Yafit Cohn is an associate at Simpson Thacher & Bartlett LLP. The following post is based on a Simpson Thacher publication authored by Ms. Cohn, Karen Hsu Kelley, and Avrohom J. Kess.

In recent years, a growing group of investors has called upon issuers to make available certain sustainability-related disclosures. In this same vein, several non-profit organizations, such as the Sustainability Accounting Standards Board (“SASB”), the Global Reporting Initiative (“GRI”), the Climate Disclosure Standards Board (“CDSB”) and the International Integrated Reporting Counsel (“IIRC”), have developed voluntary sustainability reporting standards for issuers to consider. While the Securities and Exchange Commission (“SEC”) is currently seeking public comment in connection with its Disclosure Effectiveness Initiative on whether it should “increase or reduce the environmental disclosure required” in Regulation S-K, it is unclear whether any sustainability-related disclosures will be mandated. In the absence of an SEC rule requiring sustainability disclosures, shareholders seeking to influence corporate action on sustainability reporting, as well as on climate change and other environmental issues, have increasingly turned to shareholder proposals in an effort to achieve their goals. These proposals have come in various forms; while some proposals seek increased disclosure, other proposals target companies’ corporate governance regime by requesting the nomination of directors with expertise in environmental matters or linking executive compensation with sustainability criteria.

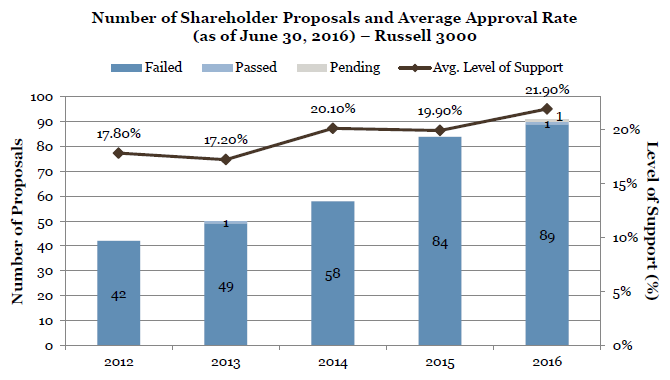

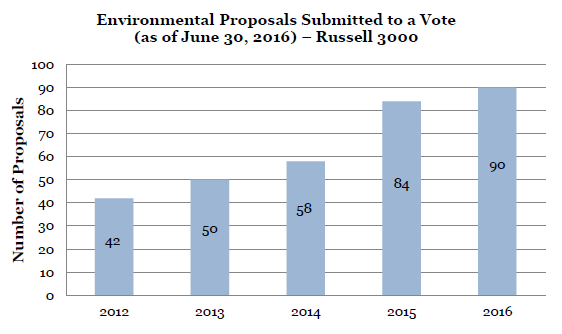

Shareholder proposals pertaining to environmental issues have become increasingly prevalent over the past five years. As of June 30, 2016, 90 environment-related proposals had been submitted to a vote at Russell 3000 companies this year, compared to 84 proposals in 2015 and 58 proposals in 2014. Despite this steady increase, however, environmental proposals have been overwhelmingly unsuccessful. Of the 90 proposals that have been voted on so far this year, only one proposal (or 0.1%) passed, while 89 proposals (or 99.9%) failed. This outcome is consistent with voting results in previous years; over the past five years, only two out of a total of 324 environmental proposals that reached a vote at Russell 3000 companies (or 0.6%) have passed. Additionally, thus far this year, shareholder proposals submitted to a vote at Russell 3000 companies received average shareholder support of 21.9%. This result is in line with the average support of 19.9% and 20.1% garnered by environmental shareholder proposals in 2015 and 2014, respectively.

Nonetheless, these proposals appear to be getting more traction, as companies seem to be more inclined to negotiate with proponents as compared to previous years.

I. Positions of the Proxy Advisory Firms

A. Institutional Shareholder Services Inc. (“ISS”)

1. Policies

As a general matter, ISS recommends a vote case-by-case on proposals addressing social or environmental issues, with the “overall principle” guiding its vote recommendations focusing on “whether the implementation of the proposals is likely to enhance or protect shareholder value.” In reaching its vote recommendations on social or environmental proposals, ISS also considers several enumerated factors, namely:

- whether “the issues presented in the proposal are more appropriately or effectively dealt with through legislation or government regulation”;

- whether “the company has already responded in an appropriate and sufficient manner to the issue(s) raised in the proposal”;

- whether the request in the proposal is “unduly burdensome” in its scope or timeframe or is “overly prescriptive”;

- how the company’s approach compares to “any industry standard practices for addressing the issue(s) raised by the proposal”; and

- in cases where the proposal requests “increased disclosure or greater transparency, whether or not reasonable and sufficient information” is available to the company’s shareholders and “whether or not implementation would reveal proprietary or confidential information that could place the company at a competitive disadvantage.”

