John Gould is senior vice president at Cornerstone Research. The following post discusses a Cornerstone Research report by Abe Chernin, Katie Galley, Yesim C. Richardson, and Joseph T. Schertler, titled “Characteristics of FDIC Lawsuits against Directors and Officers of Failed Financial Institutions—February 2014,” available here.

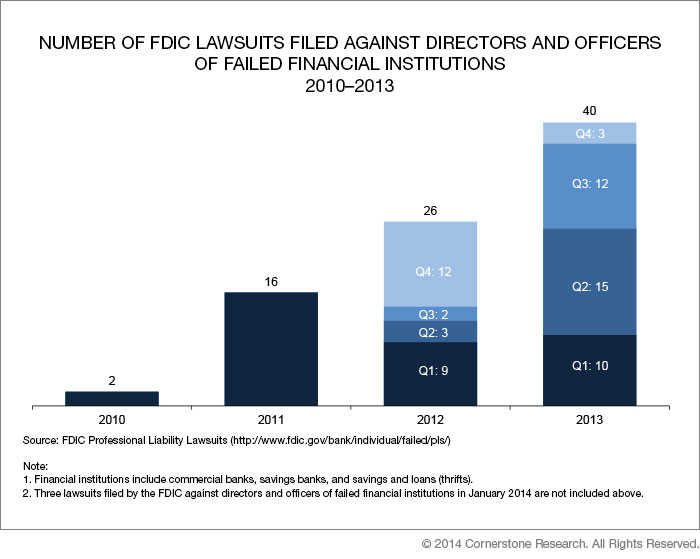

Federal Deposit Insurance Corporation (FDIC) litigation activity associated with failed financial institutions increased significantly in 2013, according to Characteristics of FDIC Lawsuits against Directors and Officers of Failed Financial Institutions—February 2014, a new report by Cornerstone Research. The FDIC filed 40 director and officer (D&O) lawsuits in 2013, compared with 26 in 2012, a 54 percent increase.

The surge in FDIC D&O lawsuits stems from the high number of financial institution failures in 2009 and 2010. Of the 140 financial institutions that failed in 2009, the directors and officers of 64 (or 46 percent) either have been the subject of an FDIC lawsuit or settled claims with the FDIC prior to the filing of a lawsuit. Of the 157 institutions that failed in 2010, 53 (or 34 percent) have either been the subject of a lawsuit or have settled with the FDIC.

From the start of 2010 to the end of 2013, the FDIC has claimed damages of at least $3.8 billion in lawsuits filed against directors and officers of failed financial institutions. In lawsuits filed in 2013, the federal agency claimed $1.2 billion in damages.

“While FDIC filings of new D&O lawsuits hit a lull in the fourth quarter of 2013, new filings are unlikely to continue at such a slow pace in the first half of 2014,” said Katie Galley, a senior vice president of Cornerstone Research and one of the report’s authors. “Three lawsuits were already filed in January, and as motions and discovery unfold in existing lawsuits, this year will be interesting to follow.”

Galley added: “For example, a recent ruling in the Eleventh Circuit pertinent to the many Georgia-based lawsuits allows directors and officers to assert affirmative defenses that will directly affect loss causation and damages arguments. These types of judicial rulings may greatly influence the relative negotiating strength of the FDIC and defendants. How this ruling and others like it affect the likelihood of settlements may determine whether we see protracted litigation in the FDIC’s D&O lawsuits, or movement to settle cases earlier.”

More Key Findings

- The pace of new lawsuits in 2013 slowed dramatically in the fourth quarter of 2013 to only three, compared with 10, 15, and 12 in the preceding quarters.

- From the beginning of 2010 to the end of 2013, of the FDIC’s 84 D&O lawsuits, 53 stem from failures in just four states: Georgia, California, Illinois, and Florida. Approximately$2.1 billion, or 56 percent of the FDIC’s total claimed damages, stem from these lawsuits.

- Of the FDIC’s 84 filed lawsuits, at least 17 have settled in whole or in part, and one has resulted in a jury verdict.

- Chief executive officers continue to be the most commonly named defendants. The FDIC named CEOs in 83 percent of the complaints filed in 2013.

- Of the 82 settlement agreements that the FDIC has reached that involved directors and officers, as many as 38 agreements, or 46 percent, required payments by the directors and officers. Directors and officers agreed to pay at least $34 million in these cases.

- The FDIC seized 24 financial institutions in 2013, the lowest number since 2007. The median size of failed financial institutions has declined steadily over the last six years.

The full study is available here.

Print

Print