Paula Loop is Leader of the Governance Insights Center at PricewaterhouseCoopers LLP. This post is based on a PwC publication by Ms. Loop and Catherine Bromilow.

Investors expect a new approach to engagement—one that covers important topics, meets their needs, and often involves directors. Companies with effective engagement programs are seizing the opportunity to build important relationships with long-term shareholders before crises hit. And they’re taking credit for them publicly, setting the bar higher for other companies. So how does your company measure up?

What are the new imperatives for directors?

Not so long ago, management, usually through investor relations, was responsible for any communications with shareholders. Directors had little or no contact with shareholders beyond attending the annual general meeting—and that’s pretty much the way the directors liked it. But things began changing rapidly, starting when shareholders got say on pay votes in 2011.

Directors (especially compensation committee chairs) began speaking with investors when companies failed or came close to failing their say on pay votes. Directors also started meeting with major shareholders when there were high profile shareholder proposal campaigns and proxy contests.

Given the rise of activist investors, it’s critical for directors to build relationships with major investors before any challenges arise. We’re now in a new engagement landscape.

- Engage with your shareholders. Shareholders expect directors to participate in the company’s shareholder engagement program. Building relationships with shareholders is particularly important given the presence of activists.

- Be transparent. Expand disclosures about your company’s engagement program: which directors were involved, what topics you discussed, and what actions your board took in response.

What are your investors looking for?

Major institutional investors engage with many of their portfolio companies every year. [1] Sometimes these are through in-person meetings, but they may be done via telephone or during investor days.

The discussions focus on:

- company performance, particularly for underperforming companies

- key risks—cybersecurity, climate change, environmental and social issues, risks brought by significant changes impacting the sector

- governance concerns—board refreshment, diversity, shareholder rights, proxy access

- the board’s role in overseeing areas such as strategy, risk, executive compensation, CEO succession, and capital allocation

Investors indicate that they’re satisfied connecting with management on most of these subjects. Investors don’t expect directors to attend every meeting. We’ve heard investors estimate that directors participate in about 20% of these engagements.

But in some cases, investors want to talk with directors. Sometimes it’s because they think management hasn’t responded to their concerns. Or they believe directors would benefit from hearing “unfiltered” investor perspectives. Other times it’s to express concerns about board performance or the performance of certain individual directors. And so more investors are calling for companies to adopt protocols for director involvement in shareholder engagement.

What investors say about engagement

BlackRock

“[Our] global team engages with approximately 1,500 companies per year on a range of issues.”

“We meet with executives and board directors… Engagement helps better inform our voting and investment decisions.”

“We engage in a constructive manner. Our aim is to build mutual understanding and ask questions, not to tell companies what to do.”

“We generally prefer to engage in the first instance where we have concerns, and give management time to address or resolve the issue.”

MFS

“… [our] Proxy Voting Committee engaged with senior representatives from 213 distinct portfolio companies (298 engagements in total) in 13 different markets during the 2015 Proxy Period, representing 11% of issuers that we voted on…”

“Our goal when engaging with our portfolio companies is to exchange views on topics ranging from executive compensation to environmental issues…”

“We are always open to engage with any company on any issue…in order for our voting decision to be adequately informed.”

The Capital Group

“We conduct thousands of in-person meetings and conversations each year with senior management and directors of portfolio companies. This allows us to assess not just the operations and strategies of the companies we follow, but also to make informed assessments of the individuals who guide and manage them. The relationships we build through this process can also result in companies seeking our input on a variety of corporate governance matters.”

Vanguard

“In the past 12 months, we spoke with the management or directors of nearly 700 companies encompassing approximately $900 billion in Vanguard fund assets.”

“…we sent letters to the chairpersons, lead independent directors, and/or CEOs of 500 of the funds’ largest US holdings. Our objective was to encourage enhanced discussions between directors and shareholders.”

“We have no interest in telling companies how to run their businesses, but we have valuable governance insights to share with the board of directors.”