ISS also has distinct voting policies on various specific environmental issues. The most notable of these are discussed below.

Climate Change/Greenhouse Gas (“GHG”) Emissions.

- Disclose information on risks of climate change. ISS generally recommends a vote in favor of proposals that seek the disclosure of information on the risks of climate change to the company’s operations and investments, considering the following factors:

- whether the company already discloses current information “on the impact that climate change may have on the company as well as associated company policies and procedures to address related risks and/or opportunities”;

- whether the company’s level of disclosure is comparable to that of industry peers; and

- whether there are “no significant controversies, fines, penalties, or litigation associated with the company’s environmental performance.”

- Report on GHG emissions. ISS also generally recommends a vote in favor of proposals requesting a report on GHG emissions from the company’s operations and/or products, unless:

- the company already discloses information on the potential impacts of GHG emissions on the company, as well as related company policies and procedures designed to address related risks and/or opportunities;

- the company’s “level of disclosure is comparable to that of industry peers”; and

- there are “no significant controversies, fines, penalties, or litigation associated with the company’s GHG emissions.”

- Adopt GHG reduction goals. ISS takes a case-by-case approach, however, on proposals calling for the adoption of GHG reduction goals from products and operations, taking into account the following factors:

- “whether the company provides disclosure of year-over-year GHG emissions performance data;

- whether company disclosure lags behind industry peers;

- the company’s actual GHG emissions performance;

- the company’s current GHG emission policies, oversight mechanisms and related initiatives;

- and

- whether the company has been the subject of recent, significant violations, fines, litigation, or controversy related to GHG emissions.”

Sustainability Reporting.

ISS generally supports proposals requesting “that a company report on its policies, initiatives, and oversight mechanisms related to social, economic, and environmental sustainability,” unless “the company already discloses similar information” or “has formally committed to the implementation of a reporting program based on Global Reporting Initiative (GRI) guidelines or a similar standard within a specified time frame.”

Renewable Energy.

ISS generally recommends a vote in favor of proposals requesting reports on “the feasibility of developing renewable energy resources,” unless the report would be duplicative of existing disclosure or irrelevant to the company’s business. ISS, however, generally recommends a vote against “proposals requesting that the company invest in renewable energy resources.” In ISS’s view, these decisions “are best left to management’s evaluation of the feasibility and financial impact that such programs may have on the company.”

General Environmental Proposals and Community Impact Assessments.

ISS assesses, on a case-by-case basis, proposals requesting “reports on policies and/or the potential … environmental impact of company operations,” considering the following factors:

- the company’s current disclosure of applicable policies and risk assessment reports, as well as risk management procedures;

- the regulatory, legal or reputational impact of failing to “manage the company’s operations in question”;

- the “nature, purpose, and scope of the company’s operations in the specific region(s)” in question;

- the degree to which the company’s policies and procedures are “consistent with industry norms”; and

- the scope of the proposal.

Environmental, Social, and Governance (ESG) Compensation-Related Proposals.

ISS recommends voting case-by-case on “proposals to link, or report on linking, executive compensation to sustainability (environmental and social) criteria,” taking into account:

- “the scope and prescriptive nature of the proposal”;

- whether the company has significant and/or persistent controversies or regulatory violations regarding social and/or environmental issues;

- whether the company has management systems and oversight mechanisms in place regarding its social and environmental performance;

- the degree to which industry peers have incorporated similar non-financial criteria in their executive compensation practices; and

- the company’s current level of disclosure regarding its environmental and social performance.”

Changes to the Board of Directors.

Shareholder proposals seeking to advance environmental causes may request that the board nominate a director with subject matter expertise or create a standing committee to oversee sustainability efforts. ISS recommends voting case-by-case on “proposals that establish or amend director qualifications,” considering “the reasonableness of the criteria and the degree to which they may preclude dissident nominees from joining the board.” ISS also recommends voting case-by-case on “resolutions seeking a director nominee who possesses a particular subject matter expertise, considering:

- “the company’s board committee structure, existing subject matter expertise, and board nomination provisions relative to that of its peers;

- the company’s existing board and management oversight mechanisms regarding the issue for which board oversight is sought;

- the company’s disclosure and performance relating to the issue for which board oversight is sought and any significant related controversies;

- and

- the scope and structure of the proposal.”

