Tyler Janney is a Consultant at FW Cook. This post is based on his FW Cook report.

EXECUTIVE SUMMARY

FW Cook’s inaugural 2025 Executive Perquisites Report analyzes the prevalence and value of perquisites (or “perks”) at S&P 100 companies from 2021 to 2024, focusing on Chief Executive Officers (CEOs) and average other Named Executive Officers (NEOs).

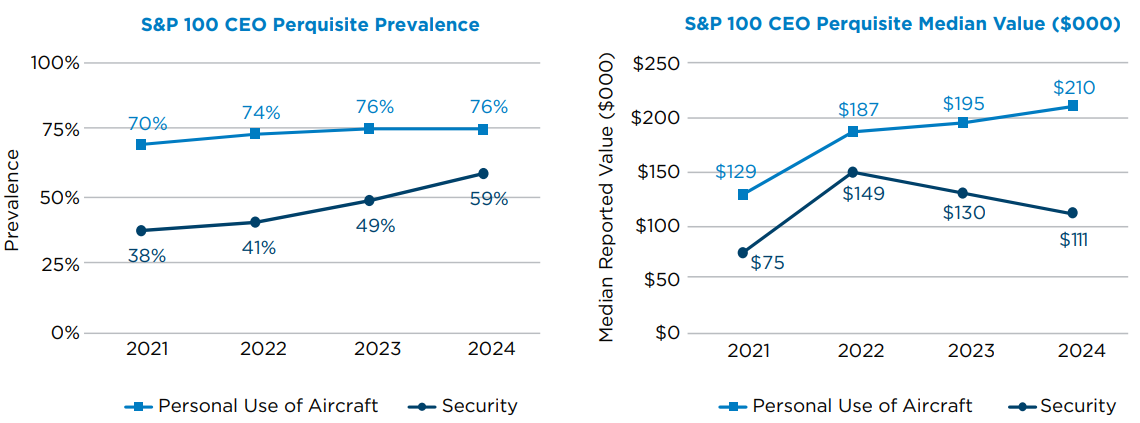

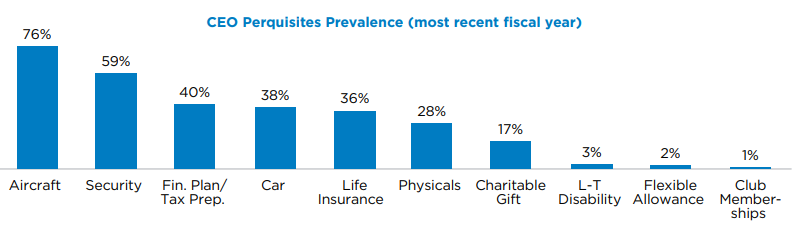

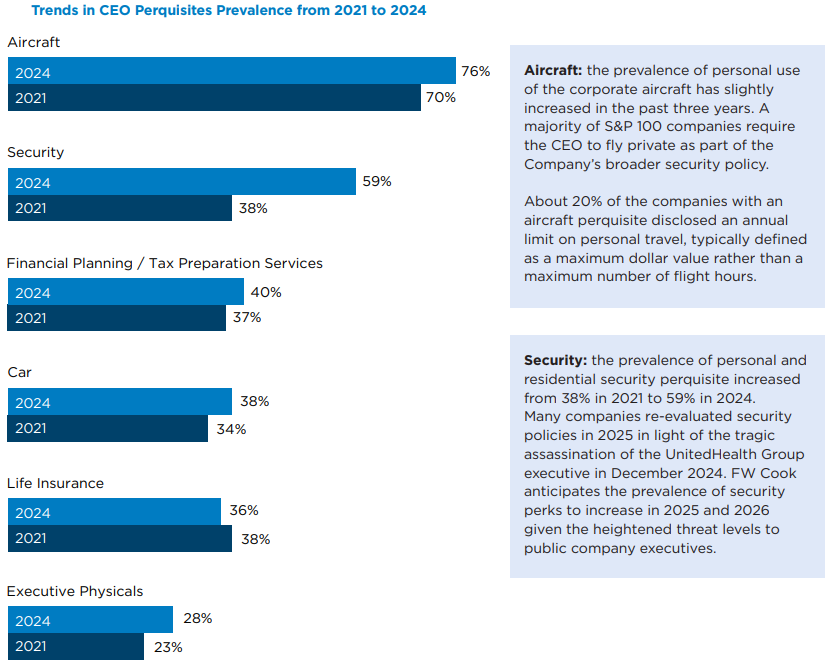

Personal use of corporate aircraft is the most prevalent CEO executive perk followed by security services, which includes personal security, residential security, and cyber-related security services. Personal use of aircraft and security perquisites are provided to more than half of S&P 100 CEOs and have increased in prevalence over the past four years: personal use of aircraft has increased from 70% of S&P 100 companies in 2021 to 76% in 2024, and security has