This post is based on a publication from the EY Center for Board Matters.

Today’s boards are navigating disruptive changes, a dynamic geopolitical and regulatory environment, shifting consumer and workforce demographics, and shareholder activist activity amid a push by leading investors for a more long-term strategic focus. These demands highlight the critical role boards play in helping companies manage risk and seize strategic opportunities.

To see how boards are keeping current and strategically aligning board composition to company needs, we reviewed the qualifications and characteristics of independent directors who were elected to Fortune 100 boards for the first time in 2016 (Fortune 100 Class of 2016). We also looked at some of the same data for the Russell 3000, and we highlight those findings at the end of this post.

; but first it’s worth noting that nearly 60% of Fortune 100 companies added at least one independent director following the company’s 2015 annual meeting. These boards added an average of 1.8 directors—and close to one-fifth of these boards added three or more directors.

The Fortune 100 Class of 2016 brings a wide range of strengths into the boardroom

Based on the qualifications highlighted in corporate disclosures, expertise in corporate finance or accounting was most frequently cited. More than half of directors assigned to the audit committee were recognized as financial experts. Companies also highlighted leadership positions in multinational corporations, managing global operations or detailed knowledge of certain markets of particular interest to company strategy. Board experience (public or private) or corporate governance expertise also was commonly cited.

Top 10 skills and expertise of Fortune 100 Class of 2016

The Fortune 100 Class of 2016 enhances gender diversity

Nearly 40% of the Fortune 100 Class of 2016 are women, compared to less than a quarter of incumbents and less than one-fifth of the exiting directors. Newly appointed women directors also are slightly younger than male counterparts (57 compared to 59).

Distribution of Fortune 100 female directorships

Only about half of the Fortune 100 Class of 2016 are current or former CEOs

While experience as a CEO is often cited as a historical first cut for search firms, about half of the Fortune 100 class of 2016 have non-CEO backgrounds as corporate executives or have non-corporate backgrounds (e.g., scientists, academics and former government officials). Ten percent worked at an institutional investor, an experience which was highlighted to communicate the company’s interest in shareholder perspectives. Another 9% were described as bringing experience in innovation or having the capability to drive innovation. It’s also notable that 17% of the entering class appear to be joining a public company board for the first time.

Fortune 100 Class of 2016 director backgrounds (% of directors)

The Fortune 100 Class of 2016 tends to be younger than their director counterparts

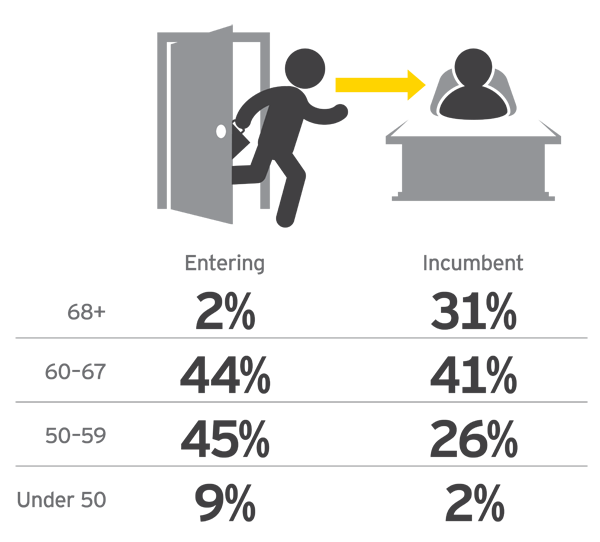

The average age of entering directors was 58, compared to 64 for incumbents and 68 for the exiting group. Although most directors are between 50 and 67, nearly 10% of the entering class was under 50 compared to 1% of incumbent directors. Over half of exiting directors were age 68 or older.

Distribution of Fortune 100 directorships by age

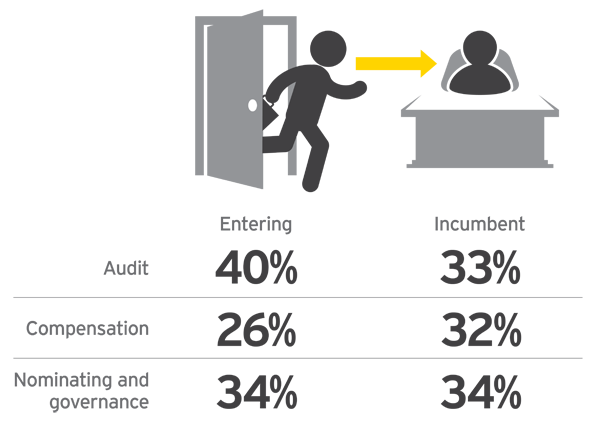

Members of the Fortune 100 Class of 2016 are mainly being added to audit committees

Entering directors are more likely to join the audit committee during their first year on the board. While the committee service of incumbent directors appears to be fairly evenly distributed, the exiting group was most likely to hold positions on the nominating and governance committees.

Distribution of Fortune 100 key committee membership

How does the Russell 3000 Class of 2016 compare?

Significantly fewer Russell 3000 companies added at least one independent director following the company’s 2015 annual meeting, and those that did added fewer independent directors. The Russell 3000 Class of 2016 independent directors tend to be slightly younger than the Fortune 100 Class of 2016, and when it comes to key committee membership, they’re also most likely to join the audit committee in their first year on the board. Just around a quarter is female, however, showing that smaller company boards have a steeper climb ahead to achieve gender parity.

Questions for the nominating and governance committee to consider

- How current and relevant are the skills of incumbent directors to the company’s long-term strategy?

- Given increasing attention to director qualifications, including by shareholder activists, do existing company disclosures effectively communicate the strengths of incumbent directors?

- How diverse is the board—defined as including considerations such as age, gender, race, ethnicity, nationality—in addition to skills and expertise?

- How can the board’s existing succession planning efforts and approach to considering director candidates be enhanced?

Print

Print