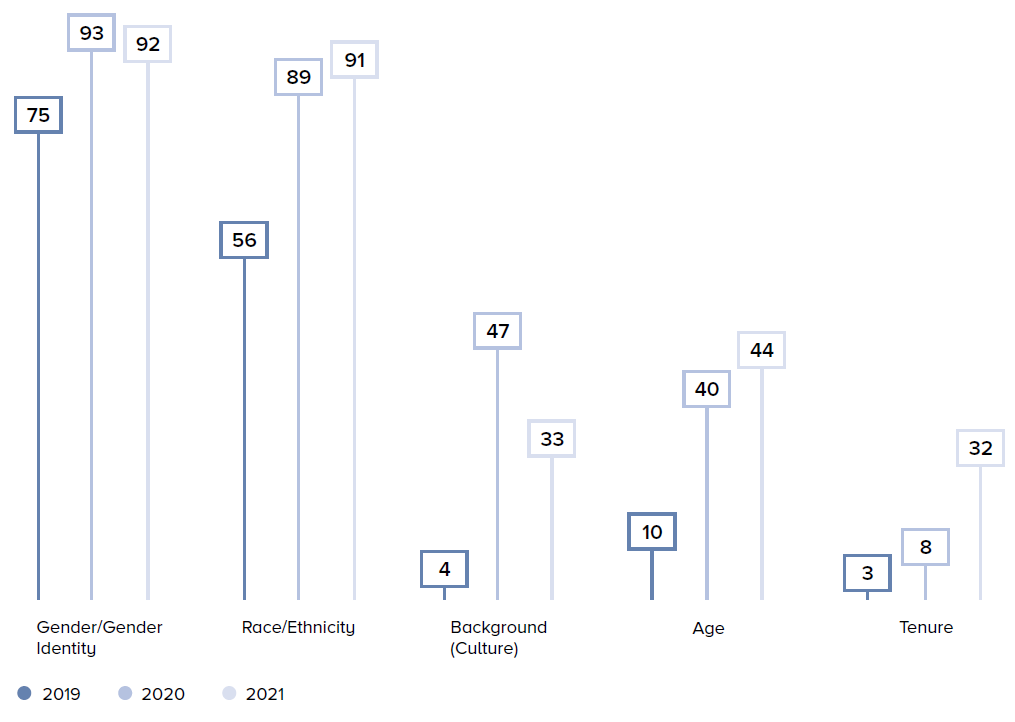

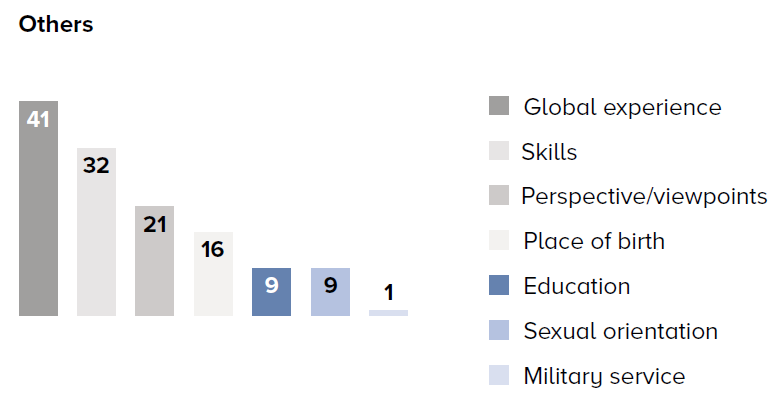

The most commonly identified categories of board diversity continue to be gender/gender identity, which decreased slightly from 93 companies in 2020 to 92 companies in 2021, and race/ethnicity, which increased from 89 companies in 2020 to 91 companies in 2021. These changes likely reflect a change in the composition of companies included in the Top 100 Companies. Various other categories that were presented included age, the cultural background of directors, such as national origin, citizenship and place of birth and tenure.

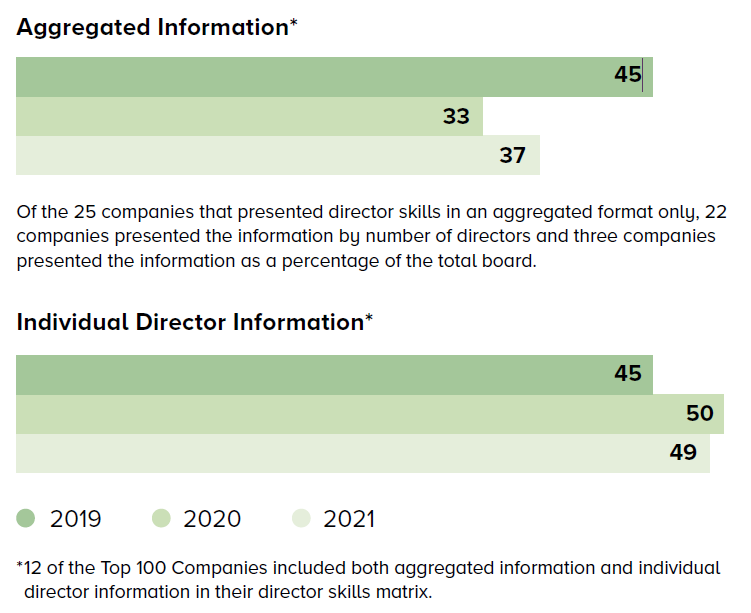

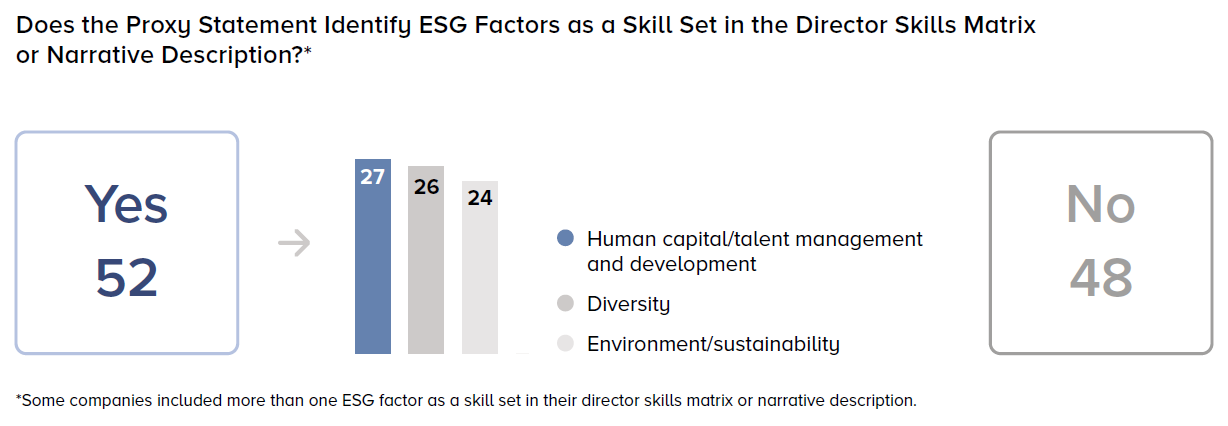

Director Skill Set

Director Skills Matrix

One of many initiatives to encourage public companies to encourage board refreshment and promote diversity on public company boards has been to encourage public companies to add a director skills matrix as part of their proxy statement disclosures.

Companies vary considerably in how they present the experience, qualifications, attributes and skills of directors in the matrix. The information may be presented in the aggregate or identify specific directors who have such experience, qualifications, attributes and skills.

Board Skills Information

SEC rules require companies to disclose the “experience, qualifications, attributes and skills that led to the conclusion that the person should serve as a director for the registrant at the time the disclosure is made, in light of the registrant’s business and structure.” As a result of this disclosure requirement, companies typically discuss director experience, qualifications, attributes and skills as part of each director’s biography. There is a continued trend in presenting this information in a matrix format so that shareholders can have a clearer picture of the experience, qualifications, attributes and skills of the board as a whole.

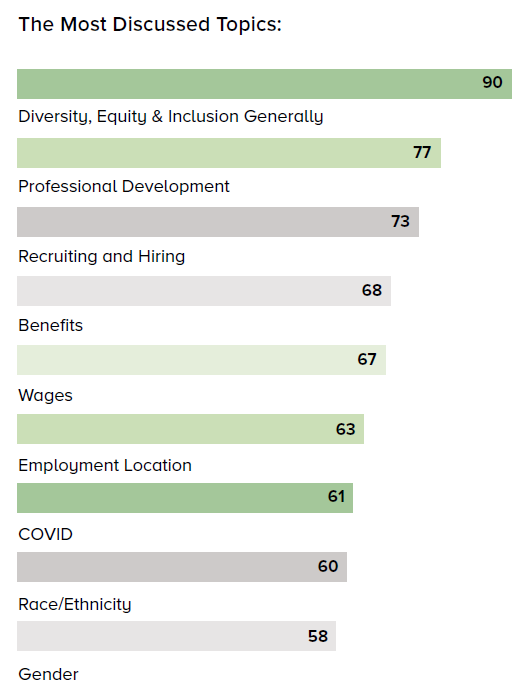

Human Capital Management

This year was the first year that the Top 100 Companies were required to provide disclosure on human capital resources material to the company’s business. It was up to each company to determine which human capital resources were material to its business. The topics chosen by the Top 100 Companies varied, as did whether the company decided to include data to supplement its disclosure.