increased from 38% in 2021 to 59% in 2024. FW Cook expects the prevalence of security perks to continue to increase in 2025 and 2026 given the recent tragic events of the assassination of the UnitedHealth Group Executive and the shooting at the Blackstone and NFL corporate offices. These events have prompted companies to re-evaluate personal security benefits, including personal security guards, home security systems, private car and driver, secured parking, and private aviation.

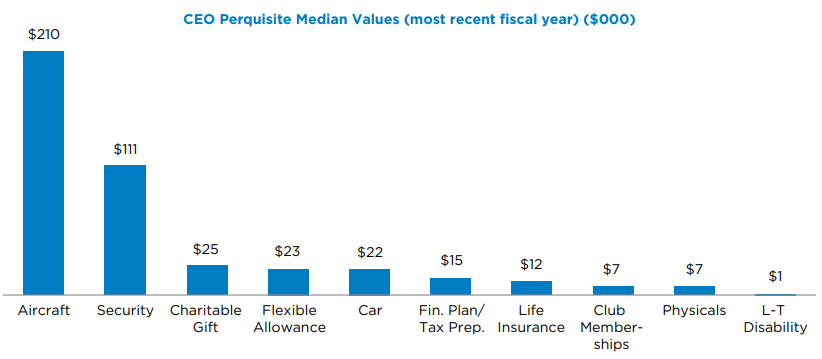

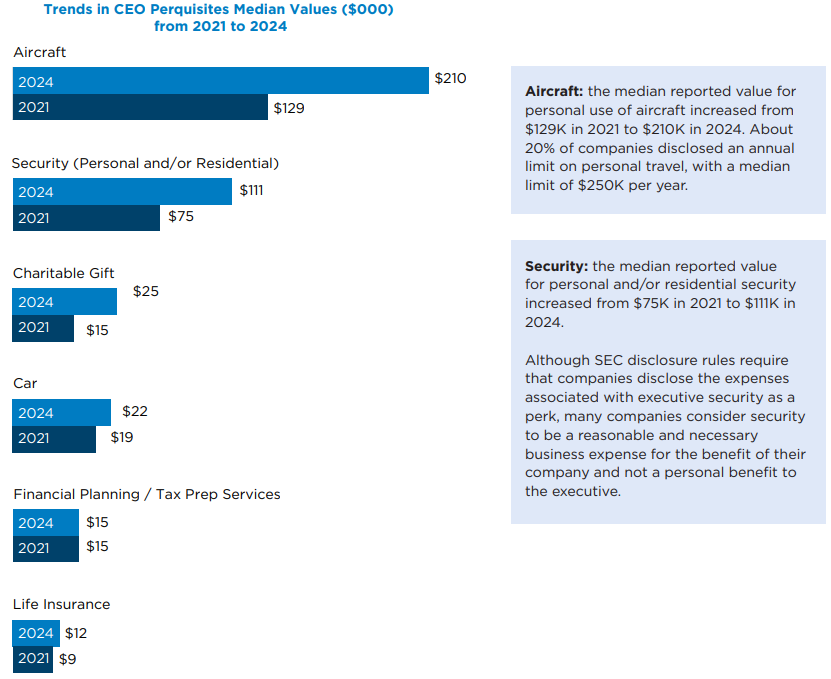

The median reported value for these perquisites have increased over the past four years: at median, personal use of the aircraft increased steadily from $129K in 2021 to $210K in 2024, and security increased from $75K in 2021 to $111K in 2024. Notably, a majority of S&P 100 companies require the CEO to fly on private aircraft as part of the Company’s broader security policy.

