Ann Yerger is an executive director at the EY Center for Board Matters at Ernst & Young LLP. The following post is based on a report from the EY Center for Board Matters.

Active—not just activist—institutional investors are reshaping the corporate governance landscape and challenging how boards think about fundamental issues such as strategy, risk, capital allocation and board composition. Large asset managers are increasingly outspoken on governance expectations and urging companies to think long term—and also making clear that they view corporate governance not as a compliance exercise but as an ownership responsibility tied to investment value and risk mitigation.

Companies are responding to investor demands for increased board accountability and transparency. They are enhancing communications with investors to share the board’s message on governance and strategy and highlight director qualifications and board responsiveness to investor concerns. Against this backdrop of increased company-shareholder engagement and evolving disclosure practices, investor support for directors and company pay programs remains high.

This post is based on EY Center for Board Matters’ proprietary corporate governance database, ongoing conversations with investors and directors, and insights from EY’s Corporate Governance Dialogue series, which convenes key governance influencers to discuss developments impacting the governance landscape. [1]

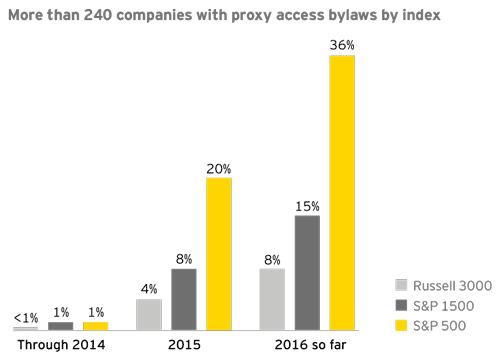

1. Adoption of proxy access is accelerating across the market

Proxy access, a provision that companies fought against for decades, has now been adopted by more than a third of Standard & Poor’s (S&P) 500 companies within a two-year span, driven largely by the submission of shareholder proposals calling for the reform. Around 60% of almost 200 companies that received proxy access shareholder proposals for 2016 annual meetings adopted proxy access bylaws before the proposal even went to a vote. Most companies with proxy access (81%) have adopted the following key provisions: a group of up to 20 investors that have collectively held at least 3% of the outstanding stock for at least three years may nominate up to 20%-25% of the board (in some cases, providing for at least 2 nominees).

What this means for boards

Pressure on companies to adopt proxy access is likely to increase. Also, at a significant—and increasing—number of companies, investors now have a new tool for holding their representatives on boards accountable. Actions to consider:

- Proactively raise the topic with key shareholders to better understand their views on proxy access, including around preferred terms (e.g., shareholders’ ability to work as a group and the number of board seats that may be filled)

- Confirm that communications around board composition make clear how the skill sets of individual directors are aligned with the company’s strategy and risk oversight efforts, and discuss the board’s assessment, refreshment and nomination processes

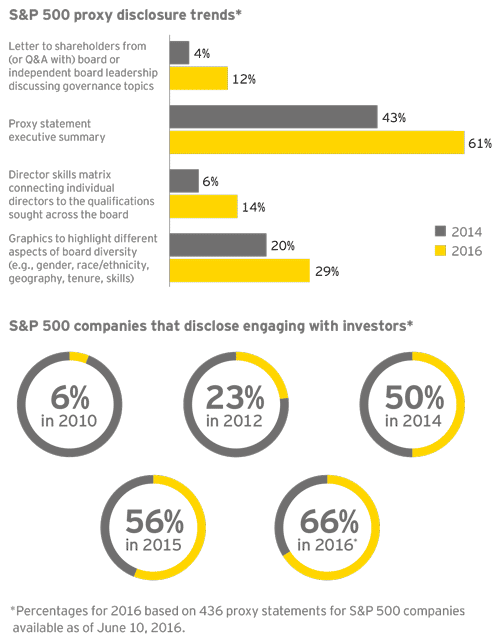

2. Companies continue to enhance investor communications

Proxy statements continue to evolve from compliance documents to communication tools that serve as an extension of corporate engagement efforts and a formal record of the board’s priorities and governance philosophy. Effective proxy statements are improving readability through enhanced formatting and graphics, demonstrating board engagement and effectiveness, and addressing key interests of institutional investors.

Company-investor engagement on governance topics—and disclosure of these efforts in the proxy statement—also continues to grow. While executive compensation remains a primary engagement driver, companies disclosed a variety of other topics that were part of those conversations, including proxy access, strategy, performance, board composition, board leadership, board assessments, director tenure, sustainability practices, risk oversight and capital allocation. And directors are getting involved: among the 287 S&P 500 companies that disclosed engagement this year, 24% disclosed that board members were involved (most often the lead director or compensation committee chair), up from 18% last year.

