The following post comes to us from Matthew Semadeni, Associate Professor of Strategy at Indiana University. This post relates to an issue of The Conference Board’s Director Notes series authored by Mr. Semadeni and Ryan Krause; the full publication, including footnotes, is available here.

One of the most contentious corporate governance issues for boards of directors is board leadership, and specifically whether sitting CEOs should also serve as board chairs. This report examines three types of CEO-board chair separation and their consequences on company performance.

To date, research on CEO-chair separation has yielded only one overarching conclusion: a CEO who also serves as board chair is no better or worse for company performance than an independent director serving as board chair. Nevertheless, many in the corporate governance field advocate for separation of the CEO and board chair roles. Here, we examine three possible types of CEO-board chair separation and their performance consequences. Our results suggest that if a company chooses to separate the CEO and board chair positions, particularly by demoting the CEO, the reason for the separation should extend beyond the conventional wisdom that doing so is “best practice.”

The debate over whether the CEO and board chair titles should be held by one or two individuals has raged for at least 20 years and shows no signs of abating. Companies like News Corp. and Wells Fargo recently faced shareholder proposals demanding that they split the top jobs. In response to such calls for separation, CEOs and many corporate directors often argue that separating the CEO and board chairperson roles risks losing unity of command, which is especially important in fast-changing environments. Commenting on splitting leadership roles, management theorist Henri Fayol wrote, “A body with two heads is in the social as in the animal sphere a monster, and has difficulty in surviving.” On the other hand, many members of the corporate governance community argue that a CEO who also chairs the board enjoys unchecked power that could potentially be used toward nefarious ends, and having a chief executive in such a position is akin to the “CEO grading his own homework.”

Many boards appear to be heeding governance experts’ advice to split the roles. Since the turn of the twenty-first century, public companies have witnessed a sizable shift in board leadership practice, with the percentage of large firms separating their CEO and board chairperson positions rising from 25 percent in 2002 to 43 percent in 2012, and the percentage of firms with truly independent board chairs (i.e., not the former CEO) rising from 13 percent in 2007 to 23 percent in 2012. At a time when boards are composed almost entirely of independent directors, board leadership constitutes one of the last remaining avenues through which CEOs can still exert power on the board. As such, the recent shuffling of board chair positions deserves close empirical scrutiny.

Performance Effects

Prior research has routinely failed to find any direct correlation between a firm’s choice of board leadership and its financial performance.1 As Dan Dalton and his colleagues described it in a 2007 paper, the lack of an evident relationship between board leadership structure and firm performance exhibits a “level of consistency…unusual in any literature.” However, most of this research has focused exclusively on comparisons across firms with relatively stable leadership structures. With more and more companies choosing to separate their top jobs, and many proxy firms and activist investors almost singularly focused on CEO-board chair separation, we felt that it was important to consider what such a change in corporate governance really entails and how it could potentially impact firm performance.

To begin, we predicted that the effect of splitting the CEO and board chair positions on future performance would be contingent on how the company was performing prior to the separation. In other words, rather than being a universal prescription for positive results, we posited that the effect of the separation would depend on how the company was doing at the time it split its CEO and board chair roles. Our prediction was based on the rationale that the separation, to have an effect, must be a reaction to something. We theorized that, for a separation to have a positive effect on future performance, it must be a reaction to poor company performance. Conversely, we predicted reacting to good performance with a separation event would have the opposite effect and hurt performance in the future.

Next, we identified three possible types of CEO-board chair separation. Apprentice separations, which are the most common, occur when the former CEO/chair retains the board leadership position but ushers in a new CEO. This is a fairly standard method of CEO succession, ensuring continuity of leadership from one individual to another. The second and less common type are departure separations, where the CEO/chair exits the firm and is replaced by two new individuals. This type of separation was endorsed by the Chairmen’s Forum, a group of current and former board chairs, in 2012. The third and least common type of separations are what we call demotion separations, where the CEO remains, but an independent director is appointed as chairperson. Chesapeake Energy underwent such a separation in 2012 following performance concerns and questions about the CEO’s personal finances.

