The following post comes to us from Luigi L. De Ghenghi and Andrew S. Fei, and is based on two Davis Polk publications; the full publications, including visuals, tables, flowcharts and timelines, are available here (focusing on U.S. bank holding companies) and here (focusing on foreign banks).

Pursuant to Section 165 of the Dodd-Frank Act, the Federal Reserve has issued a final rule to establish enhanced prudential standards for large U.S. bank holding companies (BHCs) and foreign banking organizations (FBOs).

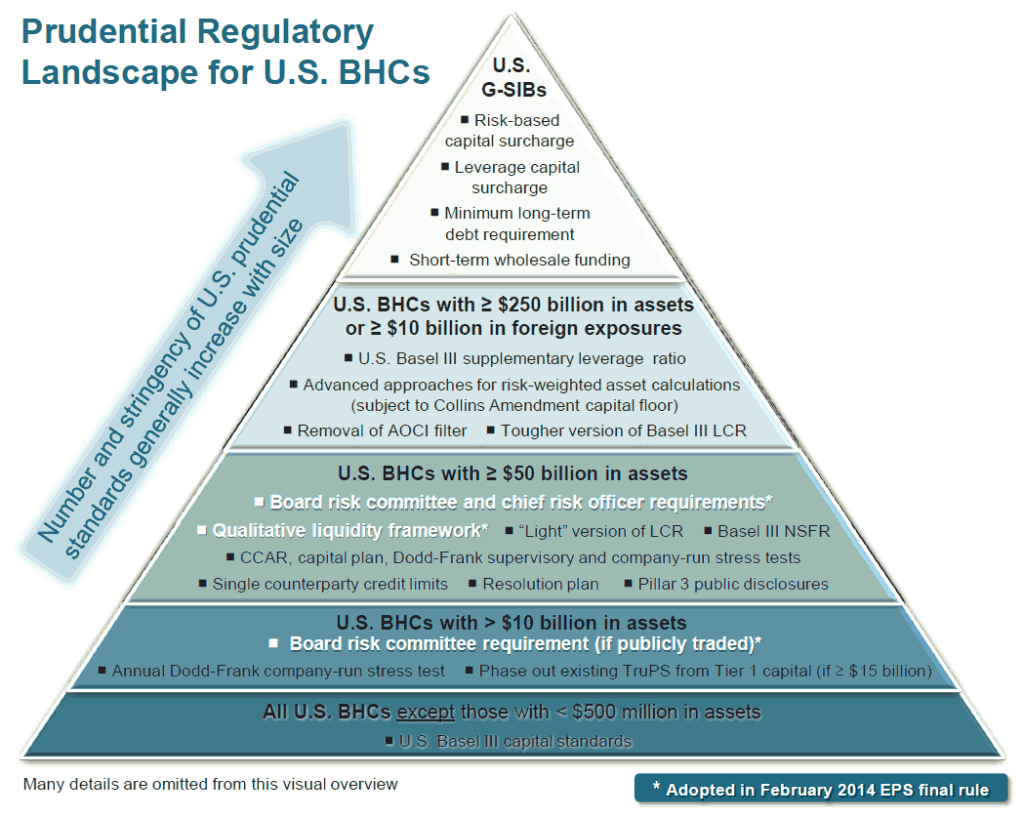

U.S. BHCs: The final rule represents the latest in a series of U.S. regulations that apply heightened standards to large U.S. BHCs. As the graphic below illustrates, under the emerging post-Dodd-Frank prudential regulatory landscape for U.S. BHCs, the number and stringency of prudential standards generally increase with the size of the banking organization.

