Martha Carter is Vice Chairman & Head of Governance Advisory, Morgan McGovern is Vice President, and Matt Filosa is Senior Managing Director at Teneo. This post is based on their Teneo memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

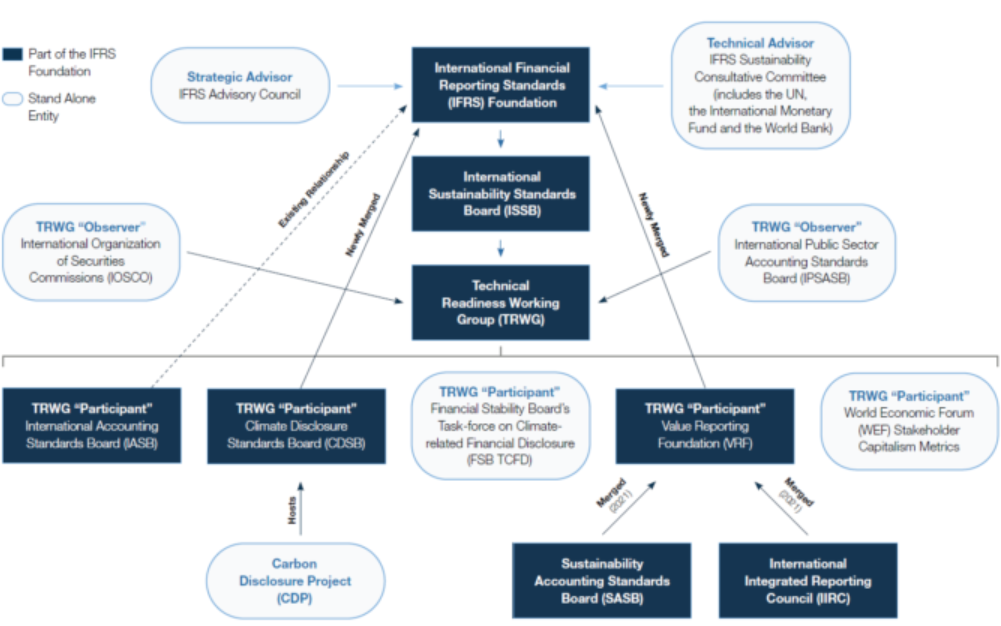

The International Financial Reporting Standards (IFRS) Foundation, an organization responsible for setting global accounting standards, launched the International Sustainability Standards Board (ISSB). The ISSB will work to establish a singular, global ESG disclosure framework for corporates.

The Value Reporting Foundation (VRF)—which includes the Sustainability Accounting Standards Board (SASB) and International Integrated Reporting Council (IIRC)—and the Climate Disclosure Standards Board (CDSB) have officially merged with the IFRS Foundation. The IFRS’ Technical Readiness Working Group (TRWG) issued a prototype framework for both general ESG and climate corporate disclosures. The ISSB will have a global presence in all regions—the Americas, Asia-Oceania, Europe and the Middle East—with primary offices in Frankfurt and Montréal and support from the San Francisco and London offices.

What Happens Next

- The ISSB will appoint its Chair and Vice Chair, fill the 12 other board positions and review the disclosure prototypes submitted by the TRWG.

- The ISSB will begin work in “early 2022” and issue a public consultation on a climate disclosure framework on “a timely basis” in 2022. Other disclosure frameworks for other ESG topics will be published by the ISSB in subsequent years.

- Given this stated timeline, the IFRS Foundation initiative is not likely to materially impact the content of company ESG reports published in 2022.

- However, the disclosed TRWG prototypes on both general ESG disclosure and climate can serve as helpful guidance on how company ESG reports may need to evolve in the next year.

- Companies should also continue to monitor the pending ESG corporate disclosure regulations from both the U.S. Securities & Exchange Commission and the European Union.

Highlights of the IFRS ESG Disclosure Prototypes

- ESG disclosure standards are voluntary but designed for use by regulators. Companies can self-certify compliance with the IFRS ESG disclosure standards.

- The general ESG disclosure prototype’s structural pillars are governance, strategy, risk management & metrics/targets. The climate disclosure prototype is in line with both the Task Force on Climate-related Financial Disclosures (TCFD) general narrative framework and SASB industry-specific climate metrics.

- Disclosure standards utilize the investor definition of “financially material” ESG information related to “risks and opportunities.” There is no specific mention of external assurance, but disclosure should be “complete, neutral, and accurate.”

- New company ESG disclosure should be published at least every 12 months and at the same time as (and with) financial disclosures. The prototype encourages a restatement if any “material” errors are discovered in ESG disclosure.

Key Questions Remain

- How much overlap will there ultimately be between the pending U.S. Securities and Exchange Commission, IFRS and EU Corporate Sustainability Reporting Directive (CSRD) corporate ESG disclosure requirements?

- Will the EU CSRD ultimately require corporate ESG disclosure based on a “double materiality” standard—different than the IFRS’ proposed “financial materiality” standard

- How will the Global Reporting Initiative (GRI) disclosure framework – one of the most utilized ESG disclosure standards – be incorporated into these pending initiatives moving

forward? - Will different ESG disclosure requirements emerge in other major global markets if such markets disagree with the final IFRS framework?

Print

Print