The following post comes to us from Andreas Neuhierl of the Department of Finance at Northwestern University, Anna Scherbina of the Department of Finance at UC Davis, and Bernd Schlusche, economist with the Board of Governors of the Federal Reserve System.

In our paper, Market Reaction to Corporate Press Releases, we provide a comprehensive investigation of how financial markets process various types of corporate news. The study argues that the importance of firm-level announcements should be assessed not only by investigating immediate stock price reactions but also by assessing their effect on firms’ informational environment.

This study became possible because of two important financial regulations that made corporate press releases a prevalent method of communicating new firm-level news to investors, Regulation Fair Disclosure, adopted in 2000 and the Sarbanes-Oxley Act implemented in 2002. These regulations mandate that publicly traded firm must disclose all private information that may have an impact on their market values and report changes in their “financial conditions and operations” in a timely fashion and simultaneously to all market participants. Firms routinely employ press releases as a way of achieving these objectives.

The dataset of corporate press releases was collected from a variety of newswire services, such as PR Newswire, BusinessWire, GlobeNewswire, and the like. The resulting dataset contains nearly all corporate press releases issued during the time period under investigation. Press releases are then classified into 60 news categories, formed with an objective of achieving a relative homogeneity in the news content within each category. While many types of financial announcements have been investigated in prior literature, a large number of other news categories have not due to the difficulty of collecting data.

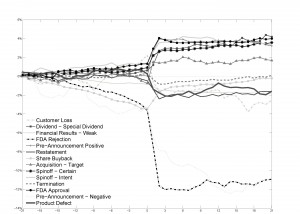

First, we find that most types of news announcements, and not only the extensively studied financial news, have large effects on stock prices and firms’ informational environments. The five news categories that elicit the most positive significant price reaction include: (1) pre-announcement of better-than-expected financial results, announcements of (2) share buybacks, (3) FDA approvals, (4) special dividends, and (5) an intent to spin of a subsidiary. The five news categories that elicit the most negative significant price reactions include: (1) the pre-announcement of disappointing financial results, announcements of (2) FDA rejections, (3) customer losses, (4) product defects, and (5) earnings restatements.

First, we find that most types of news announcements, and not only the extensively studied financial news, have large effects on stock prices and firms’ informational environments. The five news categories that elicit the most positive significant price reaction include: (1) pre-announcement of better-than-expected financial results, announcements of (2) share buybacks, (3) FDA approvals, (4) special dividends, and (5) an intent to spin of a subsidiary. The five news categories that elicit the most negative significant price reactions include: (1) the pre-announcement of disappointing financial results, announcements of (2) FDA rejections, (3) customer losses, (4) product defects, and (5) earnings restatements.

Second, many types of announcements lead to subsequent volatility increases because the news weakens investors’ valuation priors and prices start to react more strongly to subsequent new information. Not surprisingly, the types of news that result in largest volatility increases tend to be non-routine in nature. Finally, in line with regulators’ objectives, the results show that press releases tend to remove the informational advantage of firm insiders, as indicated by almost universal decreases in bid-ask spreads in the post-announcement period (the market microstructure literature argues that bid-ask spreads are a good proxy for the level of informational asymmetry about the stock value).

The full paper is available for download here.

Print

Print

One Trackback

[…] full article via Market Reaction to Corporate Press Releases — The Harvard Law School Forum on Corporate Governance…. Share OptionsPrintEmailMoreFacebookLinkedInStumbleUponTwitterPinterestRedditDiggTumblrLike […]