The following post comes to us from David Drake, President of Georgeson Inc, and is based on a Georgeson report by Mr. Drake, Rajeev Kumar, and Rhonda Brauer; the full report, including tables, is available here.

The 2013 proxy season marks the third year of Advisory Vote on Executive Compensation proposals (Management Say on Pay (MSOP)) as required under the Dodd-Frank Wall Street Reform and Consumer Protection Act. In 2011, 36 U.S. corporations failed to receive majority shareholder support for their MSOP proposal and in 2012 that number increased to 59. Based on the YTD results for 2013, it seems that there could be fewer MSOP failures this year compared to 2012. In this report, we present some interesting facts relating to the 20 failed MSOP votes for annual meetings through May 17. [1]

1. Impact of Total Shareholder Return (TSR) Performance

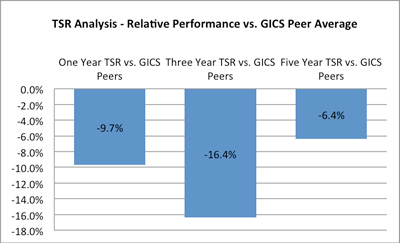

It is commonly understood that the pay for performance disconnect is one of the primary reasons for the negative recommendations from the proxy advisory firms and the failed MSOP votes. The chart below depicts the average TSR underperformance of these 20 companies compared to their four-digit GICS (Global Industry Classification Standard) peer group over one, three and five year periods. While the companies’ TSR performance trailed that of the median of their peers over each of the three time periods, the underperformance has been the greatest over a three-year TSR period.

*Source ISS Research Reports released prior to companies’ annual meetings

- On average, the 20 companies trailed the one-year TSR of the respective GICS peers by 9.7 percentage points, the three-year TSR by 16.4 percentage points and the five-year TSR by 6.4 percentage points.

- Fourteen of the 20 companies underperformed the one-year TSR of the GICS peer group, 13 of 20 underperformed the three-year TSR and 13 of the 20 trailed the five-year TSR.

- Ten of the 20 trailed the TSR of the GICS peers over the one-year and three-year periods.

- Six of the 20 trailed the TSR of the GICS peers in all three of the time periods.

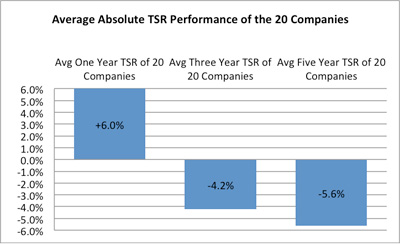

When looking at the absolute TSR performance of these companies, they averaged a +6% TSR over one-year and -4.2% and -5.6% over 3- and 5-year performance periods.

*Source ISS Research Reports released prior to companies’ annual meetings

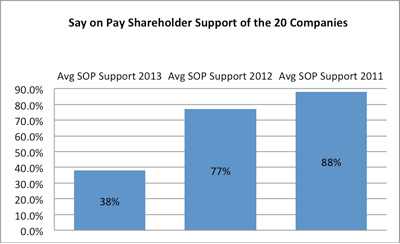

2. Trends in Vote Support

*Vote results from 8K filings and ISS Research Reports released prior to companies’ annual meetings

Many of the companies with failed votes experienced precipitous declines in support from prior years. There has been an approximately 40 percentage point average decline in vote support for these companies from last year. Even last year, these companies saw an average double digit decline in their support with the “For” votes declining from 88% in 2011 to 77% in 2012. Decline in support doesn’t necessarily result from changes in compensation policy. The timing of incentive payouts can greatly influence shareholders’ views of compensation programs.

- Of these companies, AXS had the largest percentage point drop, falling from 92% approval in 2012 to 32% in 2013. MIDD had the smallest decline, falling from 53% approval in 2012 to 48% in 2013.

- Notably, GTIV and CRK failed their MSOP vote for the second consecutive year while CCOI failed for the second time in three years (having also failed in 2011.)

- 2013 was the inaugural MSOP vote for PTSC, and DYSL [2] did not have a MSOP vote at their last shareholder meeting.

