The following post comes to us from Ted Wallace, Senior Vice President in the Proxy Solicitation Group at Alliance Advisors LLC, and is based on an Alliance Advisors newsletter by Shirley Westcott. The full text, including tables and footnotes, is available here.

During this year’s annual meeting season, issuers experienced better outcomes on say on pay (SOP) and shareholder resolutions, underpinned by a high degree of engagement and responsiveness to past votes. With SOP in its third year, companies addressed many of investors’ and proxy advisors’ pivotal compensation concerns, which was reflected in a modest improvement in average SOP support and proportionately fewer failed votes.

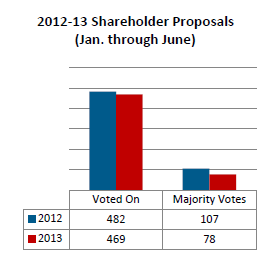

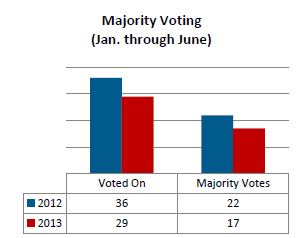

Similarly, although the volume of shareholder resolutions on ballots was nearly comparable to the first half of 2012, average support declined across many categories and there were 27% fewer majority votes (See Table 1). This was due in large part to corporate actions on resolutions that are traditionally high vote-getters, such as board declassification, adoption of majority voting in director elections, and the repeal of supermajority voting provisions, resulting in the withdrawal or omission of the shareholder proposal. Indeed, issuers made a conscious effort to avoid the prospect of majority votes, mindful of potential fallout against directors by proxy advisory firms. Beginning in 2014, ISS will oppose board members who fail to adequately address shareholder resolutions that are approved by a majority of votes cast in the prior year, while Glass Lewis is scrutinizing board responses to those that receive as little as 25% support (see our January newsletter).

On more problematic shareholder proposal topics, the occurrence of majority votes was in many cases a function of the issuers’ and proponents’ willingness to fight. In the aftermath of the “London whale” trading scandal, JPMorgan Chase stood down a controversial vote on Jamie Dimon’s chairmanship by mounting a massive communications campaign to sway investor opinion. Nabors Industries similarly beat back a second-year proxy access proposal by conducting extensive engagement with investors, striking a standstill agreement with its largest shareholder, and changing its method of vote counting to include broker non-votes as “against” votes. In contrast, weak rebuttals left CF Industries Holdings with the distinction of receiving this year’s only three majority votes on environmental and social proposals, including two (sustainability and political contributions reporting) that achieved record levels of support.

Proponents, for their part, have become more aggressive in advocating on behalf of their resolutions, often through exempt solicitations or dedicated websites. According to FactSet Research, 48 exempt solicitation notices were filed in conjunction with 2013 annual meetings, compared to 50 in 2012 and 27 in 2011, 35 of which sought support of shareholder proposals. Such expanded communications efforts helped deliver majority votes on proxy access resolutions at Century Link and Verizon Communications and on a “maximize value” proposal at Timken.

This article reviews some of the prevalent issues that arose during this year’s proxy season and looks ahead at those on the horizon for 2014.

Say On Pay

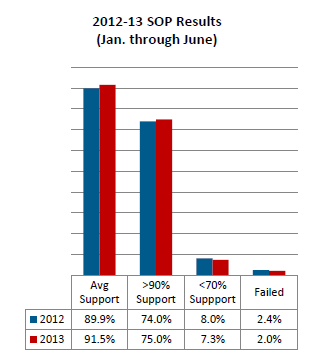

As a whole, issuers posted better results on SOP this season than in the first half of 2012, with fewer failures and fewer proposals receiving less than 70% support, the threshold at which ISS gives enhanced scrutiny to companies’ pay practices (Glass Lewis’ threshold is 75%). Statistics for 2013 indicate:

- Average support for SOP was 91.5%, compared to 89.9% in 2012

- 75% of companies received over 90% support, compared to 74% in 2012

- 7.3% of companies received less than 70% support, compared to 8% in 2012

- 2% of SOP votes failed, compared to 2.4% in 2012 (53 companies both years)

Much of the improvement in results occurred among large-cap firms, which, through extensive outreach efforts, have become attuned to investors’ pay irritants as well as proxy advisors’ policies. This season only four S&P 500 companies failed their SOP votes (Abercrombie & Fitch, Apache, Boston Properties, and Nabors Industries), compared to 12 in the first half of 2012.

