David Whissel is Vice President and Director of Corporate Governance at MacKenzie Partners, Inc. This post is based on a MacKenzie Partners publication. Related research from the Program on Corporate Governance includes Universal Proxies by Scott Hirst (discussed on the Forum here).

The SEC recently voted to propose amendments to the proxy rules, [1] requiring parties in a contested election to use a “universal proxy card,” which makes it easier for all shareholders to pick-and-choose from a combination of management and dissident nominees by including all nominees on a single proxy card, rather than having to choose between two competing cards. The impetus behind the proposed rule, according to the SEC, is to reform the proxy voting process in such a way that “reflects as closely as possible the choice that could be made by voting in person at a shareholder meeting.” [2] Proponents of the universal proxy card claim that it will make for a “fairer, less cumbersome voting process,” [3] while its detractors criticize it for attempting to “fix the unbroken,” [4] voicing concerns that it will “inevitably increase the frequency and ease of proxy fights.”

While usually regarded as a tool that favors dissidents, the universal proxy could actually change the dynamics of contested elections in a way that is beneficial to management, particularly in contests for board control.

Comparing the Universal Proxy to Proxy Access

From the outset, we should distinguish the concept of the universal proxy used in a proxy contest from that of director nominations using proxy access. The principal issues are illustrated in the table below. It is worth noting that most proxy access bylaws also contain a carve-out provision that prohibits the use of proxy access in the event of a proxy contest.

| Proxy Access | Universal Proxy | |

|---|---|---|

| Is the dissident required to file and mail its own proxy solicitation materials? | No. Its nominees are simply included on management’s proxy card. | Yes, as in any standard proxy contest. |

| Is there a limit on number of dissident nominees? | Yes, as determined by company’s proxy access bylaw (usually 20% of the board or two nominees). | No (other than the number of seats that are up for election). |

| Does the dissident have any holding requirement? | Yes. Here too, the requirement is determined by the specific bylaw (typically 3% for 3 years). | No, there is no minimum holding requirement for a dissident to run a proxy contest and use a universal proxy card. |

An Overview of Our Current System and the “Bona Fide Nominee” Rule

In this era of heightened shareholder activism, the election of directors takes on outsized importance. And, with very few shareholders today attending shareholder meetings in person, the proxy card is almost always the primary means of shareholder participation in corporate elections.

The proxy rules currently stipulate that a nominee’s name can only appear on a proxy card if they have “consented to being named in the proxy statement and to serve if elected.” [5] This is referred to as the “bona fide nominee rule.” The practical implication of this rule in a proxy contest is that neither the dissident’s nor management’s nominees can appear on the other’s card, forcing the separation of both slates onto separate proxies.

This rule effectively meant that shareholders faced a choice of voting for management’s nominees or the dissident’s nominees, with limited ability to pick from among the two slates. [6] In 1992, the passage of the “short slate” rule resolved this issue to a certain extent for those cases where the dissident nominated less a full slate, by allowing dissident shareholders to obtain authority to vote for some of management’s nominees that were not named on its proxy card. However, this left an important issue unresolved: What if the dissident was not seeking authority to vote for one or more of management’s nominees that a shareholder wanted to vote for? If neither slate was satisfactory on its own, but some combination of the slates might be, how should shareholders vote?

Though the SEC had considered implementing the universal proxy in 1992 along with its wider overhaul of the proxy system, it declined to do so. [7] The issue remained largely dormant for the next 20 years, until a dramatic rise in shareholder activism (with short slates being far more frequent than proxy contests for board control) prompted renewed attention from the SEC and shareholder rights advocates such as the Council of Institutional Investors. [8] The issue emerged in several proxy contests, such as DuPont, Target, Tessera Technologies, and Shutterfly, but was rejected in each instance, with the opposing party voicing concerns regarding its implementation.

