The following post comes to us from Michael R. Littenberg, a partner at Schulte Roth & Zabel LLP, and is based on Schulte Roth & Zabel white paper by Mr. Littenberg, Farzad F. Damania and Justin M. Neidig.

For most public companies, the 2011 annual meeting season is now over, and the first mandatory say on pay vote is behind them. Thus far, more than 2200 of the Russell 3000 companies have held say on pay votes in 2011. This White Paper analyzes the results of this year’s say on pay vote across several metrics.

An Overview of Say on Pay

As part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, Section 14A(a) was added to the Securities Exchange Act of 1934. Pursuant to Section 14A(a) and the rules thereunder subsequently adopted by the SEC, beginning with the 2011 proxy season, most domestic public companies are required to conduct say on pay (SOP) and say on frequency (SOF) votes.

Under the SOP requirement, companies must submit named executive officer (NEO) compensation to a non-binding, or advisory, shareholder vote at least once every three years, as determined by the board.

The SOF vote requires companies to conduct an advisory vote on the frequency of the SOP vote at least once every six years. Shareholders must be given the option to vote on a frequency of one, two or three years or to abstain. The board may make a recommendation on the frequency of the SOP vote, but it is not required to do so.

In 2011, slightly more than half of the companies have recommended an annual SOP vote. Most of the remaining companies have recommended a triennial vote, with a small percentage recommending a biennial vote or not making a recommendation. In line with the trends that we reported in an Alert early during the 2011 proxy season based on the first 30 days of annual meetings, shareholders have continued to indicate their preference for an annual SOP vote. Although the frequency vote is nonbinding, as expected, it has had a normative effect, with boards following the shareholder vote.

Because 2011 is the first year under the new rules, companies are required to hold both the SOF and SOP vote. However, under its final SOP rules, the SEC provided smaller reporting companies with a two-year reprieve from having to hold a SOP or SOF vote. A smaller reporting company will be subject to these requirements beginning with annual meetings held on or after Jan. 21, 2013.

Take-Aways from the 2011 Annual Meeting Season

Failed Votes Still Remain the Small Minority

Going into this year’s annual meeting season, given general economic conditions and widespread unhappiness on Main Street with executive pay levels, there was concern in Corporate America that shareholders would have a knee-jerk reaction and vote against SOP proposals without taking an individual company’s pay practices into account.

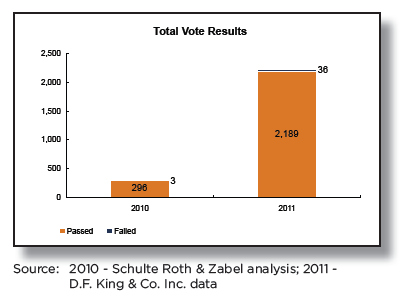

This year’s results were much better than many of the pundits expected. By June 17, 2011, the end of the last big week of annual meetings, 2225 of the Russell 3000 companies had held SOP votes. Shareholders returned negative SOP votes at only 36, or 1.6 percent, of these companies. This percentage is not significantly different than for 2010’s more limited sample of companies that held voluntary or TARP-mandated SOP votes, only 1.0 percent of which had negative results.

Neither Size nor Industry Materially Increased the Risk of a Failed Vote

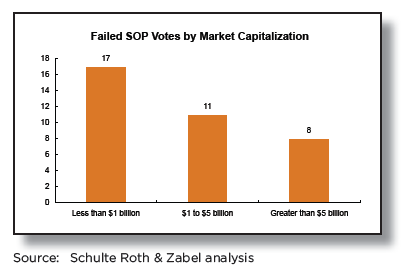

The table below breaks out failed SOP votes by market capitalization.

Although the number of failed votes increases in inverse proportion to market capitalization range, so does the absolute number of companies required to hold SOP votes.

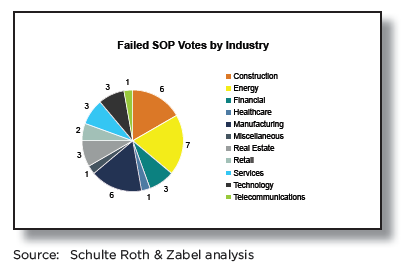

Negative SOP votes also did not skew heavily toward particular industries. Although a few broad industry groups — energy, construction and manufacturing — generated a larger number of the negative SOP votes, the number of failed votes is not enough to suggest that investors were targeting the pay practices of these particular industries.