In addition, ISS generally recommends voting against “proposals to establish a new board committee,” considering:

- “existing oversight mechanisms,” “level of disclosure” and “company performance related to the issue for which board oversight is sought”;

- “[b]oard committee structure compared to that of other companies in its industry sector; and

- the scope and structure of the proposal.”

Hydraulic Fracturing.

ISS generally recommends voting for proposals “requesting greater disclosure of a company’s (natural gas) hydraulic fracturing operations, including measures the company has taken to manage and mitigate the potential community and environmental impacts of those operations.” In determining its vote recommendation, ISS considers:

- the company’s “current level of disclosure of relevant policies and oversight mechanisms” and how it compares to that of industry peers;

- “potential relevant local, state, or national regulatory developments”;

- and

- “controversies, fines, or litigation related to the company’s hydraulic fracturing operations.”

Recycling.

ISS recommends voting case-by-case on “proposals to report on an existing recycling program, or adopt a new recycling program,” considering:

- “the nature of the company’s business;

- the current level of disclosure of the company’s existing related programs;

- the timetable and methods of program implementation prescribed by the proposal;

- the company’s ability to address the issues raised in the proposal; and

- how the company’s recycling programs compare to similar programs of its industry peers.”

2. Practice

Thus far this year, ISS has recommended a vote “For” 67 of 90 environment-related shareholder proposals (or 74.44%) submitted to a vote at Russell 3000 companies. ISS recommended a vote “For” an overwhelming majority of proposals related to sustainability reports, GHG emissions and climate change, with 13 out of 14 (or 92.86%), 13 out of 17 (or 76.47%), and 16 out of 22 (or 72.73%) proposals receiving a favorable recommendation, respectively. Notably, within the climate change category, ISS recommended a vote “Against” both “climate change action” proposals, which requested an increase in capital distributions to shareholders in light of climate change risks.

B. Glass Lewis

Glass Lewis’s proxy voting guidelines recognize that “day-to-day management and policy decisions, including those related to social, environmental or political issues, are best left to management and the board as they in almost all cases have more and better information about company strategy and risk.”

Glass Lewis will, however, favor “reasonable, well-crafted” shareholder proposals “when there is a clear link between the subject [of the proposal] and value enhancement or risk mitigation,” and, in Glass Lewis’s estimation, the company has not successfully addressed the issue. While discouraging the use of shareholder initiatives to “attempt to micromanage a company, its businesses or its executives,” Glass Lewis recognizes that, in some cases, these initiatives may serve to “protect shareholder value.”

Accordingly, Glass Lewis evaluates environment-related proposals “in the context of risk, on a case-by-case basis,” considering the following types of risk:

- Direct environmental and social risk, including “financial exposure to direct environmental risks associated with [the company’s] operations”;

- Risk due to legislation and regulation, i.e. “exposure to changes or potential changes in regulation that affect current and planned operations”;

- Legal and reputational risk, i.e., “the risk of damaging negative publicity and potentially costly legislation” resulting from “[f]ailure to take action on important environmental or social issues”; and

- Governance risk, i.e., the risk resulting from leadership that is ineffective or fails to thoroughly consider potential risks from environmental or social issues, which could ultimately lead to loss of shareholder value.

Glass Lewis also includes, in its proxy voting guidelines, policies regarding specific categories of environmental proposals. The most notable of these are discussed below.

Climate Change/GHG Emissions.

Glass Lewis considers recommending a vote in favor of “reasonably crafted proposals that request disclosure of a company’s climate change and/or [GHG] emission strategies” when:

- the company “has suffered material financial impact from reputational damage, lawsuits or government investigations”;

- “there is a strong link between climate change and its resultant regulation and shareholder value at the firm”;

- the company “lags its peers regarding the requested disclosure or actions”; and/or

- the company “has inadequately disclosed how it has addressed climate change risks.”