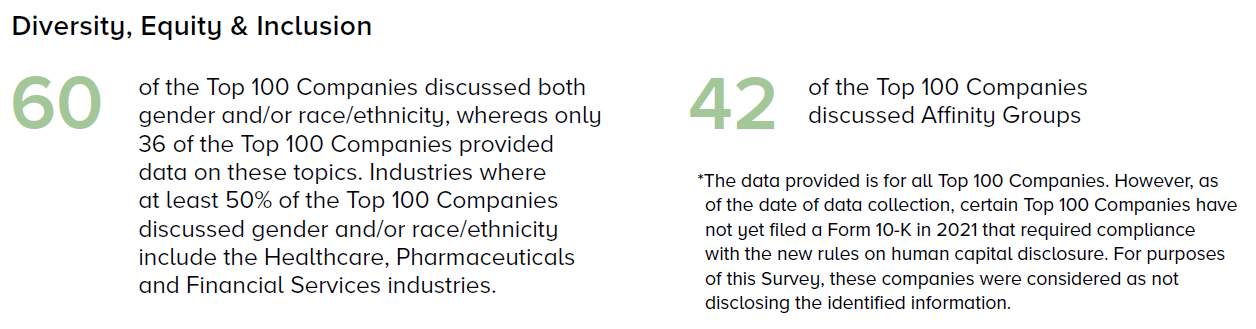

Workforce Demographics

Many Top 100 Companies discussed workforce demographic topics. A larger percentage supplemented these discussions with data on topics such as number of employees, employee classification and employment location.

Employee Turnover

While only 21 of the Top 100 Companies discussed employee turnover, 15 of those provided data to supplement their disclosure, primarily from the Technology and Financial Services industries.

