Mark Manoff is Americas Vice Chair and Stephen W. Klemash is a Partner with the EY Center for Board Matters. This post is based on a publication from the EY Center for Board Matters by Mr. Manoff and Mr. Klemash.

Amid regulatory and legislative uncertainty, investors remain committed to holding boards, and themselves, to higher levels of accountability, transparency and engagement. The 2017 proxy season is marked by the launch of a historic US stewardship code and the emergence of proxy access as standard practice across large companies.

These developments unite many leading investors behind common governance and stewardship principles and encourage other investors to take a more active approach to stewardship responsibilities. They also grant investors more influence over the companies they own.

Where’s the focus this year?

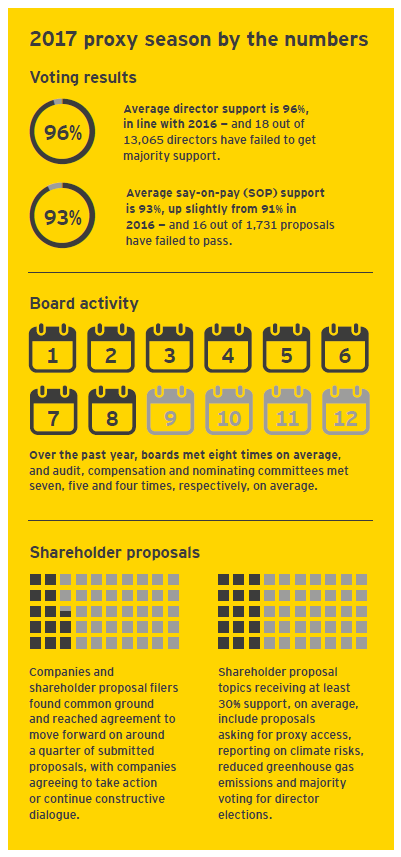

Board diversity and gender pay equity are key themes in 2017. Investors and boards recognize diversity as a critical element to enhancing board effectiveness and corporate talent agendas. Environmental sustainability is also increasingly in the spotlight, with many investors viewing companies’ approaches to climate risk management through the lens of long-term value creation. Some investors are challenging unequal voting structures and virtual shareholder meetings based on signals that those practices may be on the rise. Meanwhile, investor support for director elections and executive pay programs is holding strong as companies continue to enhance their investor communications—both in the proxy and through direct engagement.

This post is based on the EY Center for Board Matters proprietary corporate governance database and ongoing conversations with investors and directors. [1]

Six key board takeaways

1. Leading investors commit to new US stewardship code

Thirty-eight US and international investors with an aggregate of more than $20 trillion invested in the US equity markets are now signatories to the Framework for US Stewardship and Governance (discussed on the Forum here). While such codes are increasingly common in many large global markets, the framework is the first of its kind in the US. [2]

Launched in January 2017 and taking effect in January 2018, this historic, voluntary framework includes a set of stewardship principles for institutional investors, which call for transparency around investors’ philosophy on corporate governance, proxy voting, and engagement guidelines and activities. The principles also encourage investors to attempt to resolve differences with companies through engagement, further instituting direct engagement as a critical component of company-investor relationships.

The framework also unites some of the world’s largest investors behind key corporate governance principles for US-listed companies. As a result, companies may face increased pressure to come in line with leading practices related to board accountability to shareholders, shareholder voting rights, board leadership structures, board effectiveness practices and the alignment of pay with long-term strategy.

Key board takeaway

The framework reflects that key investors are not blindly following the recommendations of proxy advisory firms and may also signal increased investor engagement and transparency around corporate governance. Commitments around investor transparency will likely provide boards a clearer window into investors’ governance views and priorities—which may also increase investor expectations that companies proactively research and understand their perspectives.

