Jason Frankl is Senior Managing Director and Steven Balet is Managing Director at FTI Consulting. This post is based on an FTI publication by Mr. Frankl, Mr. Balet, and Merritt Moran.

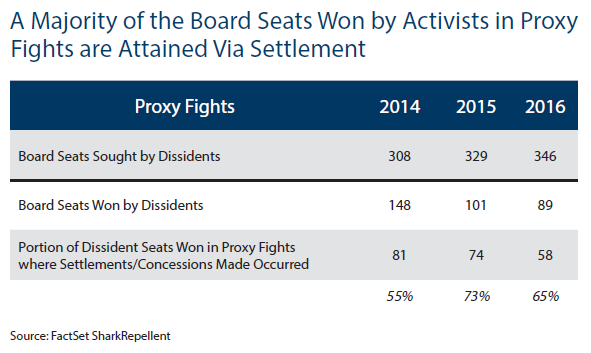

Shareholder activists showed no signs of slowing down in 2016. These investors continue to instill fear in corporate board rooms across America and bring their concerns to the public as illustrated by the growing number of proxy fights; 110 in 2016 alone, a 43% surge over 2012. [1] In that time, companies have more frequently succumbed to these investors and at times, accepted unfavorable settlement terms instead of pushing forward and fighting through a proxy contest.

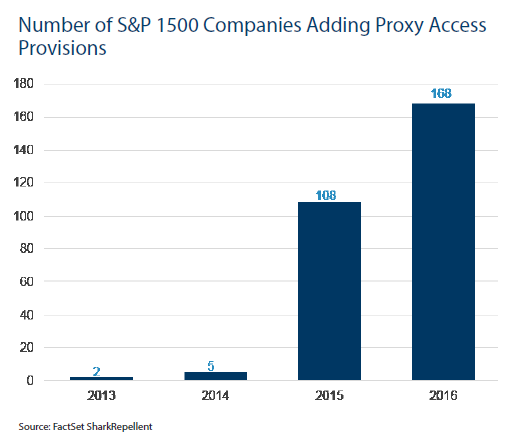

In 2016, activists’ objectives shifted from primarily business strategy and balance sheet activism to board-related governance. In 2013, board-related governance was one of the less common objectives, but it outpaced M&A actions this past year, which has been a dominant objective of activism since the corporate raider era of the 1980s. The surge of proxy access campaigns was a primary driver for the prevalence of board related activism. This bylaw provides certain shareholders the ability to nominate board candidates, and was voted on and adopted by over 75% of S&P 100 companies. [2] This fact alone demonstrates the strength of demand from shareholders for companies to refresh their boards and in some cases take on a “shareholder representative,” also known as a dissident board candidate. One of the most prolific activists, Starboard Value, obtained eight board seats at its targets in 2016 and five board seats in 2015. [3]

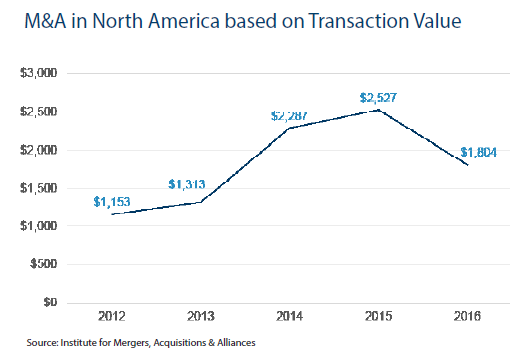

Furthermore, M&A volume was down in 2016, likely due to uncertainty surrounding the administration change in the U.S., possible changes in U.S. corporate tax policy and anticipation of continued rate hikes. The combination of an uncertain investing environment and continued aggression from activists has certainly affected management decision making when engaging with activists as well. Perhaps that broadly explains why companies were much more willing to concede to activist demands to avoid public proxy fights. Perhaps it does not.

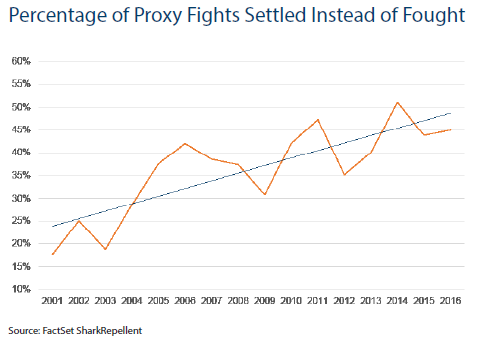

Of the 110 proxy fights in 2016, 50 ended in settlement, the most we have ever seen in a given year. Only 36 companies were willing to take the dispute to a vote in 2016, and agreed to settle in 45% of fights. The remainder of contests from 2016 are either pending or were withdrawn. This marks a significant increase over 15 years ago, when only 17.5% of fights were settled prior to a vote. [4] Additionally, these statistics only take into account the fights that reached proxy contest phase, which suggests that even more settlements occurred in private negotiations, well before shareholder meetings.

