Lucian Bebchuk is Professor of Law, Economics, and Finance at Harvard Law School; Alon Brav is Professor of Finance at Duke University; Wei Jiang is Professor of Finance at Columbia Business School; and Thomas Keusch is Assistant Professor at the Erasmus University School of Economics. This post relates to a recent article, Hedge Find Activism and Long-Term Firm Value, by Cremers, Giambona, Sepe, and Wang, which was recently made publicly available on SSRN. This post is related to the study on The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here).

This post replies to a study by Cremers, Giambona, Sepe, and Wang (“the CGSW Study”), Hedge Find Activism and Long-Term Firm Value. The CGSW study, which has recently been publicly released on SSRN and simultaneously announced in a Wachtell Lipton memorandum, aims at contesting existing evidence on the long-term effects of hedge fund activism. As we explain below, the paper overlooks prior opposing evidence on the subject, offers a flawed empirical analysis, and makes claims that are contradicted by its own reported evidence. Furthermore, the paper’s conclusions are inconsistent not just with our work, but with a large body of empirical studies by numerous researchers. CGSW’s claims, we show, should be given no weight in the ongoing examination of hedge fund activism.

In a paper titled The Long-Term Effects of Hedge Fund Activism, (“the LT Effects Study”), three of us tested empirically the “myopic activism claim” that has long been invoked by opponents of shareholder activism. According to this claim, hedge fund activism produces short-term benefits at the expense of long-term value. The LT Effects Study shows that the myopic activist claim is not supported by the data on targets’ Tobin’s Q, ROA, or long-term stock returns during the five years following the activist intervention.

CGSW focus on one part of the results of the LT Effects Study—those concerning Q (financial economists’ standard metric of firm valuation). Accepting that industry-adjusted Tobin’s Q improves in the years following activist interventions, CGSW assert that what has been missing is a comparison of how activist targets perform relative to a matched sample of similarly underperforming firms. CGSW claim that their matched sample analysis shows that the Q of activist targets improves less in the years following the intervention than the Q of matched control firms and that activism therefore decreases, rather than increases long-term value. Although CGSW do not look at stock returns, their conclusions imply that the announcement of an activist intervention represents “bad news” for investors that should be expected to be accompanied immediately or ultimately by negative stock returns for the shareholders of target companies.

Below we in turn comment on:

(i) Our obtaining different results than those reported by CGSW when applying CGSW’s empirical methodology to the same data;

(ii) The inconsistency of CGSW’s claims with some of their own reported results;

(iii) CGSW’s puzzling “discovery” of a well-known selection effect;

(iv) CGSW’s failure to engage with prior work conducting matched sample analysis and reaching opposite conclusions;

(v) CGSW’s flawed empirical methodology;

(vi) The inconsistency of CGSW’s conclusions with the large body of evidence on stock returns accompanying activist interventions; and

(vii) CGSW’s implausible claim that activist interventions have destroyed over 50% of the value of “innovative” target firms.

Although CGSW direct their fire at the Long-Term Effects Study, the discussion below explains that their conclusions are inconsistent not just with this study but with a large number of empirical studies by numerous researchers, including the many studies cited below.

CGSW’s Data and Results

The CGSW paper is based on a dataset of activist interventions that two of us collected and that the LT Effects Study used. Although we are still working with the data to produce additional papers, we agreed to provide the authors with our data to facilitate research in this area. To our surprise, the authors did not provide us an opportunity to comment on their paper before making their paper public, and we first learnt about the paper from Wachtell Lipton’s memorandum announcing it.

Although we view the empirical procedure used by CGSW as flawed, we have attempted to replicate their results using our data (which CGSW used), following the procedure described in their paper and making standard choices for elements of the procedure that the paper does not fully specify. Doing so, we have obtained results that are very different from those of CGSW.

We asked the authors to provide us with the list of the matched sample companies used in their tests. Even though their paper is based on data we shared with them, CGSW declined to provide us with the requested list and stated that they would not do so prior to the publication of their paper in a journal (which might be many months away).

Claims Inconsistent with CGSW’s Own Results

CGSW claim that their matched sample analysis shows that “firms targeted by activist hedge funds improve less in value … than similarly poorly performing firms that are not subject to hedge fund activism.” However, the patterns displayed in the authors’ key Figure 1 do not support this central claim.