The vast majority of companies that failed SOP in 2012 turned around this year’s votes either by addressing investor concerns or by registering better financial results (See Table 2). Of the 47 that have held their 2013 annual meetings, over 80% passed their SOP vote this year and 43% passed with over 90% approval. Nevertheless, a handful of companies continue to be repeat pay offenders. Ten firms have failed SOP multiple times between 2011 and 2013, including three (Kilroy Realty, Nabors Industries, and Tutor Perini) that have failed for the past three consecutive years (See Table 3). Among firms that received less than 70% SOP support in 2012, 32 (28%) saw further slippage of their votes in 2013, including 16 firms (14%) that failed.

Proxy advisor recommendations continue to have a strong impact on SOP outcomes. This year, both ISS and Glass Lewis opposed proportionately fewer SOP proposals than last year: 11% in the case of ISS (versus 13% in 2012) and 14% in the case of Glass Lewis (versus 16% in 2012). However, over half of the companies that received a negative ISS recommendation on SOP (53%) received less than 70% support. Adverse ISS opinions were also associated with 93% of the failed SOP votes. (A breakdown of Glass Lewis’s recommendations is not available.) Pay- for-performance (PFP) disconnects were the primary driver of proxy advisor dissent on executive pay plans.

Despite this influence, studies caution companies against making pay reforms to simply conform to proxy advisor policies. Academics at Stanford University and the University of Navarra found that a significant number of firms change their compensation programs prior to the shareholder vote in a manner favored by proxy advisors to avoid a negative recommendation. However, the stock market reaction to these changes was negative. Similarly, Towers Watson observed increasing uniformity in pay program design among S&P 1500 firms, particularly in their use of total shareholder returns (TSR) as a performance measure, which is a key factor in proxy advisors’ evaluation of pay-for-performance alignment. However, over- reliance on TSR can result in overpaying executives for past performance and market-based share price fluctuations rather than for sustained long-term value creation.

Proxy Access

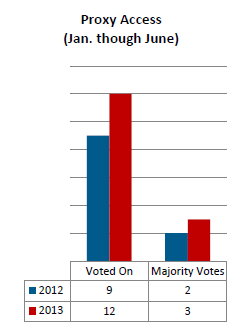

Proxy access resolutions made a light appearance again this season but with a marked shift towards higher ownership and holding requirements for nominating directors. Of the 12 shareholder resolutions on ballots through June, five sought access rights for holders of 3% of the shares for three years. A sixth is scheduled for Darden Restaurants’ September annual meeting. Other than at Microwave Filter, which has sizable hedge fund ownership, these proposals garnered the highest level of support including several majority votes (See Table 4).

More striking in this round of access proposals is that governance and compensation concerns were less determinant of vote outcomes than in 2012. Walt Disney was able to comfortably defeat a 3%/3-year resolution despite two years of high dissent on say on pay (SOP) and criticism over its recombining the chairman and CEO positions. Nabors Industries also saw scaled back support on a repeat access proposal in the face of longstanding opposition to its compensation practices. In contrast, 3%/3-year proposals won majority support at Verizon Communications (52.3%) and CenturyLink (an astounding 71.5%), notwithstanding the companies’ strong governance practices and consistently high levels of SOP approval.