The universal proxy has, however, been used in Canada in the proxy contest at Canadian Pacific in 2012. The dissident, Bill Ackman’s Pershing Square, had lobbied hard for the use of a universal proxy, as it had at Target three years earlier. In Canada, however, there is no equivalent to the “bona fide nominee” rule, and Canadian Pacific preempted the dissident by adopting its own universal proxy card listing the dissident’s nominees; Pershing Square then followed suit, the result being that there were now two versions of the same universal proxy: one for management, and one for the dissident. The universal proxy was also used by Carl Icahn at Transocean, a Swiss company, in 2013.

More recently, SEC Chair Mary Jo White has moved the issue of the universal proxy towards the top of her agenda, particularly as the term of Commissioner Kara Stein, one of the SEC’s major proponents of the universal proxy, [9] expires in 2017.

The Universal Proxy in Practice

The appeal of the universal proxy to shareholders is perhaps best articulated using a hypothetical case study:

A well-known activist ran a proxy contest at a restaurant operator, nominating six directors to a seven-person board. Many shareholders agreed that the company’s underperformance warranted some change at the board level, but were reluctant to cede majority board control, particularly since three of the dissident’s nominees were employees of its hedge fund, none of whom had prior board experience.

The proxy advisory firms ISS and Glass Lewis both recommended supporting three of the dissident’s nominees that had relevant industry experience, but explicitly cautioned shareholders against a) ceding majority control to the entire dissident slate, and b) electing the three hedge fund employees.

Under the current proxy voting regime, shareholders have limited options, each with its own inherent risks. Voting on the dissident’s card can ensure that the board undergoes some level of change; however, because voting on the dissident card deprives those management’s nominees that shareholder would like to see re-elected of votes, it can inadvertently lead to an unwanted change-in-control if too many other shareholders follow suit. On the other hand, a vote on management’s card, withholding votes from certain disfavored incumbent directors, only ensures that there are spots left open for some dissident nominees; it does not guarantee that the dissident nominees that are ultimately elected are the ones that the shareholder actually supports. Following the recommendation of the proxy advisory firms–voting for the most highly-qualified dissidents, but avoiding a change-in-control–is essentially impossible using the standard proxy voting process.

There are a currently a few workarounds available to shareholders, although most institutions are unwilling to go through the cumbersome process to take advantage of them. First, shareholders can attend the meeting and vote by ballot rather than by proxy card. Second, they can work with their custodians or Broadridge as well as getting the cooperation of one or both sides in the proxy contest to engineer a vote with the mix of candidates they specify. However, this process is cumbersome and time-consuming, is not a viable option for retail shareholders.

It should be noted that, even if an institutional shareholder feels strongly about the issue and wishes to split its vote, many are reluctant to do so, fearing that the precedent will require them to split their vote in all subsequent proxy contests.

Strategic Considerations

Although the universal proxy is generally viewed as favoring dissidents, management has proposed its use in a number of situations, including Tessera Technologies, Shutterfly, Inc. and GrafTech International Ltd. The strategic benefit to management in using the universal proxy is that it allows shareholders to vote for some dissident nominees without depriving certain management nominees of votes, addressing the unintended consequence of not having the management nominees reelected. For that reason, the universal proxy can be a powerful strategic tool for management teams, particularly those whose chance of defeating all of a dissident’s nominees in a proxy contest is remote.