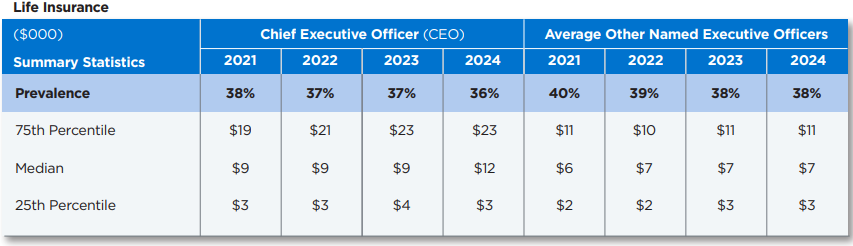

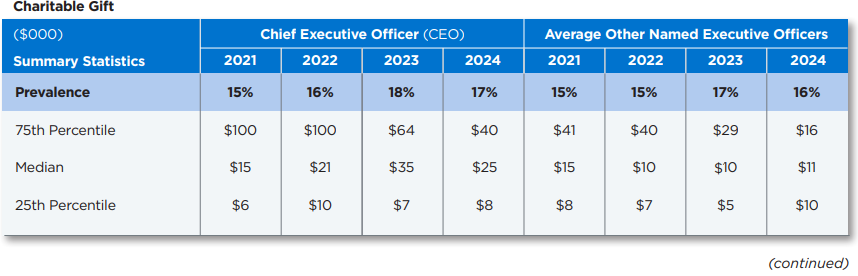

In contrast, other perks such as financial and tax planning services, company car, life insurance, executive physicals, and charitable gift matching perquisites are provided at less than half of the S&P 100 companies. The prevalence of these perks, which typically have a value less than $25K per year, have remained relatively stable for the past four years.

Executive perks like long-term disability benefits, flexible perks allowances, and club memberships are uncommon, provided by fewer than 5% of S&P 100 companies.

OVERVIEW

The data presented in this report is sourced from S&P 100 companies’ proxy statements. More specifically, this disclosure is included in the “All Other Compensation” column of the Summary Compensation Table, related footnotes and narrative, as well as any descriptions of perks in the Compensation Discussion & Analysis. The primary findings on perk prevalence and median values are specific to CEOs, and supporting sections present perk data for other named executive officers.

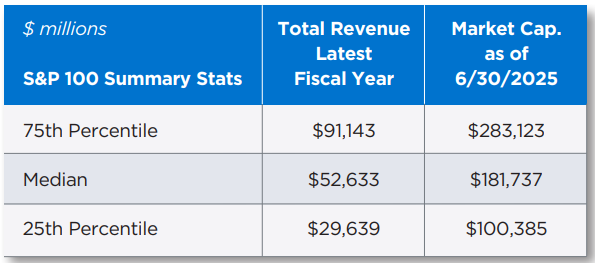

Executive perks are analyzed at S&P 100 companies, which consists of 100 companies that have a median market capitalization of ~$180B as of June 30, 2025. The S&P 100 is made up of 11 different industries as follows: Financials (18%), Information Technology (15%), Health Care (14%), Industrials (13%), Consumer Staples (11%), Consumer Discretionary (10%), Communication Services (9%), Energy (3%), Utilities (3%), Materials (2%), and Real Estate (2%). The table below presents the 25th, median, and 75th percentile total revenue and market capitalization summary stats for the S&P 100 and a list of S&P 100 companies can be found on page 13.