Proxy Advisory Services Overwhelmingly Recommended a “For” Vote on SOP, and a Negative Recommendation Usually Was Not Dispositive of the Outcome

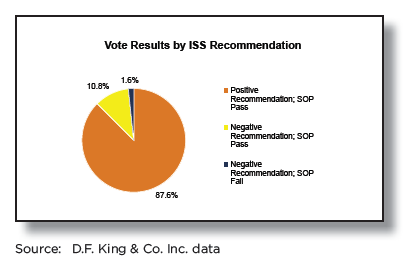

According to D.F. King & Co. Inc., out of the 2225 Russell 3000 companies that held annual meetings between Jan. 21, 2011 (when SOP became mandatory) and June 17, 2011, Institutional Shareholder Services (ISS) recommended a “for” vote on SOP at 1949 of them. Out of the 276 companies for which ISS put out a negative recommendation, 36 experienced negative SOP votes.

The table above illustrates on a percentage basis the Russell 3000 population that received “for” and “against” SOP recommendations from ISS, with the negative recommendation further broken out by passed and failed SOP resolutions. Slightly more than 86 percent of the companies that received a negative recommendation from ISS nevertheless saw their SOP proposal pass.

Although, in most cases, a negative recommendation did not result in the SOP vote failing to pass, the influence of the proxy advisory services should not be discounted. No Russell 3000 company that received a favorable recommendation from ISS had its SOP proposal voted down, and it appears that only one company below the Russell 3000 that received a favorable recommendation from ISS had its SOP proposal rejected by shareholders. Furthermore, as discussed below, companies that received a favorable recommendation saw their SOP vote approved by a much larger percentage.

A Negative SOP Recommendation From ISS Is Most Likely to be Triggered by a Pay for Performance Disconnect

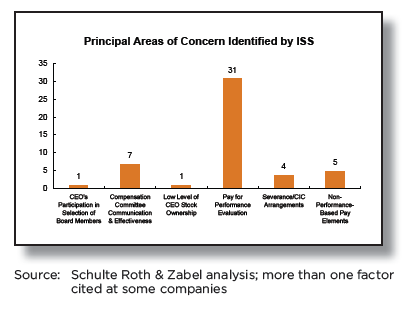

Although ISS based negative SOP recommendations on a variety of factors, far and away the most frequently cited was a pay for performance disconnect, as reflected in the table below. Out of 36 companies with negative SOP votes, ISS identified a pay for performance disconnect at 31.

In determining whether a pay for performance disconnect exists, ISS focuses in particular on companies where one-year and three-year shareholder returns are in the bottom half of the company’s industry group. ISS also gives key consideration to year-over-year increases in executive compensation and the long-term trend of the CEO’s total compensation relative to shareholder returns.

A Successful SOP Vote Requires More Than a Bare Majority

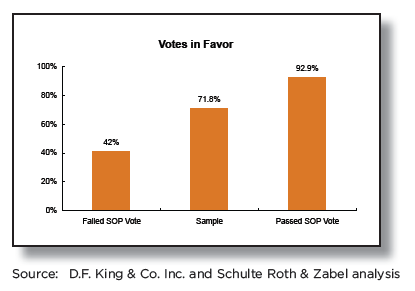

From a legal standpoint, majority support constitutes a successful SOP vote. However, companies should aspire to something significantly higher, given the generally high level of shareholder support for SOP resolutions at companies receiving positive SOP recommendations from ISS.

According to D.F. King & Co. Inc., at the Russell 3000 companies that received a positive ISS recommendation on SOP in 2011, the resolutions received, on average, 92.9 percent support.