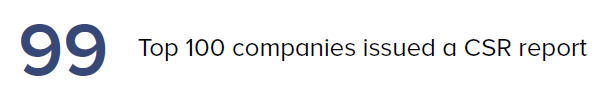

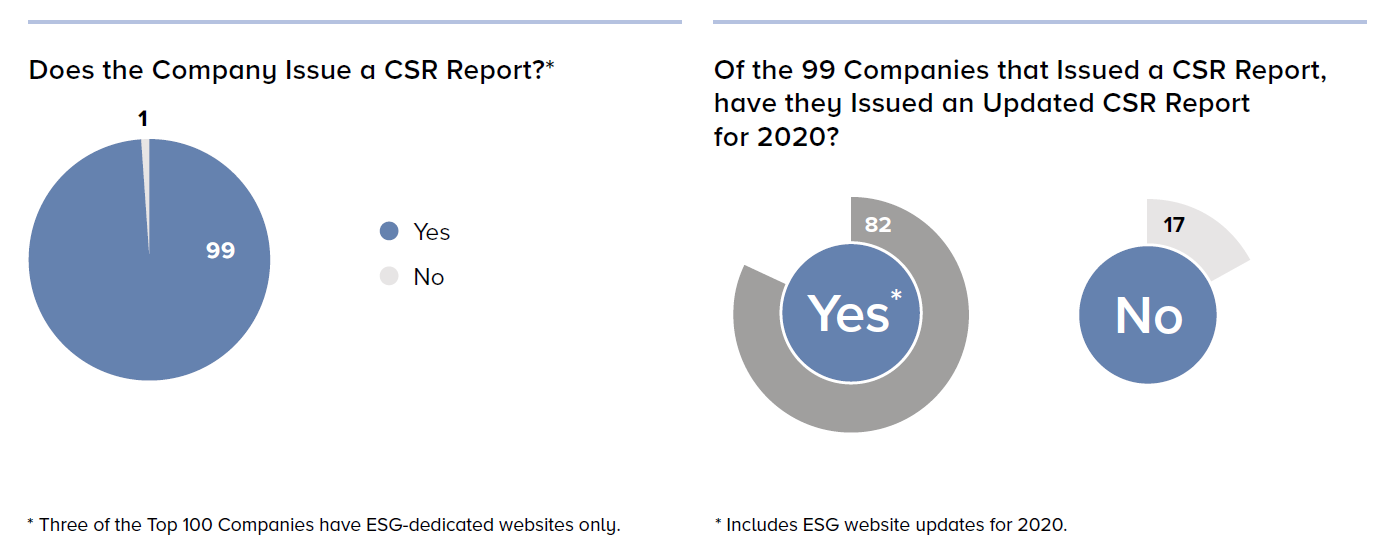

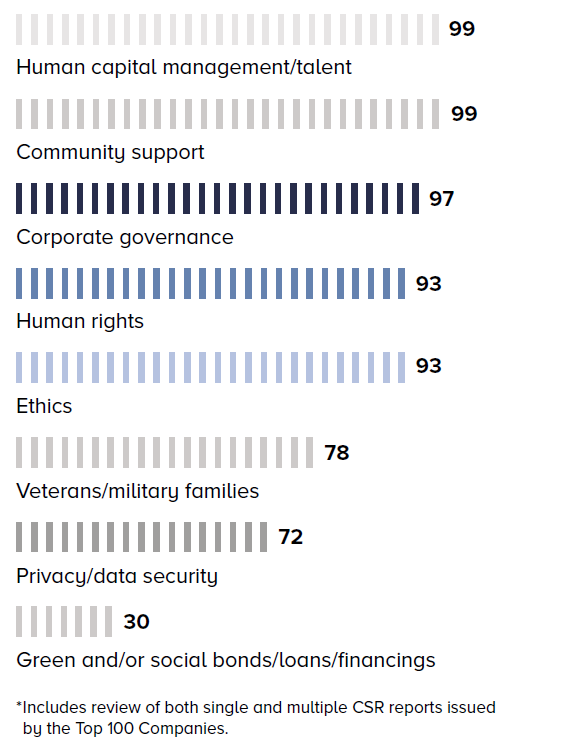

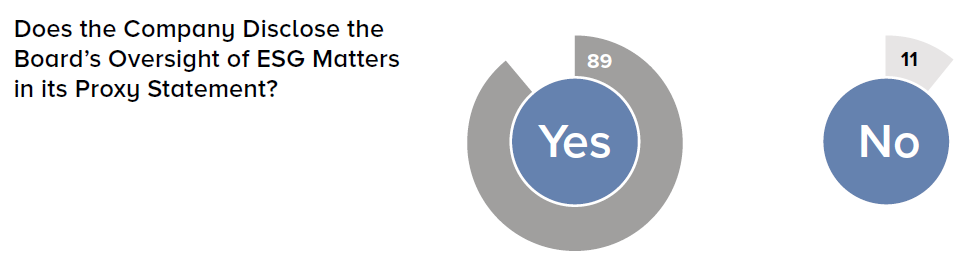

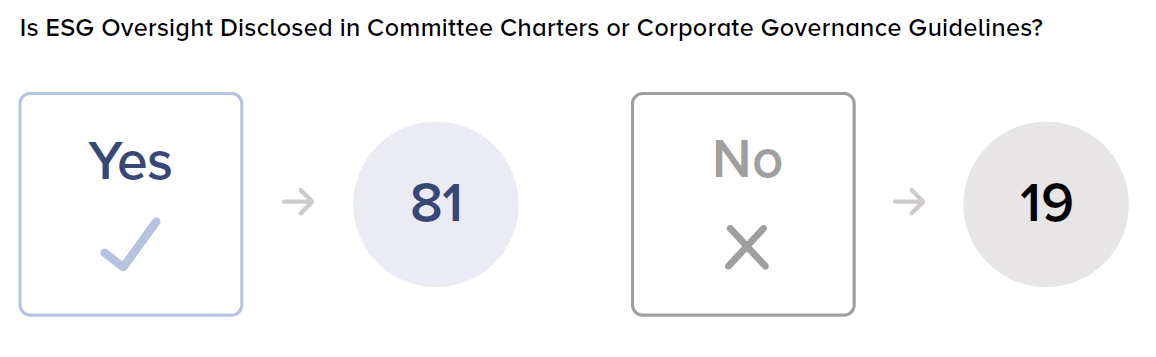

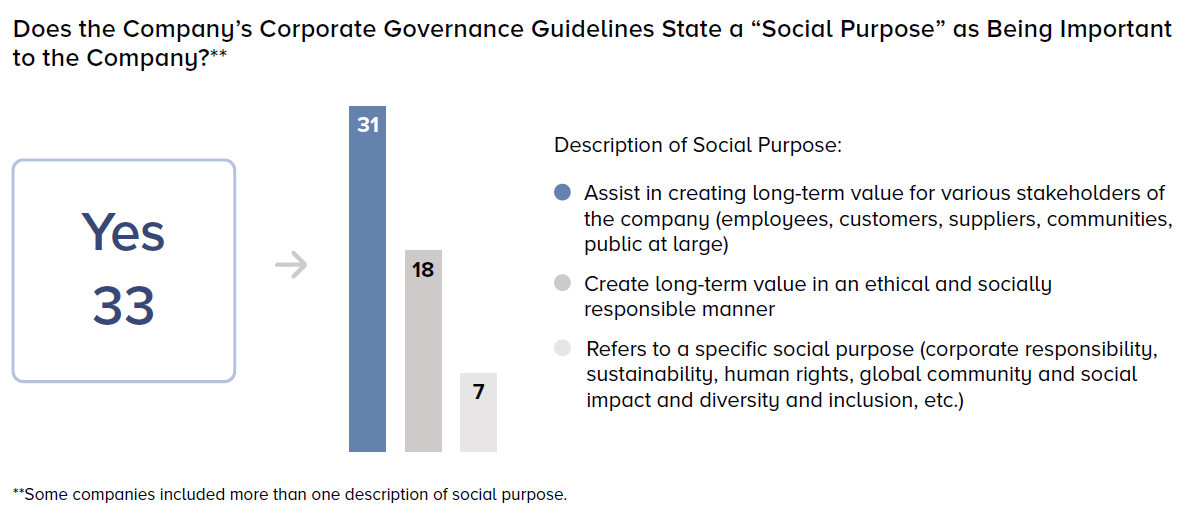

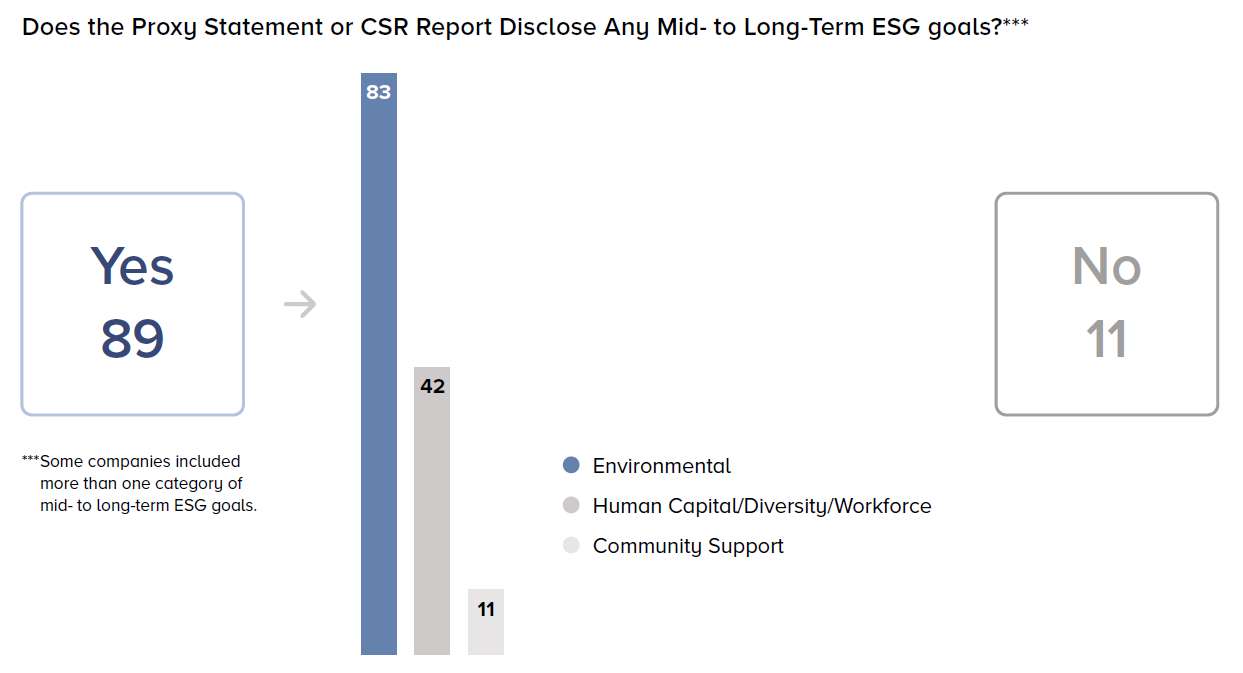

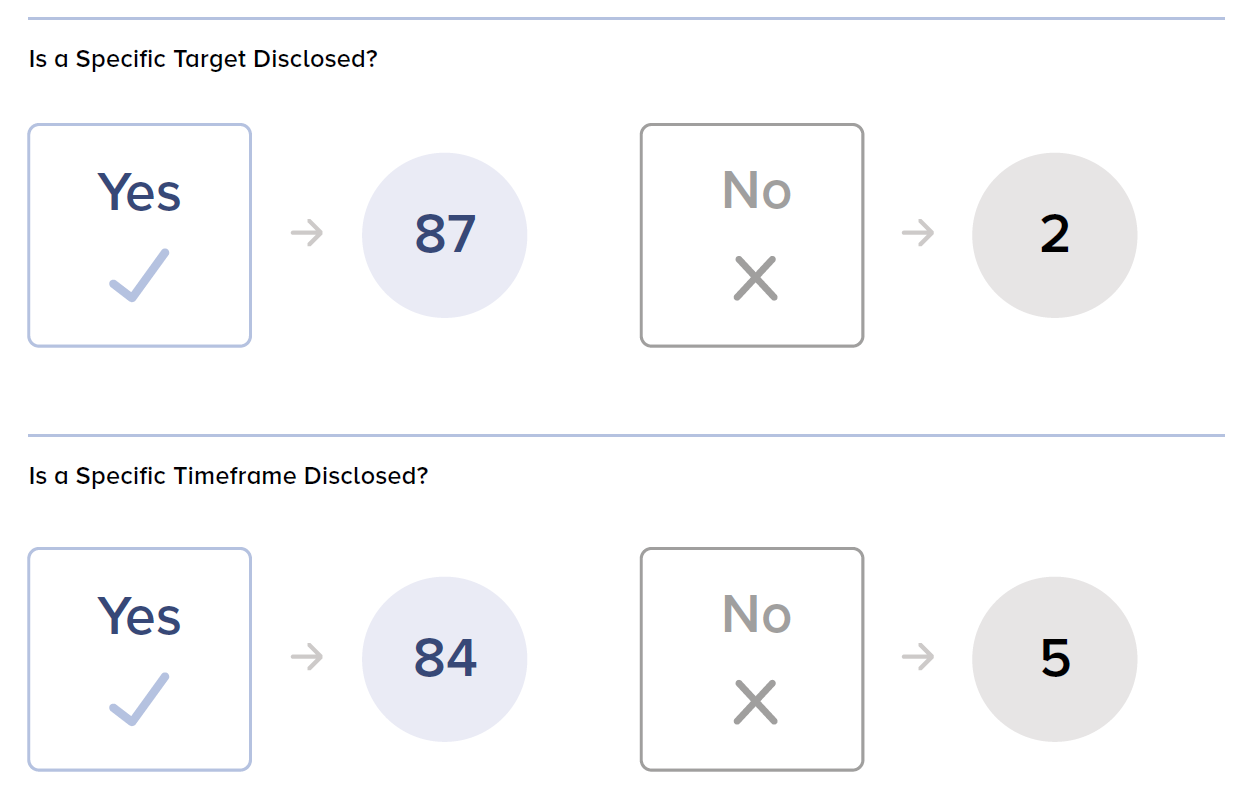

ESG Disclosure and Governance

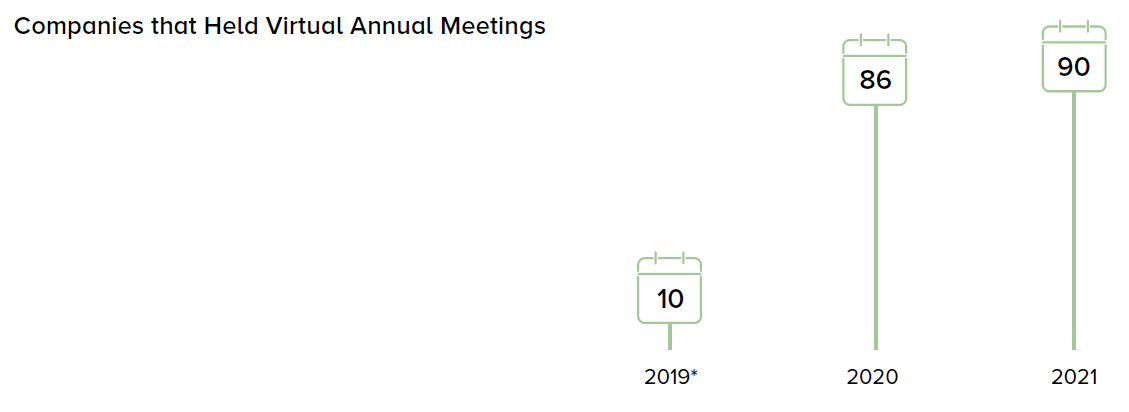

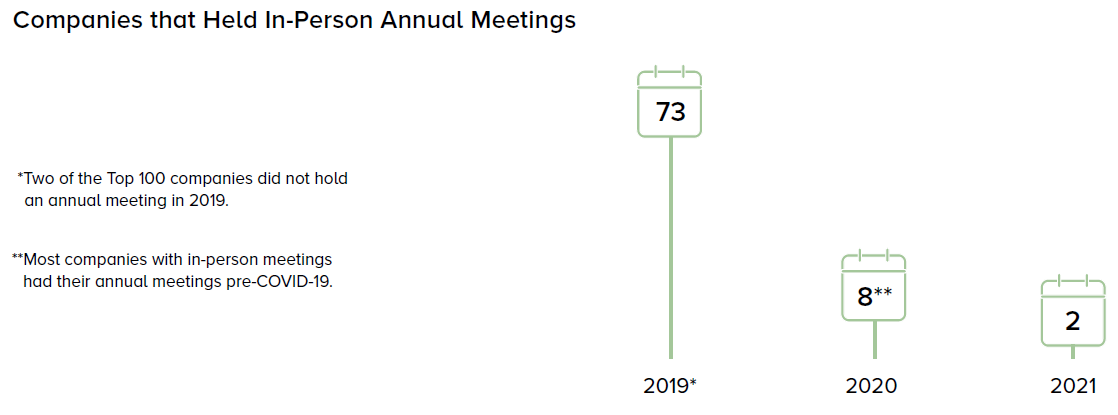

Format of Annual Shareholder Meetings