In addition, Glass Lewis considers supporting, on a case-by-case basis, “well-crafted proposals requesting that companies report their GHG emissions and adopt a reduction goal for these emissions[,] [p]articularly for companies operating in carbon- or energy-intensive industries.” In evaluating such proposals, Glass Lewis considers:

- “the industry in which the company operates;

- a lack of robust risk management of environmental issues as evidenced by material fines, lawsuits or reputational damage; and

- whether a company’s peers have provided disclosure concerning their GHG emissions and future reduction goals.”

Sustainability and Environmentally-Related Reports.

In its evaluation of proposals requesting that the company produce a sustainability or other “environmentally-related” report, Glass Lewis considers, among other factors:

- the “financial risk to the company from its business operations”;

- “the company’s current level of relevant disclosure;

- the quality and comprehensiveness of sustainability information disclosed by the company’s peers;

- the industry in which the company operates;

- the company’s oversight of sustainability issues;

- the level and type of sustainability concerns and controversies at the company;

- the time frame within which the relevant report is to be produced; and

- the level of flexibility granted to the board in implementing the proposal.”

Glass Lewis will consider recommending voting for “reasonably crafted proposals” requesting that companies “with significant exposure to sustainability-related risks,” such as those in extractive industries, produce “reports regarding the risks presented by their environmental and adverse effects on stakeholders that reduce shareholder value.” Glass Lewis will nonetheless evaluate these proposals, like all other environmental proposals, on a case-by-case basis.

Renewable Energy.

When evaluating “proposals requesting an action or disclosure related to renewable energy or energy efficiency,” Glass Lewis will take into account:

- “current energy regulations facing the company and their attendant risks to its operations; o the company’s responsiveness to issues related to energy efficiency and renewable energy; o the company’s current disclosure on this issue; and

- whether the company’s actions and disclosure are aligned with that of its peers.”

Glass Lewis may consider recommending a vote in favor of “well-crafted” proposals that seek “increased disclosure of renewable energy strategies or efforts toward increased energy efficiency,” where:

- “there is credible evidence of egregious or illegal behavior regarding the company’s energy strategy or actions in this regard;

- the company has been largely unresponsive to shifting regulatory changes related to energy policies; or

- adoption of the requested disclosure will clearly lead to an increase in or the protection of shareholder value.”

Glass Lewis, however, is “not inclined to support proposals requesting the adoption of renewable energy goals or proposals seeking the implementation of prescriptive policies related to energy efficiency or renewable energy.”

Executive Compensation.

With regard to proposals that request tying executive compensation to environmental or social practices, Glass Lewis will:

- “review the target firm’s compliance with (or contravention of) applicable laws and regulations”;

- “examine any history of environmentally and socially related concerns, including those resulting in material investigations, lawsuits, fines and settlements”; and

- “review the firm’s current compensation policies and practices.”

As a general matter, however, Glass Lewis believes that “the selection of performance metric for executive compensation … should be left to the compensation committee.”

II. Positions of Large Institutional Shareholders

Large institutional shareholders have not uniformly provided explicit guidance as to their voting policies on environment-related proposals. The voting guidelines of Fidelity, Vanguard and BlackRock, for example, do not reference environmental proposals. Additionally, institutional investors’ policies on environmental proposals are usually broad in scope and do not necessarily address how a specific proposal will be evaluated. Because environmental proposals tend to be specific, it can be difficult to discern how these institutional investors will respond to any given proposal. State Street Global Advisors, for example, addresses environmental proposals in its voting guidelines, indicating that it is chiefly concerned the financial and economic implications of environmental issues. According to its voting principles, State Street “encourages companies to be transparent about the environmental and social risks and opportunities they face and adopt robust policies and processes to manage such issues.” State Street evaluates shareholder proposals related to environmental and social risks on an issuer by issuer basis, with the understanding that “environmental and social risks can vary widely depending on a company, its industry, operations, and geographic footprint.”

III. Environmental Proposals Trends

A. Overall Trends

- The number of environment-related shareholder proposals submitted to a vote has been steadily increasing, reaching a high this year. The number of proposals relating to environmental issues has increased meaningfully in recent years, with 90 proposals reaching a vote during the first six months of 2016 (with one proposal pending as of June 30), as compared to 84 proposals in 2015 and 58 proposals in 2014. The number of proposals submitted to a vote this year represents a 114.3% increase in the number of environmental proposals submitted to a vote from 2012.

- Consistent with previous years, the overwhelming majority of environmental proposals failed this year. Only one of the 90 environmental proposals (or 0.1%) to reach a vote this year at Russell 3000 companies passed. Of the 324 environmental proposals that reached a vote over the past five years, only two (or 0.62%) garnered majority support—one in 2013 and one in 2016. Both proposals requested the production of sustainability reports.

