The following post comes to us from Barry J. Kramer, partner in the corporate and securities group at Fenwick & West LLP and is based on a Fenwick publication by Mr. Kramer and Michael J. Patrick; the full publication, including expanded detailed results and valuation data, is available here.

We analyzed the terms of venture financings for 128 companies headquartered in Silicon Valley that reported raising money in the third quarter of 2013.

Overview of Fenwick & West Results

Valuation results in 3Q13 showed a noticeable increase over 2Q13, including the greatest difference between up and down rounds in over six years. The software industry was especially strong, not only valuation-wise, but also in the number of deals.

Here are the more detailed results:

- Up rounds exceeded down rounds 73% to 8%, with 19% of rounds flat. This was a significant increase from 2Q13 when up rounds exceeded down rounds 64% to 22% with 14% flat, and the best quarter (measured by amount by which up rounds exceeded down rounds) since 3Q07.

- The Fenwick & West Venture Capital Barometer™ showed an average price increase of 65% in 3Q13, an increase from the 62% reported in 2Q13.

- The median price increase of financings in 3Q13 was 43%, a noticeable increase from the 19% and 14% reported in 2Q13 and 1Q13, respectively.

- The results by industry are set forth below. In general internet/digital media slightly edged out software for best valuation performance, although there were significantly more software deals than internet/digital media, as software deals were 53% of all deals, the highest amount since we began tracking results by industry in 1Q10. Life Science fell to 10.2% of all deals, the lowest percentage since 1Q10.

- The percentage of financings with participating liquidation preference was 27%, the lowest amount since we began our survey in 2002 and an indication of an entrepreneur friendly environment.

Overview of Other Industry Data

Overall the venture environment improved in 3Q13, but due to a slow start 2013 lags 2012 in some categories.

- Venture investing in 3Q13 increased, bringing the first three quarters of 2013 approximately even with 2012, although trailing 2011.

- IPOs were again strong in 3Q13. Although 2013 is expected to be the best year for venture backed IPOs since 2007, much of the increase through the first three quarters has been focused in the life science sector.

- M&A improved noticeably in 3Q13, but 2013 is on track to have the lowest number of acquisitions of venture backed companies since 2009.

- Venture fundraising improved over a weak 2Q13, but 2013 was on track to be the lowest fundraising year since 2010.

- Corporate venture capital participation continued to increase.

- Angel financing results were mixed. And with new more liberal regulations regarding public solicitations and crowd funding, the angel financing world is likely in for some changes.

- Venture capitalist sentiment hit the highest level since the 2008 recession.

The more detailed results follow:

Venture Capital Investment

Dow Jones VentureSource (“VentureSource”) reported a 12.5% increase in venture investment and a 1% increase in the number of venture financings from 2Q13 to 3Q13. Specifically, $8.1 billion was invested in 806 deals in 3Q13 compared to $7.2 billion invested in 801 deals in 2Q13 (as reported in July 2013). This was the largest amount invested in a quarter since 2Q12. Google Ventures was the most prolific investor funding 23 deals.

Similarly, the PwC/NVCA MoneyTree™ Report based on data from Thomson Reuters (the “MoneyTree Report”) reported a 16% increase in venture investment and a 10% increase in the number of financings from 2Q13 to 3Q13. They reported $7.8 billion raised in 1005 deals in 3Q13 compared to $6.7 billion raised in 913 deals in 2Q13 (as reported in July 2013). The software industry was especially active receiving $3.6 billion, the largest amount in a quarter in 12 years.

VentureSource, MoneyTree Report and Pitchbook all noted a trend from consumer/web to business/software investing.

IPO Activity

IPO activity continued strong in 3Q13, with 25 IPOs raising $2.2 billion, compared to 18 IPOs raising $1.7 billion in 2Q13, according to VentureSource.

Similarly, Thomson Reuters and the NVCA (“Thomson/NVCA”) reported 26 IPOs raising $2.7 billion in 3Q13, compared to 23 IPOs raising $2.4 billion in 2Q13. Sixteen of the 26 IPOs were in the life sciences industry.

VentureWire has reported that 2013 will have the largest number of venture backed IPOs since 2007 (Russ Garland, 10/7/13).

And despite the relatively healthy after market performance of IPOs in the first three quarters of 2013, the Venture Capital Journal notes that venture capitalists appear to be holding on to their public company shares longer than they have historically.

Merger and Acquisition Activity

VentureSource reported a 21% increase in the amount paid in the acquisition of venture backed companies, and a 32% increase in the number of acquisitions, in 3Q13 compared to 2Q13. Specifically, there were 111 deals for $9.7 billion in 3Q13 compared to 84 deals for $8.0 billion in 2Q13 (as reported in July 2013).

This is consistent with Thomson/NVCA which reported a 27% increase in the number of acquisitions. Although 3Q13 was an improved quarter, the number of venture backed acquisitions in 2013 is on track to be the lowest since 2009.

Yahoo was the largest acquirer of venture backed companies in 3Q13 with four acquisitions, and Apple was second with three (VentureWire, Russ Garland, 10/7/13).

Acquisitions have provided a larger percentage return to investors than IPOs, when compared to the prior venture financing round, in 2011-13, according to Pitchbook.

Venture Capital Fundraising

Thomson Reuters reported a 41% increase in dollars and a 27% increase in the number of funds raising money in 3Q13 compared to a weak 2Q13. Specifically, 56 funds raised $4.1 billion in 3Q13 compared to 44 funds raising $2.9 billion in 2Q13 (as reported in July 2013). However, the first three quarters of 2013 were down 29% (in dollars) from the first three quarters of 2012, and 2013 was on track to be the lowest fundraising year since 2010.

Similarly, VentureSource reported fundraising down 11% in the first three quarters of 2013.

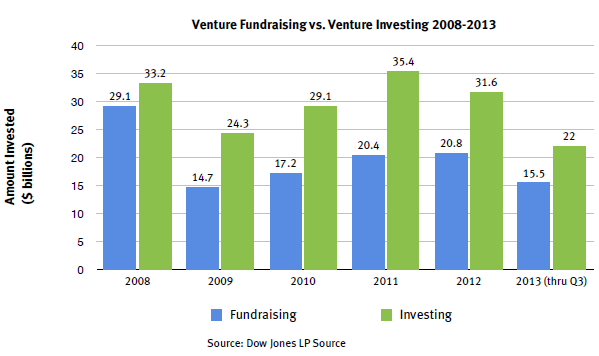

VentureSource also reported that in the 2008-3Q13 time period, the amount invested in venture backed US based companies outpaced US venture capital fundraising, $175 billion to $118 billion. Although some of this difference can be attributed to the years prior to 2008 when fundraising slightly outpaced investing, we believe that investments by late stage non-VC investors (e.g., private equity, cross-over and hedge funds), corporate venture capital and non-US based venture capital have increased during this period to mostly account for the difference.

A survey by Probitas Partners reported in the Venture Capital Journal found that 39% of institutional limited partners did not invest in venture capital, twice the amount that was reported in 2007.

Print

Print