The following post comes to us from Ken Esch, partner in the Private Company Services of PricewaterhouseCoopers LLP. This post is based on a PwC publication, titled “Trendsetter Barometer, Business outlook report, Summer 2012;” the full document is available here.

Quarterly Highlights

PwC commissioned independent research firm BSI Global Research Inc. to interview 243 chief executive officers (CEOs/CFOs) of leading privately held US businesses in the second quarter of 2012. The interviewees were asked about their current business performance, the state of the economy, and their expectations for business growth over the next 12 months. We then compared their responses with the prior quarter’s results to see how the outlook has changed.

Key findings:

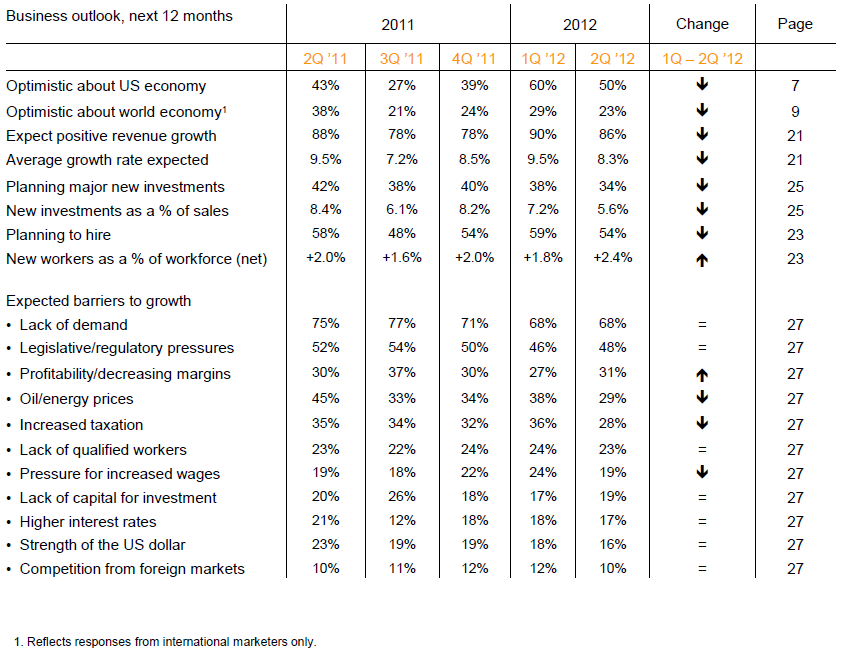

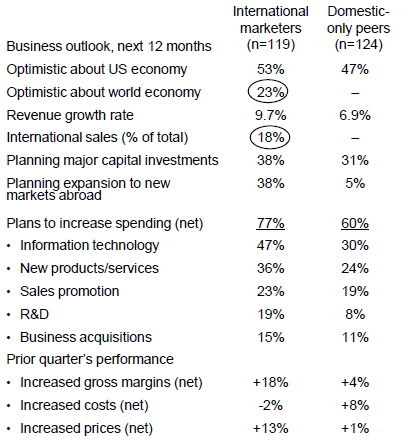

- US optimism still positive but less so. Optimism about the prospects for the US economy over the next 12 months dropped 10 points from last quarter’s high of 60 percent to a still-positive 50 percent. Pessimism remained low, at 12 percent. Thirty-eight percent of Trendsetter executives voiced uncertainty.Among companies selling abroad, optimism about the world economy for the next 12 months remained relatively low at 23 percent. An equal percentage registered pessimism (up 13 points). Over half, 54 percent, were uncertain. A year ago, optimism about the world economy was 15 points higher, at 38 percent.

- Revenue targets scaled back. Trendsetter executives lowered their own-company revenue forecasts for the next 12 months from 9.5 percent to 8.3 percent (down 13 percent). Much of this decrease is attributable to domestic-only companies, which dropped back to 6.9 percent, compared with 9.7 percent for international marketers. Calendar-year 2012 estimates for own-company growth is notably higher than 12-month forecasts — 10.0 percent versus 8.3 percent. Most Trendsetter companies (86 percent) expect positive revenue growth over the next 12 months: 33 percent expect double-digit growth and 53 percent single-digit growth. Only 5 percent expect negative growth, 7 percent zero growth, and 2 percent were not reported.

- Emerging markets activity remains strong. In the face of sustained uncertainty about the world economy, Trendsetter companies selling abroad lowered their expected contributions from international sales to total revenues over the next 12 months from 21 percent to 18 percent, similar to a year ago (19 percent). For revenue contributions from sales in emerging markets (26 percent) the drop-off was negligible (just 1 point). The majority of companies, 58 percent, reported that their international sales remained about the same. Overall, private businesses selling abroad forecast positive growth over the next 12 months, anticipating a 9.7 percent pace, despite some soft spots and continued uncertainty about world markets.

- Gross margins a concern. Concern about decreasing margins as a barrier to own-company growth over the next 12 months rose 4 points to 31 percent, a level similar to a year ago (30 percent). Yet gross margins were somewhat more positive: up for 29 percent, down for 18 percent, or a net 11 percent increase (up 3 points). Both costs and prices were moderately lower. Costs were higher for 17 percent, lower for 13 percent, or a net 4 percent with higher costs (off 9 points). Prices were higher for 16 percent, lower for 10 percent, or a net 6 percent with higher prices (off 4 points).

- Moderate pullback in spending. Thirty-four percent of Trendsetter companies are planning major new investments of capital over the next 12 months, similar to last quarter’s 38 percent, though 8 points lower than a year ago (42 percent). This slight decrease appears to come largely from international marketers (38 percent, down 10 points) — both in BRIC and other world markets.Operational spending anticipated for the next 12 months remained at levels similar to those noted the previous quarter. Increases are planned by 68 percent of Trendsetter companies, led by information technology (38 percent) and new products and services (30 percent). Lower levels of planned increases were reported for marketing and sales promotion (21 percent) and facilities expansion (17 percent). Plans to expand to new markets abroad (21 percent) were slightly higher than a year ago (18 percent). Mergers and acquisitions were reported by 15 percent and new strategic alliances by 23 percent.

- Majority of companies hiring. The majority of Trendsetter companies, 54 percent, plan to add to their workforce over the next 12 months; only 3 percent plan net layoffs, and 43 percent expect their workforce to stay about the same. Overall, these companies project a 2.4 percent increase to their headcount, up from 1.8 percent last quarter and 2.0 percent a year ago. Those hiring are more optimistic about the US economy (61 percent), expect a slightly higher US GNP (2.0 percent), are in segments with above-average industry growth (4.7 percent growth), and forecast double-digit own-company revenue growth (11.8 percent average).

- Barriers to growth. Concern about demand (68 percent) and legislative/regulatory pressures (48 percent) are the leading headwinds for the next 12 months. Lesser concern was noted about oil/energy prices (29 percent, down 9 points) and fear of increased taxation (28 percent, down 8 points). Concern about profitability/decreasing margins rose slightly to 31 percent.

Chart 1.1 International marketers outpace domestic-only peers

Note: International marketers have average revenue of $307.8 million; their domestic-only peers have average revenue of $358.2 million.

A quarter-by-quarter comparison of the key indicators shows the business outlook for the next 12 months and how the views of the survey panel have changed (see Chart 1.2). The pages that follow provide a detailed look at each question for the previous five quarterly surveys.

Chart 1.2 Key indicators for the business outlook

A quarter-over-quarter comparison of the key indicators shows how the 12-month outlook has changed. The change column indicates the movement of opinion from first-quarter 2012 to second-quarter 2012.

The full publication is available here.

Print

Print