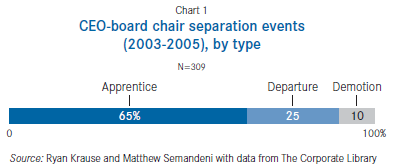

To study the impact of each type of CEO-board chair separation on company performance, we collected data on S&P 1500 companies that underwent a CEO-board chair separation between 2003 and 2005 and categorized each separation event as apprentice, departure, or demotion. We identified a total of 309 separation events. For a breakdown of separation events by type, see Chart 1.

The results of the analysis show strong support for the prediction that a CEO-board chair separation would promote strong future performance only when it followed weak performance, as well as for the hypothesis that a separation following strong performance would hurt performance going forward. We did not split past performance into strong and weak, but instead measured past performance along a continuum. Thus, the worse the past performance was, the better the result from a separation. In supplemental analysis, we examined whether firms reacted to poor performance by separating the CEO-board chair roles, and, in a manner consistent with prior research, found that they did not.

Given this, we fear that firms are undergoing a separation based not on performance necessity, but rather on a widely held misunderstanding about the universal efficacy of this governance change.

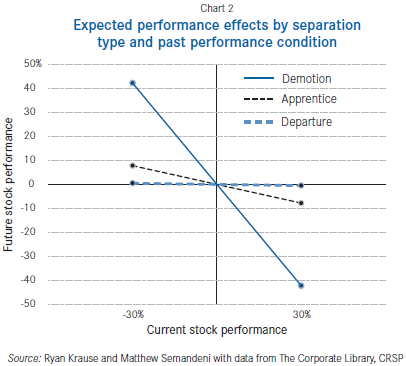

While demotions are the least common form of separation, they are typically what corporate governance activists seek when they call for a CEO-board chair split. These activists argue that unless an independent chairperson is appointed to oversee the CEO, no real change can occur. Shareholders of JPMorgan Chase & Co. proposed such a separation but the resolution failed to win majority support in a vote at the company’s May 21 annual meeting. Interestingly, the results from our study appear to back up their argument, at least in part. Our findings show that apprentice and departure separations had virtually no effect on company performance beyond the typical regression to the mean often seen in performance measures. Demotions, however, generated a considerable reversal of fortune for the firms that implemented them.

For poorly performing companies, demoting the CEO can be a real boost. Among the sample examined, a CEO demotion reversed a company’s annual stock return by 140 percent. So, if the company’s value declined by 4 percent and the board subsequently demoted the CEO, we would expect to see a shareholder gain of roughly 6 percent the next year.

Of course, reversal of fortune is not always desirable. Among the sample companies that were performing well, a CEO demotion sent the stock into a tailspin. While the board of a high-performing firm would appear to have no reason to demote its CEO, many companies have done so without regard for company performance. One example is security vendor Symantec, which announced the appointment of an independent board chairman in January on the heels of a 30 percent shareholder return the previous year. The impact of the change on performance remains to be seen. Chart 2 predicts how a firm undergoing each type of separation will perform under alternative past performance conditions.

In addition to measuring firm performance in terms of annual stock return, a fairly common measure, we collected data on securities analysts’ recommendations for each company’s stock (e.g., buy, sell, hold, etc.) and found a similar relationship. The worse the analysts’ consensus opinion of a company was prior to a demotion separation, the better the consensus opinion following the separation, and vice versa. We found no such relationship for either apprentice or departure separations.

The evidence from our study provides a very clear signal regarding CEO-board chair separation: if it ain’t broke, don’t fix it. Demotion separations can improve company performance, but only if performance was poor prior to the event. The stronger performance was prior to a demotion, the worse it became afterward. Apprentice and departure separations, which constituted roughly 90 percent of the separation events in the sample, had virtually no effect above and beyond that of just changing the CEO.

