The following post comes to us from Heidi Welsh, Executive Director at the Sustainable Investments Institute (Si2), and is based on a Si2 report. This post relates to reports by Proxy Monitor, the most recent of which was discussed on the Forum here.

Shareholder activists are meeting now to consider what proposals they will file for the 2014 proxy season and the results are largely in from the 2013 proxy season, with analysis coming from all the different proponent groups, the proxy advisory firms and others interested in what happened this year. Si2’s own report in August showed that the upward climb of investor support for social and environmental policy proposals continued this year, with average support hitting a record level of 21.3 percent and requests for more board and workplace diversity, sustainability reporting and corporate political activity disclosure got the highest levels of support. (More information on these overall findings and overall trends, illustrated with charts, appears here.)

One group that reports on proxy season findings is Proxy Monitor, a project of the Manhattan Institute’s Center for Legal Studies. It focuses on resolutions that go to votes at the 250 largest U.S. firms, reporting on the vote results and presenting analysis of the trends on its website. The group’s analyses of proxy season results trends have some significant blind spots that are not always apparent to the novice proxy analyst, but its reports nonetheless are widely quoted in the press. As such, they deserve some scrutiny, which this post offers. Si2 took a look at all the shareholder resolutions filed since 2010 and compared the results to the Proxy Monitor database to see precisely how PM reaches its conclusions.

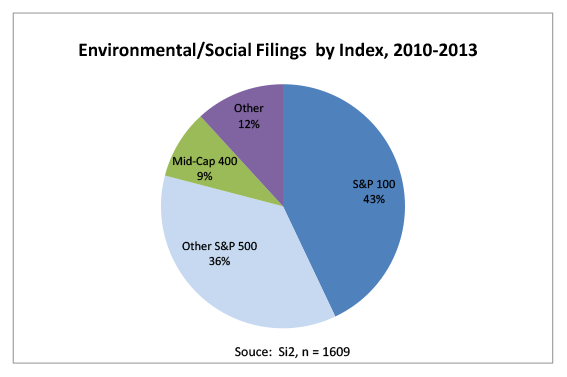

Proxy Monitor’s big company bias: A core problem with the Proxy Monitor analysis is its focus only on the largest companies. It is true that activists file the bulk of their proposals at S&P500 companies, which provide more bang for the buck in terms of potential press exposure, influence on corporate policy (given a common follow-the-leader approach) and potential impact on the amount of business (if Wal-Mart changes its supply chain, there are 60,000-plus firms affected). Increasingly, though, relatively smaller companies outside the elite tier must answer to pointed questions about how they handle a wide range of sustainability issues. About 80 percent of the 1,609 proposals filed since 2010 were at S&P 500 companies, with 43 percent of the total at the 100 largest-earning companies. But 9 percent went to Mid-Cap 400 firms and 12 percent went to firms in other indices.

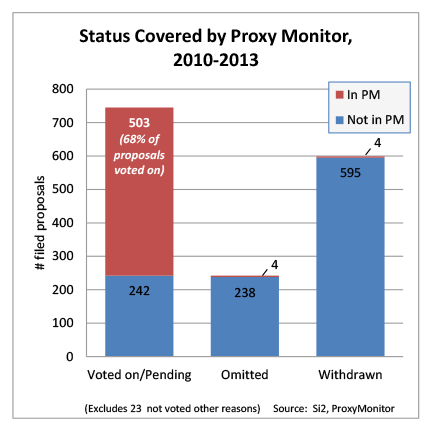

Withdrawn and omitted proposals missed: Aside from its big-company bias, which means only 68 percent of the social/environmental votes between 2010 and 2013 have been tabulated by Proxy Monitor, its conclusions are skewed in anther critical way. They largely miss filed proposals withdrawn or omitted after company challenge under provisions of the shareholder proposal rule. Since many active investors see corporate engagement through the shareholder resolution process as a key objective in itself, as an exercise of their responsibility as owners of companies, and because withdrawals usually occur after companies agree to more disclosure or some other element forwarded by the proposed resolution, the Proxy Monitor results understate the total impact of shareholder activism.

