Rebecca Sherratt is a Publications Editor at Diligent Market Intelligence. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here) by Lucian A. Bebchuk, Alon Brav, and Wei Jiang; Dancing with Activists (discussed on the Forum here) by Lucian A. Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch.

Executive summary

Key shareholder activism trends to emerge from 2023.

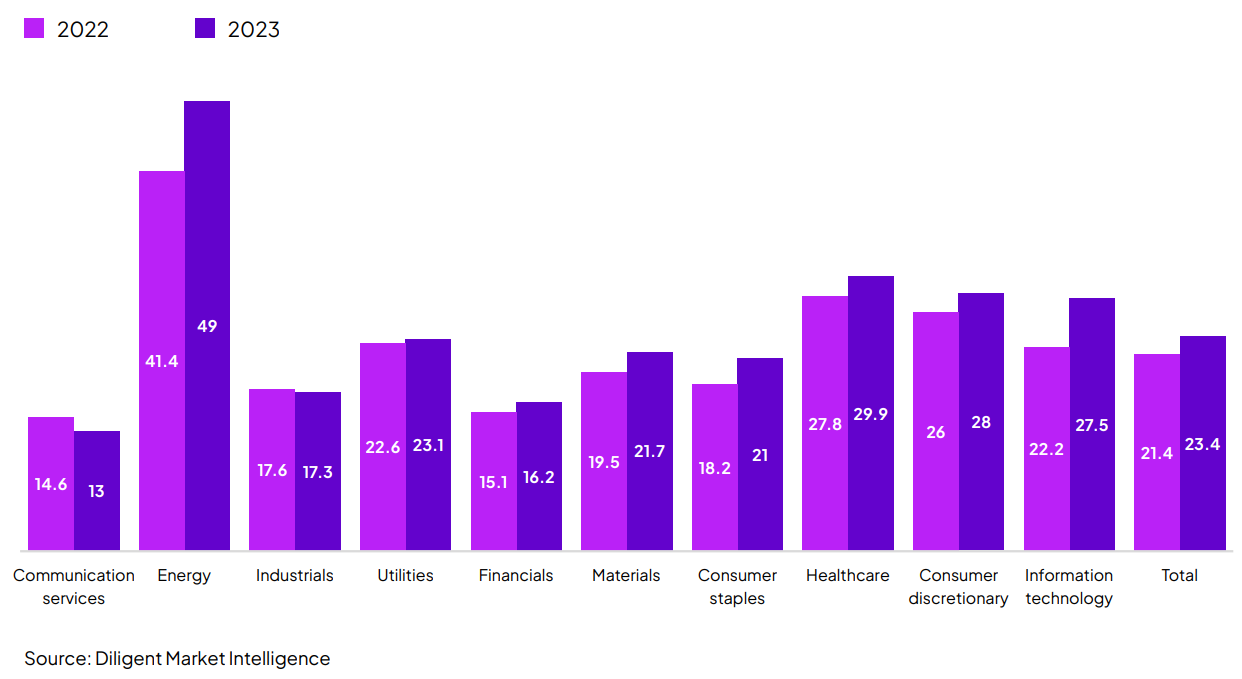

- An increasing number of U.S companies are identifying activism as a risk in their corporate disclosures. In 2023, 23.4% of Russell 3000 companies disclosed shareholder activism as a risk in their 10-K reporting, up from 21.4% a year prior.

- Activism levels remain high in many markets, with shareholders looking further afield for value creation opportunities. In 2023, 982 companies were subject to activist campaigns globally, a 4% rise compared to a year prior and the highest level since 2019. 2023 played host to a 25.5%, 13.4% and 7.8% increase in the number of companies subject to campaigns in Canada, Asia and the U.S., respectively.

