The following post comes to us from Rajeev Kumar, a senior managing director of research at Georgeson Inc, and is based on the executive summary of a Georgeson report; the full report is available here.

Shareholder activism continued to thrive in the 2014 proxy season, spurring corporate action as well as renewed engagement between issuers and investors. While the total number of shareholder proposals declined in 2014, lively activity continued with calls for independent chairs as well as burgeoning growth for social issues. And while few in number, change-in-control payout proposals were notably successful for the first time this year, while equity retention proposals continued to have a weak showing. In addition, support for proxy access proposals also grew at a rate greater than any other type of proposal.

While contested situations and certain shareholder proposals saw greater investor support, companies also experienced greater success in heading off a negative vote by addressing shareholder concerns as they arose. The overall support for say on pay proposals remained high as outreach efforts by issuers continued to grow. Likewise, support for director elections continued to increase amid efforts by boards to avoid negative votes.

Shareholder Proposal Submission: Declining Trend Continues

The number of shareholder proposals continued to decline during the 2014 proxy season. This trend began four years ago, when say on pay proposals became mandatory and replaced their shareholder proposal counterparts. There were a total of 438 corporate governance shareholder proposals submitted in 2014, a decline of 17.5% and 2.4% from 2010 and 2013, respectively. The majority of this decline has been due to a drop in executive compensation-related shareholder proposals. Nearly 57% or 249 of the 438 submitted shareholder proposals in 2014 were voted on by shareholders, with the rest withdrawn or omitted. The percentage of voted proposals has generally stayed consistent since 2011.

Individual shareholders again submitted the lion’s share of 2014 shareholder proposals: more than 57% of the proposals that went to a vote. On the other hand, labor unions sponsored fewer proposals as compared to 2013.

As a category, board-related shareholder proposals were the most prevalent, with more than a majority being independent chair proposals. Political spending and lobbying led the way with the most proposals.

Say on Pay: Results Stay Consistent

2014 marked the fourth year of mandatory say on pay votes that also included the advisory vote for companies that had adopted a triennial vote frequency in 2011. The say on pay vote results in 2014 were largely in line with last year’s, with average support for S&P 1500 companies at 90.6% of votes cast, with 2.7% failed votes and 5.0% falling the in the “red zone.” While the averages remained largely consistent, many of the individual companies saw substantial vote swings from the previous year. The companies that had a failed say on pay vote in 2013 saw an average increase of greater than 30% support in 2014, while the companies whose proposals failed in 2014 showed a similar average decline. The inclusion of triennial vote companies did not change the overall vote outcome as the results for those companies were largely in line with those for non-triennial companies. Surprisingly, the failure rate at triennial companies was lower than that of all others.

A pay-for-performance disconnect continued to be the primary reason for shareholder opposition to say on pay votes this year. Companies that underperformed relative to peers without a corresponding decline in CEOs’ relative pay often faced difficulties passing their say on pay vote. Also, as we saw with Chipotle Mexican Grill’s failed say on pay vote, in certain cases strong shareholder returns alone were not enough to ensure a strong say on pay outcome. With CEOs’ pay often outpacing shareholder returns, investors increasingly questioned the alignment of pay and performance in such instances.

The following problematic pay practices were common factors for negative votes:

- Peer selection and benchmarking—use of outsized peers or above median targeting

- Lack of performance goals or their rigor—hurdles set below previous targets and/or actual results without a corresponding decrease in incentive opportunity

- Concerns over employment agreement provisions—hire-on equity grants that had no performance conditions for new CEOs, and unjustified or unexplained pay increases for existing CEOs

- Time-based retention grants—significant retention awards without performance conditions

- Special awards to CEOs—mega-grants often in lieu of some other problematic benefit that CEOs previously gave up

It is critical that the companies provide useful and easy-to-understand disclosure of their pay practices and decisions in the CD&A. As communications firm R.R. Donnelly’s survey findings of institutional investors in November 2013 reflect, shareholders gave relatively poor marks on companies’ disclosure of pay-for-performance alignment and use of performance measures.

