The following post comes to us from David Drake, President of Georgeson Inc, and is based on a Georgeson report by Mr. Drake, Rajeev Kumar, and Rhonda Brauer; the full report, including tables, is available here.

The 2013 proxy season marked the third year of Advisory Vote on Executive Compensation (a.k.a. Management Say on Pay, or MSOP proposals) as required under the Dodd-Frank Wall Street Reform and Consumer Protection Act. This post looks at some of the interesting facts relating to the 39 companies that received majority shareholder support for their MSOP vote in 2013 (for meetings held on or before July 31) after failing the vote in 2012 (turnaround companies [1]). The factors that contributed to turnaround success included improved total shareholder return, significant shareholder outreach, changes in compensation programs, support of proxy advisory firms, and utilization of compensation consultants and proxy solicitors.

1. A Look at 2013 Results

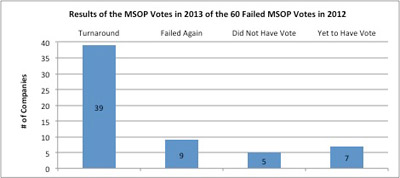

In 2012, a total of 60 companies failed their MSOP vote. Here is a quick look at the outcome of their votes in 2013 as of July 31.

*Source: Steven Hall Partners for list of 2012 failed MSOP votes;

8-K filings and ISS Governance Analytics data for voting results.

- Failed again: ANF, BIG, CRK, GTIV, HWAY, INSV, KRC, NBR, TPC

- Did not have a vote (due to merger/acquisition activity, therefore no MSOP vote in 2013): CBE, FCAL, KCG, PMTI, STL

- Yet to have a vote (2013 annual shareholder meeting not yet held): AMCC, DLLR, MASI, ORCL, PMFG, PNX, ROLL

2. Trend in Vote Support

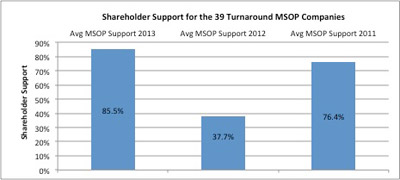

The 39 turnaround companies experienced a substantial increase in shareholder support as compared to last year’s failing vote. There has been a nearly 48 percentage-point average increase in vote support for these companies, from 37.7% last year to 85.5% this year. In 2012, when these companies had the failed MSOP vote, the average decline was nearly 40 percentage points from their voting results in 2011.

*Source: 8-K filings and ISS Governance Analytics

- Of these companies, eight were in the “red zone” this year, having received between 50% and 70% vote support in passing their MSOP vote. They will all be on the ISS/Glass Lewis [2] watch lists next year due to their low level of support.

- Of these companies, DRIV had the largest percentage increase, rising 77 percentage points – from 19% approval in 2012 to 96% in 2013. VVI (increase of 75 percentage points) and OMG (increase of 74 percentage points) saw the second and third largest advances in MSOP support, respectively.

- RIGL had the smallest increase in shareholder support, rising only eight percentage points from 45% approval in 2012 to 53% in 2013.

- After failing in 2011 and 2012, CHK and HERO passed their MSOP vote for the first time in 2013, garnering 84% and 97% shareholder support respectively.

3. Impact of Total Shareholder Return

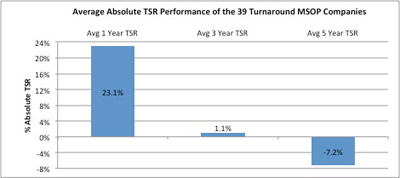

The turnaround companies seem to have benefitted from their improved TSR performance with a significant number of companies showing strong short-term TSR performance. On average, their one-year absolute TSR performance stands out and seems to have helped even more than their favorable one-year relative TSR performance. The charts below depict the average TSR performance of these 39 companies both on an absolute as well as relative to their GICS peer group basis over one-, three- and five-year periods.

*Source: ISS Research Reports released prior to companies’ annual meetings

- These 39 companies averaged 23.1%, 1.1% and -7.2% absolute TSR over the one-year, three-year and five-year performance periods, respectively.

- 32 companies had one-year TSR that exceeded their three-year TSR, while for 34 companies their one-year TSR exceeded their five-year TSR performance.

- 27 of the 39 companies had a positive one-year TSR and averaged a 39% return

- The best absolute one-year TSR was RYL with a 133% gain. Its performance over the three-year and five-year periods was +24% and +7%, respectively.

