The following post comes to us from Luigi L. De Ghenghi and Andrew S. Fei, attorneys in the Financial Institutions Group at Davis Polk & Wardwell LLP, and is based on a Davis Polk client memorandum; the full publication, including diagrams, tables, and flowcharts, is available here.

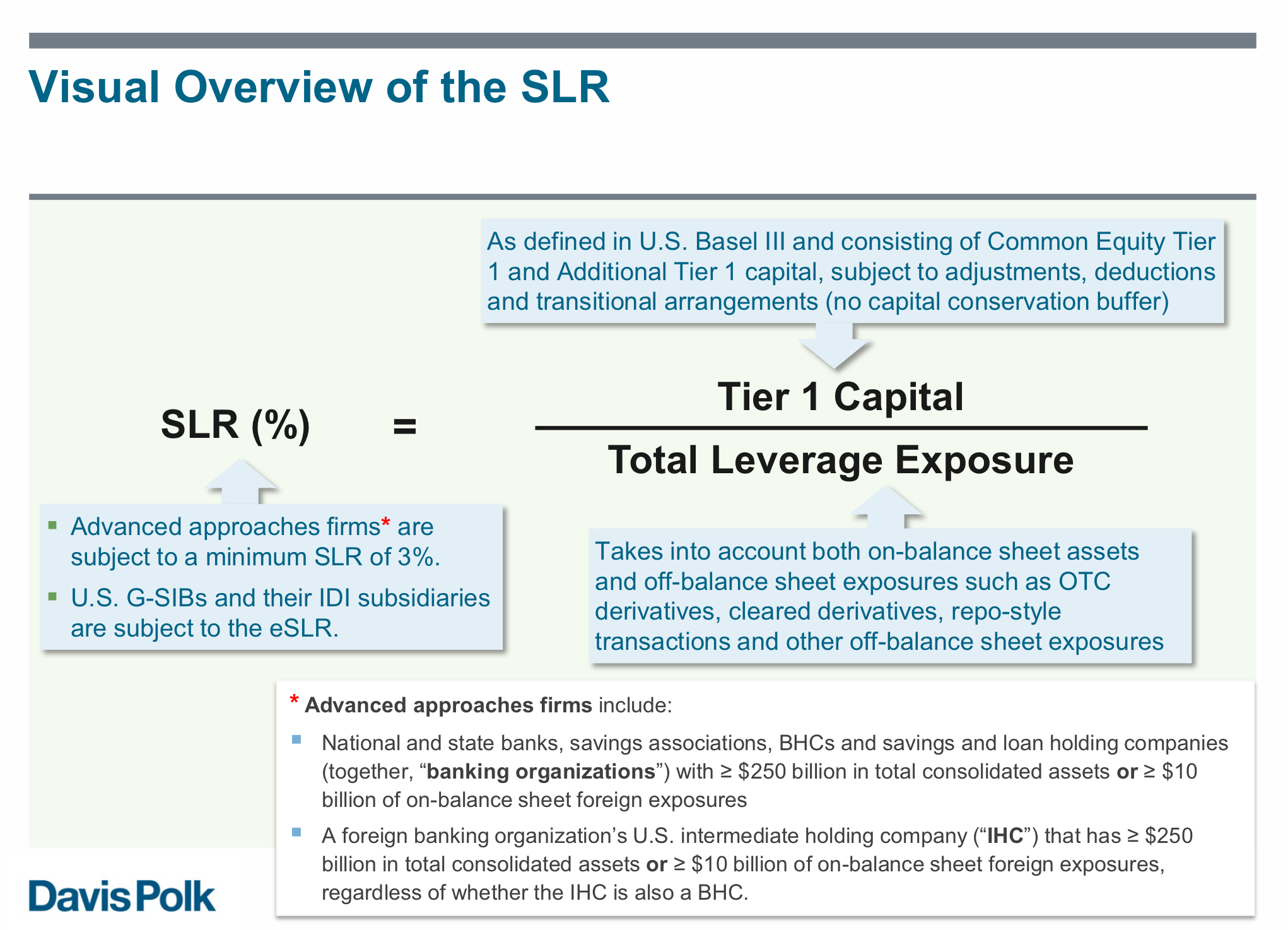

The U.S. banking agencies have finalized revisions to the denominator of the supplementary leverage ratio (SLR), which include a number of key changes and clarifications to their April 2014 proposal. The SLR represents the U.S. implementation of the Basel III leverage ratio.