What this means for boards

Proxy disclosures are an efficient way to take the company’s targeted governance message to a broad audience of investors and other stakeholders. Through direct engagement, companies are better positioned to proactively respond to investor concerns, have effective investor communications and secure investor support. Actions to consider:

- Use the proxy statement to directly address investors, e.g., through a letter from the board or a committee, a O&A with the lead director or a link to director video interviews

- Incorporate investor insights into governance decisions and communications

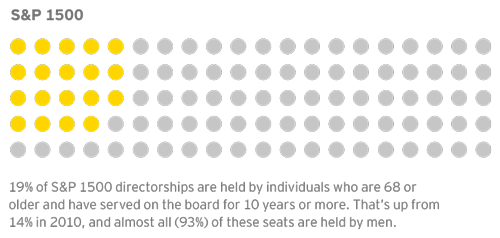

3. Board composition remains a key focus with director tenure and board leadership coming under increased investor scrutiny

Investors evaluate board composition using a number of different lenses (e.g., skill set and subject-matter experience relevant to industry, strategy and risk; diversity, specifically including gender, race and ethnicity; independence). Some investors are now particularly focused on director tenure and the board’s approach to refreshment and succession planning. Notably, several influential investors have recently adopted proxy voting policies that take tenure into account. [2]

Some investors view tenure as a measurement of the relevance of director experience. Indeed, expertise may become stale over time as a director becomes further removed from the professional qualifications underlying his or her recruitment to the board. Some investors also believe lengthy tenure may compromise board independence. Other considerations include the need for gradual board and committee turnover and the fact that board refreshment is critical to recruiting new skills aligned with the company’s evolving strategy—and creating opportunities to enhance board diversity.

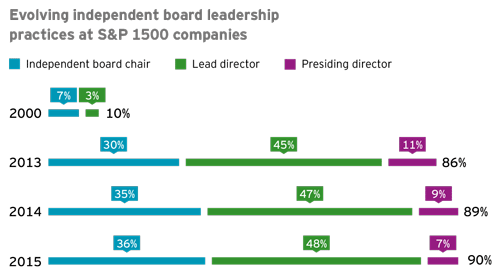

Some investors are also paying closer attention to board leadership. They seek assurances that boards have empowered and effective independent leaders with well-defined responsibilities and relevant personal strengths and qualifications. [3] For some, there is no substitute for an independent chair, but others find lead directors to be sufficient. While having an independent board leader has become standard practice, there continues to be a lack of consensus over the preferred structure among companies, and the relatively stagnant support for independent chair shareholder proposals (hovering around 30% over the past four years) may reflect that.

What this means for boards

Boards’ record of refreshment, assessment process and leadership structures are under increased scrutiny. As some investors weigh their options for encouraging regular, thoughtful board refreshment, it underscores the value in companies enhancing their communications in these areas. Actions to consider:

- Discuss board refreshment, assessment and leadership during engagement conversations with shareholders (and consider making directors available as appropriate), and enhance proxy disclosures related to these topics

- Include proxy statement graphics highlighting the board’s diversity of tenure (25% of S&P 500 companies have done so this year) and letters from (or Q&As with) the lead independent director or independent chair, demonstrating the depth of their role (6% of S&P 500 companies have done so this year)

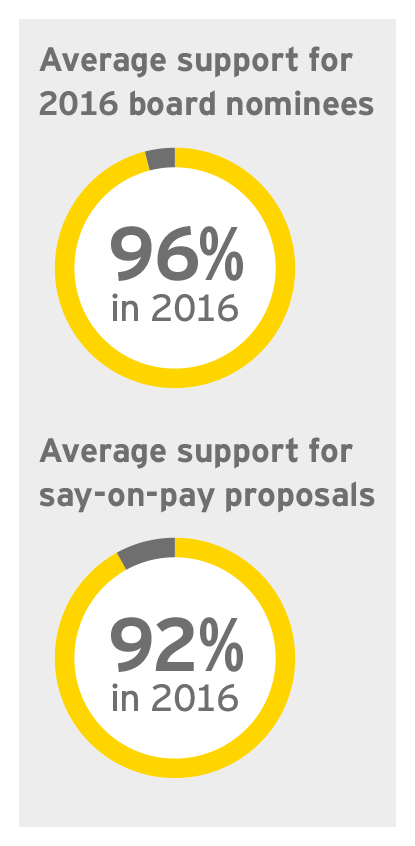

Strong investor support for directors and executive pay programs

Despite increased investor scrutiny of directors’ qualifications and tenure, support for director elections continues to rise. Only around 0.2% of directors have failed to get majority support so far this year, down from 0.3% in 2015.