- Average shareholder approval rates for environmental proposals remained low, consistent with prior years. During the 2016 proxy season, shareholder proposals submitted to a vote at Russell 3000 companies received average shareholder support of 21.9%. This is only slightly higher than the average support of 19.9% and 20.1% garnered by environmental shareholder proposals in 2015 and 2014, respectively.

- ISS’s voting recommendations had little to no impact on the voting results. While ISS recommended a vote “For” 67 environment-related proposals this year, only one of these (or 1.49%) garnered majority support. Although shareholders voted against environmental proposals in each of the 23 cases in which ISS opposed the proposal, this result appears to be consistent with shareholders’ general approach toward these proposals and is unlikely the result of ISS’s recommendation.

- The most prevalent type of environmental proposal this proxy season related to climate change, followed by proposals pertaining to GHG emissions. At Russell 3000 companies, 22 climate change proposals and 18 GHG proposals were submitted to a vote in 2016. These included two innovative “climate change action” proposals that requested an increase in the return of capital to shareholders in light of climate change risks. Proposals seeking sustainability reports were third in popularity, with 14 such proposals reaching a vote at Russell 3000 companies.

| Type/Number of Environmental Proposal | Description of Proposal | Results |

|---|---|---|

| Climate Change (22) |

|

Average Shareholder Support = 22.69% (with support ranging from 4% to 41.50%) |

| GHG Emissions (18) |

|

Average Shareholder Support = 23.22% (with support ranging from 1.30% to 47.60%) |

| Sustainability Report (14) |

|

Average Shareholder Support = 29.46% (with support ranging from 7.70% to 54.50%) |

| Renewable Energy (10) |

|

Average Shareholder Support = 21.86% (with support ranging from 8.10% to 42.60%) |

| Community/ Environmental Impact (9) |

|

Average Shareholder Support = 16.23% (with support ranging from 5.70% to 28.10%) |

| Executive Compensation (6) |

|

Average Shareholder Support = 10.75% (with support ranging from 3% to 23.30%) |

| Board of Directors (4) |

|

Average Shareholder Support = 16.32% (with support ranging from 6.50% to 20.90%) |

| Hydraulic Fracturing (4) |

|

Average Shareholder Support = 19.72% (with support ranging from 5.40% to 30.70%) |

| Recycling (3) |

|

Average Shareholder Support = 30.27% (with support ranging from 26.70% to 37.80%) |

| Nuclear Power (1) | This proposal requested a financial analysis on the potential impact of the State Corporation Commission’s denial of a certificate for the development of a nuclear reactor. | Shareholder Support = 4.30% |

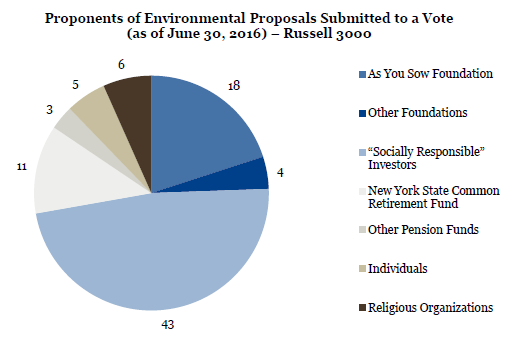

- “Socially responsible” investors submitted the vast majority of environmental proposals. “Socially responsible” investors submitted 43 (or 47.8% of) shareholder proposals on environmental matters that reached a vote at Russell 3000 companies so far this season. Among these, Calvert Asset Management submitted the greatest number of environmental proposals, submitting eight (or 8.9% of) such proposals. The single proponent that submitted the largest number of environmental proposals, however, was As You Sow Foundation, which submitted 18 (or 20% of) proposals, followed by the New York State Common Retirement Fund, which submitted 11 (or 12.2% of) proposals.

B. Successful Proposal: CLARCOR, Inc.

This proxy season, there was only one successful environmental shareholder proposal. The proposal, submitted to CLARCOR, Inc. by Walden Asset Management, requested that the company “issue a report describing [its] present policies, performance and improvement targets related to key environmental, social and governance (ESG) risks and opportunities, including greenhouse gas (GHG) emissions reduction goals.” The proposal further provided that the report should be disclosed by the end of 2016.