The findings raise the question, why would companies demote their CEOs absent a pressing performance need? From our perspective, it appears that boards are acquiescing to outside pressure from activist investors or corporate governance watchdogs to separate the CEO and chairperson positions because it is “best practice.” Based on the evidence from our study, we believe this approach is a mistake. While CEO-board chair separation can be beneficial if conducted properly and under the right circumstances, it can be detrimental to performance, akin to taking medicine when you are not sick, if undertaken without considering performance. In our view, boards should view their choice of leadership structure as a strategic concern to be assessed in the context of the company’s internal strengths/weaknesses and external opportunities/threats. In other words, the form of governance selected by the board is a reflection of how the company can best deploy its governance resources to gain and sustain a competitive advantage.

This perspective goes well beyond the baseline monitoring role that is the fiduciary responsibility of the board. The leadership of the board, like the board itself, can be the source of substantial knowledge and wisdom that can be leveraged to the company’s advantage. We believe that this approach, rather than unconditional submission to the desire of presumed “gatekeepers of good governance,” constitutes best practice in board leadership.

Not Separate for Long

We also looked beyond the mere performance effects of CEO-board chair separation to assess the permanency of each type. The results of this investigation provided further evidence that simply splitting the CEO and board chair roles does not, in and of itself, constitute a significant corporate governance change. Specifically, we found that many CEO-board chair separations were reversed in the subsequent year, with the reunifications also following a discernible pattern.

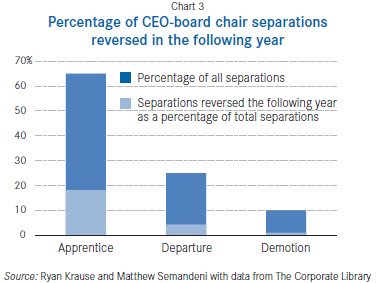

Chart 3 shows the breakdown of CEO-board chair separation events and the percentages of each type that were reversed in the following year. Perhaps not surprisingly, apprentice separations were the most likely to result in a recombination of the CEO and board chair roles (28 percent of the 201 apprentice separations were reversed in the subsequent year). This difference is statistically significant, indicating that the majority of these separations are only governance changes in the sense that the separation and reunification of the positions are part of an orderly CEO transition. Recent research in this area considers this transition only a “partial succession.” Consequently, it is not surprising that this governance change yields limited performance gains.

Departure separations were the second most likely to be reversed (17 percent of the 77 departure separations were reversed). The findings show that departure separations were more likely to lead to a subsequent recombination of the CEO and board chair positions if the company’s post-separation performance was strong. If post-separation performance was weak, the company was likely to retain the separate leadership structure. This indicates that a departure separation constitutes a trial period of sorts for the incoming CEO. If he/she performs well in the first year, the board is likely to bestow the additional role of chair on the CEO. If company performance is poor, the board will keep the separate chair in place.

Demotion separations were the least likely to be reversed; only 10 percent were recombined in the subsequent year. This may explain why demotion separations have the greatest impact on performance. They are a conscious decision by the board to alter the company’s corporate governance, whereas apprentice and departure separations are more often just CEO transition mechanisms. Again, this demonstrates that demotion separations are the key to actual corporate governance change. Whether that change is warranted, however, is contingent on the company’s prior performance.

Implications for Boards of Directors

The implications of our research are clear: when and how companies separate their CEO and board chair positions impacts future performance. Specifically, the company’s performance at the time of the separation dramatically impacts future performance if the separation is a demotion, but current performance does not impact future performance if the split is an apprentice or departure separation.

The findings raise several questions for boards. For example, is performance suffering under the CEO’s command? Is it poor enough to justify a change in board leadership structure? If so, how should that separation be undertaken? Considerable prior research and our own supplemental analyses demonstrate that companies have not considered company performance when choosing to separate their leadership roles. We believe this is a strategic mistake. The evidence shows that failing to consider those questions, as well as the company’s performance and separation type prior to implementing a separation, can have dire consequences. As such, we caution boards against separating their CEO and board chair roles without assessing their own company performance and needs. If the board feels that the company’s performance necessitates a change in leadership, we suggest that the directors consider a demotion separation, since it is the only type of separation with a demonstrable effect on performance.

Print

Print