Shareholder Engagement: Emergence of Engagement Protocols

Shareholder engagement again took center stage in 2014. In April 2014, ISS published an update to its 2011 study, “Evolving Relationship Between Shareholders, Directors and Executives,” that suggests overall engagement levels are up—in terms of both the percentage of companies undertaking engagement and the frequency of their engagement. Study findings based on ISS’s survey conducted in late 2013 indicate that only 22% of issuers and 19% of investors did not initiate any engagements that year. Both issuers and investors are paying greater attention and devoting increased resources to engagement, as regulatory and corporate governance trends have encouraged such dialogue. Evolving proxy advisory firms’ and institutional investors’ policy guidelines along with activists’ approaches have also placed greater emphasis on shareholder engagement.

Two new engagement protocols—Shareholder-Director Exchange (SDX) and The Conference Board Governance Center Task Force on Corporate/Investor Engagement—emerged in 2014. The SDX protocol provides a 10-point guide for public company boards and shareholders that determines when shareholder and director engagement is appropriate and how to make these engagements valuable and effective. Earlier this year, the SDX working group sent a letter to the lead directors and corporate secretaries of Russell 1000 companies, asking them to consider formally adopting a policy providing for shareholder-director engagement, whether pursuant to the SDX protocol or otherwise. The Conference Board Governance Center’s guidelines, released soon after the SDX protocol and discussed on the Forum here, similarly advocates for dialogue between boards and investors in special circumstances. But unlike the SDX protocol, the Conference Board guidelines do not regard it as a routine method of engagement for most companies and investors.

Governance-Related Shareholder Proposals: Support for Proxy Access Grows

Governance-related proposals have generally garnered high levels of shareholder support in years past. The three most common proposals during the 2014 proxy season related to independent board chairs, shareholders’ right to act by written consent and majority voting in director elections. There was a noticeable drop in the perennially common board declassification shareholder proposals, as there were fewer large-cap targets with increased adoption of annually elected board by S&P 500 companies. This decline was also reflected in fewer management proposals to repeal classified boards compared to last year. The number of management proposals, however, exceeded shareholder proposals, since most companies decided to proactively declassify the board given the strong shareholder support these proposals usually receive.

The independent chair issue was once again the most prevalent with 59 proposals voted in 2014, up from 53 last year. The level of support, however, declined for the second year in a row, averaging 30.6% in 2014 with only four proposals receiving majority support.

Support for proxy access, the process by which shareholders would be permitted to submit director nominees (and have those nominees included in management’s proxy statement and card), grew in 2014. In this year’s proxy season, there were 13 proxy access proposals submitted to a vote, up from 11 in 2013. Support rose significantly from an average of 31.7% of votes cast in 2013 to 39.1% of votes cast in 2014, the largest such increase of any proposal this year. In addition, the number of proposals receiving majority support doubled from three in 2013 to six in 2014.

It is worth noting that the support levels for the shareholder proposal once again varied greatly depending on the version of proposal a company received. As we reported last year, there have been a few different versions of proxy access proposals submitted to a shareholder vote over the years. The variations in the proposals included:

- Percent of shares required to be held

- Length of continuous ownership

- Percent of board potentially subject to proxy access

Institutions were less supportive of proposals that would afford proxy access rights for a collective group of holders who own 1% of the total outstanding shares for a continuous period of one year. In 2014, there were four proposals of the sort, which averaged a mere 4.8% of votes cast in support. In contrast, support for proposals that sought proxy access rights for a nominator who owns 3% of the company total outstanding shares for a continuous period of three years averaged 55.7% of votes cast in favor, with six of eight proposals receiving majority support. In addition to the 13 shareholder proposals, three companies—CenturyLink, Chesapeake Energy and Verizon Communications—opted to include management proposals to adopt proxy access. Previously, each of these companies had a shareholder proposal that received majority support and each chose to adopt proxy access with a 3%/three-year holding requirement.