Management recommended that shareholders vote against this proposal, claiming that the proponent had unsuccessfully submitted similar proposals in 2014 and 2015 and that preparing a sustainability report would “involve significant expense and would not be an efficient use of our limited financial and human resources.” Furthermore, the company argued that its larger peers that issue sustainability reports are substantially larger and have significantly greater resources than CLARCOR. Despite management’s opposition, the proposal passed, receiving shareholder support of 54.5%.

This was the third consecutive year in which CLARCOR received a sustainability reporting proposal. In 2015, the sustainability reporting proposal received shareholder support of 39.2%, while in 2014 it received shareholder support of 33.1%. ISS recommended a vote “For” the proposal in all three years. Glass Lewis, however, had previously opposed the measure, but in 2016, the proxy advisory firm supported it, possibly helping to swing the vote.

IV. SEC No-Action Letters

As of June 30, 2016, 26 no-action requests have been decided this proxy season by the SEC staff (the “Staff”) with regard to shareholder proposals on environmental issues. A total of 11 requests were granted and 13 were denied on substantive grounds. The no-action requests granted on substantive grounds were decided based on one of the following exclusionary rules:

- Rule 14a-8(i)(1)—The proposal is not a proper subject for action by shareholders under the laws of the jurisdiction of the company’s organization (one no-action letter granted).

- Rule 14a-8(i)(7)—The proposal relates to the company’s ordinary business operations (seven no-action letters granted).

- Rule 14a-8(i)(10)—The company has already substantially implemented the proposal (one no-action letter granted).

- Rule 14a-8(i)(12)—The proposal is substantially similar to a proposal submitted in prior years which did not receive sufficient shareholder support for resubmission (two no-action letters granted).

In 2014, Glass Lewis recommended a vote against the proposal, explaining, among other things, that although it “would like to see more specific disclosure regarding the Company’s sustainability initiatives,” it “[did] not believe that proponent ha[d] sufficiently demonstrated that the Company’s current practices [at the time] present[ed] a threat to shareholder value.” Furthermore, the Company did not have any “recent high-profile environmental and social controversies,” and it relatively “align[ed] with its peers regarding disclosure.” Glass Lewis repeated its recommendation in 2015, noting that though a similar proposal received “significant shareholder support” of 40% in 2014, it was still “not convinced that adoption of this proposal [was] necessary at [the] time or that shareholders would derive significant benefit from the production of the requested report.” In 2016, however, Glass Lewis recommended a vote in favor of the proposal because “it would signal responsiveness to shareholders” and “would be in the best long-term interest of the Company and its shareholders.” In addition to noting that “there is room for improvement” in the company’s current disclosure, Glass Lewis explained that although 40% and 45.2% of shareholders supported this proposal in 2014 and 2015, respectively, “the Company made no meaningful improvements to its report or disclosure over the last year.” Glass Lewis expressed concern that this might “indicate a level of unresponsiveness to shareholder concerns.”

A. Improper Under State Law under Rule 14a-8(i)(1): NextEra Energy

During the 2016 proxy season, one company submitted a no-action request to the SEC arguing that the shareholder proposal it had received was not a proper subject for action by shareholders under state law. The shareholder proposal at issue, which was submitted to NextEra Energy, Inc., requested that the company “report material risks and costs of sea level rise to company operations, facilities, and markets based on a range of [sea level rise] scenarios projecting forward to 2100, according to best available science.” In its no-action request, NextEra argued that the proposal was not a proper subject for action by shareholders under Florida law because the proposal “is not cast as a recommendation or request but as a mandatory proposal that would be binding upon the Company if approved,” in contravention of the discretionary power of the board under state law. The Staff concurred but noted that “this defect could be cured … if the proposal were recast as a recommendation or request to the board of directors.” Accordingly, the Staff concluded that it would not recommend enforcement action unless the proponent revised the proposal within seven days.

B. Ordinary Business Operations under Rule 14a-8(i)(7): General Electric, Ball Corporation, Dunkin’ Brands Group, Amazon.com, The TJX Companies, CVS Health Corporation and Duke Energy Corporation

By far, the most popular ground on which issuers requested no-action relief from the Staff with regard to environmental proposals this year was Rule 14a-8(i)(7), which permits the exclusion of shareholder proposals that deal with “a matter relating to the company’s ordinary business operations.” Fifteen companies faced with environmental shareholder proposals submitted seventeen no-action requests to the SEC on this basis, seven of which were successful. Notably, the Staff appears to consider climate change and GHG emissions to be “significant policy issues,” thereby precluding no-action relief under Rule 14a-8(i)(7) for proposals relating to GHG emissions or requesting climate change reports or action.