2. Proxy access now mainstream across large companies

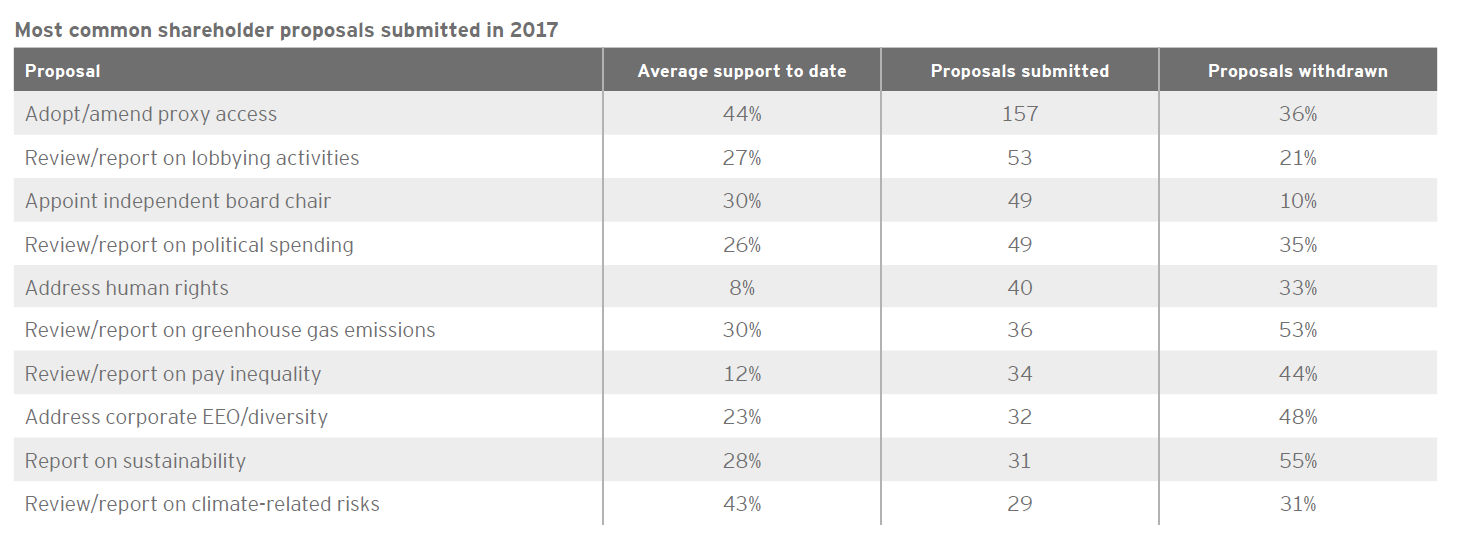

Over the past three years, proxy access—a provision that companies fought against for decades—has become the norm at large companies. Now, 60% of S&P 500 companies have proxy access bylaws, up from less than 1% in 2014. Most proxy access bylaws (88%) allow a group of up to 20 investors that have collectively held at least 3% of the stock for three years to nominate up to 20%–25% of the board (usually providing for at least two nominees).

While this sweeping change has been driven largely by the submission of shareholder proposals, this year a majority of companies facing the proposal have willingly embraced the reform: half of more than 100 companies that received shareholder proposals to adopt proxy access agreed to enact a proxy access bylaw. Notably, shareholders’ ability to submit proxy access proposals is currently being challenged (see 2017 shareholder proposal landscape on page 5). To date, investors have yet to use this new board accountability tool, [3] which many have insisted will serve as a last resort.

Key board takeaway

Investors are armed with a new power to directly influence the boards of the companies they own. Board communications should clearly demonstrate how the skills and experience of the company’s directors make them most capable to oversee the company’s strategy and risks. The company should also explain the board’s approach to board assessments and how it is recruiting diverse directors.

