David Larcker is Professor of Accounting at Stanford Graduate School of Business. This post is based on a paper authored by Professor Larcker, Brian Tayan, Researcher with the Corporate Governance Research Initiative at Stanford Graduate School of Business, and Brendan Sheehan, Managing Director of Corporate Governance at Rivel Research Group.

Executive compensation is a highly controversial topic. Seventy percent of Americans believe that CEO compensation among large publicly traded corporations is a problem. [1] Twenty-five percent of directors believe that CEOs do not receive the correct level of pay based on the expected value of awards when they are granted; and 30 percent of directors believe that CEOs do not receive the correct level of pay based on what they actually realize when those awards vest. [2] Journalists, governance commentators, and proxy advisory firms also criticize pay levels and practices. Editorialists at The Economist call executive compensation “neither rigged nor fair,” arguing that while pay is a function of market forces, those forces are not efficient in setting pay levels relative to managerial value creation and average worker pay. [2] The head of a university corporate governance center believes that there is a “bias toward escalating pay each year, which … further decouples pay from performance.” [4] Proxy advisory firms Institutional Shareholder Services and Glass Lewis routinely recommend that shareholders vote against the proposed compensation plans of large U.S. companies as part of the annual “say on pay” voting process. [5]

Missing from the discussion, however, is the viewpoint of the sophisticated institutional portfolio managers that own shares in these corporations and make investment (buy and sell) decisions on behalf of funds and their beneficial owners. Given their knowledge of industry dynamics, competitive pressures, and the strategic choices of individual firms, professional investors presumably are attuned to the factors that drive corporate outcomes, and therefore should be in a position to gauge whether the pay decisions of publicly traded corporations are correct.

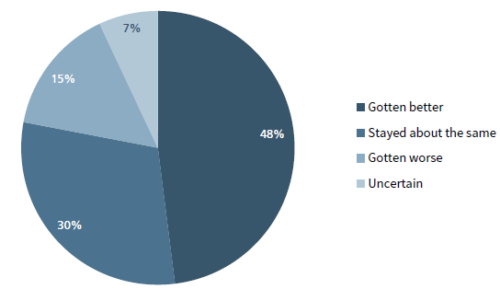

In general, institutional (“buy side”) investors have a less negative view of executive compensation than the most vocal critics, although they still express important concerns. According to research from Rivel Research Group, approximately one-half (48 percent) of institutional investors believe that executive pay practices have improved in recent years; only 15 percent believe they have gotten worse (see Exhibit 1). [6] Investors believe that pay should be tied to performance, long-term in focus, and aligned with shareholder interests. However, they do not always agree on how pay should be structured to achieve these goals, nor do they agree on the extent to which corporations are effective in designing pay packages that align pay and performance.

Exhibit 1: Buy-Side View on CEO Pay Practices

How have executive compensation practices changed in recent years?

For example, three-quarters (75 percent) of buy-side investors believe that pay for performance is an important attribute of superior compensation design. However, they are not in consensus about whether performance metrics should be tied to operating or stock-price performance. According to one investor:

The company’s targets that trigger bonuses or stock awards should be linked to shareholder return rather than accounting metrics, like earnings per share, because [accounting metrics] provide the wrong incentives for management to manage earnings. If they’re beating their peer group on total return, it’s not something they can manipulate. [7]

Another respondent believes that: “[Compensation] should be based on the success metrics for the company. I’m less concerned with stock price because that’s too easy to play around with through buybacks and such, as opposed to metrics like cash flow or profitability. The success of the company [in achieving these goals] should be the hallmark of the majority of CEO compensation.” [8]

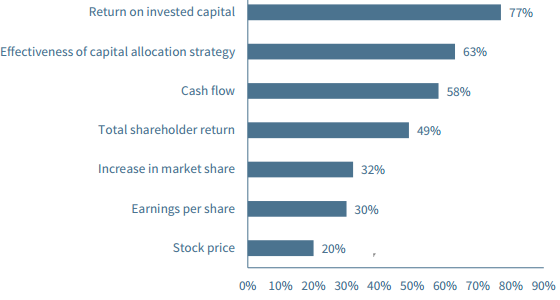

Despite their mandate to increase the market value of their portfolios, buy-side investors tend to favor operating metrics over stock-price performance. Seventy-seven percent say return on invested capital is an excellent or very good metric linking pay to performance, 63 percent say effective capital allocation, 58 percent cash flow, and 49 percent total shareholder return (see Exhibit 2). [9]

