Margaret E. Tahyar is a partner in the Financial Institutions Group at Davis Polk & Wardwell LLP. The following post is based on the introduction to a Davis Polk client memorandum by Luigi L. De Ghenghi and Andrew S. Fei; the full publication, including visuals, tables, timelines and formulas, is available here.

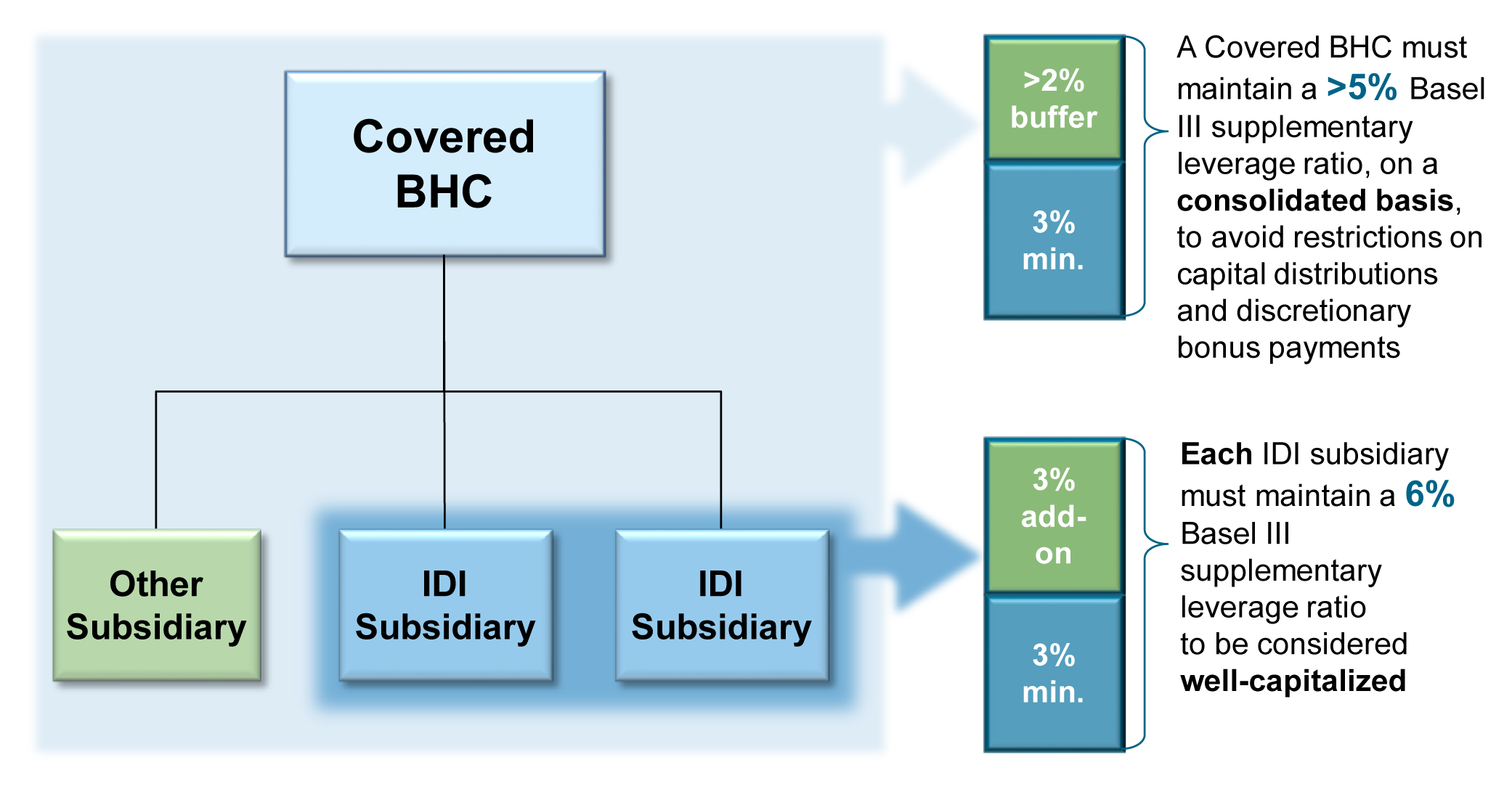

On the heels of publishing the U.S. Basel III final rule, the U.S. banking agencies have proposed higher leverage capital requirements for the eight U.S. bank holding companies that have been identified as global systemically important banks (“Covered BHCs”) and their insured depository institution (“IDI”) subsidiaries. The higher leverage capital requirements, which we are calling the American Add-on, build upon the minimum Basel III supplementary leverage ratio in the U.S. Basel III final rule.

The proposed American Add-on would require a Covered BHC’s IDI subsidiaries to maintain a Basel III supplementary leverage ratio of at least 6% to be considered well-capitalized under the prompt corrective action framework. The American Add-on also requires Covered BHCs to maintain a leverage buffer that would function in a similar way to the capital conservation buffer in the U.S. Basel III final rule. A Covered BHC that does not maintain a Basel III supplementary leverage ratio of greater than 5%, i.e., a buffer of more than 2% on top of the 3% minimum, would be subject to increasingly stringent restrictions on its ability to make capital distributions and discretionary bonus payments. The proposed effective date of the American Add-on is January 1, 2018.

The Basel III supplementary leverage ratio used in the proposed American Add-on is broadly similar to the leverage ratio contained in the 2010 version of Basel III. The Basel Committee on Banking Supervision has recently proposed important changes to the Basel III leverage ratio. As expected, most of these changes relate to the denominator of the ratio, the Exposure Measure, including how derivatives and securities financing transactions should be taken into account and the scope of consolidation for inclusion of exposures in the denominator. A number of the revisions are intended to neutralize key differences between U.S. and international accounting standards, particularly with respect to the accounting treatment of derivatives and securities financing transactions, by “grossing up” exposures in order to achieve a more consistent measure of leverage across banks that operate under different accounting regimes. The U.S. banking agencies stated that they will consider whether to revise the Basel III supplementary leverage ratio once the Basel Committee has finalized its revisions.

The full memorandum, which uses visuals, tables, timelines and formulas to analyze key aspects of the proposed American Add-on and the Basel Committee’s proposed revisions to the Basel III leverage ratio, is available here.

Print

Print