3. Board diversity and gender pay equity emerge as key themes

As the proxy season began, a statue of a girl staring down the Wall Street bull served as a symbol of investors’ commitment to increasing gender diversity in the boardroom and the C-suite. The arrival of the statue launched State Street Global Advisors’ new guidance designed to increase the number of women on corporate boards. [4] The firm is among many leading investors that are prioritizing gender diversity as they engage with and evaluate boards this year.

Just over half of the 55 investors EY spoke with in advance of the proxy season included diversity, particularly gender diversity, as a board priority in 2017, and proposals asking boards to report on and increase their board diversity are among the top shareholder proposals submitted this year. As of 2016, only 18% of S&P 1500 directorships were held by women.

Gender pay equity has also emerged as a key focus, with nearly 30 high-profile companies facing shareholder proposals asking them to report on the pay gap between male and female employees (in some cases across race and ethnicity) and the company’s plan to close that gap. Around half were withdrawn as the companies reached agreements with the proponents.

This year’s campaign, which includes financial services and consumer companies, comes on the heels of a similar shareholder proposal campaign targeting technology companies last year, which resulted in six leading tech giants agreeing to report on gender pay equity.

Key board takeaway

Boards lacking gender diversity that are not taking action to add women directors may face increased opposition when it comes to director re-elections. In addition to strengthening cognitive diversity and, according to numerous studies, enhancing corporate performance, board diversity helps set the tone at the top for the diverse talent the company seeks to attract. And gender pay equity is critical to securing and advancing top performers in an increasingly competitive war on talent. Boards should ensure that they are challenging themselves to recruit diverse directors and actively overseeing how pay programs across the workforce are supporting and enhancing diversity.

4. Environmental sustainability—particularly climate risk—is in the spotlight

Mainstream investors are increasingly outspoken in their view that a company’s integration of environmental risks and opportunities into its strategic planning is an indicator for whether the company is positioned to generate sustainable value over the long term—and climate risk has emerged as a key area of focus. For example, BlackRock and State Street, two of the world’s largest asset managers, have made clear that environmental issues are integral to their stewardship activities and have publicly announced that climate risk will be a focus of their company engagements this year. [5] And in a major shift, Fidelity Investments in 2017 revised its proxy voting guidelines to say it may support shareholder proposals calling for reports on sustainability, renewable energy and environmental impact issues. [6]

Given concern that the expected transition to a low-carbon economy may trigger disruptive changes across a number of industries as well as the global financial system, how companies are managing—and how boards are overseeing—climate-related risks and opportunities is becoming a consistent theme across investor engagement priorities. Nearly a third of the 55 investors we spoke with in advance of the proxy season included climate change as a board priority in 2017. [7]

This year’s shareholder proposal landscape provides a clear window into investors’ evolving views around climate risk. Support for shareholder proposals requesting that companies report on how they are assessing climate risk (e.g., an analysis of financial and strategic impacts resulting from potential carbon restrictions) has climbed from 7% in 2011 to 43% so far in 2017. Notably, so far three of the proposals secured majority support for the first time, including two proposals at energy companies that exceeded 60% support. This marks a historic shift—and aligns investor support with recommendations from the Task Force on Climate-related Financial Disclosures and the World Business Council for Sustainable Development.

Key board takeaway

Environmental sustainability can be a critical part of long-term risk management. Boards should make sure they are integrating company-specific sustainability risks—as well as related opportunities—into oversight of strategy. Board communications should explain how the board is increasing its sustainability expertise and institutionalizing sustainability oversight.

5. Unequal voting structures and virtual shareholder meetings come under fire

Unequal voting structures are under increased scrutiny this year. Following concerns raised by the Council of Institutional Investors, both FTSE Russell and S&P Dow Jones Indices have announced they are conducting consultations regarding the inclusion in their indices of companies with non-voting share classes. [8] “One share, one vote” has long been the mantra of most investors, who believe that voting power in the hands of company insiders can lower board accountability and increase governance-related risks.

