The following post comes to us from Luigi L. De Ghenghi and Andrew S. Fei, attorneys in the Financial Institutions Group at Davis Polk & Wardwell LLP, and is based on a Davis Polk client memorandum; the full publication, including visuals, tables, and flowcharts, is available here.

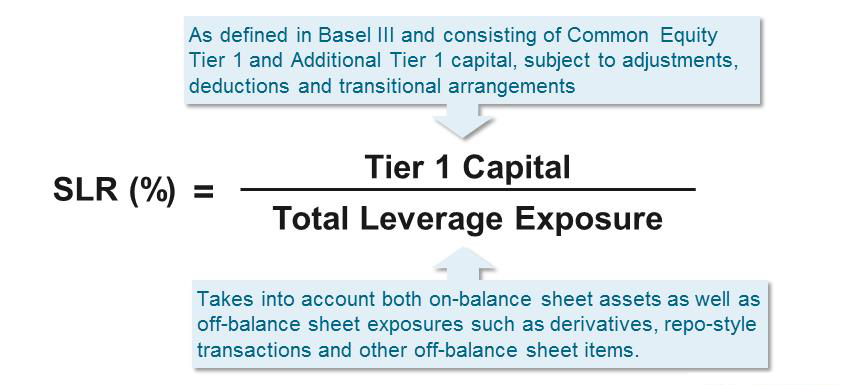

The U.S. banking agencies have finalized higher leverage capital standards for the eight U.S. bank holding companies that have been identified as global systemically important banks (“U.S. G-SIBs”) and their insured depository institution (“IDI”) subsidiaries. The agencies also proposed important changes to the denominator of the U.S. Basel III supplementary leverage ratio (“SLR”). A number of these proposed changes are intended to implement the Basel Committee’s January 2014 revisions to the Basel III leverage ratio.

Overview of the U.S. G-SIB Leverage Surcharge

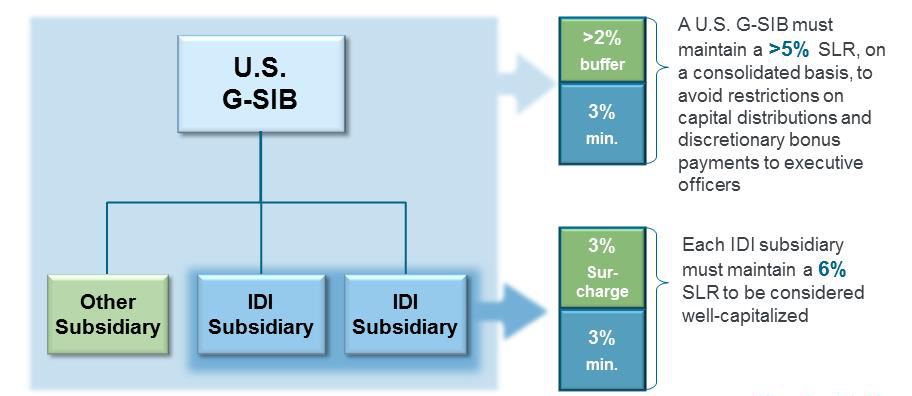

Consistent with the U.S. banking agencies’ July 2013 proposal, the U.S. G-SIB leverage surcharge will require a U.S. G-SIB’s IDI subsidiaries to maintain an SLR of at least 6% to be considered well-capitalized for regulatory purposes.

The final rule also requires U.S. G-SIBs, on a global consolidated basis, to maintain a leverage buffer that would function in a similar way to the Basel III capital conservation buffer.

Specifically, a U.S. G-SIB that does not maintain an SLR of greater than 5%, i.e., a buffer of more than 2% on top of the 3% minimum, will be subject to increasingly stringent restrictions on its ability to make capital distributions and discretionary bonus payments.

| SLR Buffer | Allowed Capital Distributions and Discretionary Bonus Payments |

| Buffer > 2.0% | No limit imposed by the U.S. G-SIB leverage surcharge |

| 2.0% ≥ Buffer > 1.5% | Up to 60% of eligible retained income |

| 1.5% ≥ Buffer > 1.0% | Up to 40% of eligible retained income |

| 1.0% ≥ Buffer > 0.5% | Up to 20% of eligible retained income |

| 0.5% ≥ Buffer | No capital distributions or discretionary bonus payments allowed |

Visual Overview of the SLR

Which Organizations Are Affected?

Organizations Subject to the U.S. G-SIB Leverage Surcharge

- A U.S. top-tier bank holding company with at least $700 billion in total consolidated assets or at least $10 trillion in assets under custody and its IDI subsidiaries—this criteria captures the 8 U.S. G-SIBs and their IDI subsidiaries

Organizations Subject to the 3% Minimum SLR Requirement

- Advanced approaches banking organization—a banking organization with ≥ $250 billion in total consolidated assets or ≥ $10 billion of on-balance sheet foreign exposures

- Advanced approaches IHC of foreign bank—U.S. intermediate holding company (IHC) with ≥ $250 billion in total consolidated assets or ≥ $10 billion of on-balance sheet foreign exposures, regardless of whether the IHC is also a bank holding company

Compliance Timing

- The effective date of the U.S. G-SIB leverage surcharge is January 1, 2018.

- The effective date of the SLR is January 1, 2018.

- Disclosures: Advanced approaches banking organizations must calculate and disclose their SLR beginning in the first quarter of 2015.

Visual Comparison Chart: SLR vs. Basel III Leverage Ratio

We have prepared a chart that compares the U.S. banking agencies’ proposed revisions to the denominator of the SLR with the Basel Committee’s January 2014 revisions to the Basel III leverage ratio. While the revised SLR proposed by the U.S. banking agencies is similar to the revised Basel III leverage ratio in many respects, there are some important differences between the two ratios. The comparison chart, including visuals, tables and flowcharts, is available here.

Print

Print