Low threshold access proposals reprised by Norges Bank Investment Management (NBIM) and retail investors affiliated with the U.S. Proxy Exchange (USPX) failed to gain any additional traction this year, even with some modifications. Average support for NBIM’s resolutions (33.8%) was unchanged from last year (33.7%), while average support for the USPX proposals dropped from 14.7% in 2012 to 9.2% 2013. This year, NBIM switched to non-binding resolutions, though sticking to its 1%/1-year formulation, while the USPX revamped its convoluted two- tiered eligibility requirements: one or more shareholders collectively holding 1%-5% of the shares for two years, or a party of 50 or more shareholders, each holding at least $2,000 of stock for one year. While it is unclear if these proponents will shift up to higher threshold proposals in the future, NBIM was willing to withdraw its 2013 submission at Western Union in exchange for the company adopting a 3%/3-year proxy access bylaw.

Aside from Western Union, Hewlett-Packard was the only other early adopter of proxy access this year, also in response to activist pressure. Chesapeake Energy followed up last year’s majority-supported shareholder resolution with a management proposal, but it failed to receive the requisite two-thirds approval. Its proposed proxy access regime, like Hewlett-Packard’s and Western Union’s, mirrored the SEC’s vacated Rule 14a-11.

Board Declassification

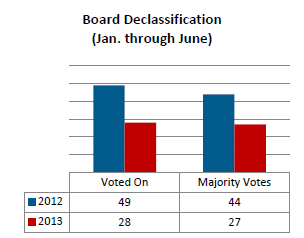

This was a milestone year in terms of large-cap companies shifting to annually elected boards, largely due to a coordinated campaign by public pension funds affiliated with the Harvard Law School Shareholder Rights Project (SRP), which targeted over 75 S&P 500 and Fortune 500 companies with declassification resolutions. Through June, the number of management resolutions to repeal classified boards was more than triple the number of shareholder resolutions (85 versus28), and the number of large-cap firms with classified boards dropped significantly from the beginning of the year: from 17% to 11% of the S&P 500 and from 20% to 17% of the Fortune 500. More corporate adoptions can be expected in 2014. Of the shareholder resolutions voted on through June, only one (at Reynolds American) failed to win majority support.

While these results are encouraging for shareholder proponents, the sticking point for further progress on board declassification—at least in the large-cap universe—will be the issuers that have supermajority vote requirements to amend their charters. Two-thirds of this year’s management resolutions needed supermajority approval, and half of these failed. Repealing the supermajority provisions is equally challenging. Of the 30 companies that tried to reduce or eliminate their supermajority requirements this season, 12 were unsuccessful. In view of this, the SRP and other proponents could very well start migrating their declassification campaigns to mid- and small-cap companies. The SRP is reportedly considering expanding to other issues as well, such as proxy access or majority voting.

Majority Voting

Shareholder proposals calling for majority voting in uncontested director elections were on the decline this year, both in the number filed, which was down by half from 2012, and in average support (59.4% versus 62.5% in 2012).

Polling trends, however, fail to capture the actual progress activists are making on this issue. Extensive behind-the-scenes efforts by the two leading proponents—the California State Teachers’ Retirement System (CalSTRS) and the United Brotherhood of Carpenters and Joiners of America (UBC)—have often resulted in corporate adoptions of majority voting through bylaw amendments. According to FactSet Research, 84% of S&P 500 firms and 21% of Russell 2000 firms now have a majority vote standard, and another 9% of the companies in each index have plurality voting with a director resignation policy (“plurality plus”).

Shifts in targeting and the extent of issuer resistance to the proposals have also caused fluctuations in year-to- year vote results. Average support for majority voting was exceptionally high in 2012 because of the number of boards that chose not to oppose the shareholder resolution. Additionally, there has been a steady decline in recent years in the proportion of majority voting resolutions receiving shareholder support because many of the targeted companies, particularly large caps, have adopted director resignation policies. Although proponents consider plurality plus to be a half-measure, many investors regard it as substantially equivalent to a majority vote standard.