*Source: ISS Research Reports released prior to companies’ annual meetings

- On average, the 39 companies outperformed the one-year TSR of their respective GICS peers by 5.6 percentage points, but trailed their GICS peers’ three-year TSR average by 11.6 percentage points and their GICS peers’ five-year TSR average by 10.0 percentage points.

- 21 of these 39 companies outperformed the one-year TSR of their GICS peer group, but only 11 outperformed over the three-year TSR period, while just seven outperformed over the five-year TSR period.

- Only five companies—CHE, GIII, MYL, SAFT and SPG—topped the GICS peer TSR average in all three time periods. Conversely, 17 underperformed their GICS peers in all three time periods.

4. Shareholder and Proxy Advisory Firms Outreach

Shareholder outreach and communication, along with compensation changes and improved disclosure, were common underlying factors in helping these companies achieve their improved voting outcomes in 2013. Based on the feedback from investors and the proxy advisors, the companies made changes in all areas of compensation: short-term compensation, long-term compensation, compensation practices in the face of change-in-control (CIC) situations, equity and non-equity compensation, etc. Carefully crafted disclosure typically described the company’s shareholder outreach efforts to respond to its negative vote, such as the feedback that was received, or the compensation-related changes that the company made to address shareholder concerns.

Thirty six of the 39 companies specifically mentioned a shareholder outreach effort in their proxy statements as a result of the failed MSOP vote in 2012. The three exceptions were CDR, EPIQ and QLTI.

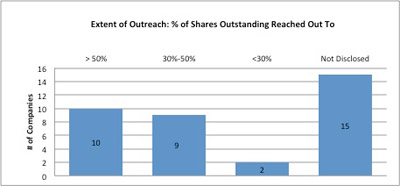

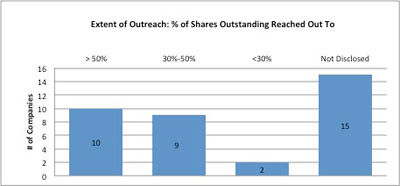

Many of the 36 that disclosed their shareholder outreach effort in their proxy statements following last year’s failed MSOP vote took the additional step of describing the extent of this effort. Twenty one of the 39 listed the number of top shareholders they contacted and/or the percent of shares outstanding that figured in their outreach efforts. The chart below illustrates the extent of shareholder outreach as disclosed by these companies.

- ATU, AGII, CHE, CYH, KFRC, NUVA, PBI, RIGL, SAFT, and VVI all stated that they reached out to holders totaling 50% or greater of the shares outstanding. BBY, CRL, CQB, FMER, KFRC and SPG specifically listed the number of top 25 or 50 shareholders to whom they reached out to.

- For the most part the outreach effort was done by the Compensation Committee members of the board with assistance from senior management. ISS and Glass Lewis specifically noted these shareholder outreach efforts in their advisory reports on all 36 companies. They also referred to the efforts of four of these companies—CVO, ICON, MYL and RIGL—as “lacking,” “inadequate” and/or “insufficient.” Regarding MYL, ISS stated their disappointment that the outreach was done by members of senior management as opposed to its Compensation Committee, and that the effort was not specific enough in addressing shareholder concerns.

Twenty of the 39 companies also reached out to the proxy advisory firms, as disclosed in their proxy statements and/or in the ISS and Glass Lewis reports. These companies realized the influence ISS and Glass Lewis have on the vote results and deemed feedback from these advisors as vital to their efforts in turning around the MSOP vote. These 20 companies averaged nearly 89% shareholder approval—slightly higher than the 85.5% shareholder approval of the entire list of 39 turnaround companies.

5. Independent Compensation Consultants

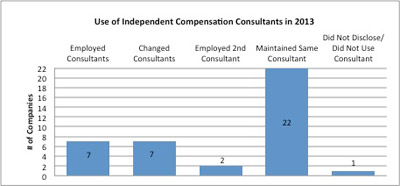

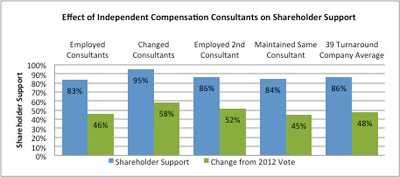

Examining the proxy statements reveals that 38 of the 39 turnaround companies employed independent compensation consultants to determine appropriate senior officer and director compensation. The lone exception was CVO. The 2012 failed vote led to some changes relating to compensation consultants at these companies. The degree of changes in compensation consultants and their impact on the shareholder vote are summarized in the graphs below.

