Alexander F. Cohen is partner and co-chair of the national office of Latham & Watkins LLP. This post is based on a Latham publication, in collaboration with KPMG LLP, by Mr. Cohen, Paul M. Dudek, Joel H. Trotter, and Melanie F. Dolan; a related guide for non-US issuers is available here.

The most frequently asked question at all-hands meetings for a securities offering is “What financial statements will be needed?” The question seems simple enough. But the answer is rarely straightforward.

This post is designed to provide a roadmap to help navigate the financial statement requirements of the federal securities laws. We focus principally on the requirements for new registration statements in public offerings, including initial public offerings by emerging growth companies (EGCs) under the JOBS Act. We also summarize briefly the practices in the Rule 144A market, as well as the special rules applicable to “foreign private issuers.”

To make the discussion below easier to follow, we have provided examples using actual dates. These dates are based on a company with a December 31 fiscal year end.

The Basics

Background to Financial Statement Requirements

Public securities offerings registered with the US Securities and Exchange Commission (the SEC) under the US Securities Act of 1933 (the Securities Act) require the filing of a registration statement with the SEC and the distribution of a prospectus in connection with the offering. The registration statement and prospectus must contain certain financial statements and other financial information regarding the issuer’s financial condition and results of operations.

The Securities Act and the related rules and regulations detail the disclosure requirements through the use of standard “forms” (for example, Forms S-1 and S-3). These forms, in turn, specify the information that must be disclosed under Regulation S-K (S-K) and Regulation S-X (S-X). To simplify, S-K largely deals with textual disclosure and S-X with financial statement form and content.

What Financial Statements Must Be Included in Public Offerings?

The following tables summarize the scope of the basic financial statement requirements for all registered offerings. Note that much of the basic information can be incorporated by reference for issuers eligible to use Form S-3, and for certain issuers filing a registration statement on Form S-1 or Form S-11. Issuers who are eligible for incorporation by reference will want to consult their underwriters before electing to incorporate all required financial information by reference. For marketing purposes, it is often desirable to include the financial information directly in the printed offering document.

| The Basic Requirements for Public Offerings | |

|---|---|

| Annual Audited Financial Statements |

|

| Interim Unaudited Financial Statements |

|

| Acquired Company Financial Information and Pro forma Financial Information—S‑X Rule 3‑05 and S‑X Article 11 |

|

| Selected Financial Information—SK Item 301 |

|

| EGC Offerings |

|

| Ratio of Earnings to Fixed Charges for Debt—SK Item 503(d) |

|

| Supplementary Financial Information—S‑K Item 302 |

|

When Does Financial Information Go “Stale?”

Understanding the timing requirements for the provision of financial statements is almost as critical as understanding the scope of the financial information required. The determination of when financial statements go “stale” is sure to come up at the all-hands meeting and planning to have the necessary financial information prepared on time is an essential part of the offering process. Among other considerations, the SEC Staff has a policy against commencing review of a filing unless the financial statements in the filing comply with the staleness rules on the filing date.

These rules vary for different categories of issuers. In particular, the rules distinguish between large accelerated filers, accelerated filers, initial filers, loss corporations and delinquent filers. For these purposes:

- A large accelerated filer is an issuer that, as of the end of its fiscal year:

- has an aggregate worldwide market value of voting and non-voting common equity held by non-affiliates (public float) of $700 million or more (measured as of the last business day of its most recently completed second fiscal quarter);

- has been subject to SEC reporting under the Exchange Act for a period of at least 12 calendar months;

- has filed at least one annual report under the Exchange Act with the SEC; and

- is not eligible to use the requirements for smaller reporting companies in S-K.

- An accelerated filer is an issuer meeting the same conditions, except that it has a public float of $75 million or more, but less than $700 million (measured as of the last business day of its most recently completed second fiscal quarter).

- An initial filer is generally a company that was not subject to the SEC’s reporting requirements prior to filing the registration statement (i.e., a first-time filer, an IPO filer or a voluntary filer) and is not an “all other filer” as indicated in the charts below.

- A loss corporation is a company that does not expect to report positive income after taxes but before extraordinary items and the cumulative effect of a change in accounting principle for the most recently ended fiscal year and for at least one of the two prior fiscal years.

- A delinquent filer is a company that is subject to the SEC’s reporting requirements, but has not filed all reports that are due.