Also under scrutiny is the practice of companies holding virtual-only shareholder meetings, which appear to be on the rise with 5% of S&P 500 companies holding such meetings so far this year, up from 3% in 2016. While the number of companies holding virtual meetings is small, the growing trend has alarmed some investors who believe they deny shareholders the opportunity to engage company leaders in-person, and may shield companies from direct accountability and criticism. [9]

Key board takeaway

As scrutiny of unequal voting structures increases, boards of public and IPO-bound companies alike should consider that many investors expect companies to enter the public market with a “one share, one vote” structure, or with meaningful sunset mechanisms in place to dismantle differential voting rights over a limited time. Companies considering virtual-only meetings should think through whether certain factors might create the appearance that the company is insulating itself (e.g., a controversial proposal, “vote no” campaign or other shareholder dissent). Companies may give assurance to some investors by providing for virtual meetings that approximate, as much as possible, the dialogue and participation afforded at an in-person meeting. [footnote no=10]

6. Companies continue to enhance investor communications

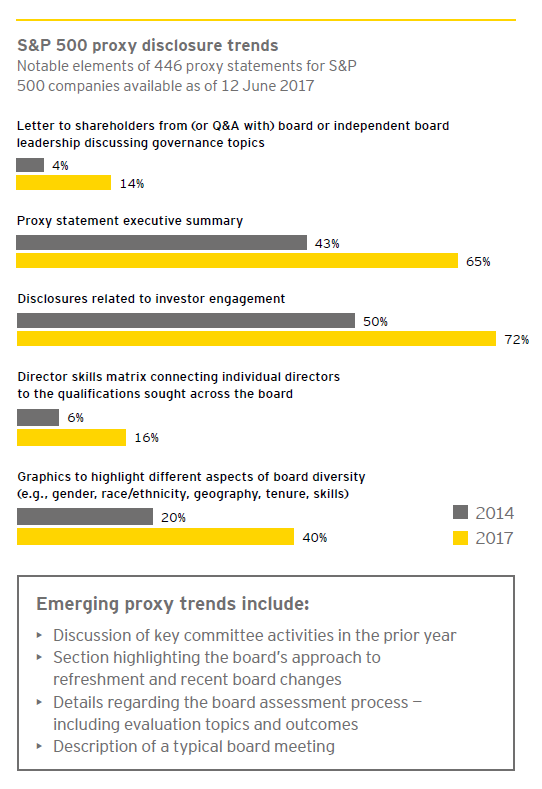

Investor communications continue to evolve as more companies recognize the opportunity to secure investor support and build trust through enhanced proxy statement disclosures and direct engagement with shareholders.

Proxy statements have become communication tools that serve as an extension of corporate engagement efforts and a formal record of a board’s priorities and governance philosophy. Effective proxy statements are improving readability through enhanced formatting and graphics, demonstrating board engagement and effectiveness, and addressing key interests of institutional investors.

Company-investor engagement on governance topics—and disclosure of these efforts in the proxy statement—also continues to grow. The portion of S&P 500 companies disclosing engagement has grown from 6% in 2010 to 72% in 2017. And directors are getting increasingly involved in this engagement. This year, 29% of companies that disclosed engagement with investors noted director involvement. This is up from 25% last year.

Key board takeaway

Proxy disclosures are an efficient way to take the company’s targeted governance message to a broad audience of investors and other stakeholders. Through direct engagement, companies are better positioned to proactively respond to investor concerns and secure investor support. Boards should ensure they are taking advantage of these communication opportunities as appropriate.

2017 shareholder proposal landscape

As the 2017 proxy season concludes, the future of shareholder proposals is uncertain. As part of an effort to roll back financial regulation, Congress is considering changes that would sharply curb the ability of investors to put forward such proposals. In the meantime, shareholder proposals continue to play a leading role in shaping the governance landscape and highlighting both longstanding and emerging areas of focus for a number of investors.