It will be interesting to see how shareholder proponents approach the issue moving forward. Some have expected a more widespread approach to submitting proposals. Thus far that has not been the case. Despite the relatively small sample size, these latest results seem to show that a consensus opinion has clearly started to form in favor of proxy access, provided that a meaningful threshold is required. It may be the case that the strong levels of support seen will result in more shareholder resolutions being submitted to companies.

Compensation-Related Shareholder Proposals: Breakout Year for Change-in-Control Payout Proposals

Compensation-related shareholder proposals were fewer in the 2014 proxy season, declining approximately 27% from last year. Approximately three-fourths of the proposals related to the issues of a) requiring senior executives to retain a significant portion of their equity awards and b) prohibiting acceleration of vesting of equity awards in the event of a change-in-control situation.

Change-in-control payout proposals had a breakout year in 2014, with majority support for the first time since 2010, when they first appeared on ballots. The proposals were approved at four companies—Boston Properties, Dean Foods, Gannett and Valero Energy. The overall votes cast for all proposals were also higher, averaging just over 35% this year. On the other hand, the equity retention proposals continued to have a weaker showing: none received majority support, and they averaged 22% of the votes cast, a slight decline from last year. The other notable proposal was the shareholder ratification of “golden parachute” severance packages at Kindred Healthcare. It was the only other compensation proposal that garnered majority support, receiving 73% of votes cast.

Environmental and Social (E&S) Proposals: Political Contribution and Lobbying Proposals Continue to Lead the Way

Shareholder resolutions focused on social issues have long remained out of the spotlight compared to other issues. However, over the past few years the trend has begun to change as social proposals have gained more attention, with shareholder proposals relating to political activity leading the way. The number of shareholder proposals on the political activity topic (84) was the highest among all shareholder proposals. After declining in 2013, climate change-related proposals rebounded in 2014, becoming the second largest category of E&S proposals. There were 28 proposals relating to greenhouse gas emissions and climate change reporting that were submitted to a vote, compared to only 11 such instances in 2013. The number of proposals on the third most prominent issue of sustainability reporting increased to 14 from 13 last year.

The vast majority of the political activity proposals fall into two categories: (1) report on policies and procedures for making political contributions; or (2) report on policies and procedures for lobbying activities (including grassroots lobbying). The two proposals accounted for 77 of the 84 political activity proposals and averaged 23% and 22% support of votes cast, respectively. Although none of the proposals received clear majority support (including abstentions), four managed to receive more “for” votes than “against” (excluding abstentions) and another 19 received better than 30% support, a very respectable level of support for an E&S proposal.

According to the Center for Political Accountability’s (CPA’s) 2014 Report on Political Disclosure and Accountability, 61% of the companies tracked make some disclosure on political contributions and 53% of the companies tracked improved their political disclosure between 2013 and 2014. Additionally, the report notes that nearly 140 companies decided to make voluntary disclosures despite not being the subject of shareholder activism. These numbers indicate that companies are taking social issues more seriously and have increased their attention on political accountability.

It is worth noting that most of the companies targeted are large-cap issuers and we expect that they will continue to be the primary target for activism on this topic in the near term. We also expect that while individual results will vary on a case-by-case basis, it may be hard for these proposals to gain significant additional support. A number of institutional investors tend to generally vote against or abstain on social-related proposals as a matter of policy. Thus, unless there is a philosophical shift in how these proposals are viewed, it seems unlikely that we will see widespread majority support on the issue.