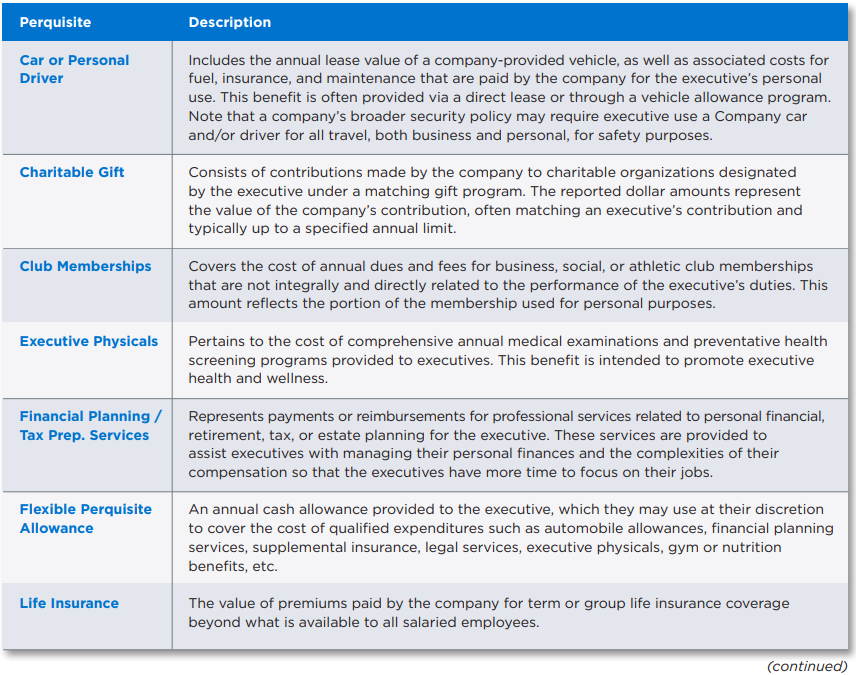

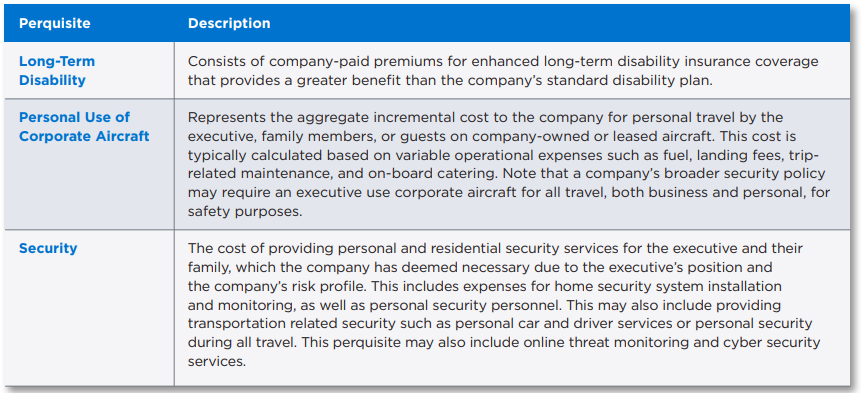

Executive perks included in this report include the following:

Per proxy statement disclosure rules, not all perquisites need to be individually disclosed if specific dollar threshold amounts are not met:

- Aggregate Threshold: a company is only required to disclose perquisites for a named executive officer if the aggregate value of the perk for an individual is $10,000 or more

- Footnote Disclosure: if the aggregate threshold is met, the company must include the total value of all perquisites in the “All Other Compensation” column. For any individual perks that are valued at the greater of $25,000 or 10% of the total value of all perks for an individual executive, the company must separately identify the perk and its value in a footnote to the Summary Compensation Table