However, of the 37 proxy fights that did make it to a vote this year, 27 were won by management; seemingly pretty good for the incumbents. Yet when examined deeper, this statistic further illustrated how willing companies have been to settle with activists. Maybe this statistic shows that companies only held their ground when a win was a near certainty. The average time to settlement, from the first campaign announcement to reaching a settlement, decreased to 56 days. In 2013, that same statistic was 146 days. [5] Together, these trends indicate the strength investors have been able to exert on target companies. An example from this year was when QLik Technologies,a $2.9 billion market cap technology company, held out for only eight days prior to settling with Elliott Management.

Reasons Companies Settle

It is not surprising that companies fear public proxy fights these days as institutional investors and the media are increasingly siding with activists. At a minimum, companies take on heavy uncertainty and risk by engaging with activists. The perception change of activist investors has given the strategy a boost in popularity and media following, causing many moves companies make in proxy fights to hit front-page news. These fights can be damaging to long-term company credibility, especially those with difficult facts to defend. For example, in Starboard’s fight against Yahoo!, Jeff Smith’s team secured four board seats and pushed to remove CEO Marissa Mayer upon completion of the Verizon merger. Other activists have followed a similar playbook with accompanying public disclosures that highlight operational weakness and threaten credibility of existing management and boards of directors.

Beyond avoidance of public scrutiny from activist funds, some companies may settle in order to avoid the distraction and costs associated with a proxy campaign. Many companies targeted by shareholder activists are underperforming, and therefore, it can be alluring to quietly accept one or more activist nominated board members in order to quickly initiate a standstill agreement and force the activist to be silent while management executes existing strategies. This position leaves companies in a vulnerable position.

Risks of Premature Settlement

Disproportionate voting rights

In many settlement scenarios, activists gain outsized influence for the amount of investment put into company stock. Consider a company with 10 board seats. Until a shareholder owns 10% of outstanding shares, it is unreasonable to expect that shareholder should receive one board seat and receive the influence of 1/10th of the board. When a board of directors has even fewer total directors, and an activist owns less than the corresponding percentage of outstanding shares, it is effectively gaining outsized influence to the long-held corporate governance principle of one share, one vote, which continues to be embraced by Nasdaq and NYSE listing standards. For example, in Carl Icahn’s insurgency at Hertz, he helped name the new CEO and three of the seven directors. Icahn reportedly held 9% of Hertz at the time and simultaneously, three non-dissident directors stepped down.

By accepting dissident board nominees, management teams are handing over a disproportionate amount of control—contrary to the one share, one vote principle, at least until the next shareholder meeting. This could introduce a harsh new reality for management teams. At the beginning of Icahn’s activist engagement, he negotiated three board seats in exchange for not running a proxy contest. Two years later, Hertz’s then-CEO, John Tague, was replaced by Kathryn Marinello. Activist engagement preceded CEO departures many other times in 2016.

CEO Turnover Rate after Activist Engagement—A History Lesson

FTI Consulting’s Activism and M&A Solutions group looked at more than 300 activist campaigns between 2012 and 2015 and found that CEOs were three times as likely to be replaced within 12 months after an activist received a board seat compared to our baseline. Even when activists engaged a company and did not receive a board seat, CEOs were twice as likely to be replaced within the same period. Once an activist gains a board seat, his or her influence to find a new shareholder-friendly CEO increases. Our baseline includes a broad array of companies both underperforming and outperforming; therefore, these turnover statistics cannot be credited to activist investors in every case. Regardless, the jump in CEO turnover rate after an activist joins a company’s board should be cause for concern for management teams.