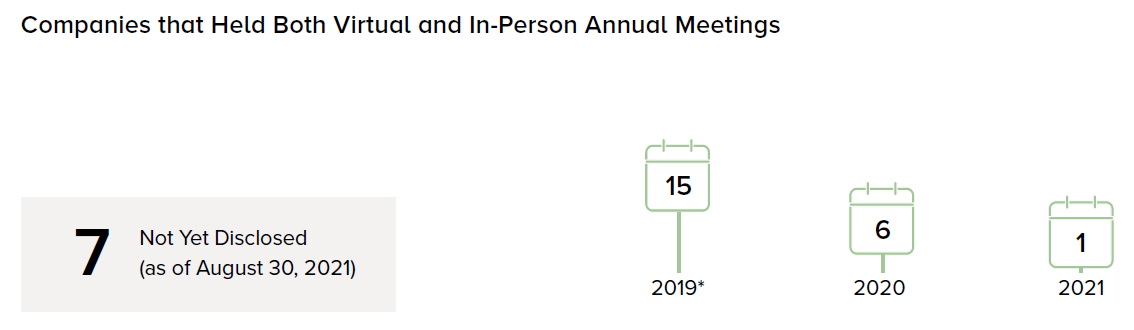

Cybersecurity

Cybersecurity and data protection and related risk management discussions continue to be areas of focus for directors.

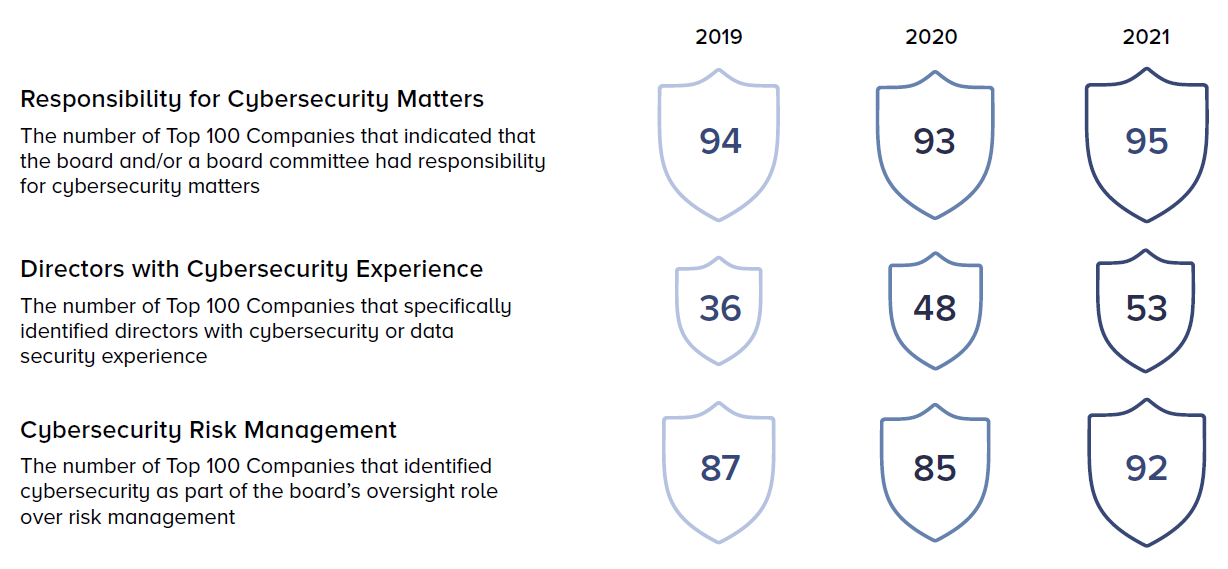

IPO Governance Practices

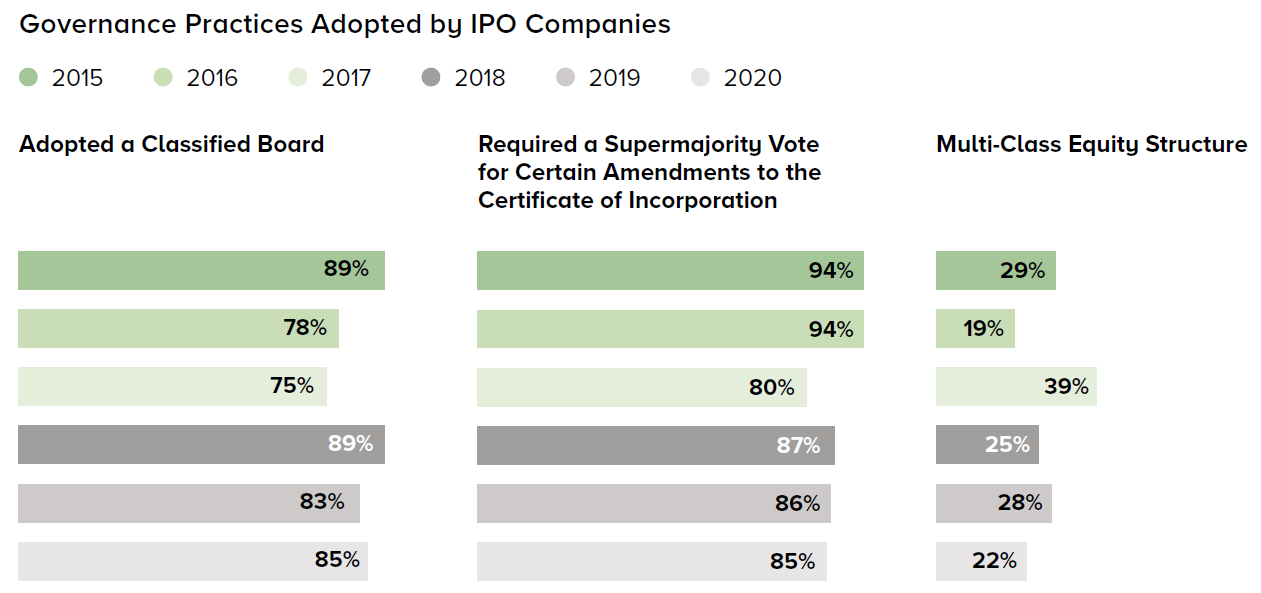

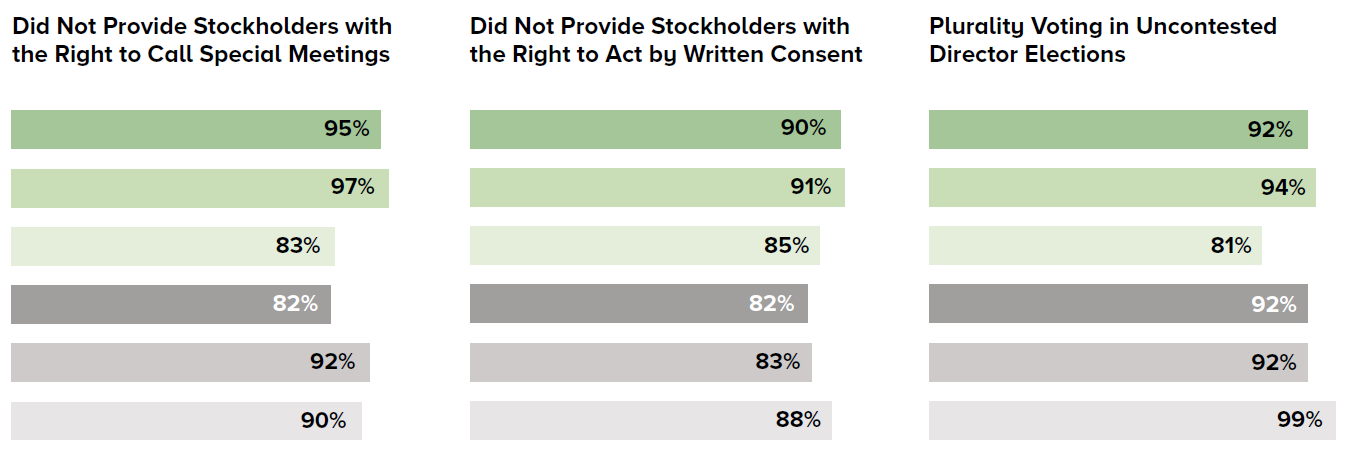

IPO companies continue to adopt the corporate governance practices that work for them, regardless of ISS voting policies.