Exhibit 2: Buy-Side View on Performance Metrics

Excellent/very good metrics to link management pay to company performance

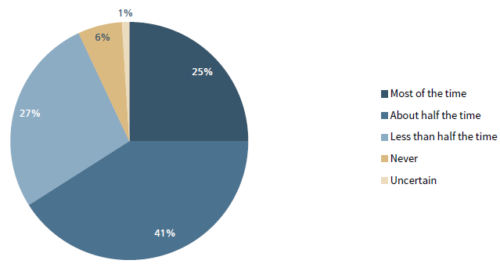

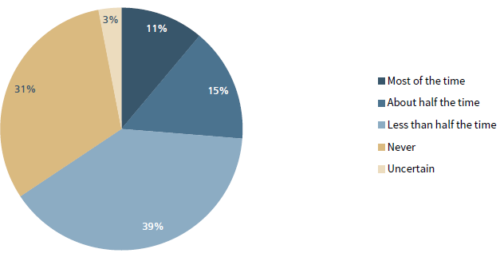

Institutional investors are decidedly more negative as to whether companies are effective in designing compensation packages that encourage pay for performance. Only a quarter (25 percent) believe that executive compensation packages are structured to encourage pay for performance “most of the time,” 41 percent “about half the time,” 27 percent “less than half the time,” and 6 percent “never.” Investors are even more negative in their assessment of whether CEOs face sufficient financial downside risk for underperformance. Only 11 percent of investors believe that CEOs are exposed to financial downside risk “most of the time,” 15 percent “about half the time,” 39 percent “less than half the time,” and an astounding 31 percent say that CEOs are “never” exposed to financial downside risk (see Exhibit 3).

Exhibit 3: Buy-Side View on Pay for Performance

How often are executive compensation packages sufficiently linked to performance?

How often do executive compensation packages typically include sufficient downside risk?

In assessing the quality of a company’s compensation program, buy-side investors pay close attention to the articulation and justification of performance goals:

“[We look at] the metrics on which the executives are being judged, the logic behind them, and the calculations of the targets.”

“[We look at] the share of each component, the objectives to be reached, and in which term. [We also look] to see that it has an upside component in it and a downside component in it.”

“If you give me a total comp figure, I should be able to go back and understand what were the drivers of the compensation payout from an attribution analysis…. You should be able to back into that number reasonably closely and when you can’t, that is when there is just a little too much opacity surrounding your compensation structure, and I don’t think equity investors are well served by that.”

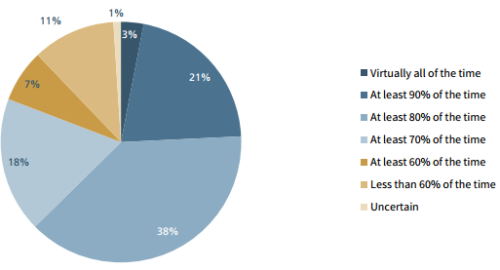

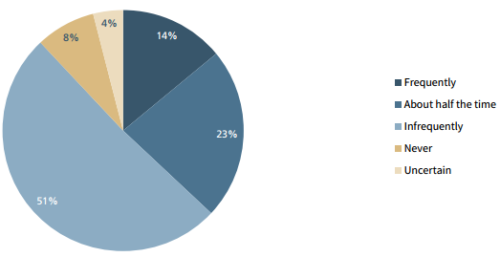

Third-party data demonstrates that, in general, investors are highly likely to vote in support of executive compensation plans as part of the annual say-on-pay voting process. [10] The majority of respondents in Rivel’s research panel report voting in favor of say on pay between 70 percent and 90 percent of the time. They indicate that they are more likely to vote against the company’s plan because of a disconnect between pay and performance (42 percent) than because pay levels are egregious (25 percent). A significant minority of respondents (37 percent) admit to voting in support of say on pay even while harboring concerns about some elements of the pay plan (see Exhibit 4).

Exhibit 4: Buy-Side View on Say on Pay

Frequency of voting “for management” on a company’s senior executive compensation plan

Have you ever voted to support say on pay while still having concerns about some elements of the pay plan?

One result of special interest is that buy-side investors consider the recommendations of proxy advisory firms such as Institutional Shareholder Services and Glass Lewis to be largely irrelevant to their assessment of a company’s compensation plan. Only 3 percent of respondents consider these recommendations important. Although proxy advisory firm recommendations are known to influence the overall shareholder vote on proxy proposals, they apparently do not have much influence on many buy-side voters. [11]

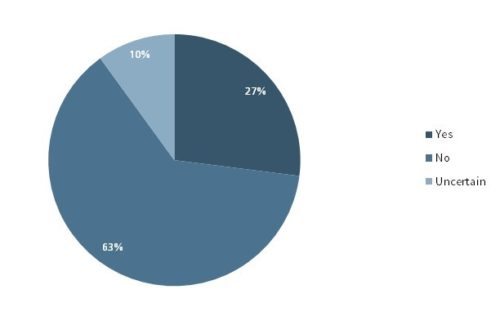

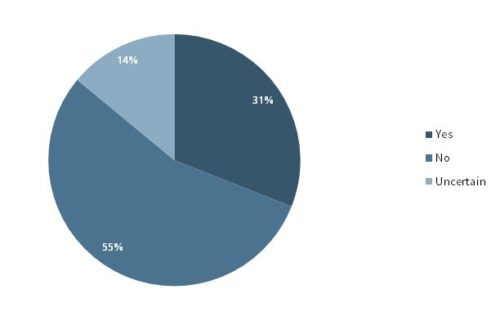

Finally, investors generally do not believe recent regulations that require companies to disclose the ratio of CEO-to-average-worker pay to be useful information. Only 27 percent of respondents believe that this figure provides an accurate comparison tool across companies. Only a third (31 percent) believe that a high ratio represents a governance failure (Exhibit 5).