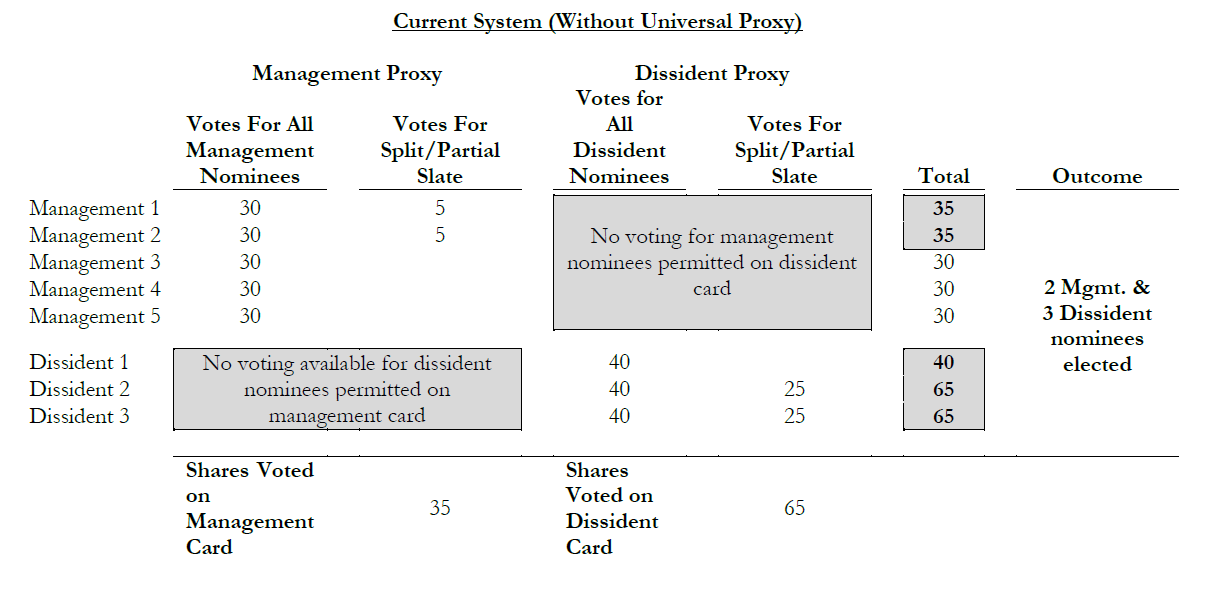

The table below illustrates how this potential “unintended consequence” scenario can play out in practice, where more dissident nominees were elected than shareholders apparently intended:

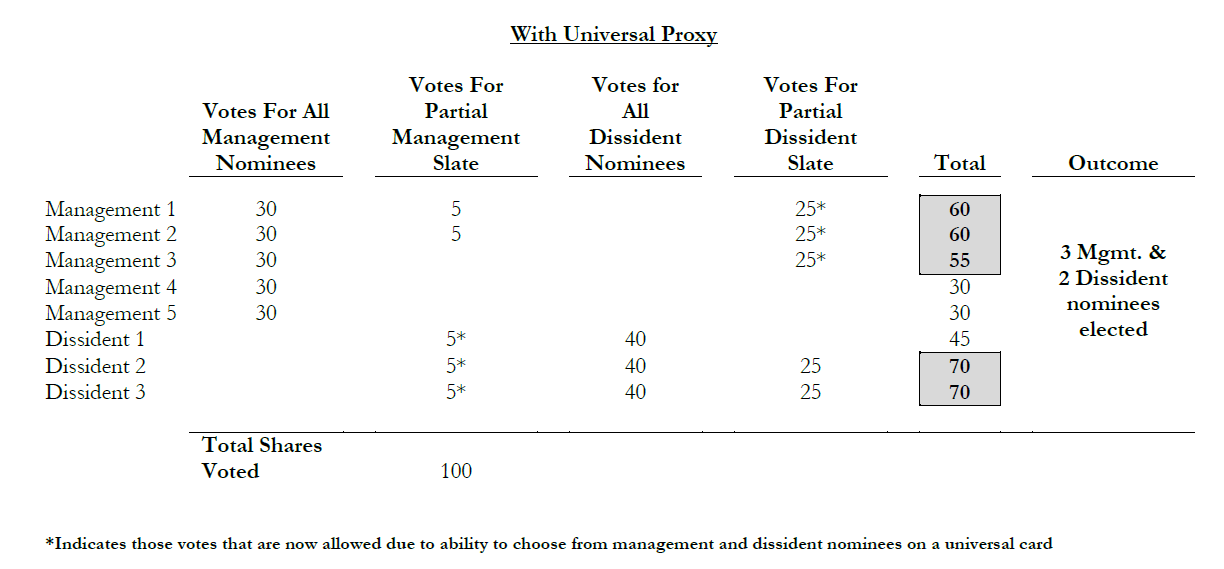

As shown below, the Universal Proxy would improve the alignment of the result with the apparent intention of shareholders in this specific situation:

