Richard Zeckhauser is the Frank P. Ramsey Professor of Political Economy at the Harvard University Kennedy School of Government, and a Research Associate at the National Bureau of Economic Research (NBER). This post is based on a recent paper authored by Professor Zeckhauser; Alexander F. Wagner, Associate Professor of Finance at the University of Zurich and Faculty Member at the Swiss Finance Institute; and Alexandre Ziegler, Director of the Center for Portfolio Management at the University of Zurich. Additional posts addressing legal and financial implications of the Trump administration are available here.

Donald Trump’s election was a significant surprise. So too was the dramatic run up in the stock market that followed. A story less told is how individual stocks and industries responded to the Trump surprise, and expectations about the policies that might follow. In fact, some stocks gained significantly relative to the market; others were major losers. The paper Company Stock Reactions to the 2016 Election Shock: Trump, Taxes and Trade, recently made available on SSRN, illuminates the factors that produced winners and losers.

In an era where politics is extremely polarized and forward-looking assessments of economic prospects are often tilted and exaggerated, it is instructive to investigate how investors assessed the prospects for individual firms. Investors clearly expect US corporate taxes to be cut substantially; thus firms paying high taxes out-performed. What to expect for US companies with significant non-US revenues was less clear cut. Trump and his Republican allies had promised to make firms more competitive abroad. But talk of tariffs and trade raised retaliation concerns. In fact, foreign-oriented firms lost significantly. Companies with high interest expenses suffered for two possible reasons: deductions lose value when taxes are slashed, and some Trump/Republican plans threaten interest deductibility. Investors have not yet taken a clear view on the implications of plans to allow expensing of capital investments.

The election of Donald J. Trump as the 45th President of the United States of America on November 8, 2016 surprised most observers. On the morning of Election Day, Trump’s chances were 17% on Betfair and 28% on Nate Silver’s FiveThirtyEight. Such low odds on the outcome, combined with the wide policy differences between the two candidates, led to substantial reactions on financial markets. Analysts and the media have commented extensively on the economic implications of this historic election. To our knowledge, however, no academic study has investigated which industries and firms will benefit or suffer under the new administration. Assessing the winners and losers from the election is interesting, because there were sizable differences in the policies favored by the two candidates in at least four economically important areas: government spending (and the size of the deficit), taxation, trade policy, and regulation.

Many past studies examine the effect of elections on financial markets, but the 2016 Presidential election is an anomaly. It is rare in American elections to have the combination of an extremely surprising outcome and two candidates who favor substantially disparate policies. Adding to the surprise, following the election many asset prices, apart from the Mexican Peso, moved opposite to the direction forecast should Trump win. Such movements occurred even though the forecasts had empirical support. For instance, in a study of asset price moves during the first Presidential debate on September 26, 2016, Wolfers and Zitzewitz (2016) had found a strong positive relationship between the odds of Clinton winning on Betfair and the returns on all major US equity index futures. While stock index futures fell sharply on election night as the outcome of the election became known, stock markets finished up on the day following the election, and then rallied strongly during the rest of the year and beyond.

It is impossible to determine whether the market’s rally will continue beyond January 2017, nor whether developments to date have been due to overall beliefs about the economy and firm fundamentals, to the view that a Trump administration will be good for business (e.g., much lower corporate taxes and reduced regulation), and/or just some combination of excess animal spirits and group exuberance. More generally, it is impossible to diagnose the reasons for a particular overall movement in the stock market; one observation provides too little evidence.

Recognizing this, this paper investigates the differential performance of a large number of stocks to determine which factors produced relative winners and relative losers among companies as the stock market moved sharply upward after the election. Heavy industry (which Trump has promised to resurrect) and financial firms, which he has said he would deregulate, performed well. By contrast, healthcare, medical equipment, and pharmaceuticals lost dramatically, presumably due to the expectation that Obamacare would be dismantled or at least significantly altered; as did textile and apparel firms, reflecting their significant dependence on imports, which Trump has vowed to strongly discourage. Business supplies and shipping containers also lost, probably reflecting his tough stance on trade. Even after controlling for the rally in the broad market, several low-beta industries (beer, tobacco, food products, utilities) were losers, while cyclical industries tended to be winners. Presumably, expectations of higher growth induced investors to rotate from low-risk to high-beta industries.