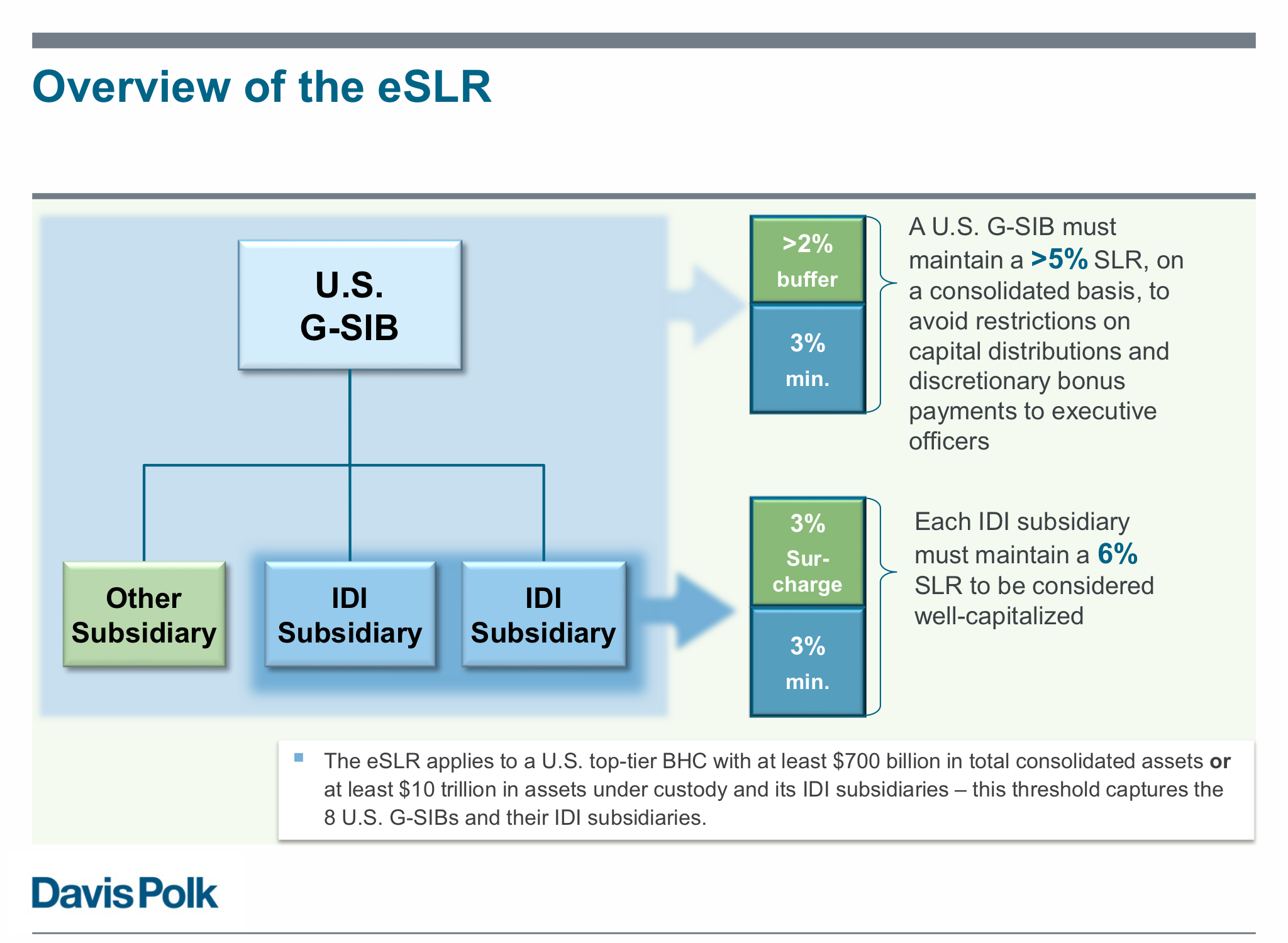

Under the U.S. banking agencies’ SLR framework, advanced approaches firms must maintain a minimum SLR of 3%, while the 8 U.S. bank holding companies that have been identified as global systemically important banks (U.S. G-SIBs) and their U.S. insured depository institution subsidiaries are subject to enhanced SLR standards (eSLR).

Key Changes and Clarifications to April 2014 SLR Denominator Proposal

Following is an overview of the key changes clarifications made to the April 2014 SLR denominator proposed rule.

Conditions for cash variation margin to avoid reversal of the U.S. GAAP offset option

- Clarification that unless segregation is required by law, regulation or any agreement with the counterparty, a banking organization that posts cash variation margin to a counterparty may assume that its counterparty has not segregated the cash variation margin it has received for purposes of meeting criterion of absence of segregation for derivatives not cleared through a qualifying central counterparty (QCCP).

- Clarification that cash variation margin exchanged on the morning of the subsequent trading day would meet criterion of variation margin fully covering the current credit exposure.

Credit protection sold and purchased on overlapping portions of same reference index

Clarification that where a banking organization has purchased and sold credit protection on overlapping portions of the same reference index, but the purchased credit protection does not cover the entirety of the portion of the index or securitization on which the banking organization has sold credit protection, the banking organization may offset the sold credit protection by the overlapping portion of purchased credit protection.

Cleared credit protection sold

The effective notional principal amounts of sold credit protection that are cleared for clearing member clients through CCPs are not included in a clearing member banking organization’s Total Leverage Exposure. These derivative transactions are treated in the same manner as other cleared derivative transactions.

Conditions to avoid reversal of the U.S. GAAP offset for repo-style transactions