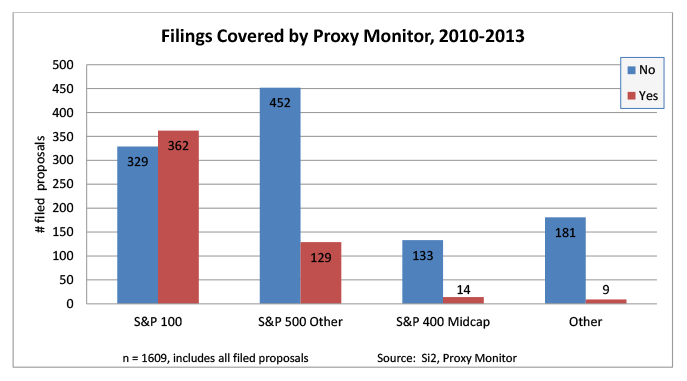

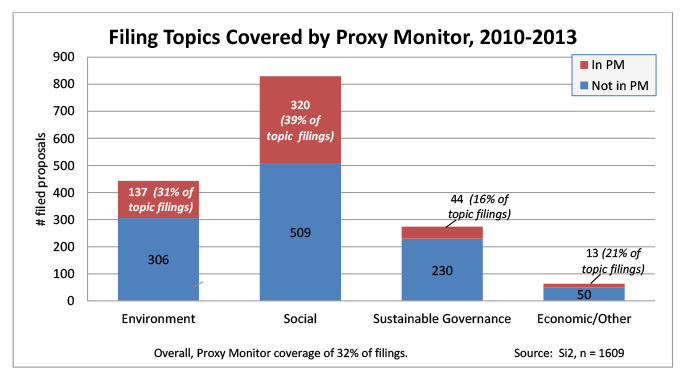

Disaggregating results by index shows further the extent to which the Proxy Monitor database and related reports miss out on describing corporate engagement that occurs during the corporate annual meeting season, illustrated below.

Resolutions filed at the largest companies are more likely to be voted on than proposals filed at other companies, with 53 percent of filed proposals going to votes at the S&P 100 compared with only 37 percent at Mid-Cap 400 companies. Proposals filed at relatively smaller companies also are more likely to be withdrawn, usually after negotiations between management and proponents that produce agreements. (More research into why that occurs is warranted.) The largest companies also are more likely to successfully challenge resolutions under provisions of the shareholder proposal rule and to receive SEC approval for excluding them from proxy statements, with 21 percent of filings at S&P 100 companies omitted compared with just 7 percent at Mid-Cap 400 companies. This is likely the result of well-financed and experienced legal teams.

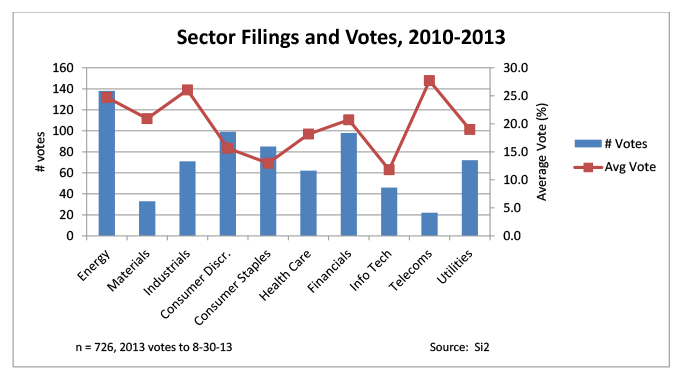

Energy sector firms get the most proposals that go to votes: Resolution volume and average votes in favor of proposals on social and environmental topics vary by sector. Since 2010, Energy sector companies have received the most proposals that have gone to votes—nearly 140 resolutions, and these have earned support from about one-quarter of the votes cast for and against. Other sectors that have received a relatively high number of proposals have been Consumer Discretionary, Consumer Staples and Financials firms, with companies in these sectors seeing 80 to 100 resolutions go to votes in the last four years combined. Consumer Discretionary, Consumer Staples and Information Technology sector firms saw votes average about 15 percent or less, but all the other sector vote averages were close to or above 20 percent, taking all the issues together. (A more detailed analysis of votes by sector and issues is beyond the scope of this brief post.)