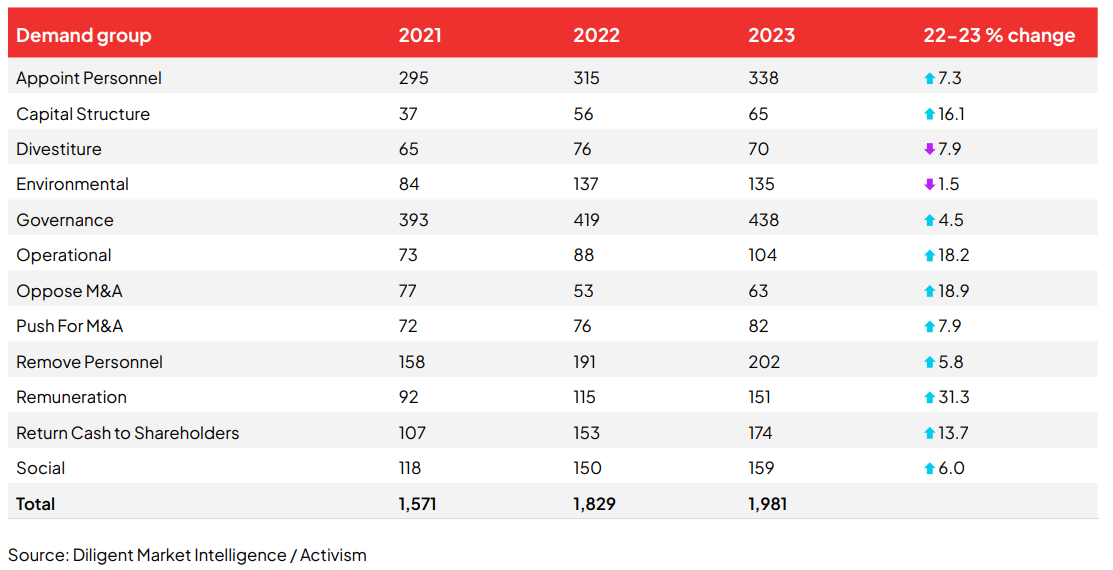

- Activists are increasingly focusing on corporate remuneration policies, looking for companies to be prepared to weather the challenges brought on by rising costs and slowing economic growth. In the U.S., 81 companies faced remuneration-related demands last year, a 37.3% increase compared to the 59 seen in 2022 and the highest increase of any demand type. Shareholder proposals concerning pay are also winning increased backing, with investors keen to understand policies governing severance and clawback payments.

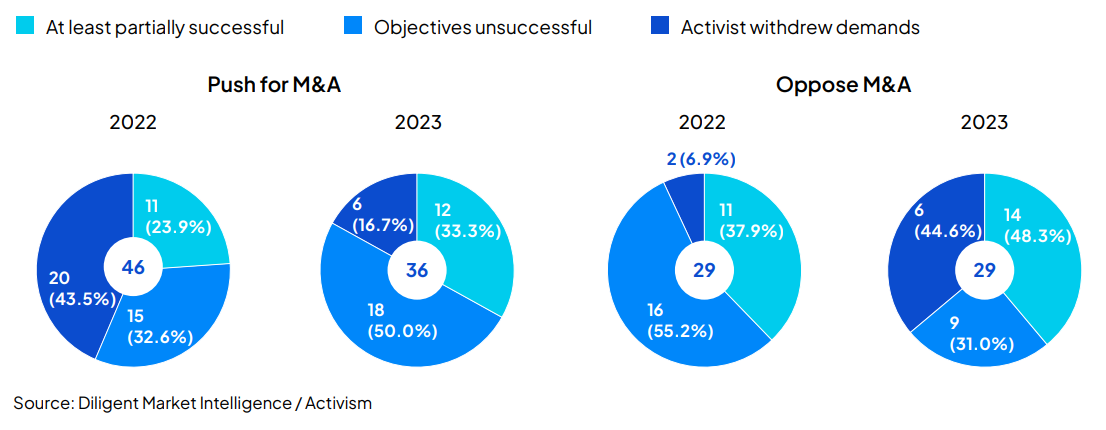

- In a period of rising costs, some of the most high-profile campaigns were a result of what activists deemed to be costly M&A transactions. 2023 saw a 20.8% increase in the number of U.S.-based companies subjected to oppose M&A demands. 14 (48.3%) of resolved oppose M&A demands were at least partially successful in the U.S., compared to 11 (37.9%) in 2022.

- 2023 saw the first increase in the number of activist short campaigns recorded globally for four consecutive years, increasing 14.6% on 2022 levels to 110. Of these, 17 (15.5%) of campaigns were launched at large-cap companies, up from eight (6.5%) and 11 (11.5%) in 2021 and 2022, respectively.

Activism infographics

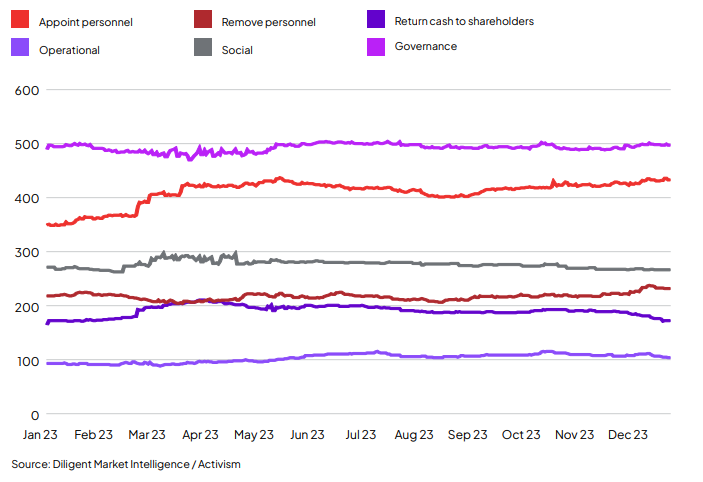

Rolling 365-day total of public activist campaigns globally by demand type

M&A-related demands made at US-based companies where the activist was at least partially successful, by outcome year and demand type