- A total of seven companies (AGII, CDR, CHK, C, EPIQ, WOOF and VVI) employed consultants after not using one in 2012. These seven companies averaged 83% shareholder approval on their 2103 MSOP vote, an increase of 46 percentage points above the 2012 vote.

- Seven companies (BBY, CRL, IGT, OMG, PBI, SAFT and RYL) changed consultants in 2013. These seven averaged 95% shareholder approval on their 2013 MSOP vote, an increase of 58 percentage points above the 2012 vote.

- SQNM and VVI augmented their compensation efforts by employing a second consultant. These two averaged 86% shareholder approval on their 2013 MSOP vote, an increase of 52 percentage points above the 2012 vote.

- Twenty two of the companies maintained the same consultant they used in 2012. These 22 companies averaged 84% shareholder approval on their 2013 MSOP vote, an increase of 45 percentage points above the 2012 vote.

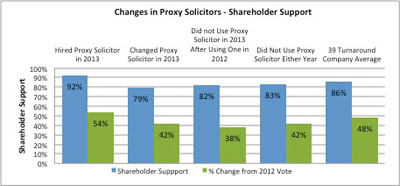

6. Proxy Solicitors

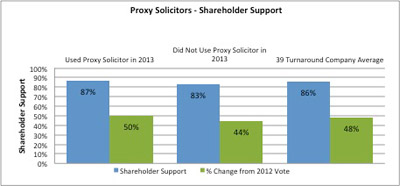

The use of proxy solicitors, in both the facilitation of the votes for the annual meetings as well as in assisting in the investor outreach efforts, played a role at the 39 turnaround companies.

- Twenty-five of the 39 companies utilized the services of a proxy solicitation firm versus 21 in 2012. These 25 companies averaged 87% shareholder approval for their MSOP vote—an average gain of 50 percentage points above last year’s failed vote. Meanwhile, the 14 that did not utilize the services of a solicitor averaged 83% shareholder approval, with an average gain of 44 percentage points.

- Six companies (AGII, BBY, INFN, KFRC, TWGP and UNTD) employed proxy solicitors in 2013 after not using one in 2012. They averaged 91.5% shareholder support (above the average 85.5% for the 39 turnaround companies), an increase of 54 percentage points (also above the average 47.8% for the 39 turnaround companies) versus their vote results in 2012.

- CHE and CRY did not use a proxy solicitor this year after employing one last year.

- A total of nine companies changed solicitors in 2013 after the failed vote in 2012. These companies averaged 79% shareholder support (below the average of the 39 turnaround companies) which was an increase of 42 percentage points (also below the average of the 39 turnaround companies).

- Twelve companies did not utilize the services of a proxy solicitor in either year. These 12 averaged a shareholder support of 83%, an increase of 42 percentage points from 2012.

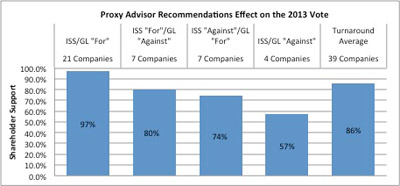

7. The Effect of Proxy Advisory Firms

The effect of ISS and Glass Lewis recommendations on the MSOP votes has been apparent. Back in 2012, when the 39 companies failed their MSOP vote, 35 of them had received “Against” recommendations on their MSOP proposal from both advisory firms, with three receiving an “Against” recommendation from one of the proxy advisory firms and only one company QLTI receiving a “For” recommendation from both ISS and Glass Lewis [3]. In 2013 again, getting the support of the proxy advisory firms has been critical in order to achieve a strong positive vote outcome for these companies.

- 21 of the 39 companies that received a “For” recommendation from both advisory firms averaged 97% shareholder approval.

- The other 18 companies that had an “Against” recommendation from at least one of the proxy advisory firms averaged 72% shareholder approval.

- Seven companies had a “For” recommendation from ISS and an “Against” recommendation from Glass Lewis, and they averaged 80% shareholder support.

- Seven companies had an “Against” recommendation from ISS and a “For” recommendation from Glass Lewis, and they averaged 74% shareholder support.

- Four companies received an “Against” recommendation from both ISS and Glass Lewis, and they averaged 57% shareholder support.

- In many cases in which an “Against” recommendation on MSOP proposal was rendered, the proxy advisory firms also issued a “Withhold” recommendation on Compensation Committee members who were up for re-election. Glass Lewis, more than ISS, has been inclined to issue a negative recommendation on Compensation Committee members in such cases.