“Zombie” Directors

Underpinning the case for majority voting are directors who remain on their boards or are reinstated after being opposed by a majority of votes. Through June, 84 directors at 48 companies were rejected by shareholders, including six whose directors were voted down for a second or third consecutive year, largely in protest over compensation programs or for failing to adopt a majority-supported shareholder resolution. Only nine of the 48 firms had majority voting or director resignation policies in place, yet in some cases these measures had limited utility. Although the directors offered to step down, three firms (Commonwealth REIT, Hospitality Properties Trust, and Nabors Industries) simply reappointed them to the board.

Frustrated over intransigent boards, the Council of Institutional Investors (CII) is urging the New York Stock Exchange and Nasdaq stock market to propose rules mandating listed companies to adopt majority voting along with a requirement that failed directors resign and not be reappointed. CII made a similar appeal last year to the American Bar Association and Delaware State Bar Association. Meanwhile, the California Public Employees’ Retirement System (CalPERS) announced in April that it would ferret out some 52 “zombie” directors and press companies not to re-nominate them. Repeat pay offenders can also expect more fallout against compensation panels. Already this year, compensation committee members at five companies with recurring SOP failures (Big Lots, Kilroy Realty, Nabors Industries, Stillwater Mining, and Tutor Perini) were delivered a majority of dissenting votes.

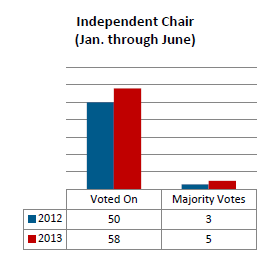

Independent Chairman

Shareholder proposals calling for an independent board chairman were plentiful again this proxy season with nearly 90 filed, but support levels were down as more and more companies upgraded the roles of their lead directors. Of the 58 proposals voted on through June, average support dipped to 31.2% from 34% in 2011 and 2012.

Proxy advisor recommendations had a significant impact on the results. Although Glass Lewis generally supports independent chairman proposals, ISS endorsed proportionately fewer of these resolutions this year (47%) than last year (75%). A key driver of ISS’s recommendations is not only the establishment of an independent lead director to counterbalance a dual chairman/CEO, but the scope of the person’s duties. Because companies have often fallen short in this regard in the past, a number of issuers expanded their lead directors’ responsibilities this year to align with ISS’s policy. Typically, these included giving the lead director the authority to preside at board meetings when the chairman is not present, approve board meeting schedules and agendas, call special meetings of the independent directors, and communicate directly with major shareholders. In most cases, these enhancements resulted in a reversal of ISS’s opinion on the resolution in 2013 as well as significantly lower voting support.

Lead directors aside, other factors can influence investor and proxy advisor opinions on independent chairman proposals, such as poor financial performance, oversight failures, and problematic governance or compensation practices. Of the five resolutions that scored majority votes this season, four reflected shareholder discontent over pay programs or failure to adopt majority-supported shareholder resolutions. Financial results can prove even more decisive. Subpar shareholder returns tipped the proposal over the majority mark at Kohl’s, while stellar performance under Jamie Dimon’s leadership swung a highly contentious vote at JPMorgan Chase in the company’s favor. McKesson shareholders were equally challenged at their July 31 annual meeting in weighing Chair/CEO John Hammergren’s performance— including a tripling of the company’s market value during his tenure—against his copious pay package. Last year an independent chairman proposal won majority support at McKesson, but was supplanted this year by a “vote no” campaign by CtW Investment Group against Hammergren and two committee chairs. All of the McKesson directors were re-elected.

Board Diversity and Tenure

Companies continued to be responsive this year to shareholder initiatives to improve their ethnic and gender diversity. Of the 25 proposals filed to date, only three have come to a vote, receiving average support of 35.8%, including one majority vote (at CF Industries Holdings).

Various studies have pointed to the benefits of diverse boards. Most recently, Thomson Reuters found that across 4,100 global companies, shares of those with mixed-gender boards matched or outperformed the MSCI benchmark index over the past 18 months, while shares of those with no female directors underperformed their gender-diverse peers. Yet among U.S. public companies, the level of female representation on boards has risen by less than 5% in the past ten years, according to Governance Metrics International (GMI).

