Marco Ventoruzzo is a comparative business law scholar with a joint appointment with the Pennsylvania State University, Dickinson School of Law and Bocconi University. This post is based on a recent paper authored by Professor Ventoruzzo; Gianfranco Siciliano, Assistant Professor of Accounting at Bocconi University; and Piergaetano Marchetti, Senior Professor in the Department of Law at Bocconi University.

At a time when a group of leading U.S. corporate executives promotes “Commonsense Principles of Corporate Governance,” it is apt to remark that one of the most commonsense governance ideas is that blind conformism and acquiescence are as bad for board members as ill-motivated divisiveness and litigiousness. Policy makers, scholars and practitioners around the world seem to agree that a diverse board, able to express different perspectives and challenge stereotypes, is desirable. This insight has prompted discussions around rules ranging from proxy access in the U.S., to co-determination in Germany and other European jurisdictions, and to list voting in Italy.

For all our talk about independent directors standing up to corporate insiders, however, we have very limited understanding of one of the few actual metrics of independence: how often directors voice their dissent, either by voting against the majority or resigning from the board. More generally, notwithstanding a wealth of anecdotal evidence, we have very little solid empirical information on the inner workings of corporate boards. This deficit is largely due to confidentiality concerns that protect the board from external scrutiny. The lack of data, however, is surely of no consolation to the inquisitive minds of our readers.

In our recent paper, Dissenting Directors, we attempt to overcome this gap in the literature by studying a unique hand-picked dataset of cases in which directors of Italian listed corporations have voted against the majority or resigned their position in open contrast with the management of the corporation. The Italian case is interesting for several reasons. First, in Italy, corporate ownership structures involve both corporations with a strong shareholder and a growing number of public corporations with active institutional investors. Second, Italy has an advanced set of governance rules mandating the election of a diverse board of directors. Finally, in Italy, it is possible to access public information about corporate events and personal features of directors.

After a brief analysis of the relevant legal framework, and a presentation of our data and methodology, we address questions such as:

(a) Which directors are more likely to dissent (in terms of who elected them, whether they are independent or not, and their education, compensation, age, number of appointments, gender);

(b) The evolution of the frequency of dissent over time, also in light of legislative or self-regulation reforms;

(c) Which issues do directors dissent on more frequently (e.g. accounting principles, transactions with related parties, etc.);

(d) In what types of corporation is dissent most common (industry, size, governance structure and, in particular, economic performance);

(e) What are the consequences of dissent on the market price of the shares, and are markets more sensitive to dissent voiced by certain types of directors (e.g. outside versus inside)?

This work falls into a line of scholarship still in its infancy, and our results—some of which are intuitive and confirm broadly held beliefs, other surprising—should be taken with a grain of salt. However, we believe that our findings offer insights and topics for discussion well beyond the Italian business scene.

Just to pique the curiosity of the reader, for example, we found that directors appointed by minority shareholders, who receive higher compensation and sit on fewer boards, are more likely to dissent. We also found—contrary to other studies focused on other systems—that gender, age and education do not seem to have a significant impact on the propensity to dissent.

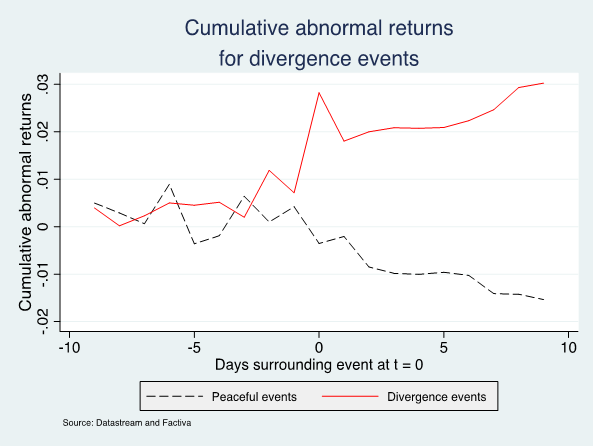

Our event study also allowed us to find positive abnormal results associated with dissenting events, when compared to peaceful events, as indicated in the graph below.

One additional reason why this work is different from previous studies is that we did not limit the analysis to independent directors, but extended it to non-independent (executive) directors, something that allows interesting comparisons.

In our conclusions, we also suggest a few possible policy implications of the analysis, for example on disclosure of dissent and the correlation between dissent and deference of courts and regulators to the business judgment of directors.

The full paper is available for download here.

Print

Print