- ISS had an “Against” recommendation on the MSOP proposal at 11 companies, ten of which had Compensation Committee members up for re-election. At four of those ten companies ISS recommended a “Withhold” vote on the Compensation Committee members (EPIQ, GII, ICON and RIGL). For the other six companies, ISS highlighted the proactive investor outreach program as well as changes in compensation programs as reasons for the “For” recommendation on the Compensation Committee members.

- Glass Lewis also had an “Against” recommendation on the MSOP proposal at 11 companies, 10 of which had Compensation Committee members up for re-election. However, unlike ISS, they recommended a “Withhold” vote for the Compensation Committee members in nine instances. The lone exception was SPG, for which Glass Lewis highlighted the company’s strong investor outreach efforts.

- Eight companies received shareholder support of less than 70%. These included:

- Four companies that received an “Against” recommendation from both proxy advisory firms: ICON (52%), RIGL (53%), SPG (56%) and CHE (65%)

- Four that received an “Against” recommendation from ISS and a “For” recommendation from Glass Lewis: WOOF (64%), EPIQ (66%), FMER (69%) and MYL (69.7%)

- These eight are in the “red zone,” having received between 50% and 70% vote support in passing their MSOP vote. They will all be on the ISS/Glass Lewis [4] watch lists for next year due to this low level of support.

- In rendering “For” recommendations, ISS and Glass Lewis cited the company’s engagement with shareholders as well as their addressing of shareholder concerns through compensation changes and subsequent disclosure in the proxy statements.

- In rendering “Against recommendations, ISS and Glass Lewis cited continued problematic compensation practices and pay-for-performance disconnect as well as a lack of adequate disclosure and engagement with shareholders.

8. Conclusion

Of the 60 companies that failed their MSOP vote in 2012, 48 companies have had an MSOP vote in 2013 for meetings held through July 31. Of those 48 companies, 39 were able to turn around that vote to achieve a passing vote at this year’s annual meeting. The turnaround companies exhibited certain characteristics and took some key steps as illustrated above. Those companies that failed their vote this year or achieved a shareholder support of less than 70% vote should take note of these factors as they prepare for their MSOP vote at the 2014 annual meeting of shareholders.

- 1. Highlight improvements in company’s performance. Any improvements in TSR (and other business and financial performance) should be communicated in the outreach efforts as well as highlighted in the company’s proxy statement.

- 2. Undertake an aggressive investor outreach program to understand shareholder concerns and to solicit feedback on steps for improving executive pay practices. This outreach should be made to the proxy voting contact (usually different from the normal investor relations contact) at the institutional investor and, as appropriate, can benefit from the involvement of a compensation committee member.

- 3. Engage with ISS and Glass Lewis to help them better understand the company’s compensation practices as well as gain further understanding of proxy advisory firms’ concerns and suggestions for improvement. Such outreach should be done during the off-season and early in the planning cycle for the next year’s shareholder meeting.

- 4. Make changes, as appropriate, to the company’s compensation practices to address shareholder and proxy advisory firms’ concerns. Such changes should be communicated in shareholder outreach efforts as well as in discussions with ISS and Glass Lewis.

- 5. Consider using the services of a proxy solicitor. The data shows that hiring a proxy solicitor, after not using one when the failed MSOP vote occurred, led to better voting results than the average of those not utilizing a solicitor. Not only did proxy solicitation firms play a significant role in assisting with the solicitation at annual shareholder meetings to help ensure higher positive votes, but several companies utilized proxy solicitor services to assist in shareholder outreach efforts.

- 6. Provide clear disclosure in the CD&A section describing the steps taken to address the say on pay issues. This should include discussion of the investor outreach efforts including the specific feedback received as well as the resultant compensation changes that were made.

In summary, companies that have a prudent plan consisting of a proactive outreach to shareholders and proxy advisory firms, reviewing the executive pay practices and making changes, as appropriate, can turn around a failed or low shareholder vote on their say on pay proposal.

Endnotes:

[1] For a complete list of the 39 turnaround companies, the results of the shareholder votes and recommendations from proxy advisory firms ISS and Glass Lewis, please see Tables I and II in the full version of this document, available here.

(go back)

[2] Note, a company is placed on ISS’ and Glass Lewis’ watch lists if the company receives less than 70% or 75% vote support, respectively.

(go back)

[3] Note that the 2012 failed MSOP vote at QLTI resulted in the context of a contested election of directors (which resulted in the change in the company’s board as well as major changes among the senior management of the company).

(go back)

[4] Note, a company is placed on ISS’ and Glass Lewis’ watch lists if the company receives less than 70% or 75% vote support, respectively.

(go back)

Print

Print