Demand type breakdown of global companies publicly subjected to activist demands

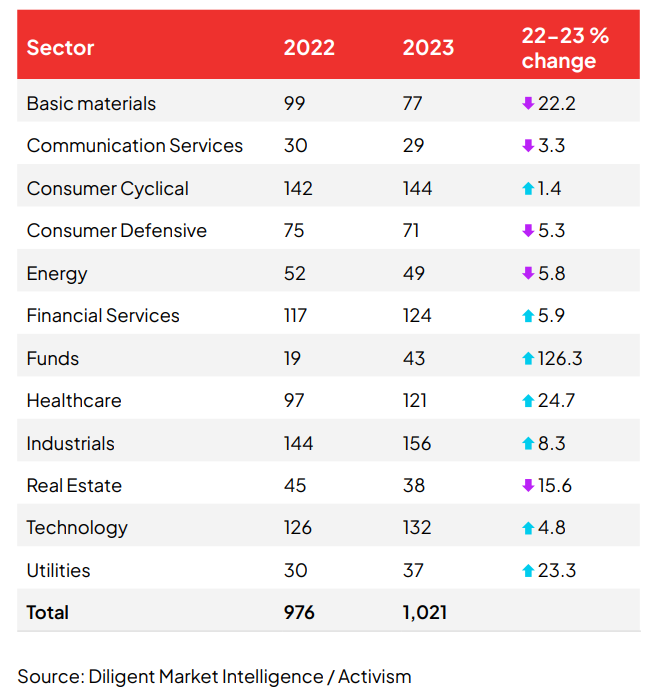

Sector breakdown of global companies publicly subjected to activist demands

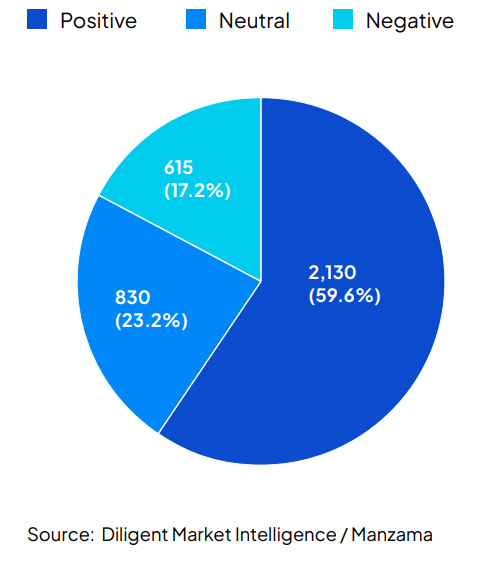

Global shareholder activist-related news sentiment in the past 12 months (no. stories)

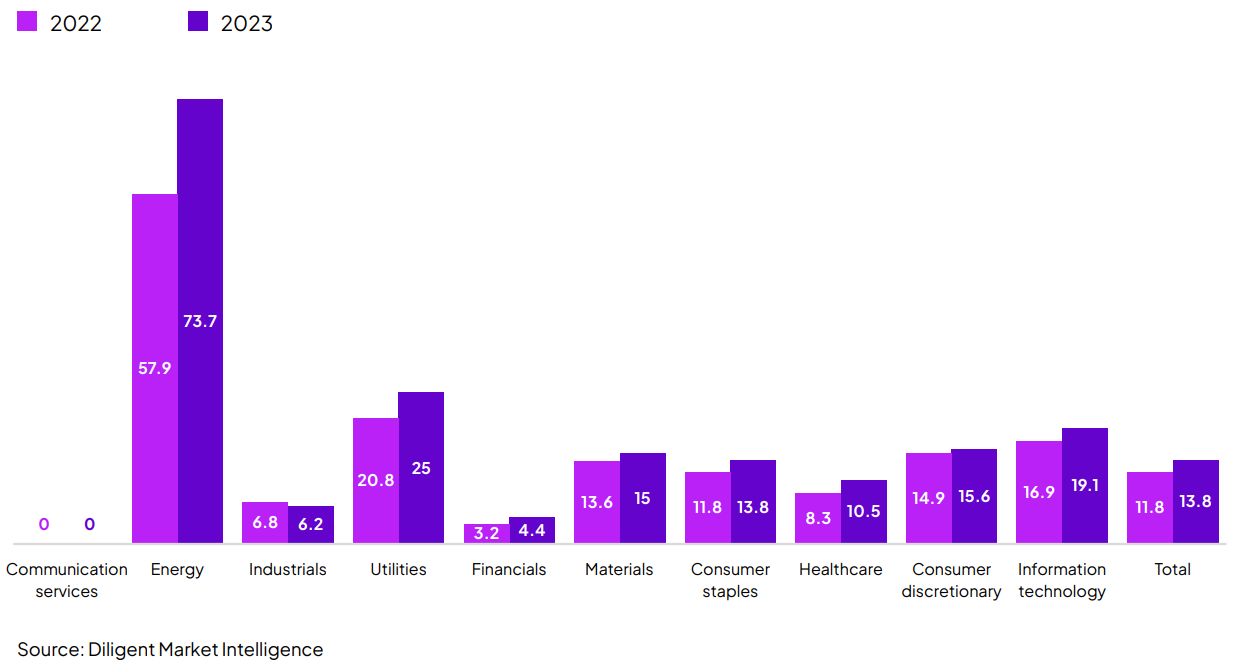

Proportion of S&P 500 companies to disclose “shareholder activism” as a risk by sector (%)

Proportion of Russell 3000 companies to disclose “shareholder activism” as a risk by sector (%)

Print

Print