In contrast, failed SOP proposals received on average 42 percent support. Bridging these two statistics, we reviewed a random sample of 30 Russell 3000 companies that received a negative ISS recommendation, but where the SOP proposal passed. This sample group saw on average 71.8 percent shareholder support for its SOP proposals. Reasonable people can differ on what constitutes a successful SOP vote, but the data suggests that the percentage is well in excess of a majority. For example, governance expert Francis Byrd at the Laurel Hill Advisory Group and head of their Corporate Governance and Risk Practice has indicated that companies with less than 75 percent to 80 percent support for their SOP proposals this year remain at risk in 2012 due to both year-over-year changes in institutional shareholder base and increased activism from governance advocates.

Negative SOP Votes Had Spill-Over into Votes for Compensation Committee Directors

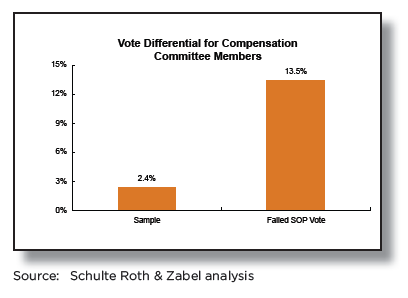

According to ISS, this proxy season, directors have been re-elected with the highest average level of shareholder support in the last five years. This increased level of support is likely due to shareholders generally channeling their dissatisfaction away from directors and into the SOP vote.

However, at the 36 Russell 3000 companies that experienced a negative SOP vote, compensation committee directors up for re-election nevertheless received on average 13.5 percent fewer votes in favor than the other directors on the ballot. In comparison, at our random sample of the 30 companies that received a negative ISS recommendation but had a passing SOP vote, compensation committee directors up for re-election received on average 2.4 percent fewer votes in support than the other directors on the ballot. Although the compensation committee directors in the random sample group still received less votes than other directors, they fared significantly better overall on re-election than their counterparts at companies who lost the SOP vote.

Compensation committee members at companies that experienced a negative SOP vote in 2011 will be at greater risk for re-election next year if the company does not satisfactorily address ISS’s pay concerns. ISS has indicated that it may recommend a vote against a compensation committee member that is up for re-election if the company has not addressed its prior negative SOP vote.

A Well-Thought-Out SOP Outreach Strategy Can Make or Break the Outcome

Companies need to be able to respond quickly to a negative SOP vote recommendation, since the proxy advisory firms typically issue their recommendations only a few weeks before the annual meeting. Many companies that received negative SOP recommendations in 2011 were unprepared and were unable to quickly ramp-up their shareholder outreach to help ensure a successful vote. The shareholder base had not been analyzed, the messaging had not been fleshed-out and the outreach strategy had not been determined in advance. In at least some cases, it is likely that the inability to quickly address a negative SOP recommendation was fatal to being able to deliver a favorable SOP vote.

Companies that received a negative SOP recommendation have employed a variety of techniques to help turn investor sentiment. Examples of additional solicitation materials that have been filed this year include: slideshow presentations to shareholders and the media; letters to proxy advisory firms, including letters that take issue with the accuracy of the information cited in the reports or disagreeing with the analysis; scripts for use in shareholder outreach; and letters to shareholders. At one Fortune 100 company, in order to turn around a negative ISS recommendation on SOP, the company modified certain elements of its NEO compensation prior to its annual meeting. There is, of course, no “one-size-fits- all” approach. The appropriate outreach strategy will differ from company to company. However, the one commonality is that companies must be prepared for a quick response.

With a year of SOP under their belts, companies conducting annual SOP votes are less likely to be caught unaware in 2012. In particular, those companies that saw their SOP vote pass but received a negative recommendation in 2011, if still expected to be at risk in 2012, should hone their messaging and outreach strategy well in advance of next year’s annual meeting. Ideally, outreach regarding NEO pay practices, at not only these but other public companies, should become part of the year-round investor relations function, and not something that only occurs leading up to the annual meeting, when it is often difficult to get the attention of institutional investors.

Failed Votes Create Litigation Risk

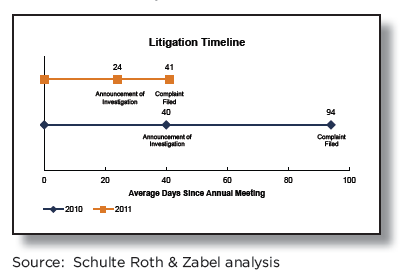

A failed SOP vote exposes directors to shareholder lawsuits alleging breach of fiduciary duty and corporate waste. Lawsuits were filed against directors at two of the three companies that received a negative SOP vote in 2010. One of the two lawsuits was settled; however, a suit is still pending at the other company. At all three of these companies, there were also changes to executive compensation policies and/or leadership.