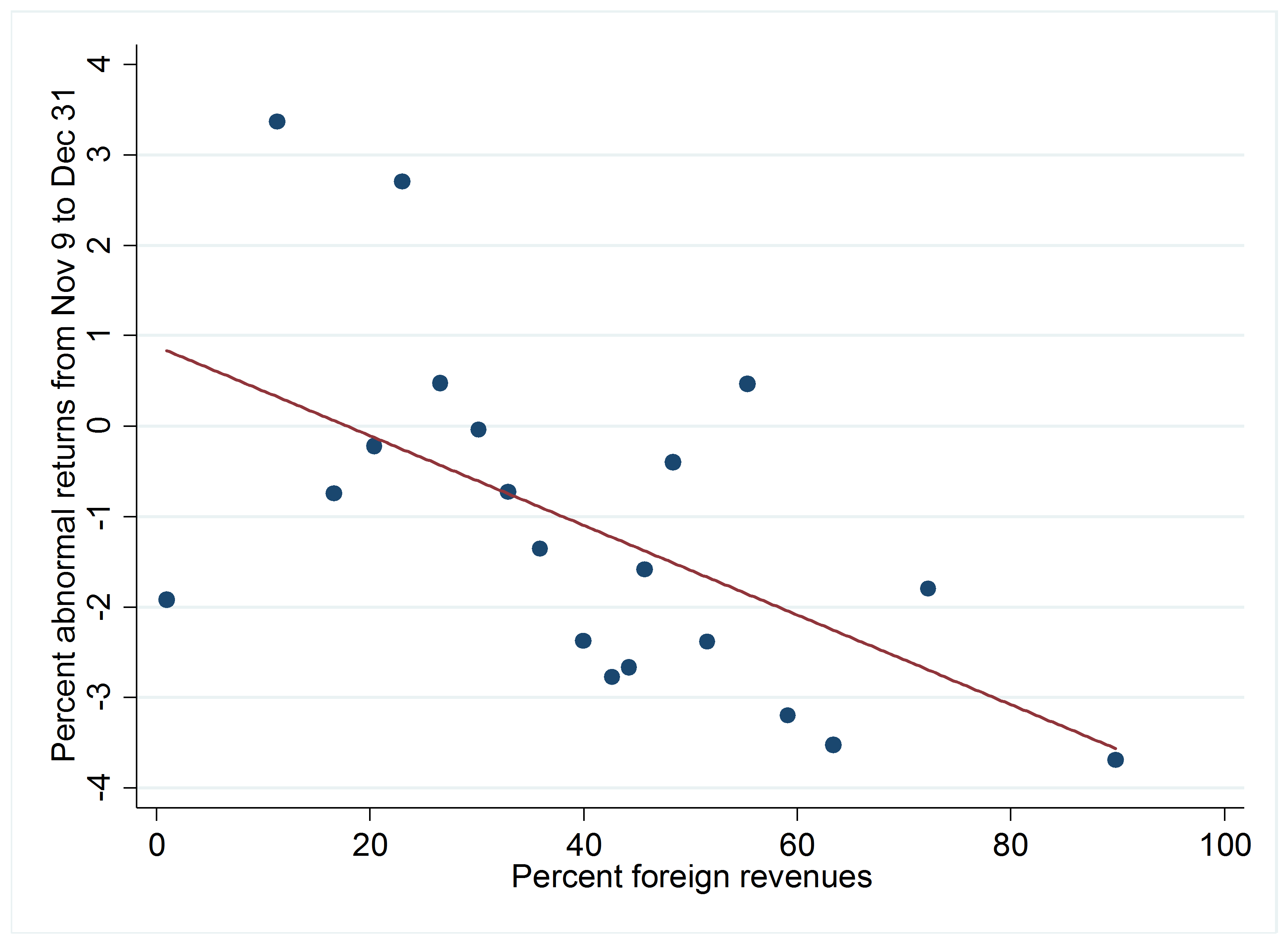

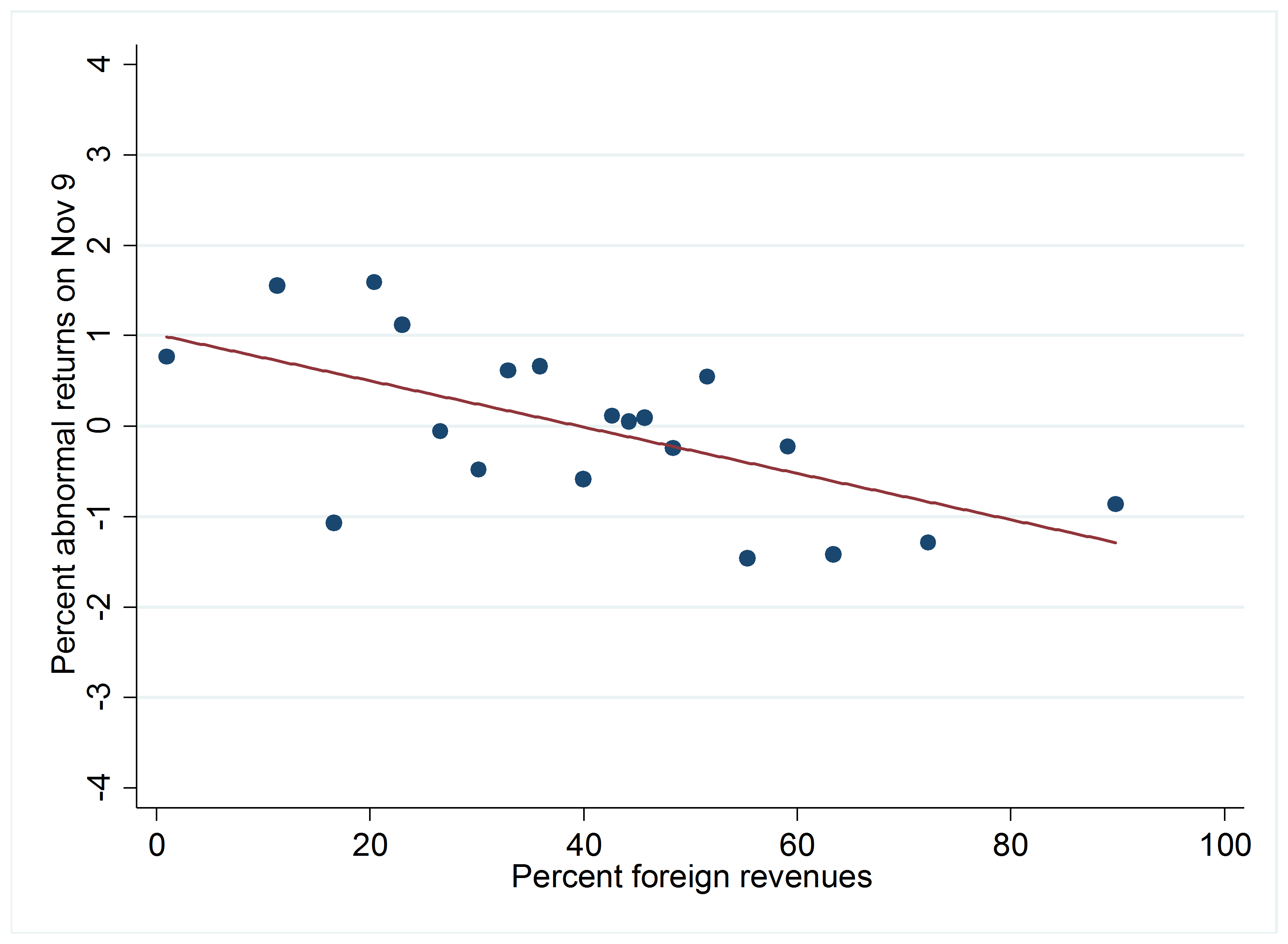

Turning to the different policy areas, we find evidence that both growth prospects and expectations of a major corporate tax cut were viewed positively by the stock market. By contrast, the stock market’s reactions imply negative expectations about the effects of anticipated policies for internationally-oriented firms. It is worth noting that these effects are quantitatively important. For example, comparing two otherwise similar firms, the one that had a one standard deviation higher fraction of foreign revenues than the other had a 0.96 percentage point lower first-day return, and a 2.15 percentage point lower cumulative abnormal return through year-end.

The figure that follows illustrates these latter results. Here, all S&P 500 stocks for which we have data are sorted into 20 equal-sized bins by their percent non-US revenues, and we then compute the average abnormal stock return in each of the bins. The downward-sloping line indicates a strong negative relationship between international orientation of firms and investor reactions to the election.

Interestingly, markets did not process information on these various aspects at the same speed. While the positive impacts of corporate tax cuts and higher growth were apparent in the cross-section of stock returns on the first day after the election, the negative impact of expected policy changes on internationally-oriented firms mostly became felt later on.

Investors also downgraded companies with high interest expenses. This result does not necessarily have to do with an expectation regarding interest deductibility being abolished (as is the case under some Trump/Republican plans), as deductions also lose value when taxes are slashed. Investors thus far think that expensing capital investments is either unlikely to be implemented, or not consequential. (If such expensing is permitted merely for manufacturing companies, the Trump campaign prescription, some companies may attempt to reclassify other activities as manufacturing.)

Substantial new information will unfold as the Trump Presidency progresses. Important elements of the short-term expectations about policies and their effects on company fortunes, whether for the day beyond or the seven weeks beyond Election Day, may well reverse themselves when policies are actually implemented. Whatever one’s politics, the initial days of the Trump Presidency lend confidence to one prediction: significant policy surprises, and significant changes in company stock prices, lurk in the near- and not-so-near term future.

The full paper is available for download here.

Print

Print