Topic areas most commonly missed: The Proxy Monitor coverage of the topics raised in shareholder resolutions filed on social and environmental issues is the most complete for social policy matters (including most prominently corporate political activity, decent work, human rights and workplace diversity) and the most limited for sustainable governance topics (such as sustainability reporting, board diversity and board oversight). Even so, Proxy Monitor misses 60 percent of the filings on social issues. Its coverage of environmental topics misses 70 percent of the filings and for sustainable governance nearly 85 percent of the activity. Investors file far fewer proposals on economic justice issues (mostly relating to fair lending) and many of these have not gone to votes; Proxy Monitor misses 80 percent of these filings.

Vote results are inconsistent: When it comes to reporting on the results, Proxy Monitor does not use a consistent methodology, making apples-to-apples comparisons of voting results impossible. Long-time observers of shareholder resolution results use the standard set out in the SEC’s shareholder proposal rule that governs resubmission thresholds, counting the shares cast in favor divided by those cast for and against (3 percent for first-year proposals, 6 percent for second-year proposals and 10 percent for third-year and subsequent proposals). Companies do not always use this standard when reporting on voting results, however. They variously include in their calculations shares cast as abstentions or votes outstanding. Proxy Monitor appears to base its reporting not on the votes cast but instead on the percentage reported by the company. A consistent calculation can be discerned by examining corporate 8-K filings, however, gleaning comparable results.

In the last four years, the Proxy Monitor results reported therefore have consistently understated the voting results, sometimes significantly. The table below shows the largest gaps, in which resolutions that earned more than 40 percent of the total shares cast (and in two cases majority votes, at Sprint Nextel and Tesoro) were reported to have earned far less in the Proxy Monitor tally. These differential vote tallies were most common for corporate political spending resolutions: seven of the nine proposals that earned 40 percent or more of the shares cast in favor were on political activity. The two others were about refinery safety at Tesoro and Valero Energy.

|

High Shareholder Votes and Proxy Monitor Results Reported, 2010-2013 |

|||||

| Year | Company | Proposal |

Vote For (% of yes+no) |

Proxy Monitor % |

Difference |

| 2011 | Tesoro | Report on accident prevention efforts |

54.3 |

34.3 |

20.0 |

| 2010 | Coventry Health Care | Review/report on political spending |

46.0 |

30.3 |

15.7 |

| 2012 | Coventry Health Care | Review/report on political spending |

48.6 |

34.0 |

14.6 |

| 2011 | Coventry Health Care | Review/report on political spending |

44.3 |

30.2 |

14.1 |

| 2011 | Sprint Nextel | Review/report on political spending |

53.4 |

41.0 |

12.4 |

| 2011 | Halliburton | Review/report on political spending |

46.5 |

34.4 |

12.1 |

| 2013 | McKesson | Review/report on political spending |

46.8 |

35.3 |

11.4 |

| 2011 | Valero Energy | Report on accident prevention efforts |

43.3 |

33.4 |

9.9 |

| 2010 | Sprint Nextel | Review/report on political spending |

41.2 |

31.4 |

9.8 |

2013 Proxy Season Results

As the analysis above clearly shows, the Proxy Monitor database has significant limitations and does not present a comprehensive picture of corporate engagement by investors. It also does not consistently present comparable vote results. As a result, the conclusions reached from the data are both limited and inaccurate. With respect to the 2013 proxy season, Proxy Monitor concluded that companies faced more shareholder proposals than in 2012 but said average support fell and no social policy proposal earned a majority vote. Proxy Monitor also reported in early summer that corporate political spending proposals were the most common type of resolution, none received majority support and their average support was 18 percent. The picture of what really happened is quite different, as the discussion below clearly shows.

