The following post comes to us from John Graham, Professor of Finance at Duke University; Mark Leary of the Finance Area at Washington University in St. Louis; and Michael Roberts, Professor of Finance at the University of Pennsylvania.

In our paper, A Century of Capital Structure: The Leveraging of Corporate America, forthcoming in the Journal of Financial Economics, we shed light on the evolution and determination of corporate financial policy by analyzing a unique panel data set containing accounting and financial market information for US nonfinancial publicly traded firms over the last century. Our analysis is organized around three questions. First, how have corporate capital structures changed over the past one hundred years? Second, do existing empirical models of capital structure account for these changes? And, third, if not explained by existing empirical models, what forces are behind variation in financial policy over the last century?

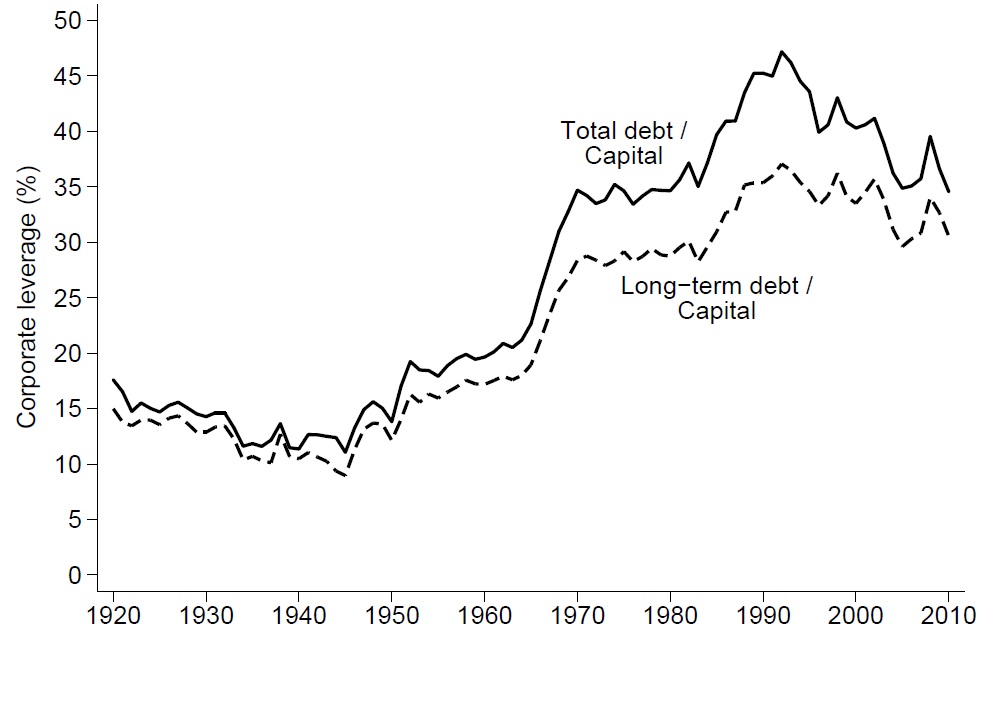

We begin by showing that the aggregate leverage ratio (i.e., debt-to-capital) of unregulated firms was low and stable, varying between 10% and 15%, from 1920 to 1945. In contrast, leverage more than tripled, from 11% to 35%, between 1945 and 1970. Since then, leverage has remained above 35%, peaking at 47% in 1992. Combined with an increase in non-debt liabilities, the aggregate corporate balance sheet shifted from 25% liabilities in the 1930s to over 65% liabilities by 1990.

This substantial increase in leverage is robust, observed in a variety of leverage measures that reveal additional insights into the changing nature of financial policy over the last century. For example, we show that debt gradually substituted for preferred equity between 1920 and 1960, when relatively little preferred equity remained. We also show that cash holdings exhibited a secular decrease concomitant with the secular increase in debt usage. In aggregate, cash and short-term investments accounted for nearly 25% of assets in 1945, but fell to 6% by 1970 when cash began a moderate climb to just over 10% in 2010. As a result, measuring leverage net of liquid assets reveals an even more pronounced levering up of unregulated firms during the last century.