Comparing IPOs from 2015 to 2020

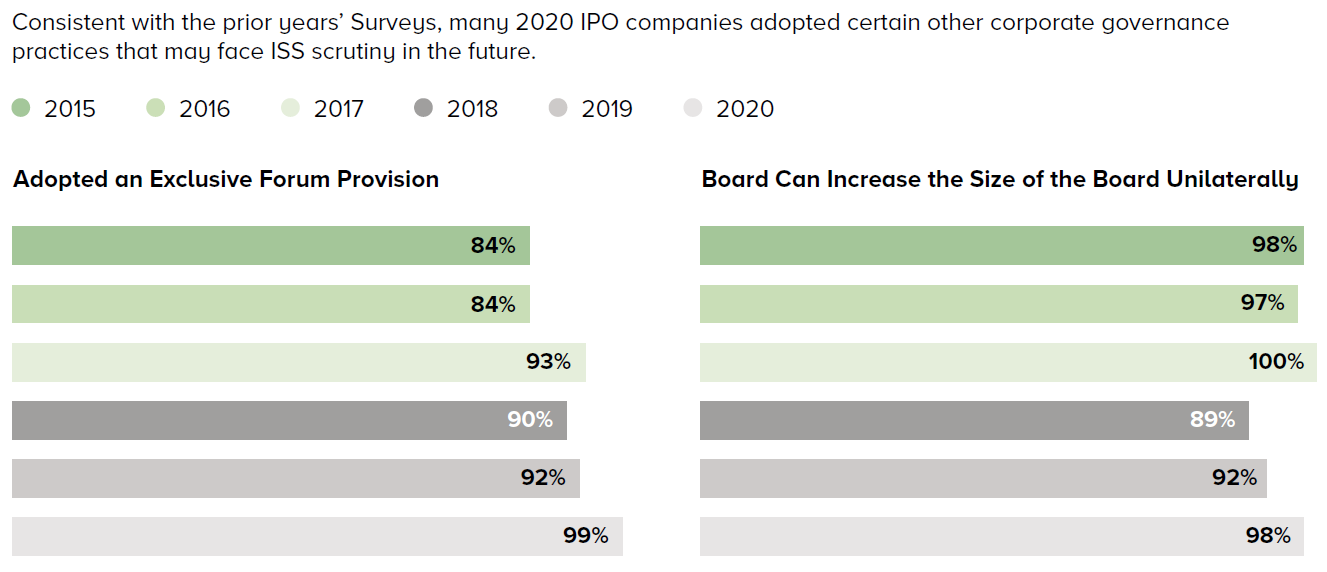

ISS initiated voting policies in 2015, updated in 2017, with respect to newly public companies, designed to influence the governance practices of companies considering an initial public offering in the United States by recommending a vote against directors of newly public companies due to the adoption of governance policies that diminish shareholder rights. We look back on our Surveys of IPO companies since 2016 to consider whether the voting policies have had a significant impact over time.

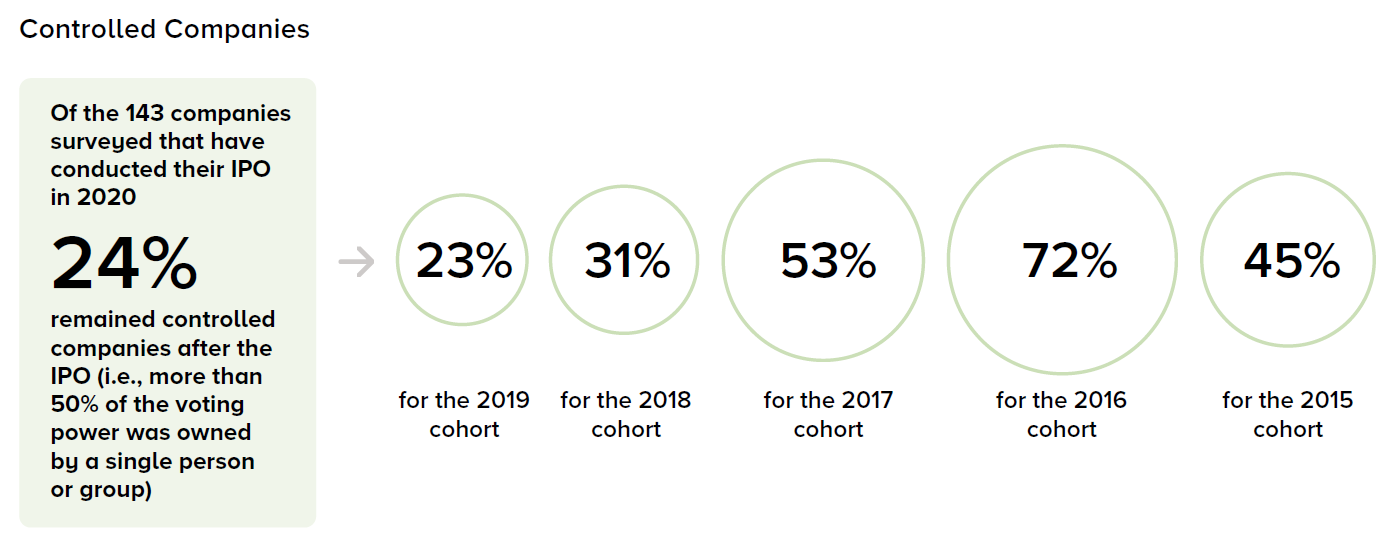

In order to evaluate the impact of the ISS policy and voting recommendations, we examined IPOs that were priced with a size of at least $100 million to analyze governance practices that we would expect to be considered problematic by ISS. Foreign private issuers, SPACs, master limited partnerships and REITs were excluded. In 2020, most IPOs surveyed were on Nasdaq (119 out of 143). In prior years, IPOs were roughly evenly split between the NYSE and Nasdaq.

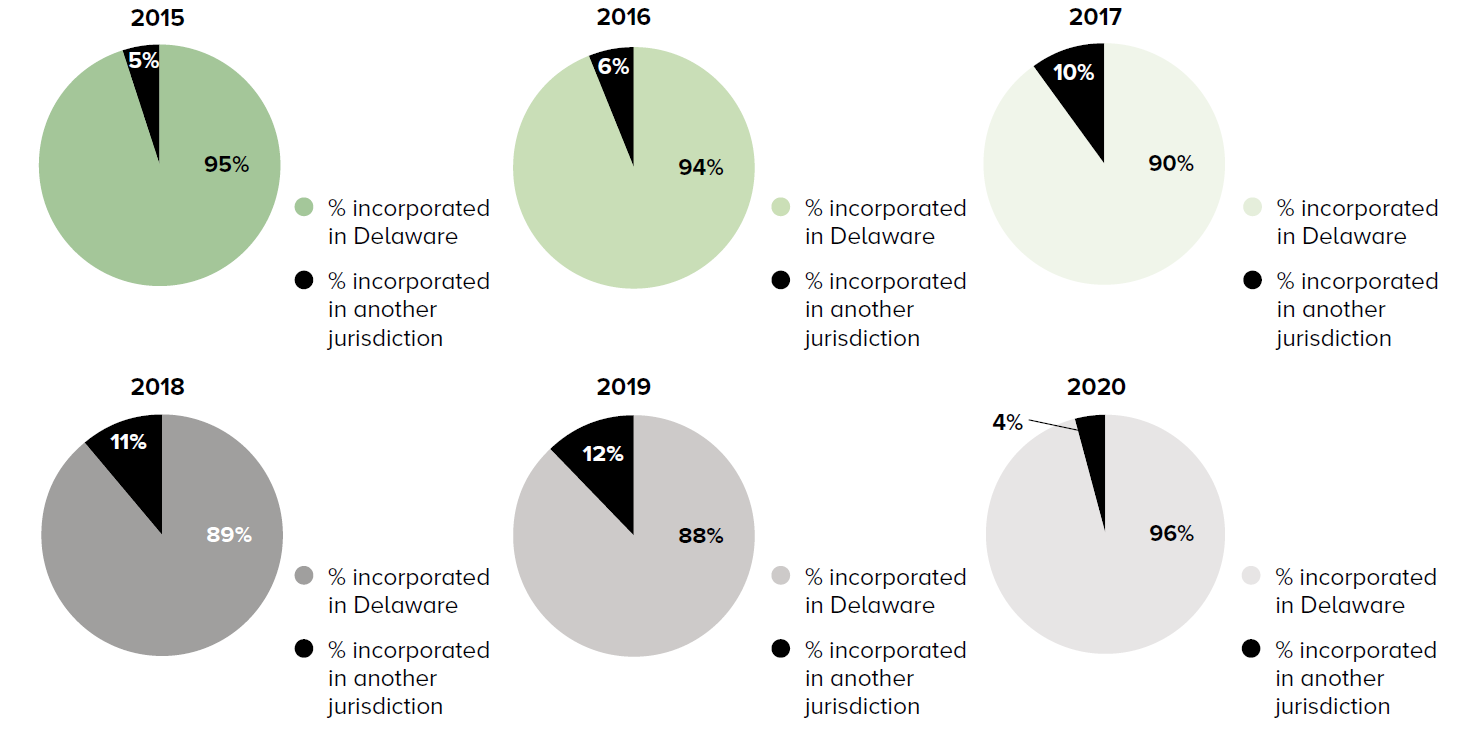

State of Incorporation

Delaware continues to be the most popular state of incorporation for the IPO companies surveyed, and the percentage of Delaware-domiciled corporations in 2020 increased compared to prior years.