CEO PERQUISITES PREVALENCE

SUMMARY STATISTICS

Personal Use of Aircraft

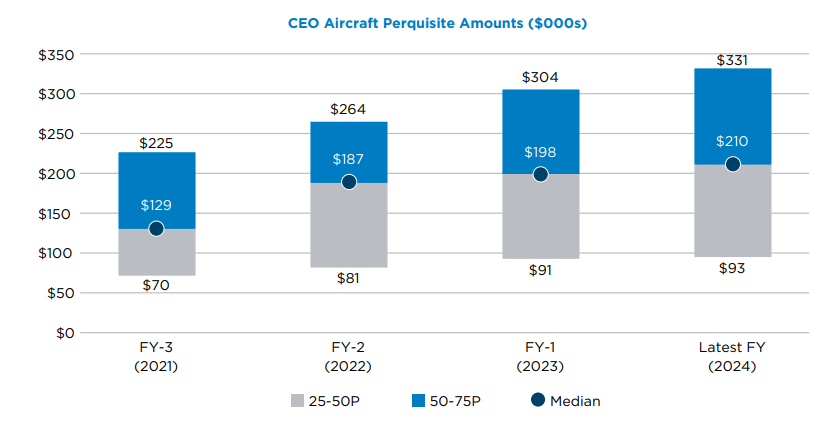

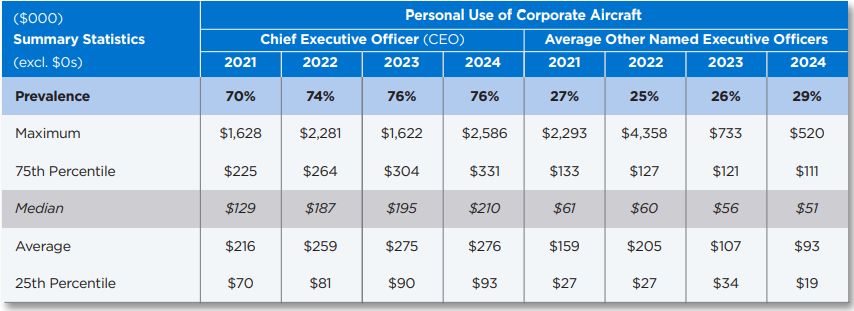

Aircraft perquisite reported values in the most recent year ranged from $93K to $331K, at the 25th and 75th percentile, respectively, with a median reported value of $210K. From 2021 to 2024, the 25th percentile reported value moderately increased, while the median increased by $81K (+63%) and the 75th percentile increased by $106K (+47%).

For security purposes, roughly two-thirds of the S&P 100 companies that provide corporate aircraft also require their CEO to use it for all personal travel.

Among the companies that have this perk, about 20% disclose a specific annual limit. The most common type of limit is a dollar value, with a median of $250K.

About 30% of the S&P 100 companies reported aircraft perquisite values for other named executive officers. Private aviation is typically provided on a limited basis to executive officers other than the CEO, and in some cases, requires permission from the CEO or Board of Directors for personal use of corporate aircraft. The median reported values have ranged from about $50K to $60K in the past four years.

Security (Personal and/or Residential)

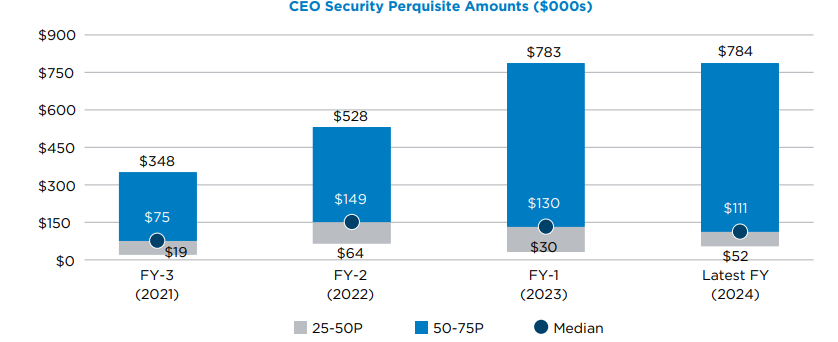

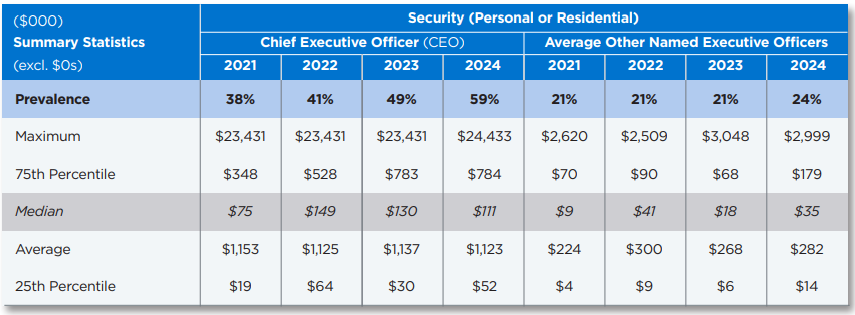

While median spending on executive security benefits grew modestly from 2021 to 2024, the cost of these benefits increased significantly at the 75th percentile, climbing from $348K in 2021 to $784K in 2024. The wide variation in spending often depends on the level of protection provided. Lower costs typically cover only residential security systems, while the highest costs include comprehensive protection including secure transportation, armed drivers, and personal security details.