Further analysis reveals that these aggregate trends are systemic. The leverage series of each unregulated industry—defined by the Fama and French 12-industry classification—exhibits a pattern similar to that found in the aggregate, as does the leverage of small, medium, and large firms Moreover, the median firm had no debt in 1946, but by 1970 had a leverage ratio of 31%. Finally, the fraction of investment financed with debt doubled from approximately 10% in the pre-WW II era to over 20% after 1970.

Having established the dramatic increase in leverage, we first ask to what extent this trend can be accounted for by changing firm characteristics identified in prior studies as capital structure determinants (e.g., Rajan and Zingales, 1995; Frank and Goyal, 2009). The answer is not much, if at all. We estimate regressions of leverage on firm characteristics using pre-WW II data and use these coefficients to make post-WW II predictions. Predicted leverage computed using realized firm characteristics is flat to declining from 1945 through the end of our sample period—in stark contrast to the increase in observed leverage over this period. Inspection of individual characteristics reveals that, with the possible exceptions of earnings volatility and firm size, none of the average or aggregate characteristics change over the century in a way that would support greater debt capacity or higher optimal leverage. Alternative estimation periods and model extensions do not improve the out-of-sample fit.

The inability of firm characteristics to account for the shift in leverage policies over time suggests either omitted firm characteristics that have yet to be identified, or macroeconomic factors that altered firms’ propensities to use debt. We therefore turn to our final set of analyses, which examines macroeconomic factors capturing changes in the economic environment that are theoretically relevant for financial policy. These factors capture changes to taxes, economic uncertainty, financial sector development, managerial incentives, and government borrowing. While a complete investigation into each underlying theory is beyond the scope of this paper, our results provide suggestive evidence.

Specifically, one of the more robust relations that we find is a negative association between corporate leverage and government leverage, the latter defined as the ratio of Federal debt held by the public to gross domestic product (GDP). A one standard deviation increase in government leverage is associated with a one-quarter standard deviation decrease in aggregate corporate debt-to-capital. This marginal effect on capital structure is significantly larger than that of other macroeconomic factors, such as GDP growth, inflation, and the BAA-AAA corporate bond yield spread, as well as firm characteristics, such as profit margins, asset growth, and the market-to-book assets ratio. This negative relation holds not just for the level of debt but also for the flows of debt in the two sectors. Thus, when the government reduces debt issuance, corporations increase their use of debt relative to equity, resulting in an increase in corporate leverage.

There are several potential mechanisms behind these findings. First, our results are consistent with government deficit financing crowding out corporate debt financing through competition for investor funds (Friedman, 1986). Second, and closely related, market imperfections, such as taxes (McDonald, 1983), informational frictions (Greenwood, Hanson, and Stein, 2010), and transaction costs (Krishnamurthy and Vissing-Jorgensen, 2012) generate an imperfectly elastic demand curve for corporate debt, as investors are no longer able to costlessly transform return streams from corporations to match their consumption needs. Consequently, fluctuations in the supply of government debt, a substitute for corporate debt, can shift the demand curve for corporate debt in a manner that affects equilibrium quantities.

Alternatively, the supply of government debt may proxy for latent investment opportunities. Increases in the supply of Treasuries tend to occur during economic downturns when firms’ investment opportunities are poor and their need for external capital falls. Because debt is the primary source of external capital (Gorton and Winton, 2003), corporate leverage falls. In this case, the relation between leverage and government borrowing may reflect fluctuations in unmeasured investment opportunities.

We also find a positive relation between corporate financial policy and the output of the financial sector from business credit and equity (Philippon, 2012). This relation exists with both leverage and the fraction of investment funded with debt, implying a potentially important role for the development of financial institutions and markets. However, other measures of financial market development, such as the fraction of debt and equity held through intermediaries, are not robustly correlated with aggregate leverage.

The full paper is available for download here.

Print

Print