Director Election: Focus on Board Composition

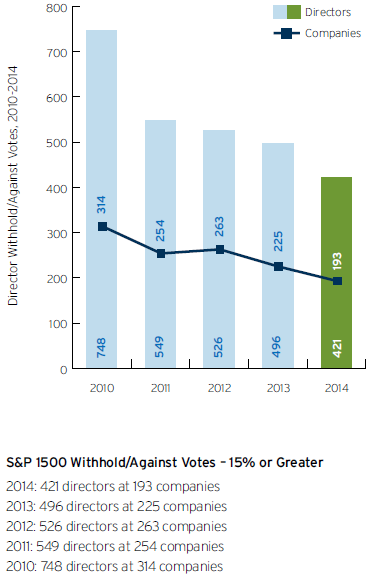

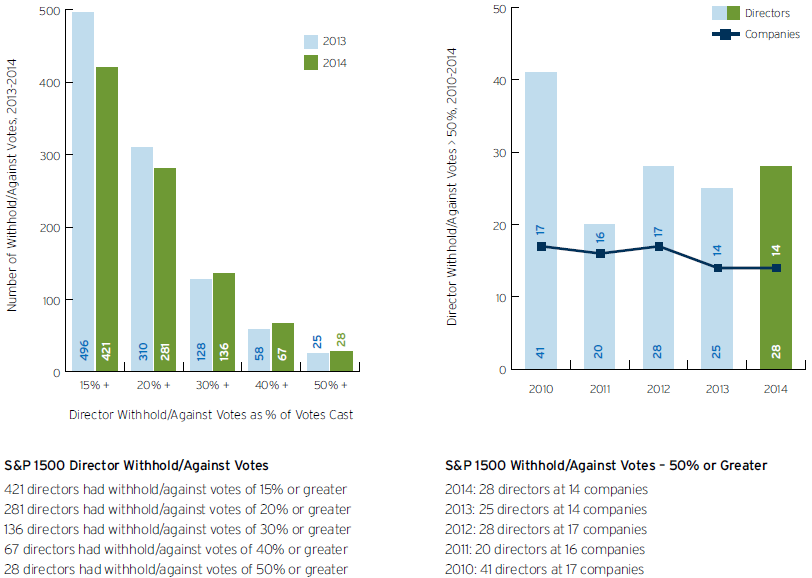

Support for director elections continued to increase in 2014. Among the S&P 1500 companies, the number of directors receiving 15% or greater opposition fell from 496 in 2013 to 421 in 2014. This coincides with the recent PwC 2014 Annual Corporate Directors Survey that notes that directors are more sensitive about low support for board nominees. 56% of the directors who were surveyed said that negative voting in the range of 11% to 25% would cause them to be concerned about renomination, compared to less than 50% of directors last year. According to Georgeson’s data, the number of directors receiving 15% or greater opposition has been steadily declining and has fallen 44% since 2010. Boards are increasingly taking corrective steps to avoid negative votes (including increased shareholder engagement), and in addition, say on pay proposals are acting as a buffer for opposition to compensation committee members.

There were 28 directors at 14 companies who faced majority or greater opposition to their election. More than half of those elections occurred at three companies, with nine directors at Healthcare Services Group, Inc. (HCSG) alone receiving majority withhold votes. The reasons for the entire board at HCSG receiving majority withhold votes were a) non-responsiveness to a 2013 majority supported shareholder proposal requesting a majority voting standard for director elections and independent board chair, and b) failure to address the issues underlying the majority opposition to two of the 2013 director nominees.

Six companies faced “Vote No” campaigns against re-election of directors in 2014, a slight decline from eight last year. Investment Group (CtW) led the charge in all but one of the cases. The main issues raised at each of the companies were as follows:

| Company | Proponent | Purported Reason |

| Burger King Worldwide, Inc. | CtW | Lack of compensation committee independence, grant of unjustified large discretionary payments |

| Domino‘s Pizza, Inc. | CtW | Excessive and poorly structured pay practices, compensation disclosure |

| Duke Energy Corporation | CalPERS | Environmental concerns relating to coal ash spill |

| Skechers USA, Inc. | CtW | Concerns over the board‘s composition and recruitment process |

| Starwood Property Trust, Inc. | CtW | Lack of board independence |

| Wendy‘s Company | CtW | Material failures relating to governance, board and risk oversight, and compensation |

There were nine proposals relating to board composition on the topics of

- Establishing board-level human rights committee (4)

- Adding minority and women directors (3)

- Nominating director(s) with environmental expertise (2)

Of these, the three proposals relating to board diversity received the most support, averaging 29% of votes cast. Gender and racial diversity is seen as helpful to promote different perspectives in the boardroom that can lead to better decisions and greater shareholder value. However, despite increased focus and demand for greater board diversity, progress has been slow.