The prevalence of S&P 100 companies providing security to their CEO has meaningfully increased since 2021 (59% prevalence, up from 38% prevalence). FW Cook expects this trend to continue in 2025 given the recent tragic events of the assassination of the UnitedHealth Group Executive and the shooting at the Blackstone and NFL corporate offices. These events have prompted companies to re-evaluate personal security benefits during 2025 including personal security guards, home security systems, private car and driver, secured parking, and private aviation (a majority of S&P 100 companies already require the CEO to fly private for security purposes). FW Cook anticipates the prevalence of security benefits to increase in 2026, which may not ultimately be disclosed until the 2027 proxy season.

About 20% of the S&P 100 companies reported security perquisites for other executive officers, which typically reflects residential security and monitoring services. The median reported values have ranged from about $15K to $35K in the last four years.

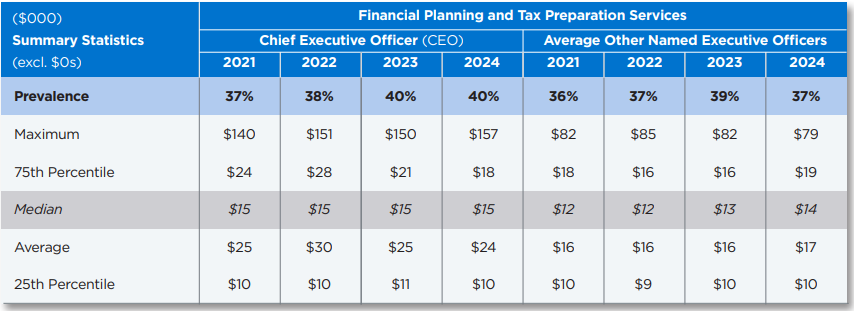

Financial Planning, Tax Preparation, Estate Planning Services

The reported values of financial planning, tax preparation, and estate planning perks in the most recent year ranged from $10K to $20K at the 25th and 75th percentile, respectively, with a median reported value of $15K. The median reported value has remained constant over the past four years.

Forty percent of S&P 100 companies offer financial planning, tax preparation, and estate planning services to all of their executive officers. This perk is typically capped at an annual limit of $10,000 to $25,000.