Slow progress on board diversity is often linked to low board turnover. GMI data shows that 34% of the independent directors at Russell 3000 companies have served a decade or more, up from 18% in 2006, while Spencer Stuart reports that in 2012 S&P 500 companies elected the smallest number of new directors in ten years. As a result, director tenure may come under greater shareholder scrutiny in the upcoming year due to both diversity and independence concerns. Recently, CII announced that it would urge its constituents to look more skeptically at long-serving directors whose lengthy ties to their companies may compromise their ability to fully exercise independent judgment.

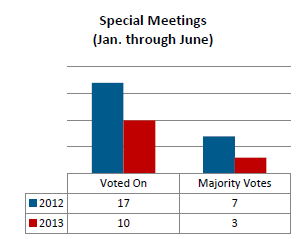

Special Meetings

Retail activists’ longstanding campaign to allow 10% shareholders to call special meetings receded this year as proponents shifted more attention to written consent and other topics. Filings of special meeting resolutions—largely by John Chevedden, William and Kenneth Steiner, and James McRitchie—were down by half of their 2012 level, and over half of those submitted were ultimately excluded due to competing management resolutions or technical deficiencies.

Of the 10 shareholder proposals on ballots through June, average support remained high (41.9% versus 45.4% in 2012), buoyed by across-the-board endorsement by ISS, which favors the proponents’ 10% ownership threshold. However, this year’s votes, particularly on resubmissions (See Table 5), reconfirmed investors’ preference for higher ownership requirements for shareholders to call special meetings. Only three resolutions received majority support: at Edwards Lifesciences and Xylem, which have no special meeting rights, and at SunEdison, which only grants the right to holders of a majority of shares.

As retail proponents back off this campaign, institutional activists may fill in the void. CalSTRS, for example, presented a binding resolution a Freeport McMoRan Copper & Gold’s July 16 annual meeting that would permit 15% holders to call special meetings. The proposal was approved by 55.4% of shareholders present and entitled to vote (70.7% of the votes cast for and against).

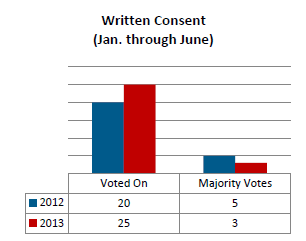

Written Consent

Chevedden and his affiliates bolstered their filings of written consent proposals this year (38), but this campaign also appears to be losing steam due to a combination of omissions and waning investor interest in the issue. Virtually all of the targeted companies provided their shareholders with the alternative ability to call special meetings, which is a more orderly and inclusive mechanism for shareholder action between annual meetings.

Of the 25 written consent proposals voted on through June, average support declined to 40.7% from 45.7% in 2012. This was particularly pronounced among resubmissions where support levels stagnated and in some cases dropped substantially (See Table 4). Eastman Chemical and Gilead Sciences, for example, turned around last year’s slim majority votes on the resolution, while General Electric ratcheted down support by reducing the ownership threshold for calling special meetings from 20% to 10%. This prompted ISS to oppose the written consent resolution at General Electric, as well as at Johnson Controls and Prudential Financial, which also permit 10% shareholders to call special meetings. Only three written consent proposals received majority support this season (at Allergan, Duke Energy and Occidental Petroleum), though in two cases by narrow margins.

Over a half dozen issuers preempted the shareholder resolutions by offering up their own versions of written consent, typically with procedural protections to prevent abuse. Many of these parameters are becoming standardized:

- A minimal share ownership to initiate a consent (ranging from 10% to 40%), usually conforming to the company’s ownership threshold for calling special meetings,

- A requirement that consents be solicited from all shareholders,

- Restrictions on the timing and agenda of consents,

- A blackout period for submitting executed consents (e.g., no earlier than 50-60 days after record date) to ensure that shareholders have sufficient time to consider the action, and

- A staleness provision (e.g., consents must be delivered 120 days after record date or after the first consent is delivered).