“Large shareholders like Vanguard want to know your approach and how you plan to engage [with investors].”

Sources:

BlackRock, Investment Stewardship, viewed June 9, 2016.

MFS, 2015 Global Proxy Voting and Engagement Report, viewed June 15, 2016; Proxy Voting and Engagement Report, February 2016, viewed June 15, 2016.

The Capital Group, American Funds and Corporate Governance, viewed June 15, 2016.

Vanguard, Our proxy voting and engagement efforts: An update, for the 12 months ended June 30, 2015, viewed June 9, 2016; Text of a letter sent by F. William McNabb III, Vanguard’s Chairman and CEO, to the independent leaders of the boards of directors of the Vanguard funds’ largest portfolio holdings, February 27, 2016, viewed June 9, 2016.

What should directors expect of management?

The new activist environment means it’s even more vital for companies to engage with their shareholders. Engaging helps you understand where your key shareholders believe you are vulnerable. Then you can either decide to address those issues or affirm—and perhaps better disclose your reasoning behind—your previous decisions. This lets you be prepared if (or when) an activist comes calling.

Directors should ensure management has a thoughtful, ongoing program for shareholder engagement. The best ones:

- Regularly track who owns the company stock

- Focus engagement on long-term shareholders

- Set targets for annual engagement—e.g., the 20 largest shareholders, or shareholders representing 60% of the base

- Engage at the right time—i.e., not during proxy season, unless there’s a compelling issue

- Integrate messages with what the company discloses on analyst calls, during investor days, at its annual meeting, and in its SEC filings

- Clarify when to involve key members of the C-suite

- Ensure concerns heard during discussions are fully discussed with both senior management and the board

The most critical messages to get right in engagement discussions relate to how the company’s strategy ties to long-term value and how key decisions relate to the strategic plan—both areas of intense interest to shareholders. Directors will find that examining and debating those topics will help focus their discussions with management about company strategy. Once directors are satisfied the company has an appropriate strategic plan, they can provide management with input on messaging.

How are directors getting involved?

Having directors participate in direct engagement with certain major investors can be incredibly beneficial. Establishing a relationship of trust between key directors and major shareholders is especially helpful if the company subsequently finds itself in activists’ cross hairs.

While more boards are stepping up, some directors are reluctant to get involved. [3] Among other things, they worry about delivering mixed messages and violating Regulation Fair Disclosure (Reg FD). (For ways to communicate in a Reg FD-compliant way, see Director dialogue with shareholders—what you need to consider, p 14.)

But with the environment changing, it’s more likely that at least some directors will engage with company shareholders in some way. Even directors who have resisted being proactive with shareholder engagement may change their position if the company is under attack.

If that happens, someone on the board has to be prepared and ready to handle communications.

In our review of 100 company proxy statements, we found that 42 identified who on the board is or would be involved in any engagement effort. Almost without exception (41 of the 42), they identified the lead independent (or presiding) director as the one to be involved in any shareholder engagement.

How can boards prepare for investor meetings?

- Know who your investors are and how much they own

- Determine which investors you would be willing to meet with—possibly based on ownership percentage

- Identify the director(s) who will be involved; properly prepare them for the meeting

- Agree on appropriate agenda topics

- Know the company’s strategy story and how the capital allocation plan aligns with it

- Understand how to comply with Reg FD

What are companies disclosing?