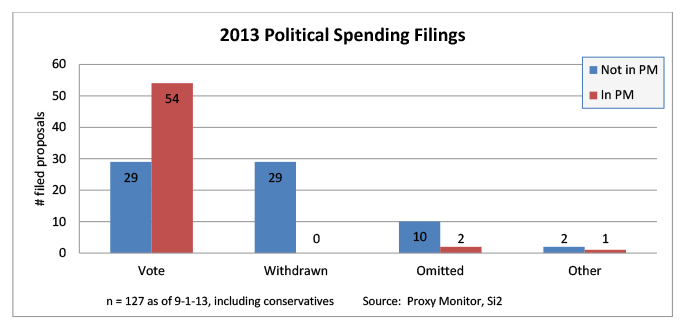

Corporate political activity: The chart below shows which of all the corporate political activity shareholder resolutions filed in 2013 were covered by Proxy Monitor. Thirty-four of the 83 votes to date, all 29 of the withdrawals and 10 of the 12 omissions were excluded.

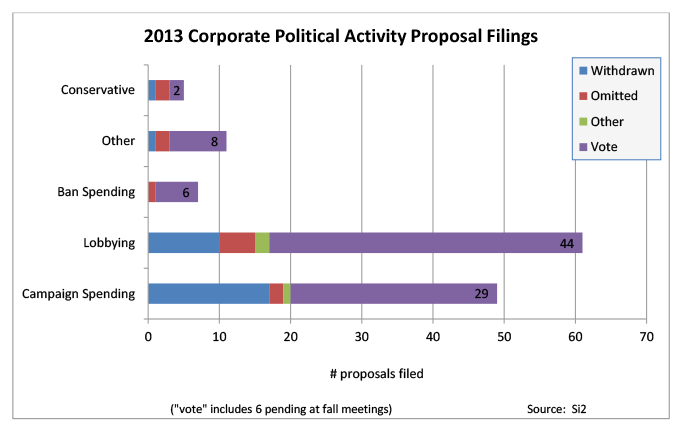

In 2013, there were more proposals on corporate political activity that dealt with lobbying than with campaign spending, as Proxy Monitor indicates. Proponents of these resolutions also withdrew a relatively smaller proportion of the lobbying resolutions compared with the campaign spending proposals, which used the template of the Center for Political Accountability.

A close look at the 83 resolutions that have gone to votes as of September 1 illustrates the extent to which Proxy Monitor understates the level of investor support for more disclosure on corporate activity—be it for campaign spending or lobbying. Campaign spending and oversight proposals have gotten the highest level of average support overall in 2013, with 31.5 percent, but they were closely followed by resolutions asking for more complete disclosure of lobbying expenditures (which got 27.1 percent on average). Both emphasize spending through intermediaries such as trade associations and non-profit groups that need not report their donors, so-called “dark money.” Investor support is very limited for other types of proposals about corporate political activity—such as banning spending or those from conservative groups questioning corporate support for gay rights or health care reform. (The two majority votes noted below occurred at firms not tracked by Proxy Monitor—Mid-Cap constituent Alliant Techsystems and CF Industries, which is in the S&P 500 but outside the top 250 firms PM tracks—at meetings in late July that occurred after the group published its analysis of the season.)

|

2013 Corporate Political Spending Shareholder Resolution Votes |

||||||

|

All Filed Proposals |

Proxy Monitor |

|||||

| Proposal Type |

# votes |

Avg % |

Highest % |

# votes |

Avg % |

Highest % |

| Campaign Spending |

25 |

31.5 |

66.0 |

14 |

25.6 |

40.6 |

| Lobbying |

43 |

27.1 |

64.8 |

29 |

20.9 |

37.0 |

| Ban Spending |

6 |

4.4 |

6.2 |

5 |

4.6 |

5.7 |

| Other |

7 |

4.7 |

6.4 |

4 |

4.7 |

6.4 |

| Conservative |

2 |

3.9 |

4.2 |

2 |

3.9 |

4.2 |

| Grand Total |

83 |

24.3 |

66.0 |

55 |

18.8 |

40.6 |

Conclusion

This post shows the extent to which Proxy Monitor misses much of what happens in the U.S. proxy season. Shareholder proponents—generally a liberal crowd—can have a tendency to overstate the impact of their actions, but their focus on off-balance sheets risks has prompted growing support in the investment world and traction with companies that is irrefutable. Proxy Monitor hoists a flag for the contention that social policy shareholder activism can be discounted, for any number of reasons. But at the very least, this discussion about shareholder resolution outcomes should be grounded in fact, not based on a skewed subset of the results.

Print

Print