One of the impediments to realizing board diversity is the issue of lack of board refreshment, another area of increased focus in 2014. According to Spencer Stuart Board Index 2013, an annual study that examines the state of corporate governance among S&P 500 companies, board turnover has trended downward over the past decade. The rising age for mandatory retirement has contributed to this trend, and independent directors are now older than they were a decade ago. However, director turnover increased by 16% in 2013, a positive sign that the trend of recent declines may be reversing. A noticeable development in 2014 that should further board refreshment was the adoption of a director tenure policy by State Street Global Advisors (SSgA). In its multilayered approach, SSgA policy considers average board tenure, preponderance (over one-third of the board) of very long-tenured, non-executive directors and existence of classified board structures. At companies that meet these criteria, SSgA’s policy may result in a vote against the Chair of the nominating/ governance committee, or against long-tenured directors serving on key committees, or against both nominating/governance committee and long-tenured directors serving on classified boards.

Contested Solicitations: “Golden Age” of Activism

Shareholder activist funds are increasingly viewed as an acceptable and successful asset class. With over $100 billion in assets under management, the impact of these funds is being felt throughout the corporate world. SEC Chair Mary Jo White even touted the benefits of shareholder activism. At an SEC Roundtable discussion held earlier this year, Chairwoman White was quoted as saying, “More and more, investors have become comfortable with being called an ‘activist’ in part because of the support they have received for their goals and, in some cases, even the tactics that they use. As we meet here today, there is widespread acceptance of many of the policy changes that so-called activists are seeking to effect.” Clearly, the trend is that more companies are facing activist situations. Big or small, strong performance or weak, no company is immune to the possibility of an attack.

In 2014 proxy contest activity continued its increasing trend, where the number of companies targeted for a proxy contest rose to 45 from 37 in 2013. That marks the third year in a row of increased proxy fight activity.

More important, we continue to see activists winning in many of these contested situations. Of the 45 proxy fights Georgeson tracked in which the dissident filed proxy materials, nine were settled or withdrawn. Of the 30 situations that went the distance and came to a vote, management won 12 cases and the dissident gaining representation in 18 cases (six situations are still pending as of the writing of this report).

What makes activists so successful? They come to the table with very sophisticated analyses outlining their economic thesis and they are implementing tactical nuance in their campaigns. When director nominations are made, candidates are highly qualified. But perhaps most important, traditional institutional investors are increasingly siding with activists. Certain traditional institutional investors are reportedly even inviting activists to take a look at specific portfolio companies.

M&A activism continues to be a significant force in 2014. Activists have increasingly sought to force issuer sales and mergers, becoming increasingly ambitious and creative in their approach. In one of the more interesting situations of 2014, Botox maker Allergan continues to fend off a hostile bid by Valeant Pharmaceuticals, aided by Bill Ackman’s Pershing Square Capital Management, L.P. Pershing Square used the written consent process to force a special meeting of Allergan shareholders to replace a majority of the board, and that meeting is now scheduled for December 2014.

Another interesting development regarding M&A activity involves tax inversions. These transactions, where a U.S. company would find a foreign company merger partner and reincorporate into that foreign jurisdiction to presumably avoid or minimize its tax burden, have been controversial. For example, Chiquita Brands International, Inc. which was seeking a friendly inversion deal with Irish fruit grower Fyffes plc., has come under significant pressure, and Chiquita was forced to consider an unsolicited offer from a pair of Brazilian companies. ISS ended up recommending against the merger with Fyffes, and Chiquita delayed its shareholder meeting and revised the terms of the offer. To discourage new transactions, the U.S. Treasury Department recently tightened its rules on corporate inversions, which is expected to make such deals harder and less profitable.

In conclusion, shareholder activism has now become main-stream. The negative stigma associated with activism has abated, and activists are playing smarter and more aggressively. In addition, investors are more aligned with activists on the shared goal of increasing shareholder value. To avoid or mitigate activist attention, companies need to understand their own vulnerabilities and take steps to address them.

Print

Print