Although ISS prefers that shareholders have “unfettered” written consent rights, it has continued to support management resolutions that contain procedural safeguards. The proponents similarly object to any material restrictions in written consent provisions. This year they sought to revoke the requirements at Altera and Home Depot that a certain percentage of shares ask for a record date and that all shareholders must be solicited, but both resolutions were omitted as vague and indefinite.

Lobbying and Political Contributions

Activists kept up the pressure on companies this season to disclose their lobbying and political spending, particularly funds funneled through trade associations and 501(c) social welfare organizations, which are not required to reveal their donors. For a second year, resolutions related to campaign finance constituted the most prominent shareholder proposal category, with over 130 filed—nearly half of which dealt with lobbying activities. Yet despite the barrage of proposals, there were only minor gains in shareholder support, which averaged 24.7% on lobbying proposals (versus 23.3% in 2012) and 31.4% on traditional disclosure proposals that follow the Center for Political Accountability’s (CPA) format (versus 28% in 2012). Only one political spending proposal received majority support this year (at CF Industries Holdings).

Proxy advisor recommendations on the resolutions were mixed but influential. As in 2012, ISS backed virtually all of the CPA-style resolutions, except at Republic Services and WellPoint. Voting support was the lowest at these two companies (in the mid-teens), as well as at AutoNation and Seaboard which have high hedge fund and insider ownership, respectively. ISS continued to be split on lobbying proposals, but supported somewhat more (74%) than in 2012 (68%). Total voting on these also fell in line with ISS’s recommendations: below 15% where ISS opposed the resolution and above 20% where ISS supported the resolution.

More extreme variations of political contribution proposals were summarily rejected by both investors and proxy advisors, receiving only single-digit support. These included NorthStar Asset Management’s requests to incorporate company values into political and electioneering contribution decisions and proposals calling for a moratorium on all political spending.

While campaign finance resolutions haven’t gained solid traction among mainstream investors, the proponents’ efforts have paid off in other ways. The CPA reported in May that 16 companies committed this year to enhancing their political spending disclosures, bringing to 117 the total number of voluntary adoptions among large-cap firms since 2003. Shareholder campaigns have also kept the issue visible in conjunction with a 2011 rulemaking petition that is before the SEC. Although the Commission affirmed this spring that it is not currently working on a disclosure proposal, Congressional Democrats have reintroduced bills mandating disclosure of corporate political expenditures (H.R. 2214, the Corporate Politics Transparency Act and H.R. 2670, the Openness in Political Expenditures Now Act) or requiring board and shareholder approval of them (H.R. 1734, the Shareholder Protection Act).

Pro-business advocates meanwhile continue to push back against efforts by special interest groups to curtail companies’ political and policy advocacy under the guise of transparency. In April, House Republicans sponsored legislation (H.R. 1626, the Focusing the SEC on Its Mission Act) to prohibit the SEC from enacting disclosure rules on the basis that the Commission should focus on its core mission and backlogged rule- making agenda, rather than expend time and resources on advancing social policy. Business organizations followed suit by sending letters to Fortune 200 companies urging them to resist efforts to force public companies to disclose their political contributions. They argue that the intent of activists—primarily unions, public pension funds, and environmental groups—is to use disclosures to censure political opponents and intimidate businesses into withdrawing from political engagement.

Compensation-Related Proposals

Shareholder proposals on executive compensation are making a revival after dropping off in volume in 2011 when mandatory SOP went into effect. Through June, 89 pay-related proposals appeared on ballots, compared to 76 in 2012 and around 50 in 2011. However, nearly three quarters of the resolutions, filed primarily by labor funds and the Chevedden group, dealt with two issues: adopting a stock retention policy and limiting the accelerated vesting of equity awards following a change in control (CIC).