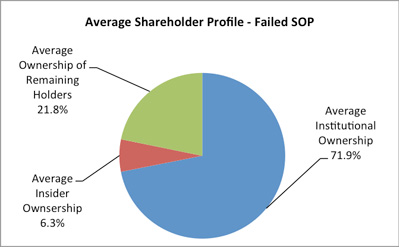

3. Ownership and Size Profile

*Source Thomson StreetSight

- Seventeen of these 20 companies had the majority of their shares held by institutions. On average, nearly 72% of the outstanding shares of this group were held by institutions.

- High insider ownership in the case of BH, DGIT and DYSL was not sufficient to avoid a failed vote. BH had over 15% of its outstanding shares controlled by insiders, DGIT had nearly 18% held by insiders and DYSL had 44% insider ownership, yet they garnered only 33%, 39% and 48% shareholder support respectively.

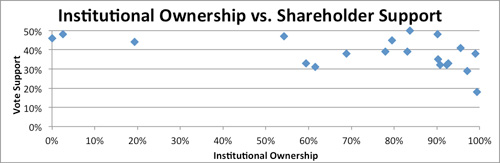

The following chart plots the level of shareholder support against their institutional ownership for these companies.

*Voting data source ISS; Institutional ownership data source Thomson StreetSight

- The market caps of these companies averaged nearly $3.2 billion and ranged from nano-cap DYSL (just under $8 million) to large-cap APA (over $32 billion.)

- APA is the only large cap company (market cap greater than $10 billion) in the group. It appears failed MSOP votes were concentrated in the small- and mid-cap space.

4. The Effect of Proxy Advisory Firms

- The effect of ISS and Glass Lewis is clearly apparent. ISS recommended “Against” the MSOP proposals for 18 of the 20 companies while Glass Lewis recommended “Against” 15 of the 20.

- The 15 companies that had both proxy advisors recommend “Against” averaged just 36% shareholder support.

- The three companies that received a “For” recommendation from Glass Lewis but an “Against” recommendation from ISS (APA, DGIT and VRML) averaged 44% shareholder support.

- DYSL and PTSC were the only two failing companies that had both proxy advisors recommend “For” their MSOP proposal and they had two of the highest levels of shareholder support among this group at 48% and 46% respectively.

- There were no instances of a “For” recommendation by ISS and an “Against” recommendation by Glass Lewis.

- ISS and Glass Lewis both cited problematic compensation practices and pay for performance disconnect as the primary reasons for their negative recommendations.

- ISS and Glass Lewis stated in their Voting Policy Updates that any company that received less than 70% shareholder support at their 2012 meetings would face a high level of scrutiny and they would expect an explicit response from the board with respect to shareholder engagement and actions taken as a result of the low vote. A lack of response by management to a failed or poor shareholder MSOP vote in 2012 would most likely result in an “Against” recommendation in 2013. This left CCOI (just 68% approval vote in 2012), MIDD (just 53% approval vote in 2012), GTIV (failed 2012 MSOP with 36% approval) and CRK (failed 2012 MSOP with 35% approval) susceptible to a negative recommendation from the proxy advisors and a failed vote in 2013…both of which came to fruition.

5. Conclusion

Mid-May marks roughly half-time of the 2013 Annual Shareholder Meeting season and as this review has gone to print, the failed MSOP’s has risen to over 40. Companies with problematic pay practices as identified by the major proxy advisory firms, a large institutional shareholder base and did not proactively reach out to shareholders (as strongly recommended by ISS and Glass Lewis) following a failed or low passage rate for their MSOP proposal at the 2012 meeting, are at risk at failing in 2013.

In July, Georgeson will publish an end-of-proxy-season review where we will examine all the failed MSOP votes in 2013 as well as review the companies that were able to turnaround a failed MSOP vote last year into a passing vote this year.

Endnotes:

[1] For a complete list of the 20 companies that failed their MSOP vote, the results of the shareholder votes and recommendations from proxy advisory firms ISS and Glass Lewis, please see Tables I and II in the full version of this document, available here and here.

(go back)

[2] Dynasil (DYSL) received 48% of the votes in support of the proposal counting abstentions. However, if abstentions were excluded, the proposal has passed (as reported in the company’s 8K filing) with a 78% favorable vote.

(go back)

Print

Print