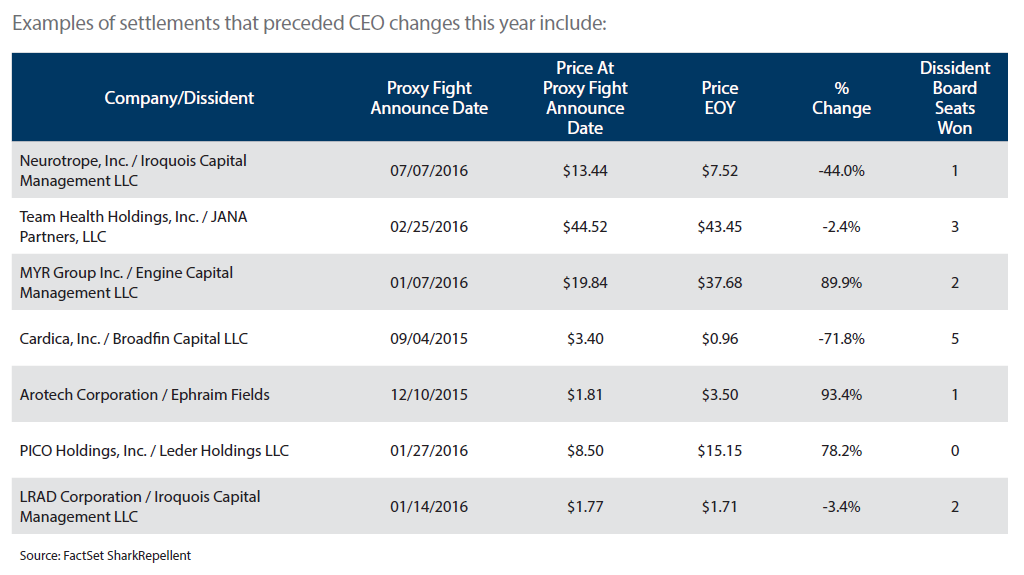

Furthermore, of the 50 companies that negotiated settlement agreements in 2016, 11 had a management change later on in the year. These 11 situations were not all classic activist investor campaigns, however, many of the settlement agreements that CEOs accepted last year preceded their job loss. It is well understood that most management changes at that level are complicated and take time to execute. Private negotiations within the company, and between the activists and companies, may provide more insight into whether the CEO departure was planned even prior to activist engagement.

Short-termism

In the current environment, it is not always clear whether it is institutional investors or activist funds seeking change. The highest profile activist investors often seek out institutional support prior to launching their campaigns. In the 1980s, this type of partnership was unheard of (or at least unspoken).

Today, activist investors depend upon institutional support in campaigns and have been successful in attaining it. However, when it comes to settling with activists, institutional funds have recently held a more pro-management stance. Funds like State Street Global have voiced concern that the shortened period from campaign launch to settlement is causing companies to accept too harsh of settlement terms that do not take into account the prerogative of other shareholders. [6]

Institutional funds like BlackRock and Vanguard have additionally pointed out that the short-term focus of activist investors directly contradicts the best interest of institutional funds whose focus is longer-term. [7] The holding period of hedge funds is often much shorter than that of institutional funds, creating the possibility that the activist influence will negatively impair the institutional fund’s interest in the long-term.

Investors in hedge funds almost always demand relatively rapid returns whereas shareholders of a public company, especially pension funds and institutional investors are more interested in building long-term, sustainable value. This conflict may not immediately materialize, especially during initial negotiations, however, the short-term perspective of the activist might manifest. Often, the demands cited are immediate in nature, such as a sale of assets or subsidiaries, share buybacks or changes in management and/or the board. Activists seldom demand investment in plants, property, and equipment over share buybacks.

Suggestions for Companies

The best defense against activist investors will always be preparedness. Our report on the basic steps companies can take to prepare and defend against activist investors dives deeper into this subject. However, aggressive activist campaigns do not always afford companies enough time to make proper preparations. When a company is in this position, management should remain reluctant to welcome dissident directors onto the board. The increased likelihood of management ouster should stand as encouragement to remove board seats as a bargaining chip in discussions with activists and seek a pro-management outcome.

Activist suggestions are not always negative, so it is in the company’s best interest to listen to activists’ suggestions and, in some cases, adopt recommendations, but not give away board seats as easily as companies have this past year. Companies need to have more confidence in their ability to negotiate with activists in ways that support long-term shareholder value.

Endnotes

1FactSet SharkRepellent.(go back)

2FactSet SharkRepellent.(go back)

3FactSet SharkRepellent.(go back)

4FactSet SharkRepellent.(go back)

5FactSet SharkRepellent.(go back)

6See State Street Press Release Dated 10/10/16: http://newsroom.statestreet.com/press-release/corporate/state-street-global-advisors-calls-corporations-protect-long-term-shareholde(go back)

7Letters from Blackrock and Vanguard: http://www.businessinsider.com/blackrock-ceo-larry-fink-letter-to-sp-500-ceos-2016-2 and https://about.vanguard.com/vanguard-proxy-voting/CEO_Letter_03_02_ext.pdf(go back)

Print

Print