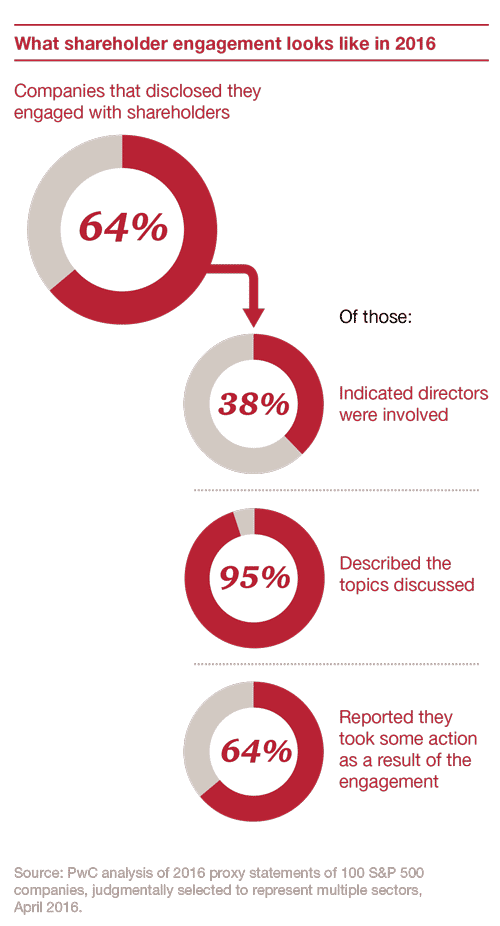

While many companies disclose they have a shareholder engagement program, the quality of what they say varies.

The best disclosures describe:

- the outreach program, including what proportion of shareholders they want to reach and the frequency or timing of outreach,

- how the engagement happened (e.g., in-person meetings, conference calls),

- the topics covered during the discussions,

- the number (e.g., ten of our largest shareholders) or percentage of shareholdings (e.g., over 60% of our outstanding shares) represented by meeting participants,

- the reasons driving any special or new outreach efforts, such as a fall in say on pay approval rates,

- who from the company was involved, including who from the C-suite,

- whether directors were involved in the engagement—and, if so, which directors (e.g., lead director, compensation committee chair),

- what feedback the company received, and

- the specific actions taken in response to the discussions.

The most common actions disclosed were changes in compensation programs and the adoption of proxy access, while others mentioned increased disclosure about board composition and refreshment, changes to financial metrics to align better with company strategy, and enhancement of other company disclosures.

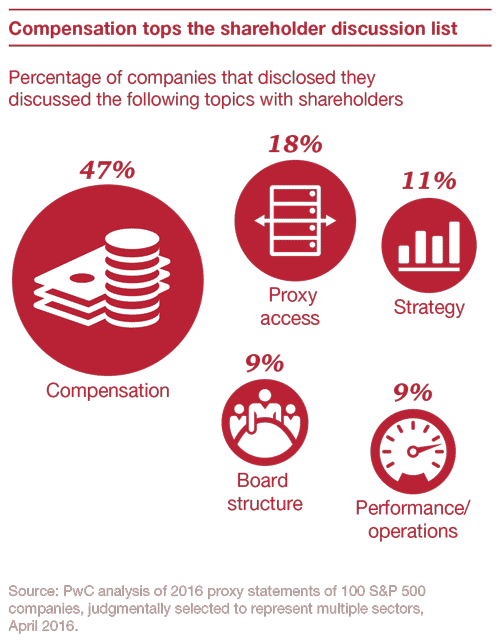

Of the 64 companies that disclosed they had engaged with shareholders, 61 disclosed the topics discussed. Compensation was most frequently cited. Almost half the companies also referred to “corporate governance” or “governance practices” as topics of discussion.

Endnotes:

[1] Investors that disclose engagement policies on their websites include State Street Global Advisors. BlackRock. Vanguard. MFS, and The Capital Group, among others.

(go back)

[2] Matt Turner, “Here is the letter the world’s largest investor, BlackRock CEO Larry Fink, just sent to CEOs everywhere,” Business Insider, February 2, 2016; http://www.businessinsider.com/blackrock-ceo-larry-fink-letter-to-sp-500-ceos-2016-2.

(go back)

[3] In PwC’s 2014 Annual Corporate Directors Survey, 22% of directors “very much” agreed it is not appropriate to engage directly with investors on any subject.

(go back)

Print

Print