Both types of proposals are intended to better link executive pay to long-term performance. Although many companies have stock ownership guidelines, the proponents argue that a meaningful retention ratio, such as 75% of net after-tax shares held to retirement or termination of employment, would go further to align the interests of executives with those of shareholders. Similarly, CIC severance packages can result in sizable payouts to executives that are untied to performance. According to Bloomberg Businessweek, at least a dozen executives of S&P 500 companies are eligible to receive over $100 million if dismissed, largely from accelerated payments of unvested equity awards. The proponents want to curb such payouts other than pro rata vesting of awards up to termination or, in the case of performance-based awards, partial vesting to the extent performance goals have been met.

Neither measure has resonated solidly with investors, notwithstanding robust backing from ISS. Average support for the stock retention proposals (23.7%) was relatively unchanged from 2012 (24.3%), while average support for the accelerated vesting proposals fell to 33.4% from 37.4% in 2012. Because of their often prescriptive nature, compensation resolutions hardly ever win majority approval other than in exceptional circumstances. This year, only one proposal held that distinction: a severance-related initiative at Nabors Industries, whose troublesome pay practices have resulted in multiple years of failed SOP votes.

Union pension plans introduced two new compensation proposals this year, which received modest levels of support. The first requested that companies specify the performance metrics used in compensation plans that are intended to qualify for a tax deduction under IRS Section 162(m). The two voted on (at Abercrombie & Fitch and Nabors Industries) received 23.2% average support along with ISS’s endorsement. The second type of proposal addressed the practice of benchmarking CEO pay to that of peers, which proponents blame for escalating pay levels. The variation submitted by the AFL-CIO (to not benchmark CEO pay above the 50th percentile of peers) received 21.9% at Waste Management, while a more restrictive version filed by the Utility Workers Union of America (to end the practice of pay benchmarking altogether) was largely shunned, scoring less than 12% support at Consolidated Edison, FirstEnergy, and NiSource.

Clawbacks

Offline, union and public pension plans made inroads on strengthening corporate clawback policies even beyond the gross misconduct and financial restatement requirements of the Sarbanes-Oxley and Dodd-Frank Acts. This spring, six pharmaceutical companies and an investor coalition led by the UAW Retiree Medical Benefits Trust agreed to a set of principles that expand recoupment parameters as follows:

- Broadening triggers to include a material violation of company policy related to the sale, manufacture, or marketing of healthcare services that has caused significant financial harm to the company,

- Extending recoupment to both the individuals responsible for compliance failures and their supervisors,

- Giving compensation committee members the discretion to recover not only incentive compensation paid, but also to reduce compensation that has not yet vested or been paid, and

- Publicly disclosing recoupment decisions.

The UAW also withdrew shareholder resolutions at Boston Scientific, Healthways, and Quest Diagnostics after the companies agreed to expand their clawback policies in line with the principles.

Separately, the New York City Comptroller persuaded three financial institutions (Capital One Financial, Citigroup, and Wells Fargo) to enhance their recoupment policies to cover any wrongdoing caused by executives or their subordinates that result in serious financial or reputational harm to the company. This is in line with agreements reached last year with Goldman Sachs, JPMorgan Chase, and Morgan Stanley. This year’s commitments, however, also included disclosure of any recoupment actions taken and, in the case of Capital One, the amount recovered

Because of these successful negotiations with issuers, only two clawback resolutions (at Wal-Mart and McKesson) have gone to a vote this year. The resolution at Wal-Mart, which already has a strong recoupment policy, including annual disclosure of any NEO compensation recovered, received 14.8% support. The proposal at McKesson received majority support.

Pay Ratios

Mandatory disclosure of CEO-to-median worker pay ratios, pursuant to the Dodd-Frank Act, could add another complexity to future SOP votes and provide an additional focal point for the targeting of shareholder resolutions. Recently, SEC Chair Mary Jo White confirmed news reports that the Commission planned to introduce a proposal within the next two months, which would be followed by a public comment period.

While it is unclear how proxy advisors and institutional investors might factor pay differentials into their reviews of executive compensation, they have historically been unsupportive of shareholder proposals seeking such information. This year, three resolutions seeking disclosure or caps on the disparity between executive pay and that of the lowest paid workers averaged 10.9% support. Qube Investment Management, a Canadian socially responsible investment firm, has filed three additional resolutions for fall annual meetings to limit senior executive compensation to 100 times the average pay of full-time non-contract employees. According to data compiled by Bloomberg, the average multiple of CEO compensation to that of rank-and-file workers at S&P500 companies is 204, up 20% from 2009.