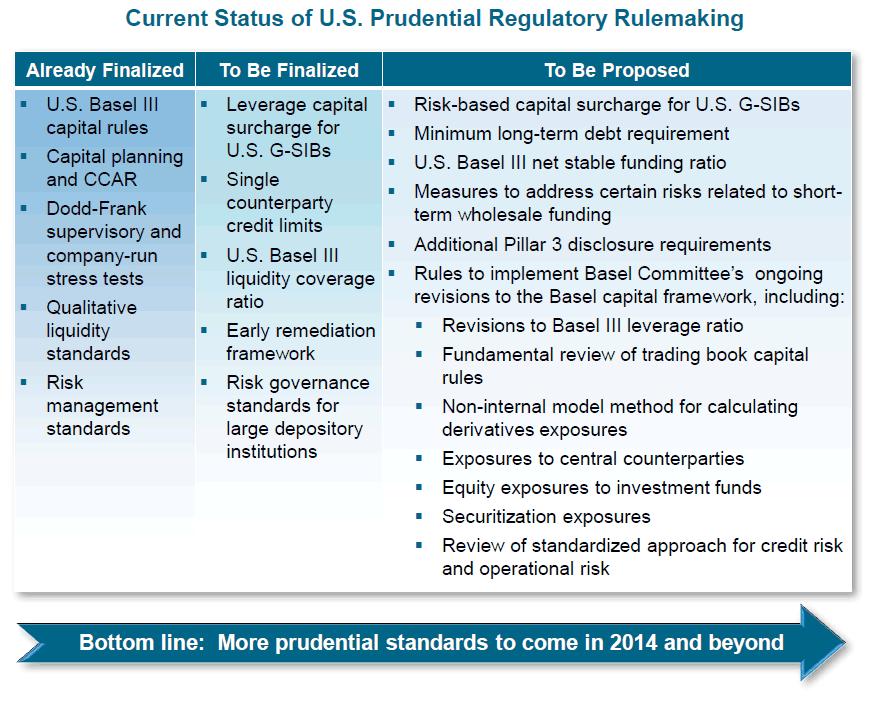

For the largest U.S. BHCs, the final rule marks the beginning of a series of prudential regulatory initiatives on the Federal Reserve’s 2014 agenda. This is illustrated by the graphic below.