Accordingly, the Staff did not grant no-action relief this year with regard to any such proposals under Rule 14a-8(i)(7).

General Electric Company (GE).

GE received a shareholder proposal requesting that the company “undertake an independent evaluation and prepare an independent report by October 2016, demonstrating that the company has assessed all potential sources of liability related to [Polychlorinated Biphenyl] discharges in the Hudson River … and offering conclusions on the most responsible and cost-effective way to address them.” In its no-action request, GE asserted that this proposal relates to the company’s ordinary business operations because it would substitute the board’s judgment with that of the shareholders on decisions involving litigation strategy with regard to an ongoing litigation and because it interferes with the company’s legal compliance program by putting shareholders in a position to evaluate its effectiveness. The SEC granted no-action relief, specifically noting that the proposal would “affect the conduct of ongoing litigation to which the company is a party.”

Ball Corporation.

The shareholder proposal submitted to Ball Corporation requested that the company “issue a report (by October 2016, at reasonable cost, omitting proprietary information) reviewing the Company’s policies, actions, and plans to reduce [bisphenol-A (‘BPA’)] use in its products and set quantitative targets to phase out the use of BPA, in light of reputational and regulatory risks.” In its request for no-action relief, Ball Corporation argued that this proposal deals with matters relating to the company’s ordinary business operations because it “seeks to influence the Company’s development, manufacture and sale of its packaging products, which comprise the core of the Company’s packaging business.” The SEC concurred, noting that the proposal “relates to Ball’s product development.”

Dunkin’ Brands Group, Inc.

The shareholder proposal received by Dunkin’ Brands requested that the company “issue a public report describing the company’s short- and long-term strategies on water use management specifically related to toilets in the retail facilities.” In its no-action request, Dunkin’ argued that this proposal is excludable pursuant to Rule 14a-8(i)(7), among other exclusionary provisions. The company asserted that the proposal would involve a “direct interjection into the Company’s relationship with its customers, the franchisees, which is a crucial component of [its] day-to-day business operations.” The company took the position that the proposal seeks to micro-manage this relationship and, in particular, the company’s ongoing efforts to “assist its franchisees in building more sustainable restaurants” through the DD Green Achievement Program, a certification program for franchisees. Furthermore, the company claimed that the proposal “focuses on the specific issue of water consumption by toilets, which is not a significant policy issue that transcends the company’s day-to-day business operations.” The Staff granted no-action relief pursuant to Rule 14a-8(i)(7).

Amazon.com, Inc.

Amazon received a shareholder proposal seeking a report “on the company’s policy options to reduce potential pollution and public health problems from electronic waste generated as a result of its sales to consumers, and to increase the safe recycling of such wastes.” The company argued that this proposal is excludable under Rule 14a-8(i)(7) because it requests that Amazon.com “offer a specific service (to assist in recycling customers’ discarded electronics” and that it “revise its policies regarding products it sells.” The company further asserted that the proposal “relates to [its] customer relations efforts.” The Staff concurred that “the proposal relates to the company’s products and services and does not focus on a significant policy issue.”

The TJX Companies and CVS Health Corporation.

The proposals received by The TJX Companies and CVS Health Corporation requested that senior management “set company-wide quantitative targets by November 2016 to increase renewable energy sourcing and/or production.”

The TJX Companies argued that the proposal is excludable because it “concerns the Company’s management of energy expenses” and establishes a deadline of five months, which is “unjustifiably short, arbitrary and inappropriately seeks to dictate the allocation of the Company’s human and financial resources.” Similarly, CVS maintained that the proposal relates to its ordinary business operations by: “(1) focusing on cost-saving measures and the day-to-day financial management of the Company and (2) micro-managing (a) the deadline … and (b) the manner in which the Company chooses to pursue … environmentally-friendly initiatives.” In both cases, the Staff agreed that the proposal may properly be excluded under Rule 14a-8(i)(7).

Duke Energy Corporation.

The proposal submitted to Duke Energy requested that “a committee of the Board of Directors oversee a study of the potential future impact of changes in the electric utility industry, and prepare a report on how to meet these challenges and protect shareholder value” by September 2016. The company argued that the proposal concerns its ordinary business decisions of products and services offered, since it focuses on Duke’s “consideration of which alternative energy sources to offer” and “choice of technologies,” therefore attempting to impermissibly micro-manage its business. The Staff granted no-action relief pursuant to Rule 14a-8(i)(7).