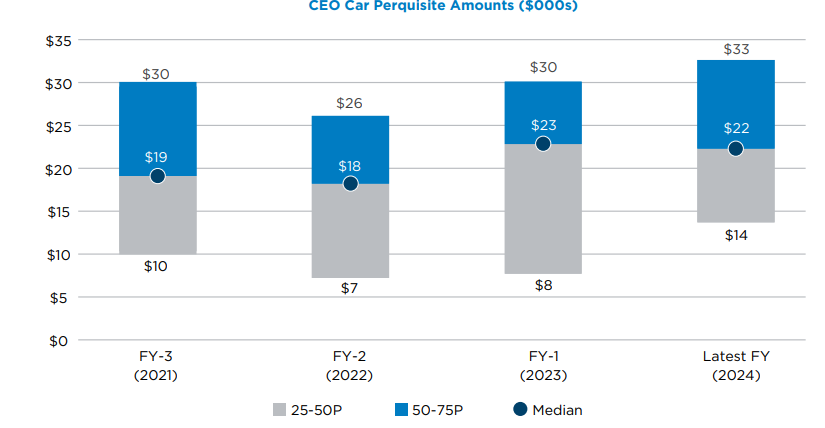

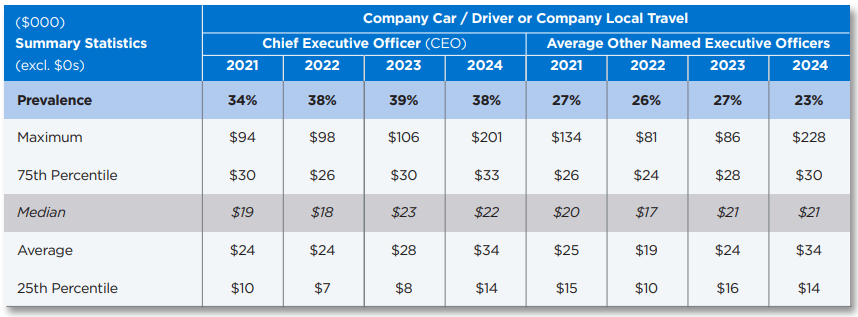

Company Car / Driver

Car perquisite reported values in the most recent year ranged from $14K to $33K at the 25th and 75th percentile, respectively, with a median reported value of $22K. Car perquisite values have remained relatively stable over the past four years.

About 40% of S&P 100 companies provide a car perquisite to the CEO, sometimes as part of a broader security policy, while only about 25% of S&P 100 companies provide car perks to other named executive officers. The value of cark perks for other named executive officers ranged from $10K to 30K at the 25th and 75th percentile, respectively, with a median value of about $15K.

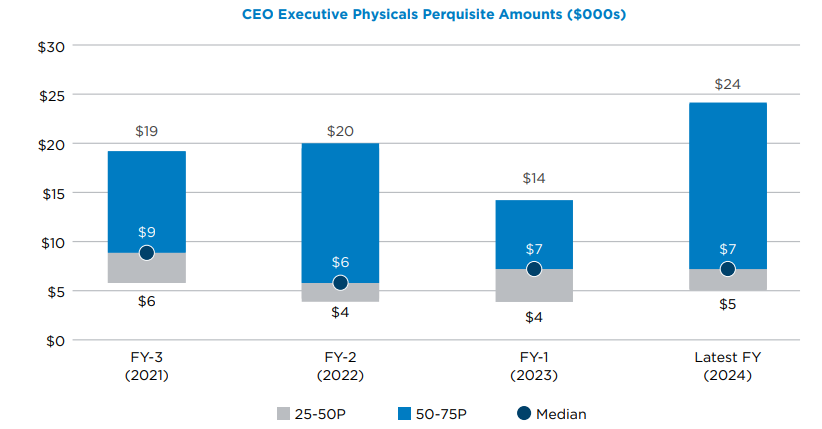

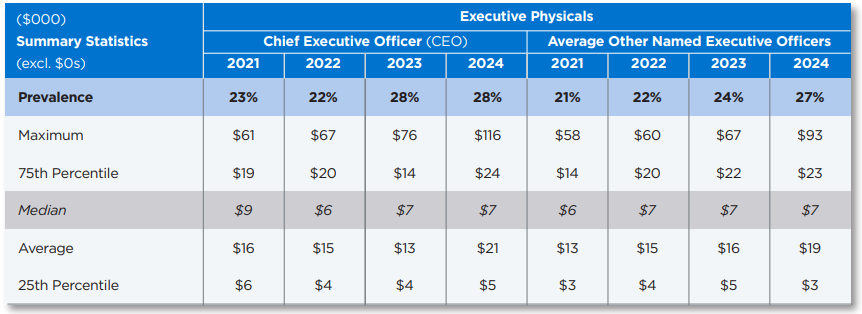

Executive Physicals

The reported values of executive physicals in the most recent year ranged from $5K to $24K at the 25th to the 75th percentile, respectively, with a median reported value of $7K. The median reported value has remained at $7-10K over the past four years.

The executive physical perk is provided to CEOs at 28% of the S&P 100 (26% for CFOs, and 16% for other named executive officers), an increase since 2021, when only 23% of companies provided this perk. Other named executive officer executive physical perk values range from $5K to 20K at the 25th to 75th percentile, respectively, with a median value of about $5-7K.

Other Perquisites

Other perk prevalence and reported values are summarized below. Prevalence and median values have generally remained stable across the categories over the past four years. Summary statistics only include companies that reported a perk value (i.e., zeros are excluded). Only the median is presented for perquisites that had less than five percent prevalence.

Other Perquisites, continued

Print

Print