Conclusion

When the ISS voting policies on the corporate governance practices of newly public companies were initiated in 2015, we expected law firms and banks would initially advise IPO companies not to overreact to the then-new ISS policy, as investors have traditionally been relatively insensitive to the specifics of corporate governance practices for newly public companies. Our Survey of IPO companies from 2015 through 2020 has shown that companies continue to adopt the corporate governance practices without regard to ISS voting policies. While boards of newly public companies should be aware of ISS voting recommendations and corporate governance trends, and consider whether certain governance practices would benefit the company, boards do not seem to be overly concerned about adopting policies simply to fit within ISS voting policies.

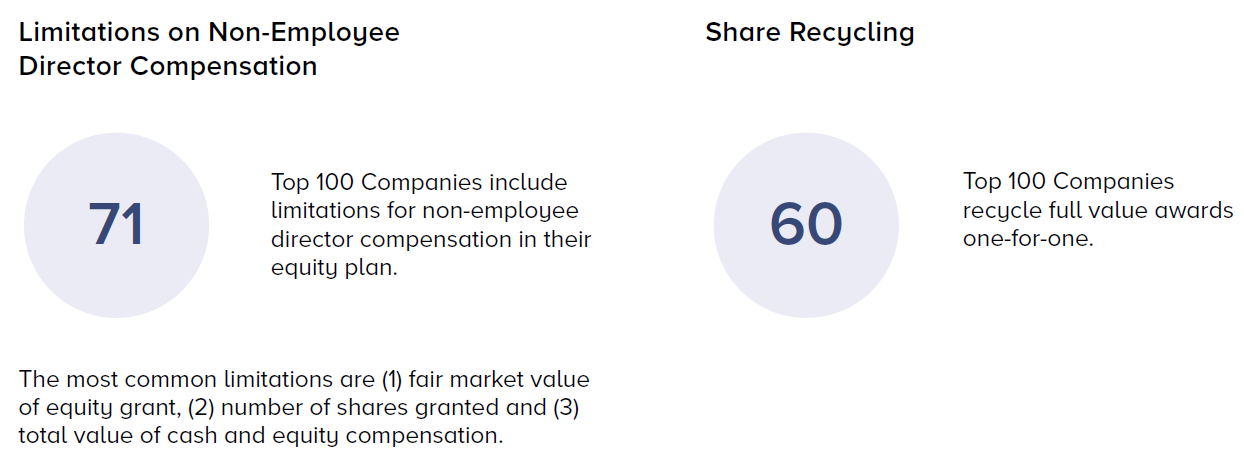

Equity Plans

99 of the Top 100 Companies maintain equity plans to compensate employees and non-employee directors. We highlight trends in the Top 100 Companies with regard to board discretion, non-employee director compensation and share recycling.

ISS Updates Stock Ownership Guidelines for Officers and Directors

ISS credits companies that maintain stock ownership guidelines for its officers and directors. ISS announced this year that if a company’s stock ownership guidelines count unearned performance awards or unexercised options (or any portion thereof), it will not count the company as having stock ownership guidelines. ISS believes that these awards should not count, as they are not actual shares owned by the individual subject to the policy.

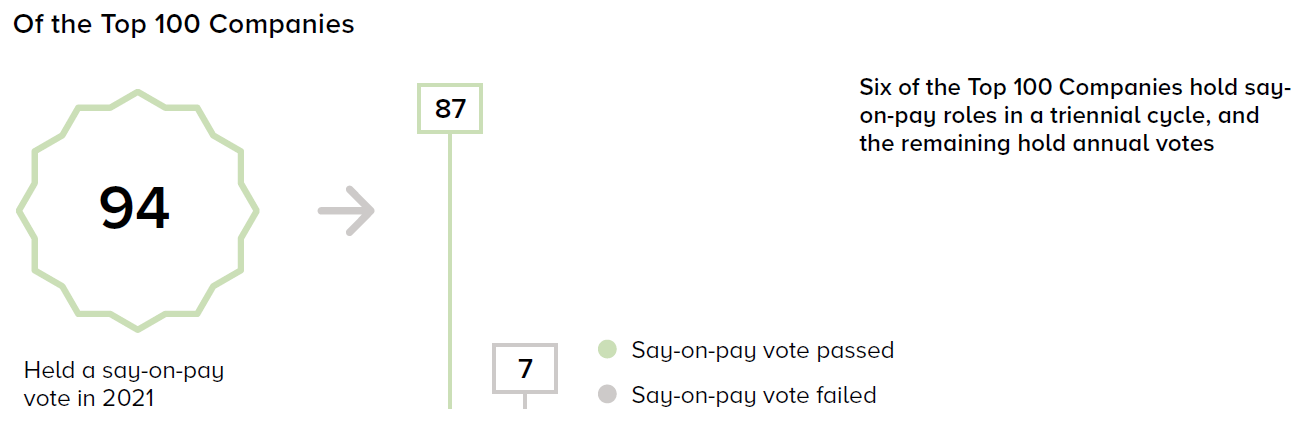

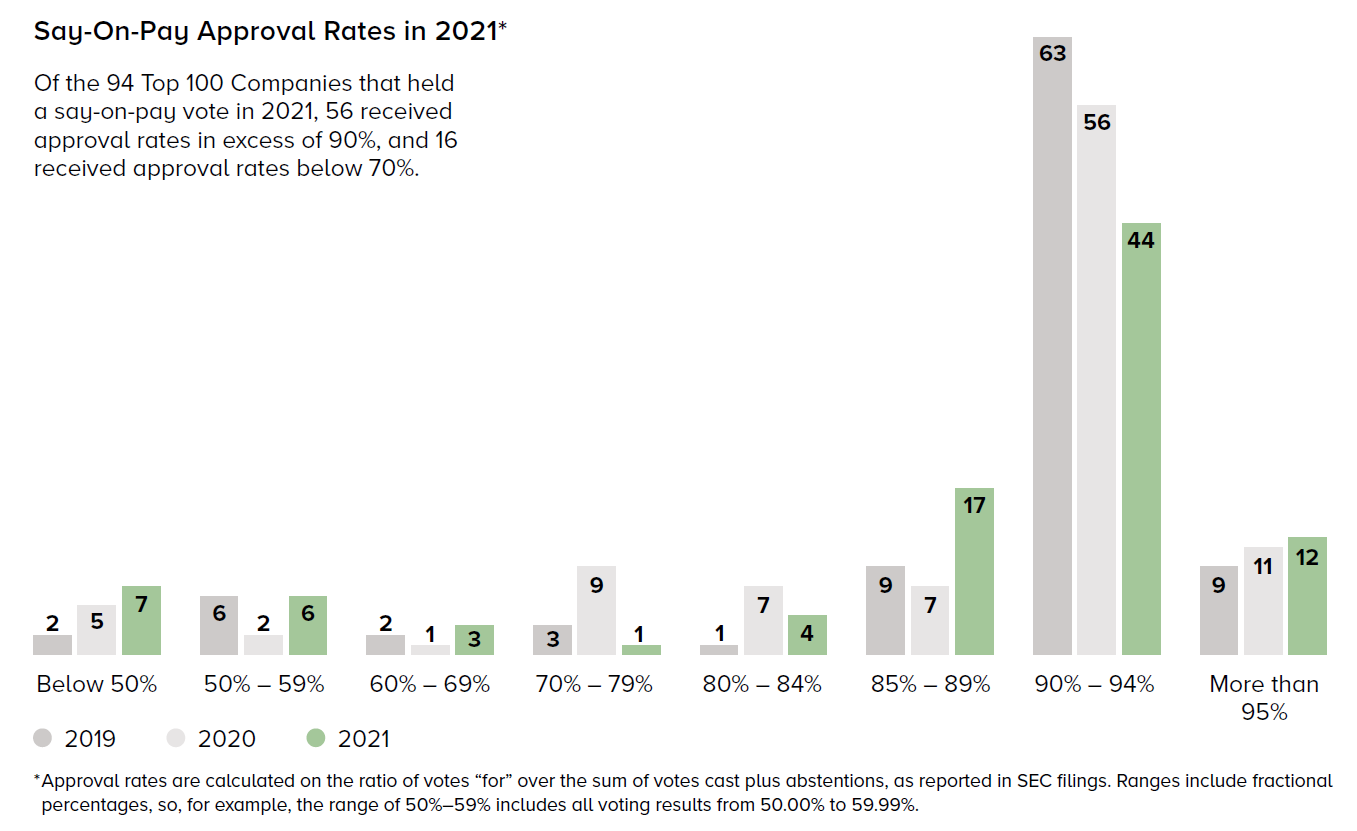

Say-on-Pay

2021 represented the tenth proxy season under the Dodd-Frank Act’s mandatory say-on-pay regime. Although most Top 100 Companies continue to receive high approval rates, this year saw an increase in say-on-pay failures.