The following tables summarize financial statement staleness requirements, measured by the number of days between the effective date of the registration statement (or, by analogy, the pricing date of a Rule 144A offering if the underwriter desires to mirror SEC requirements) and the date of the financial statements in the filing. For any of the time frames noted below, if the last day before the financial statements go stale is a Saturday, Sunday or US federal holiday, Securities Act Rule 417 allows the filing to be made on the next business day, thereby effectively postponing the staleness date.

Staleness of Financial Statements

For first and second quarter financial statements, “staleness” means the point in the year when the quarterly financial statements become so old that the issuer needs to include the subsequent quarter’s financial statements. By contrast, for third quarter financial statements, “staleness” means the point in the year when the third quarter financial statements become so old that the issuer needs to include annual audited financial statements.

The dates below are based on a December 31 fiscal year end in a year that is not a leap year, and do not reflect a permitted extension to the next business day where staleness days would otherwise fall on a weekend or US federal holiday.

| Staleness of Financial Statements | |

|---|---|

| When Do 1st Quarter Financial Statements Go Stale? |

|

| When Do 2nd Quarter Financial Statements Go Stale? |

|

| When Do 3rd Quarter Financial Statements Go Stale? |

* In leap years, these deadlines occur one day prior to these dates (i.e., February 29, March 15 and March 30, respectively). |

| When Do Year‑End Financial Statements Go Stale? |

* In leap years, these deadlines occur one day prior to these dates (i.e., May 8 and May 13, respectively). |

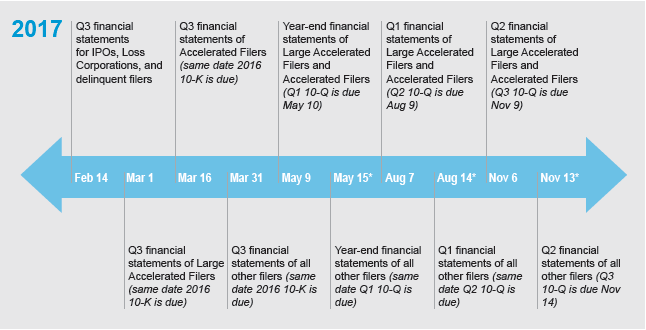

When Do Financial Statements Go Stale in 2017?

At the close of business on the following dates (for issuers with a fiscal year ended December 31, 2016):

* These dates reflect a permitted extension to the next business day where dates would have otherwise occurred on a weekend or US federal holiday.

Special accommodation for timely filers: Staleness dates do not correspond exactly with the Form 10-Q filing deadlines because the 10-Q deadlines run from the end of the most recently ended quarter, whereas the staleness dates run from the end of the preceding quarter. However, the SEC Staff generally provides an accommodation for repeat issuers that have been timely filers for the past 12 months by allowing their registration statements to become effective during the gap period between the staleness dates shown above and the nearest 10-Q filing deadline, absent unusual circumstances. As a result, for most repeat issuers, the effective staleness date is the same as the 10-Q filing deadline.

Note that the most recent interim financial information filed with the SEC must always be included in a registration statement.

MD&A

Registration statements must contain or incorporate by reference a “management’s discussion and analysis” section (the MD&A). The requirements for the MD&A are set out in S-K Item 303.

The purpose of the MD&A is to provide investors with the information necessary to understand an issuer’s financial condition, changes in financial condition and results of operations. It is the place where management interprets the financial statements for investors. A well-written MD&A will focus on trends and uncertainties

in the marketplace and will identify the key “drivers” of the issuer’s results of operations. It will explain the issuer’s business as management sees it, from separately discussing each segment’s performance to the business as a whole. It will also identify and discuss the key metrics that management uses to evaluate the business’ performance and financial health. Many MD&A sections include a general discussion of the issuer’s future prospects under a subheading such as “Outlook,” and some issuers even go so far as to give specific guidance for the following quarter or the current or following fiscal year. Drafting the MD&A section of the disclosure requires close coordination among the issuer’s financial team, its accountants and counsel and can be a time- consuming exercise.

The SEC has steadily expanded the line-item disclosure requirements for the MD&A, adding specific requirements for off-balance sheet arrangements, long-term contractual obligations, certain derivatives contracts and related-party transactions as well as critical accounting policies.For a recent explanation of the SEC’s view of required liquidity and capital resources disclosure, see the guidance release from September 2010,56 and for a sweeping explanation of the purpose of MD&A disclosure, see the guidance release from December 2003.

* * *

The complete publication is available for download here; a related guide for non-US issuers is available here.

Print

Print