Dissident Compensation Schemes

Special incentive arrangements between dissident groups and their board candidates have opened a new debate over director independence and conflicts of interest. In this year’s proxy fights at Agrium and Hess, hedge funds Jana Partners and Elliott Management offered to pay their nominees sizable bonuses if they won election and met certain short-term performance goals. Critics, including academics and CII, argue that differential director compensation schemes can balkanize boards, foster risky behavior, and create a subset of directors who are loyal to the dissident rather than the company. The proxy advisors have not taken a formal position on the issue.

In reaction, at least one company—Halliburton—has recently adopted a bylaw that would disqualify any proposed director nominee who has entered into a compensation, reimbursement, or indemnification arrangement with a third party in connection with his board candidacy or service. Other companies can be expected to follow suit.

Exclusive Jurisdiction Bylaws

Last year’s shareholder challenges to board-adopted forum selection bylaws reached a resolution in late June when the Delaware Chancery Court upheld their validity in shareholder suits against Chevron and FedEx. Over 250 companies have adopted such provisions, which designate Delaware as the exclusive jurisdiction for litigating intra-company disputes.

In addition to the multi-jurisdictional strike suits that accompany many merger and acquisition transactions, the decision will better position companies to deal with the recent wave of executive compensation lawsuits that are largely filed outside of Delaware. In 2012, shareholder plaintiffs filed 22 suits and announced 70 investigations that sought to enjoin SOP votes over allegedly deficient compensation disclosures. These were either dismissed or settled and no other SOP injunctive lawsuits have materialized in 2013. Nevertheless, legal actions to enjoin binding shareholder votes on equity plans may still arise.

While the ruling will encourage more adoptions of forum selection bylaws, issuers may still face backlash from some investors and proxy advisors who feel such provisions limit shareholders’ legal recourse when asserting claims of wrongdoing. Glass Lewis will oppose the chair of the corporate governance committee at companies that adopt exclusive forum bylaws without shareholder approval. If put to a shareholder vote, ISS and Glass Lewis will only support them if the company has strong governance practices and can demonstrate material harm caused by litigation outside of its state of incorporation. This year, five companies sought shareholder approval for charter amendments or other transactions that included exclusive venue provisions. All of them passed, though most were opposed by ISS.

Looking Ahead

Going forward, shareholder activists can be expected to continue their drive to expand board accountability mechanisms. In addition to declassification and majority voting, which are easy wins, proxy access proposals may be on the rise next year, particularly at large-cap companies, in view of the success rate of those modeled after the 3%/3-year rule proposed by the SEC in 2010. Because targeting this year hasn’t been confined to companies with severe oversight lapses, boards should be contemplating various courses of action in the event they receive a proxy access proposal.

Operational activism may also become a new front for traditional governance proponents. CalSTRS’ and Relational Investors’ successful resolution at Timken this year to split into separate companies could spell a shift by pension funds from proposing governance reforms to challenging corporate strategies and operations.

Directors, particularly those on compensation panels, will face increased vulnerability to negative votes. Although opposition to compensation committee members has largely been deflected by SOP, it is on the rise again at companies with repeat SOP failures. As with shareholder proposals, proxy advisors have rigorous expectations of corporate responsiveness to mediocre SOP votes. At support levels below 70% (75% in the case of Glass Lewis), the proxy advisors may recommend against directors unless they demonstrate some level of engagement with shareholders and disclose the results of their outreach and actions taken to address shareholder concerns. Even companies that have received high SOP support in the past should continue having ongoing dialogues with investors as views on executive compensation practices and PFP alignment can shift dramatically year to year. By maintaining open communications, issuers can head off potential problems early on and set the stage for a successful proxy season in 2014.

Print

Print