Clarification of the criterion that “settlement of the underlying securities does not interfere with the net cash settlement”: Failure of any single securities transaction in settlement system should only delay matching cash leg or create an obligation of the settlement system. Settlement system must not require all securities transactions to settle before settling any net cash obligations.

Potential future exposure exclusions

The potential future exposure related to a forward agreement associated with a repurchase or securities lending transaction that qualifies for sales treatment under U.S. GAAP may be excluded from Total Leverage Exposure. Forward agreement should not be included as off-balance sheet exposure subject to credit conversion factor (CCF).

Interaffiliate clearing arrangements

A banking organization may exclude from its Total Leverage Exposure the clearing member’s exposure to its clearing member client for a derivative transaction if the clearing member client and the clearing member are affiliates and consolidated on the banking organization’s balance sheet.

Averaging of Total Leverage Exposure

- On-balance sheet portion of Total Leverage Exposure is calculated as the daily average for the reporting quarter.

- Off-balance sheet portion of Total Leverage Exposure is calculated as the average of the three month-end amounts for the reporting quarter.

Key Comments Not Taken by U.S. Banking Agencies

- No exclusion of cash, central bank deposits or sovereign securities from Total Leverage Exposure

- No change in tenor requirements for purchased credit protection to reduce effective notional principal amount of sold credit protection

- No inclusion of undated or “open” repo-style transactions as offsetting repo-style transactions with same explicit final settlement date to avoid reversal of U.S. GAAP offset

- No exclusion of cash collateral posted to CCP for cleared repo-style transactions from Total Leverage Exposure

- No change to CCF applicable to trade finance exposures

- No exclusion of cash provided by clearing member client and held in segregated account from clearing member banking organization’s Total Leverage Exposure

The complete publication is available here.

Print

Print