Similarly, investors are giving directors high marks on one of their key responsibilities: compensating executives. So far, only 2% of all say-on-pay proposals voted on this year have received less than majority support—that is just 24 proposals out of 1,484. [4]

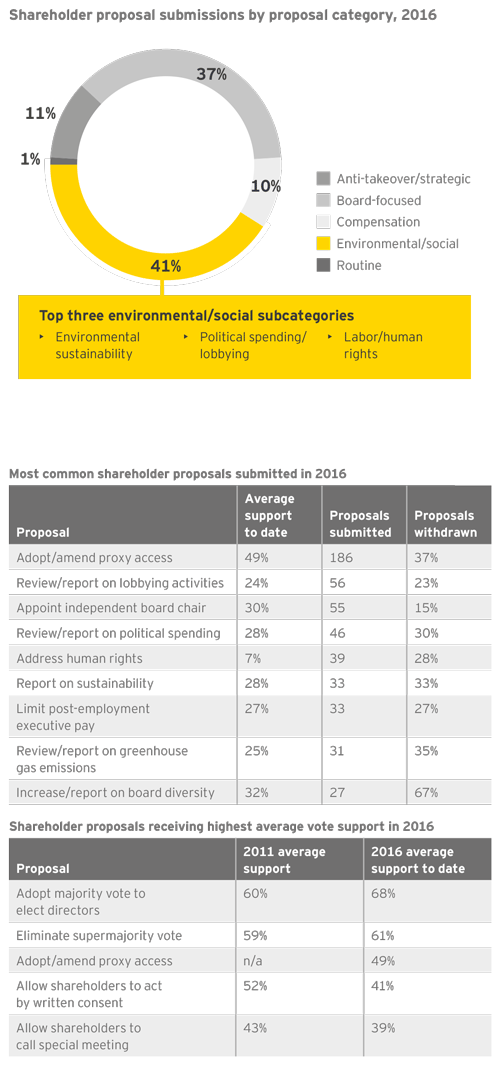

4. Shareholder proposal submissions remain high, driven by push for proxy access and environmental sustainability

Shareholder proposal submissions generally remain high. We are tracking around 890 shareholder proposals submitted for meetings through June 30, 2016, which is close to what we tracked over the same period last year. This sustained high level of proposals is largely driven by the campaign for proxy access and a continued push for increased transparency and accountability around environmental sustainability practices. Some key takeaways include:

- Environmental and social topics remain in the lead among proposal categories, but board-related proposals have increased with the expansion of the campaign for proxy access. This year, 37% of shareholder proposal submissions are board-related, up from 28% in 2015.

- The most submitted shareholder proposal topic again this year was proxy access. Shareholder proposals on this topic average close to majority support—and usually fall under that mark only when the target company has already adopted proxy access by the time the proposal goes to a vote or management is submitting a counterproposal to adopt proxy access. The proposal averages 59% when excluding such companies.

- Environmental considerations appear to be moving further into the mainstream, [5] and some proxy votes to date may reflect that shift. Average support for proposals on climate risk have jumped from 7% in 2011 to 28% so far this year, including a proposal at an oil and gas company that nearly received majority support with 49% of the votes cast. In addition, there have been two environmental sustainability-related proposals so far this year to receive majority votes: one seeking a sustainability report, including greenhouse gas emissions reduction goals, and another seeking a report on the company’s monitoring and managing of methane emissions.

- The percentage of shareholder proposals withdrawn before going to a vote is 26%, which is consistent with recent years.

Questions for the board to consider:

- Is your board prepared to integrate conversations about long-term strategy with conversations about governance—and are key directors prepared to take part in shareholder engagement?

- Does your board know key shareholders’ views on proxy access and the company’s governance practices?

- How is your board verifying that director qualifications align with the company’s risks and opportunities going forward? And that regular refreshment brings in current expertise and increases board diversity?

- How does your board’s leadership structure improve board effectiveness?

- Is your company optimizing the proxy statement as an investor communications tool? Are there ways to enhance communications around board leadership, director qualifications, board succession planning and assessments?

- How is the board overseeing environmental and social risk and value drivers? Are environmental and social considerations integrated into the company’s long-term strategy—and is the company communicating that to investors?

Endnotes:

[1] All data is from EY’s proprietary corporate governance database, which covers more than 3,000 companies listed in the US. For additional timely governance data, see EY’s Corporate Governance by the Numbers Shareholder proposal data is based on meetings through June 30,2016. Vote results for 2016 are available for meetings through May 31,2016. All other data is full year.

(go back)

[2] See statements from State Street Global Advisors, February 2015; CalPERS, March 14, 2016; and Legal & General Investment Management, February 21, 2016.

(go back)

[3] See statement from State Street Global Advisors, February 2016.

(go back)

[4] See EY’s Corporate Governance by the Numbers for more data on director elections and say-on-pay proposals.

(go back)

[5] See 2016 proxy season preview: a focus on the long term.

(go back)

Print

Print