Thus far in 2011, shareholder derivative lawsuits have been commenced against the directors at four of the companies that experienced negative SOP votes. Given the lag time between a failed SOP vote and the filing of a lawsuit, the number of SOP-related lawsuits is likely to increase substantially.

Plaintiffs’ firms have thus far announced investigations against 18 additional companies, with the announcement coming on average 45 days after the annual meeting. Therefore, the averages in 2011 are likely to move closer to the 2010 averages.

Whether these suits become a permanent part of the landscape for companies that have failed SOP votes will depend upon whether this year’s crop of suits are largely dismissed at the summary judgment phase. In the meantime, in light of the increased litigation risk arising out of failed SOP votes, boards need to be especially sensitive to the deliberative process leading up to pay decisions and the way in which that process is documented.

Failed SOP votes also create risk for outside consultants. To date in 2011, well-known consulting firms have been sued for their role in executive compensation decisions at all four companies. The plaintiffs have alleged that the firms aided and abetted breaches of the duty of loyalty by the directors and that there was a breach of contract arising out of the firms’ failure to provide competent and sound advice. This troubling development also has ramifications for public companies, not just their advisors. Companies that either experienced a negative SOP vote in 2011, or that are perceived as being at risk of a future negative vote, are likely to pay a risk premium for executive compensation advice from name brand advisors. In addition, all public companies are likely to see stronger indemnification provisions in future contracts with outside compensation consultants.

Smaller Reporting Companies Should be Preparing for SOP Now

Smaller reporting companies are not subject to SOP until 2013. However, given the significant lead-time needed to adjust compensation terms and practices, as smaller reporting companies enter into new compensation arrangements with named executive officers over the next 18 months, they should be sensitive to which elements of their executive compensation are most likely to trigger a negative advisory firm recommendation or shareholder backlash. Based on the experience of larger companies, smaller reporting companies should expect that, if they do not have significant insider ownership, shareholders are likely to vote for an annual SOP vote in the 2013 SOF vote.

Companies Can Recover From a Failed SOP Vote

A negative vote in one year does not necessarily mean a negative vote the next year. All three companies that lost their SOP vote in 2010 saw their SOP proposals pass by wide margins in 2011, with votes cast in favor exceeding 85 percent at each company. However, these companies were not static over the last year. All three companies made changes to their executive compensation policies and/or leadership after the 2010 annual meeting season.

So far in 2011, companies generally have been slow to publicly announce a plan of action in response to a failed vote, taking a more gradual, deliberative approach. At most companies that ultimately make changes to their pay policies in response to a failed vote, there is likely to be significant lag time between the vote and the announcement of change, since thoughtful deliberation and internal buy-in will be a predicate to action. However, not all companies that had a failed vote this year feel the need to make changes, and, in many cases, changes to NEO compensation will not be the right decision. Before considering changes to NEO pay practices, many of these companies first are engaging in additional shareholder outreach to determine whether a failed vote can be turned around next year through better dialogue with larger shareholders. Some companies that experienced a failed SOP vote in 2011 have taken a different tack, instead publicly defending their pay policies and blaming the proxy advisory firms for the failed vote.

Conclusion

Most companies made it through SOP unscathed in 2011. However, because the SOP vote is a recurring, and for most companies annual, requirement, boards and companies, in conjunction with their advisors, must maintain an ongoing focus on SOP in order to ensure successful votes in future years.

The authors gratefully acknowledge the assistance of Richard Grubaugh and Rebecca Kral of D.F. King & Co. Inc. and of Francis Byrd at Laurel Hill Advisory Group in providing some of the data and other information used in this White Paper. All data in this White Paper is as of June 17, 2011.

Print

Print

One Trackback

[…] Read full follow up here……via The Votes Are In — Deconstructing the 2011 Say on Pay Vote — The Harvard Law School Forum on Cor…. […]