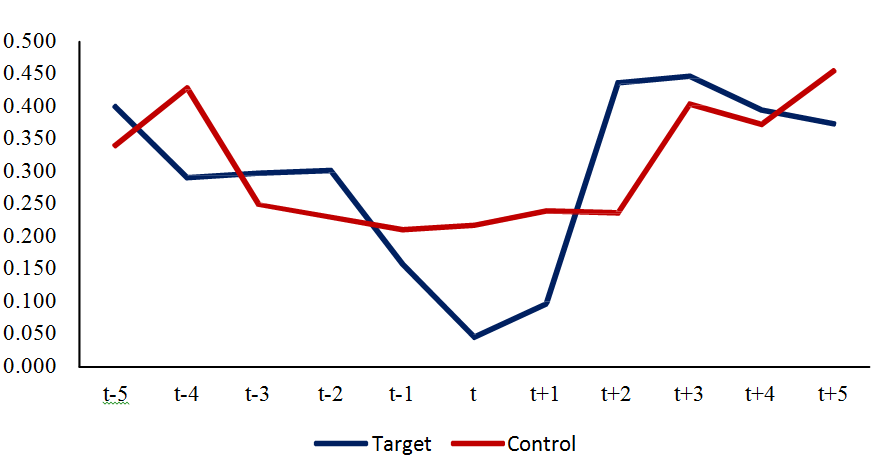

This Figure 1, which we reproduce below, reports industry-adjusted Tobin’s Q for firms targeted by hedge funds (blue graph) and industry-adjusted Tobin’s Q for the matched control firms (paired with the target firms by CGSW) during the years before and after the year at which target firms became a target.

Although the authors state that the Figure “confirms” their conclusions, it does not appear to do so. The Figure vividly shows that targets’ valuation increases more sharply than that of matched control firms that are not subject to hedge fund activism during the years following time t (denoting the end of the intervention year).

CGSW might argue that, although target valuation increases more sharply relative to matched control firms from time t (the end of the intervention year) forward, the activist intervention is responsible for the short-term decrease in value relative to control firms that targets experience from time t-1 (the beginning of the year of the intervention) to time t (the end of the year of the intervention). However, this short-term decrease is likely to at least partly precede the intervention and thus be a potential cause rather than a product of it. Furthermore, while opponents of hedge fund activism have been seeking to ground their opposition in claims regarding long-term effects, we are unaware of any claims by such opponents that such activism decreases value in the short term, and the well-documented stock market gains accompanying announcements of activist interventions would make such a claim implausible.

Indeed, CGSW themselves explain that the view that is empirically supported by their paper is that hedge fund interventions pressure management to produce short-term gains that come “at the potential expense of long-term performance.” This view implies a short-term increase in valuation followed by a decline in valuation during the years following the intervention year. The clear improvement in target valuation (relative to control firms) from time t forward displayed in Figure 1 thus contradicts CGSW’s claims and conclusions.

Tobin’s Q around the start of activist hedge fund campaigns (sample of all hedge funds campaigns)

Source: Cremers et al., November 2015, page 44.

Although the inconsistency of CGSW’s claims with their own Figure 1 is worth noting in assessing CGSW’s paper, we should stress that, due to the methodological problems noted below, we otherwise do not attach weight to the authors’ results, including those in Figure 1.

The Puzzling “Discovery” of a Selection Effect

The first contribution that CGSW claims to make is to “show” a selection effect “as activist hedge funds tend to target poorly performing firms.” After replicating the results of the LT Effects Study, CGSW argue that it is important “to understand what type of firm tends to be targeted by activist hedge fund” and proceed to present an analysis that shows that targeted firms “tend to have relatively low valuations before they are being targeted.”

The CGSW announcement of this “discovered” selection effect is puzzling. The relatively low valuation of activist targets prior to the intervention has been well-known and documented in the literature (see, e.g., the recent papers by Gantchev, Gredil, and Jotikasthira (2015), Cheng, Huang, Li, and Stanfield (2012), Cheng, Huang, and Li (2015), Aslan and Kumar (2015), and Brav, Jiang, Ma, and Tian (2014)). Indeed, the LT Effects Study itself stresses the selection effect and devotes a whole subsection (section III.D) to this effect. That section extends the analysis to include control variables for past performance and shows that the results are robust to such inclusion.

Prior Matched Sample Analysis Reaching Opposite Conclusions

Whereas the selection issue led the LT Effects Study to include regressions that control for the level of underperformance prior to the activist intervention, an alternative approach is to identify a set of similar matched control firms and to compare the evolution of targets’ operating performance with that in the matched control sample. Such an analysis has already been conducted, producing opposite results to those of CGSW’s matched sample analysis, but the authors fail to engage with or even note this research.

To begin, in a paper published this year in the Review of Financial Studies, two of us and Hyunseob Kim conducted a matched sample analysis for the subset of activist interventions that take place in the manufacturing sector. This analysis shows that the operating performance (measured by the total factor productivity) of manufacturing plants owned by targets improves over time relative to matched control assets held by similar firms, with one match criterion is having a similar deterioration trend up to the year of intervention. CGSW do not engage with or even note this analysis.

Furthermore, in a current research project, covering all the activist targets included in the LT Effects Study, the four of us have compared the performance of activist targets with that of matched control firms that were selected using a propensity score analysis. Consistent with the conclusions of the LT Effects Study, we found that Tobin’s Q of activist targets increases relative to the matched control firms in the years following the intervention. We presented these findings at the annual meeting of the American Law and Economics Association in May 2015. Although one of the authors of the CGSW study was in the audience, CGSW do not engage with or even note these findings.

