Alberto Manconi is Assistant Professor of Finance at Bocconi University. This post is based on a recent paper authored by Mr. Manconi; Oliver G. Spalt, Professor of Behavior Finance at Tilburg University; and Antonino Emanuele Rizzo, Tilburg University.

In March 2015, a group of public investment funds, collectively managing assets in excess of one trillion dollars, submitted a petition to the SEC which asks for enhanced diversity disclosure for board nominees, arguing that better disclosure on “skills, experiences, gender, race, and ethnic diversity can help us as investors determine whether the board has the appropriate mix to manage risk and avoid groupthink.” [1] Echoing this argument, a large management literature supports the importance of management team “diversity,” defined as variation among the top managers in functional backgrounds, industry and firm tenure, education, and other characteristics that define an executive’s “cognitive frame.” In contrast to an extensive body of work on diversity in other fields, there is comparatively little work on top management team diversity in the finance literature.

Our paper aims to fill this gap, by looking at the impact of top management team diversity on stock returns. If prominent investors care about the diversity of top management teams, two questions emerge: Is top management team diversity related to stock returns? And if it is, are returns driven by differences in what diverse top management teams do, or in how investors perceive them? To answer these questions, we exploit managerial biographies firms are required to disclose to the Securities and Exchange Commission (SEC), and use them to develop a novel measure of team diversity, based on textual analysis applied to those biographies. These new data allow us to cover nearly 70,000 individual executives in about 8,000 U.S. firms over the period from 2001 to 2014.

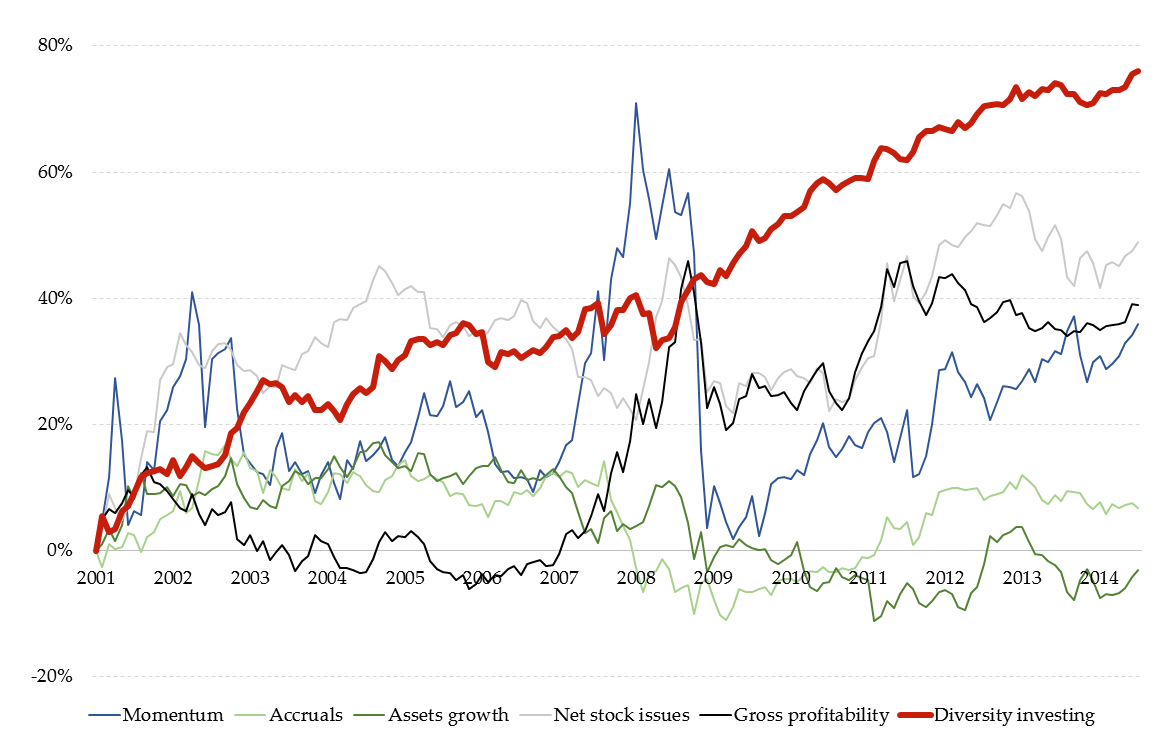

Our central result is that firms with diverse top management teams (“diverse firms”) dramatically outperform firms with non-diverse top management teams (“homogenous firms”). A strategy buying diverse firms and selling homogenous firms (which we label “diversity investing”) yields a 50bps average monthly return over our sample period, with an annualized Sharpe ratio of 0.73. This remarkable performance is robust to a range of standard risk-adjustments and, as show in Figure 1, exceeds the returns from a number of prominent trading strategies over our sample period. We also find that diversity investing has several attractive features: it works best on a value-weighted basis, among large stocks in the S&P500, its returns are concentrated in the long leg of the strategy’s investment portfolio, and it requires a low turnover. These features suggest that diversity investing is easy to trade.

Figure 1. Performance of diversity investing compared to prominent anomalies

We identify two sources for the empirical success of diversity investing. First, as suggested by a large strand of the related management literature on the benefits of diverse teams, diverse firms may be more profitable, which, in turn, would imply higher returns as argued in Fama and French (2014) and Novy-Marx (2014). We show this channel is operative, and that it explains up to one fourth of the returns to diversity investing.

Second, we find evidence consistent with a role for mispricing: all else equal, returns to diversity investing are concentrated in stocks with lower analyst coverage, smaller institutional ownership, and higher Google search volume, i.e., in stocks which are, all else equal, less likely to be held by sophisticated investors. Using a direct test of mispricing due to Engelberg, McLean, and Pontiff (2016), we find evidence suggesting the market is systematically positively surprised about diverse stocks on days when new firm-specific information becomes available. Consistent with the latter results, we also show that analyst price forecasts are systematically downward-biased for diverse firms.

Combined, our paper proposes a simple rationale for why professional investors care about top management team diversity: diversity predicts subsequent stock returns. Our findings suggest that both higher profitability of diverse firms and misvaluation of diversity by less sophisticated investors contribute to return predictability. Hence, top management team diversity matters for stock returns both because diverse firms are fundamentally different and because investors perceive diverse and homogenous teams differently. In particular, investors appear systematically too pessimistic about firms with diverse top management teams. The investor perception channel is, to the best of our knowledge, new to the literature.

The complete paper is available for download here.

References

Engelberg, J., R. D. McLean, and J. Pontiff. 2016. Anomalies and news. Working paper, UC San Diego.

Fama, E. F., and K. R. French. 2014. Dissecting anomalies with a five-factor model. Fama-Miller working paper.

Novy-Marx, R. 2014. Quality investing. Working paper, University of Rochester.

Endnotes

1The signatories include the California Public Employees Retirement System (CalPERS), the Washington State Investment Fund, the Connecticut Retirement Plans and Trust Fund, the California State Teachers’ Retirement System, the Illinois State Board of Investment, the Ohio Public Employees Retirement Systems, the New York State Common Retirement Fund, and the North Carolina Department of State Treasurer. The full text can be found at: https://www.sec.gov/rules/petitions/2015/petn4-682.pdf.(go back)

Print

Print