But whether or not the universal proxy will be strategically valuable will depend upon its implementation and the specific provisions of the forthcoming amendments. In its press release announcing the proposed amendments, [10] the SEC included a “Fact Sheet” highlighting their key features. Some of these features are obvious. For example, the definition of a “bona fide nominee” in Rule 14a-4(d) would be changed to include a person who agrees to be named in any proxy statement at the company’s next shareholder meeting. [11] The “short slate” rule would be eliminated, with dissidents no longer having to “round out” their slates with management nominees.

Some concerns regarding the universal proxy, however, are left unaddressed. For example, the SEC’s release states only that the universal proxies would be “subject to presentation and formatting requirements,” [12] but does not go into detail as to what these requirements might be in order to ensure that the formatting of the universal card is consistent and does not disadvantage either party. Nor does the release explain what the proxy card might look like if there are multiple dissidents submitting competing slates, or if a proxy contest is run concurrent with a shareholder proxy access campaign.

Conclusion

The SEC, to its credit, seems cognizant of the fact that the adoption of the universal proxy could have a significant influence in proxy contests, which themselves are viewed as having outsized importance within the context of corporate governance.

With little in the way of precedent in the US, there are still some logistical and other considerations to be ironed before it is put into practice. However, with the issue having gained a considerable amount of momentum over the past five years, shareholders appear to be eager to test out the universal proxy on an expedited timeline. It may not dramatically turn the tide of proxy voting in favor of either side, but the universal proxy will undoubtedly change the strategic dynamics of proxy contests going forward.

Endnotes

1 “SEC Proposes Amendments to Require Use of Universal Proxy Cards.” SEC Press Release 2016-225. October 26, 2016. Available at: http://www.sec.gov/news/pressrelease/2016-225.html (go back)

2 “Universal Proxy.” SEC Release No. 34-79164. October 26, 2016. Available at:http://www.sec.gov/rules/proposed/2016/34-79164.pdf (go back)

3 “Universal Proxy.” Council of Institutional Investors. Available at: http://www.cii.org/cii_universal_proxy (go back)

4 Tom Quaadman. “Letter to Mary Jo White.” Center for Capital Markets Competitiveness. February 18, 2015. Available at: http://bit.ly/1A7kPfZ (go back)

5 Securities and Exchange Act Rule 14a-4(d)(1). (go back)

6 “SEC Grants No-Action Relief to Activist Shareholders Seeking to ‘Round Out’ Short Slates With Each Other’s Nominees.” Gibson Dunn Client Alert. Gibson, Dunn & Crutcher LLP. April 2, 2009. Available at: http://bit.ly/2f8fmDA (go back)

7 Bryan Pitko and Stephen M. Quinlivan. “The SEC’s Universal Proxy Rulemaking: History & What to Expect.” JDSupra Business Advisor. October 24, 2016. Available at: http://www.jdsupra.com/legalnews/the-sec-s-universal-proxy-rulemaking-28206/ (go back)

8 Id. (go back)

9 Kara M. Stein. “Remarks Before the Consumer Federation of America’s 27th Annual Financial Services Conference. December 4, 2014. Available here: http://www.sec.gov/News/Speech/Detail/Speech/1370543593434 (go back)

10 “SEC Proposes Amendments to Require Use of Universal Proxy Cards.” SEC Press Release 2016-225. October 26, 2016. Available at: http://www.sec.gov/news/pressrelease/2016-225.html(go back)

11 Id. (go back)

12 Id. (go back)

Print

Print