Exhibit 5: Buy-Side View on CEO-to-Worker Pay Ratio

Do you think the CEO pay ratio can be used to provide an accurate comparison tool across companies from different sectors, industries, or markets?

Do you generally believe that a large CEO pay ratio represents a governance failure?

Source: Rivel Research Group (June 2016).

Source: Rivel Research Group (June 2016).

Why This Matters

- Research evidence suggests that buy-side investors generally have a more positive view of CEO compensation than governance experts and members of the general public. Which constituency is right? Which is in a better position to objectively evaluate pay? How can their views be reconciled?

- Buy-side investors believe that pay for performance is a critical element in evaluating pay packages. Their views on how to align pay and performance are somewhat contradictory, with some investors favoring operating-based performance metrics and others favoring stock-price based targets. Which metrics are more useful in aligning pay and performance? Which are more useful in aligning pay with shareholder interests?

- The data from Rivel suggests that investors do not believe that executives are exposed to sufficient “downside risk” in situations where companies underperform expectations. At the same time, excessive exposure to downside risk might encourage executives to become excessively risk-averse, or to leave for employment opportunities where compensation is more secure. How much downside risk should an executive be exposed to in order to properly encourage pay for performance? How should a pay plan best be structured to achieve this goal?

- Buy-side investors claim not to be influenced by the recommendations of proxy advisory firms, and yet third-party research demonstrates that their voting practices in fact are highly correlated with the recommendations of these firms. How much influence do proxy advisory firms really have over the voting practices of institutional investors? How do buy-side investors and proxy advisory firms differ in their evaluation of executive compensation?

The full paper is available for download here.

Endnotes:

[1] The Rock Center for Corporate Governance at Stanford University, “Americans and CEO Pay: 2016 Public Perception Survey on CEO Compensation,” (2016).

(go back)

[2] Heidrick & Struggles and the Rock Center for Corporate Governance at Stanford University, “CEOs and Directors on Pay: 2016 Perception Survey on CEO Compensation,” (2016).

(go back)

[3] “Neither Rigged Nor Fair,” The Economist (June 25, 2016).

(go back)

[4] David Ward, “Reining in Executive Compensation: A Q&A with Charles Elson,” HR Magazine, Society for Human Resource Management (September 24, 2014).

(go back)

[5] “Say on Pay Vote Results (S&P 500),” Compensation Advisory Partners (May 18, 2016).

(go back)

[6] Unless otherwise noted, the data and quotations in this post are derived from three reports by Rivel Research Group: The Corporate Governance Intelligence Council: “Hallmarks of Superb C-Suite Compensation” (June 2016); “Linking Pay to Performance” (June 2016); and “Board Oversight and Incentives” (June 2016). Sample includes 71 institutional (buy-side) investors in the United States and Canada, 37 percent with assets under management (AUM) of $50 billion or more, 21 percent with AUM of $10 billion to $49 billion, 30 percent with AUM of $1 billion to $9 billion, and 11 percent with AUM less than $1 billion.

(go back)

[7] Quotes here and throughout are edited lightly for clarity.

(go back)

[8] Note that both respondents are cognizant of the possibility that performance targets and firm results can be manipulated.

(go back)

[9] According to one respondent: “The stock market is basically a Las Vegas casino…. The CEO or the corporate executive team has very little impact on the stock price.” This type of perspective would lead a buy-side investor to consider fundamental operating measures to be more useful for compensation purposes.

(go back)

[10] According to Semler Brossy, only 1.6 percent of companies in the Russell 3000 failed their say on pay vote in 2016, and 93 percent passed with at least 70 percent support. See Semler Brossy, “Say on Pay Reports” (July 13, 2016), available at: http://www.semlerbrossy.com/say-on-pay/reports/.

(go back)

[11] See Jennifer E. Bethel and Stuart L. Gillan, “The Impact of Institutional and Regulatory Environment on Shareholder Voting,” Financial Management (2002); Angela Morgan, Annette Paulson, and Jack Wolf, “The Evolution of Shareholder Voting for Executive Compensation Schemes,” Journal of Corporate Finance (2006); and David F. Larcker, Allan L. McCall, and Gaizka Ormazabal, “Outsourcing Shareholder Voting to Proxy Advisory Firms,” Journal of Law and Economics (2015).

(go back)

Print

Print