Finally, we should note three papers that document benefits produced by hedge fund activism using a comparison of activist targets with matched control firms—Brav, Jiang, Ma, and Tian (2014), Cheng, Huang, and Stanfield (2012), and Cheng, Huang, and Li (2015). Although these studies focus on beneficial outcomes other than Tobin’s Q improvements, there is a clear tension between their conclusions and the claims of CGSW, but CGSW, again, do not engage with or even note these studies.

Flaws in Empirical Analysis

The authors’ matched sample analysis is flawed and cannot provide a solid basis for making inferences. For example, to get industry-adjusted Tobin’s Q, CGSW have chosen to compare the Tobin’s Q of each firm to the median in its 4-digit SIC industry, a large fraction of 4-digit SIC industry buckets have only 1 or 2 public firms in any given year, rendering the authors’ non-standard procedure for industry adjustment highly problematic. Also, in CGSW’s matching procedure, larger firms are more likely to become an activist target, which is inconsistent with the literature. There are additional and substantial methodological problems with the CGSW matched sample analysis, and the research paper that the four of us will issue (based on the findings presented in the ALEA meeting in May 2015) will provide a detailed discussion of adequate methodologies for conducting a matched sample analysis in this context.

It should be emphasized that, even if the CGSW empirical procedure were to be accepted, their results would not follow robustly from it. As noted earlier, we have obtained very different results from those of CGSW when we used the same data, followed the procedure specified in their paper, and made standard choices for elements of the procedure that the paper does not fully specify. The different results we obtained when we attempted to implement their procedure suggest that, at a minimum, their reported results would not follow robustly, even if one were to accept their flawed methodology.

Inconsistency with the Large Body of Evidence on Stock Returns

Although a substantial part of the LT Effects Study is devoted to examining the stock returns accompanying and following activist interventions, CGSW do not examine these stock returns. Furthermore, CGSW fail to engage with the inconsistency of their conclusions with a large body of evidence on the stock returns accompanying activist interventions.

According to CGSW, the announcement of an activist stake in a poorly performing firm is “bad news” for its shareholders, as such activist intervention reduces the expected future improvement in operating performance. Thus, CGSW’s findings imply that the bad news produced by the announcement of an activist stake (the filing of a 13(d)) should be accompanied by negative abnormal stock returns. This implication of CGSW’s claims is inconsistent, however, with the significant body of research documenting the positive abnormal stock returns accompanying 13d filings (see, e.g., Brav, Jiang, Partnoy, and Thomas (2008), Klein and Zur (2008)).

Of course, CGSW might argue that the well-documented stock price spike accompanying activist interventions represents inefficient market reaction. In this case, however, one would expect negative abnormal returns to follow subsequently, and such reversals have not been found in the data (see, e.g., Bebchuk, Brav, and Jiang (2015), Becht, Franks, Grant, and Wagner (2015), Clifford (2008), Kang, Ozik, and Sadka (2015), nor do CGSW attempt to show their existence.

Implausible Claims

Some claims made by CGSW seem to be so patently implausible that we are surprised that CGSW rushed out announcing these claims with fanfare. In particular, CGSW claim to have evidence that “innovative” target firms suffer value destruction on a massive (yet thus far unnoticed) scale. In particular, CGSW claim that research-intensive firms (defined as ones that are in the top quartile in terms of R&D expenses) and high patents citation firms (defined as ones that are in the top quartile in terms of patent citation) “declined in value by [more than 50%] in the three years after being first targeted” relative to the group of similar firms that were not targeted (pp. 8, 25-26 and Table 7).

The claimed three-year decline in value exceeding 50% is larger than what U.S. companies suffered, on average, in the aftermath of the financial meltdown of 2008. Furthermore, CGSW fail to document empirically any significant adverse effect on these firms that could explain the claimed destruction of value on a massive scale. CGSW also fail to engage with or even cite the three studies that document benefits associated with activist interventions in innovative firms: He, Qiu, and Tang (2014), which shows that hedge fund interventions are associated with significant improvements in innovation output, that the improvement is more pronounced in active intervention events, and that hedge fund activists deliver positive abnormal returns to shareholders of target innovative firms during the 5-year period following the intervention; Wang and Zhao (2015), which show that hedge fund ownership is associated with increases in patent quantity and quality, with such ownership increasing R&D productivity and innovation efficiency rather than R&D input; and Brav, Jiang, Ma, and Tian (2014), which shows that firms targeted by hedge fund activists experience a subsequent increase in innovation efficiency and innovation output.

———

We thus conclude that the CGSW claims are unwarranted. CGSW assert that “[their] findings have significant implications for the current corporate governance debate….” Their findings, however, do not have any such implications; for the reasons explained above, the CGSW study fails to make a contribution to this debate.

Print

Print