C. Substantial Implementation under Rule 14a-8(i)(10): Dominion Resources

Eight companies sought to exclude ten environmental shareholder proposals this year pursuant to Rule 14a-8(i)(10), which permits the exclusion of a proposal if the company had already substantially implemented it. Only one such company, Dominion Resources, Inc., was successful.

The proposal received by Dominion Resources requested that the company’s board publish a report on how the company is “measuring, mitigating, setting reduction targets, and disclosing methane emissions.” In its no-action request, Dominion Resources took the position that it had substantially implemented the proposal through its publicly available Methane Management Report 2015, which describes the company’s practices related to methane emissions and thus “compares favorably with the guidelines in the Proposal.” The company further asserted that, in addition to mandatory disclosures, it makes various voluntary disclosures that address its GHG emissions, including in its 2014 Greenhouse Gas Report. The SEC agreed that the company’s actions “compare favorably with the guidelines of the proposal” and thus granted no-action relief under Rule 14a-8(i)(10).

D. Resubmission under Rule 14a-8(i)(12): Wal-Mart Stores Inc. and Chevron Corporation

During the 2016 proxy season, Wal-Mart Stores Inc. and Chevron Corporation requested three no-action letters on the ground that an environmental shareholder proposal they had received was substantially similar to a previous shareholder proposal that was submitted to a vote at the company but did not receive the requisite shareholder support for resubmission under Rule 14a-8(i)(12). Two of these requests were successful.

The shareholder proposal submitted to Wal-Mart Stores, Inc. urged the company to “set quantitative goals, based on current technologies, for reducing total greenhouse gas (‘GHG’) emissions produced by the international marine shipping of products sold in Walmart’s stores and clubs” and “to report to shareholders by December 31, 2016 … regarding the goals and steps Walmart plans to take to achieve them.” In its no-action request, Wal-Mart explained that the proposal was nearly identical to a proposal that was included in its 2015 proxy materials. The company indicated that the proposal submitted to a vote in 2015 received a mere 1.75% of the vote. Accordingly, the company asserted, the proposal “did not receive the support necessary for resubmission” under rule 14a-8(i)(12)(i), which permits exclusion where the proposal deals with substantially the same subject as another proposal in the preceding five years and received less than 3% of the vote. Concurring that the 2015 proposal “deal[t] with substantially the same subject matter,” and the Staff granted the company no-action relief.

Chevron Corporation similarly requested no-action relief under Rule 14a-8(i)(12), though under a separate provision thereof, which permits the exclusion of a proposal dealing with substantially the same subject matter as a proposal that received “[l]ess than 10% of the vote on its last submission to shareholders if proposed three times or more previously within the preceding 5 calendar years.” The proposal submitted to Chevron Corporation in 2016 requested that the company prepare a report that includes:

“a) The numbers of all offshore oil wells… that Chevron Corporation owns or has a partnership in

b) Current and projected expenditures for remedial maintenance and inspection of out-of-production wells

c) Cost of research to find effective containment and reclamation following marine oil spills.”

Chevron argued that this proposal deals with “substantially the same subject matter” as at least three previous shareholder proposals submitted to a vote at the company in 2013, 2012 and 2011, respectively, and that, on its last submission, the proposal “did not receive the support necessary for resubmission.” Given that the previously submitted proposals were virtually identical, the Staff found that “proposals dealing with substantially the same subject matter were included in Chevron’s proxy materials for meetings held in 2013, 2012 and 2011.” Indicating that “the 2013 proposal received only 7.25 percent” support during its last submission to shareholders in 2013, the Staff concurred that Chevron may exclude the proposal under Rule 14a-8(i)(12)(iii).

V. Takeaways

Although environmental shareholder proposals are increasingly prevalent, they are rarely successful. If faced with a shareholder proposal related to climate change, sustainability or other environmental issues, management should consider whether it is in the best interests of the company and its shareholders to attempt to negotiate exclusion of the proposal through the substantial implementation of the proposal’s request or to submit the proposal to a shareholder vote. If management determines not to negotiate with the proponent (or if negotiations are unsuccessful), and if no-action relief is either unlikely to be granted or is denied, management should bear in mind that proposals of this nature are unlikely to receive majority support.

The complete publication, including footnotes, is available here.

Print

Print