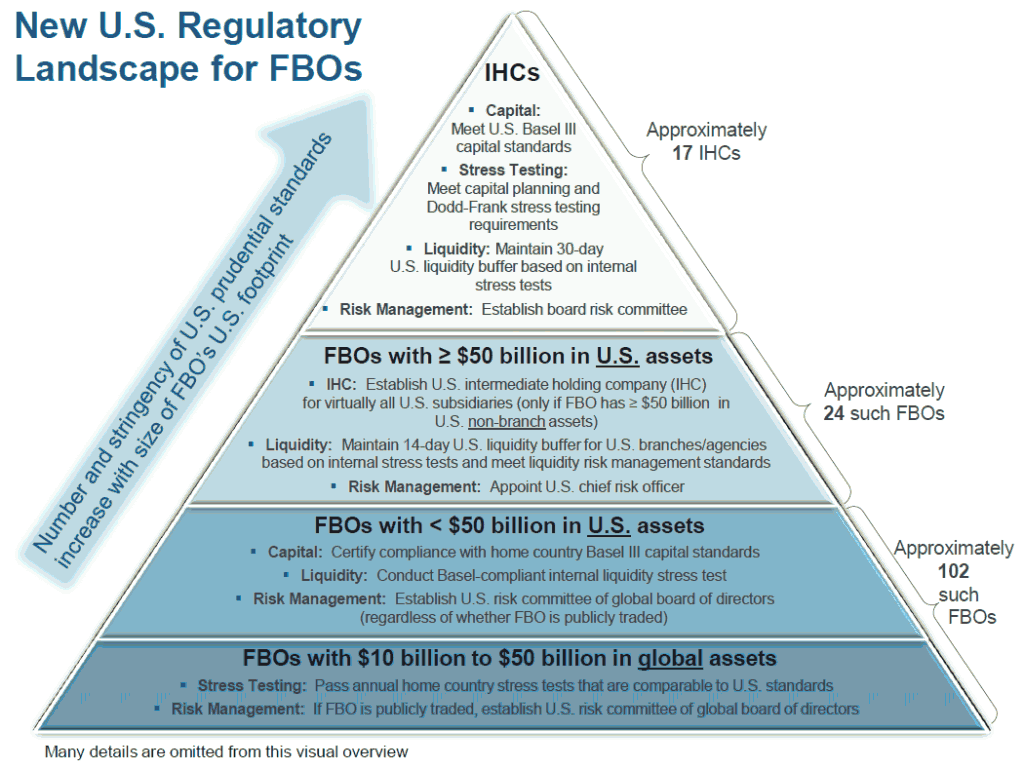

FBOs: The Federal Reserve’s final rule includes a tiered approach for applying enhanced prudential standards to FBOs. Under the tiered approach, the number and stringency of U.S. prudential standards increase with the size of an FBO’s U.S. footprint. Generally, the most burdensome requirements will apply to FBOs with $50 billion or more in U.S. assets. Fewer requirements will apply to FBOs with limited U.S. footprints, as shown in the diagram below.

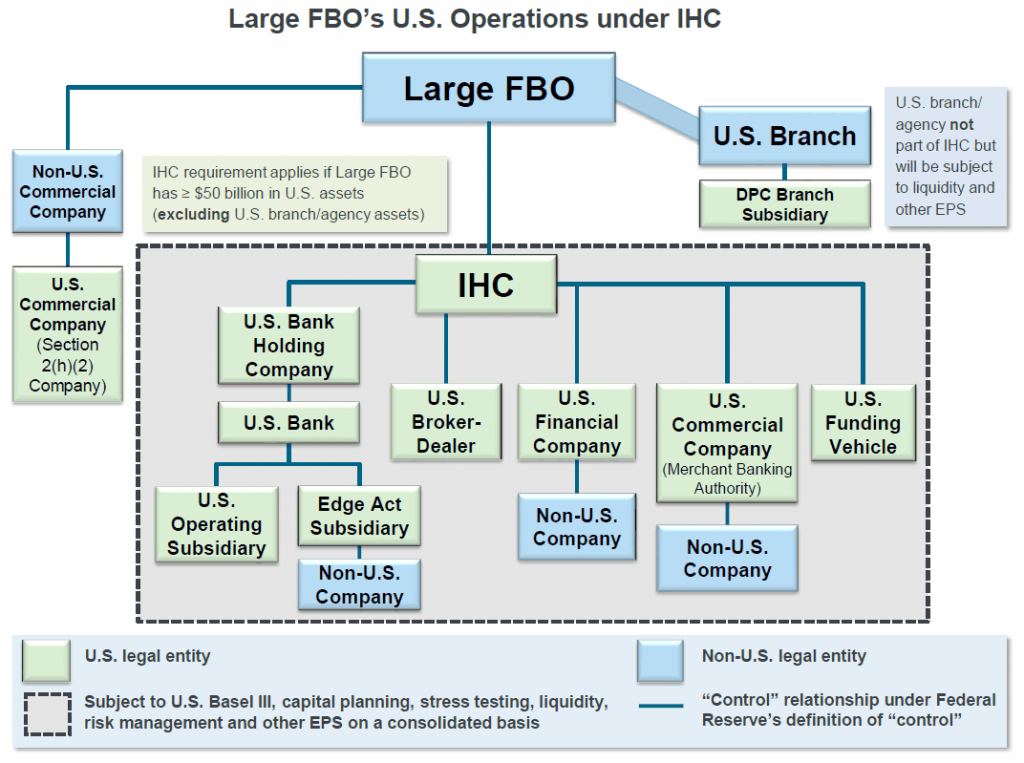

U.S. Intermediate Holding Company Requirement: Under the final rule, FBOs with $50 billion or more in U.S. assets outside of their U.S. branches and agencies will be required to place virtually all of their U.S. subsidiaries underneath a top-tier U.S. intermediate holding company (IHC). As illustrated by the diagram below, the IHC will be subject to a number of U.S. prudential requirements, including U.S. Basel III risk-based and leverage capital standards, capital planning and stress testing requirements, as well as qualitative liquidity standards and risk management requirements.

Visual Summaries of the Enhanced Prudential Standards Final Rule: We have prepared two visual summaries of the Federal Reserve’s Dodd-Frank enhanced prudential standards final rule. One visual summary (available here) focuses on requirements that apply to large U.S. BHCs and the other (available here) focuses on requirements that apply to foreign banks, including the IHC requirement.

Print

Print