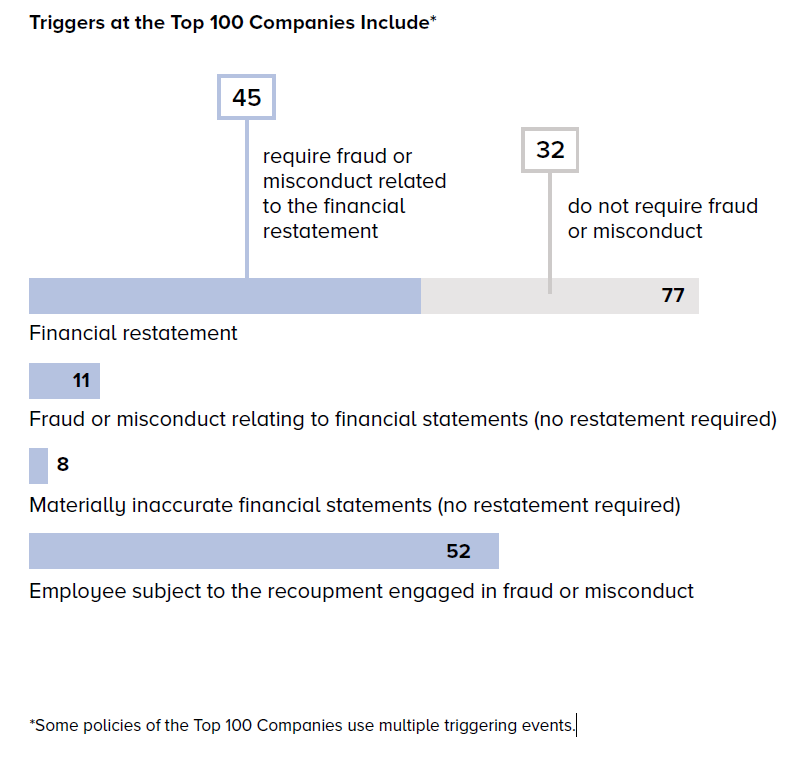

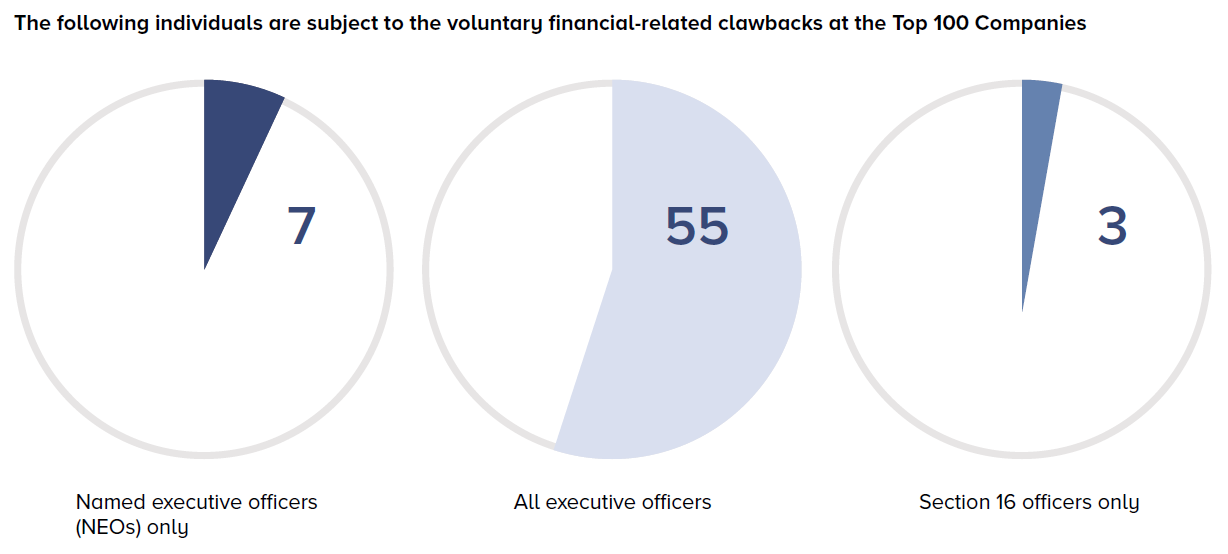

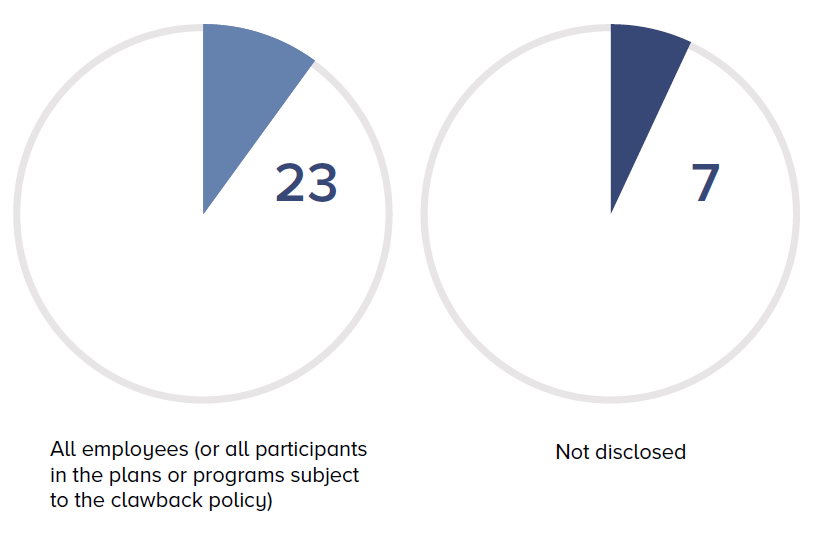

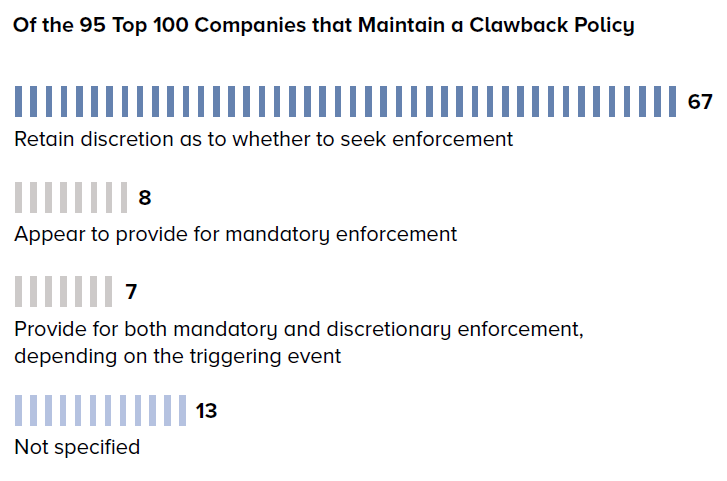

Clawback Policies

The SEC proposed rules implementing Section 954 of the Dodd-Frank Act in 2015. In October 2021, the SEC reopened the comment period on the proposed clawback rules. Notwithstanding the lack of final rules, many Top 100 Companies voluntarily maintain clawback policies as a best practice. Their policies, however, are not uniform.

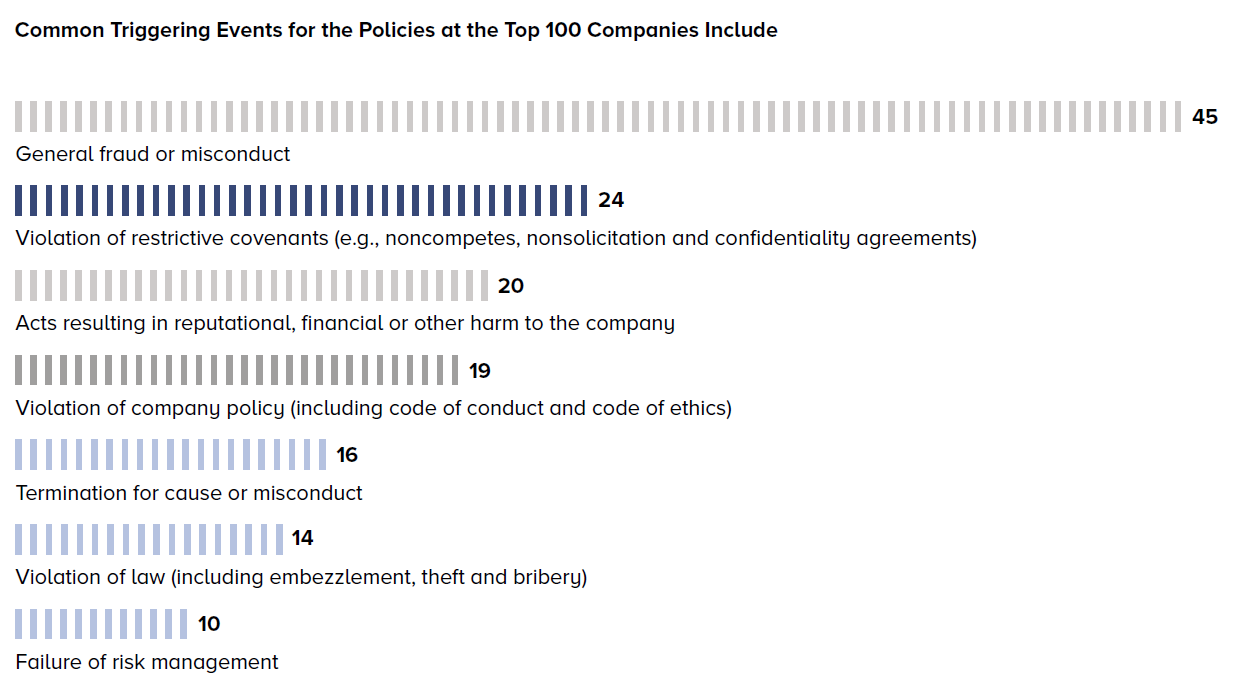

Triggers

The Dodd-Frank Act requires recoupment of compensation upon an accounting restatement due to material noncompliance with any financial reporting requirements. The SEC’s proposed rules interpret material noncompliance to mean any error that is material to previously filed financial statements. The restatement need not result from fraud or misconduct by the issuer or any of its employees.

