Neil McCarthy is Co-Founder and Chief Product Officer, G. Michael Weiksner is Co-Founder and Chief Technology Officer, and James Palmiter is CEO and Co-Founder at DragonGC. This post is based on a DragonGC memorandum by Mr. McCarthy, Mr. Weiksner, Mr. Palmiter, Markus Hartmann, Jennifer Carberry, and Nicholas Sasso.

Background

SEC rules require that public companies hold a separate shareholder advisory vote to approve the compensation of executives. This covers compensation disclosed per S-K Item 402 including CD6A, the compensation tables, and other narrative executive compensation disclosures.

Most years for most companies this vote passes with greater than 80% support from those shareholders who vote on the matter. But sometimes for some companies the approval rate is less than 80%. Sometimes the resolution receives less than a majority and fails to pass at all.

These adverse outcomes are typically driven by an adverse voting recommendation from one or more of ISS, Glass Lewis and large institutional investors for violating their voting policies for executive compensation. While SEC rules only require a non-binding advisory vote, in practice these entities provide an enforcement mechanism.

Companies that have received an adverse say-on-pay vote nearly always respond with a shareholder engagement program during the following season.

Methodology

We wrote an article on this topic last season which is available here, and we’ve taken a similar approach for this season.

With a view to reviewing how companies responded to adverse say-on-pay votes:

-

We reviewed say-on-pay voting results for the Fortune 1000 for the 2024-2025 annual meeting season and identified 24 where less than 80% of voted shares voted to approve (there were 24 for the 2023-2024 season)

-

For these companies we then reviewed their shareholder engagement program as summarized in their 2025 AGM proxy statement. All the 24 had an announced program, some more detailed than others

-

Subsequently, all 24 had an improved say-on-pay vote at their 2025 AGM, with increases ranging from 5% to 67%

-

All but two improved to over 80% (one was 74%, the other at 77%)

Note: The voting results were calculated based on the “for” and “against” votes

Sources: Fortune, SEC, gov, and DragonGGC analysis

Examples of Shareholder Engagement Programs

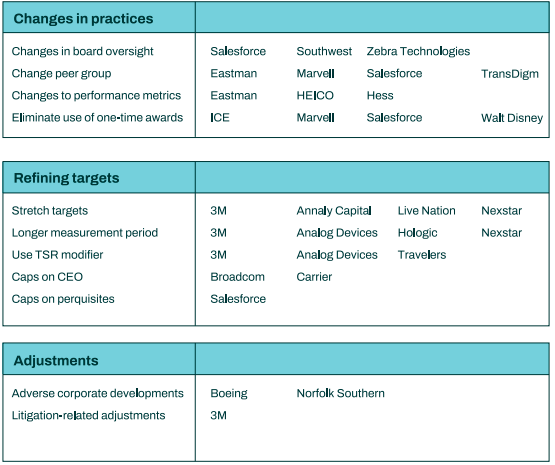

This table shows examples of the ways in which F1000 companies engaged with their shareholders in the 2025 season after they had an adverse say-on-pay vote during the 2024 season. Links go to the pertinent part of their 2025 AGM proxy statement.

Observations

The 2024-2025 season was like what we saw in 2023-2024: A small number of the F1000 had an adverse say-on-pay vote but were able to ‘fix the problem’ in the following season with a shareholder engagement program that engaged with their large institutional shareholders.

These programs, particularly the detailed responses they often elicited from large institutional shareholders, as detailed in their AGM proxy statements, can provide insight for other companies into the current thinking of these shareholders on executive compensation practices, e.g. use of one-time rewards.

While the SEC only requires a non-binding advisory vote on ‘say-on-pay’ we note that in practice ISS / Glass Lewis / Large Funds have created an enforcement mechanism as shown by this paper. The SEC may want to build on this as it explores changes to its rules on executive compensation.

Print

Print