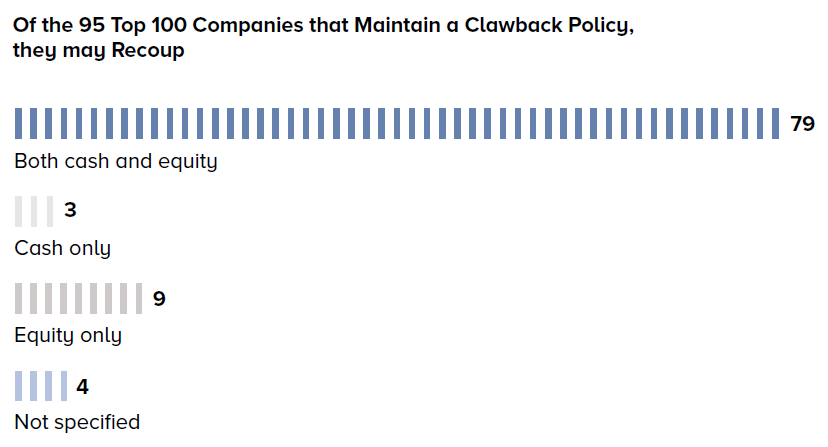

Compensation Subject to Clawback

The Dodd-Frank Act requires companies to recover “certain incentive-based compensation (including stock options).” The SEC’s proposed rules define “incentive-based compensation” as including both cash and equity compensation, but time-vested awards are not covered. While voluntary clawback policies generally permit a company to recoup incentive compensation, the forms of incentive compensation that may be recouped vary.

CEO Pay Ratio

2021 represented the fourth proxy season that companies were required to disclose the ratio of CEO pay to pay of the median employee.

The CEO pay ratio rules permit companies to use the same median employee for up to three years. In its fourth season, we saw a jump in the number of companies using a new median employee.

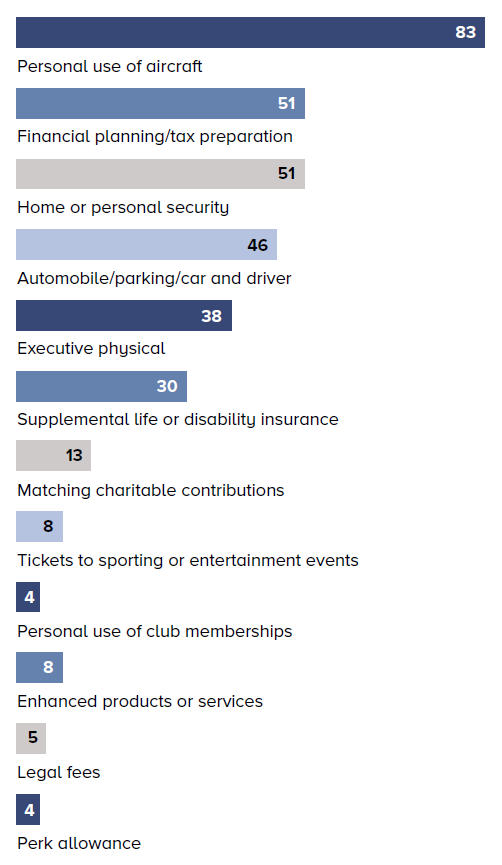

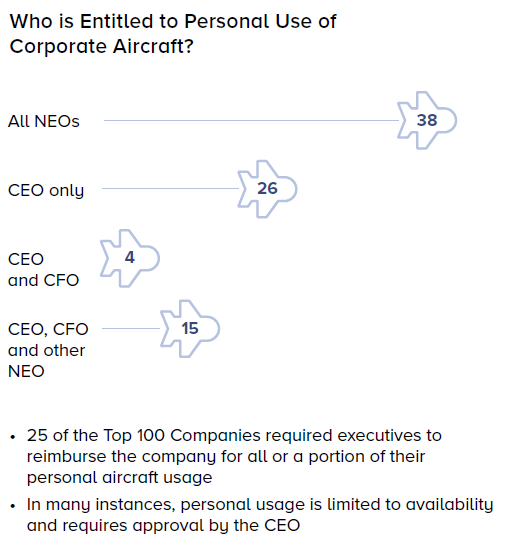

Executive Perquisites

While some of the perk categories showed a small decrease in the number of Top 100 Companies offering them, 2021 did not generally bring a drastic change to executive perks.

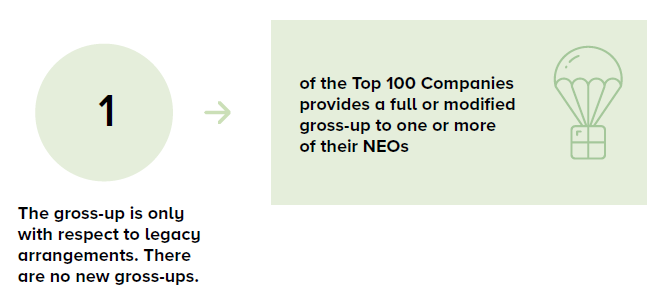

Golden Parachute Provisions

With the advent of say-on-pay and increased focus by institutional investors on executive compensation, golden parachute gross-up provisions have become all but obsolete at the Top 100 Companies. Many of the Top 100 Companies are implementing reduction provisions intended to protect executives from the excise tax.

Change in Control Excise Tax Provisions

Description of Golden Parachute Provisions Under the Code

Section 4999 of the Internal Revenue Code (the “Code”) imposes a 20% excise tax on the amount of any “excess parachute payments” received by certain executives, and Section 280G of the Code disallows an employer deduction for those payments. Any gross-up payment made in connection with the excise tax will also be subject to the excise tax and will be non-deductible. If the aggregate present value of all parachute payments paid to an executive (including cash and accelerated equity awards) equals or exceeds three times the executive’s base amount, then the executive will be considered to have received an excess parachute payment.

Excess Parachute Payment

Code Sections 280G and 4999 are triggered if all parachute payments equal or exceed three times the executive’s base amount. The amount of the excess parachute payment that is not deductible under Section 280G, and subject to the excise tax under Section 4999, is any payment in excess of one times the executive’s base amount.

Safe Harbor

The safe harbor is three times the executive’s base amount, less one dollar. Many companies use a 2.99 multiple in making their calculations to avoid an inadvertent trigger.

Base Amount

An executive’s base amount is the average of his or her compensation from the employer that was includible in his or her gross income for the most recent five calendar years ended prior to the year in which the change in control occurs.

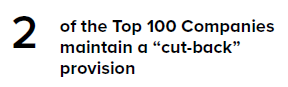

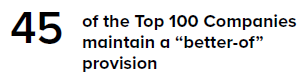

Excise Tax Reduction Provisions

Companies are increasingly adopting measures to protect executives from the excise tax without providing tax gross-ups. The two most common measures include a “cut-back” provision and a “better-of” provision.

“Cut-Back” Provisions

Under a “cut-back” provision, the change in control payments are automatically reduced to the safe harbor amount (or, in many instances, 2.99 times the base amount) so that no excise tax applies.

“Better-Of” Provisions

Under a “better-of” provision, employees will receive change in control payments equal to the greater of (1) the after-tax amount they would have received after the imposition of the Section 4999 excise tax and (2) the “cut-back” amount (i.e., the safe harbor).

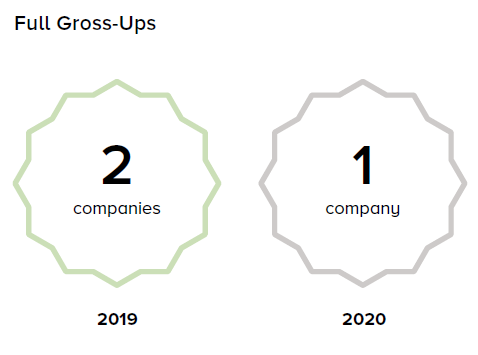

Golden Parachute Excise Tax Gross-Ups

For the past six years, the number of companies providing “golden parachute” excise tax gross-up protection has remained small.

Modified Gross-Up

Under a modified gross-up, payment is only made if the change in control payments exceed a specified amount over the safe harbor. For instance, a company may provide that it will only pay a gross-up if the aggregate amount of the change in control payments exceeds the safe harbor amount, generally by 10% or more. At some companies, if the change in control payments are below this percentage, they will be cut back to the safe harbor amount.

Print

Print