We are tracking more than 850 shareholder proposals submitted for meetings through June 30, 2017, which is around the same level as what we tracked over the same period last year. While proxy access proposals are the most submitted proposal topic for the third year running, proposals on environmental and social topics account for the largest category of proposals submitted, at 49% of the total, up from 41% in 2016 and 43% in 2015. The dominance of these topics is largely driven by proposals related to environmental sustainability (which account for 14% of all shareholder proposal topics submitted), corporate lobbying and political spending, and pay inequality and other corporate diversity topics.

Regulatory and legislative uncertainty reigns

With significant regulatory and policy changes on the table across a number of areas this proxy season, boards and investors alike seek to better understand the potential implications for the capital markets and corporate governance. Among the key policy areas impacting public companies and investors are the potential for tax reform, the future of trade agreements, and the outlook on capital formation. Other topics related more directly to public company reporting include SEC initiatives related to disclosure effectiveness, non-GAAP reporting, enforcement, boardroom diversity disclosures, cybersecurity, and Dodd-Frank rule-making and related repeal efforts (which touch upon the ability of shareholders to file proposals, universal proxies, say-on-pay, clawbacks, SEC rule-making and the regulation of proxy advisory firms, among other things). [footnote no=11] Until there are concrete changes, extraordinary uncertainty remains for companies and investors.

Questions for boards to consider

- How does the board stay informed about key shareholders’ engagement priorities, governance philosophies and views of the company’s governance practices?

- How is the board making sure that director qualifications align with the company’s long-term strategy and key risks, and that regular refreshment increases board diversity and relevant director expertise? How is the board communicating this to investors?

- Are environmental and social considerations integrated into the company’s long-term strategy—and is the company communicating that to investors? How is the board institutionalizing sustainability oversight?

- If the board lacks diversity, how is it actively challenging this status quo? If the board is diverse, how is it promoting inclusiveness to fully leverage cognitive diversity?

- Is the company optimizing the proxy statement as an investor communications tool?

- How does the board oversee the talent agenda and confirm that gender and racial pay equity, workforce diversity and company culture are positioning the company to attract the workforce of the future?

Endnotes

1All data is from EY’s proprietary corporate governance database, which covers more than 3,000 companies listed in the US. Shareholder proposal data is based on meetings through 30 June 2017. Vote results for 2017 are as available for meetings through 2 June. All other data is full-year.(go back)

2See About the Investor Stewardship Group and the Framework for US Stewardship and Governance.(go back)

3In November 2016, an investor publicly announced its intention to use proxy access, but the move was halted when the company argued that the investor was in violation of the company’s bylaw.(go back)

4See Fearless Girl Sends Powerful Message and Enhancing Gender Diversity on Boards, State Street Global Advisors, March 2017.(go back)

5 See EXPLORING ESG: A Practitioner’s Perspective, CEO Larry Fink’s 2017 letter to CEOs, and Engagement priorities for 2017-2018, BlackRock; and Climate Change Risk Oversight Framework for Directors and Active Stewardship, Sustainable Value, State Street Global Advisors.(go back)

6Fidelity Funds’ Proxy Voting Guidelines, January 2017.(go back)

7See 2017 proxy season preview, EY Center for Board Matters, January 2017.(go back)

8Eligibility of Securities with Zero Voting Rights, FTSE Russell, 3 April 2017; S&P Dow Jones Indices Announces a Consultation on the Eligibility of Non-Voting Share Classes, S&P Dow Jones Indices, 3 April 2017. See also Council of Institutional Investors letter to FTSE Russell Governance Board, 24 March 2017.(go back)

9See Comptroller Stringer: Virtual Only Meetings Deprive Shareowners of Important Rights, Stifle Criticism, New York City Comptroller, 2 April 2017, and the Interfaith Center on Corporate Responsibility’s Statement in Support of In-Person Annual Stockholder Meetings, 11 April 2017.(go back)

10See also Guidelines for Protecting and Enhancing Online Shareholder Participation in Annual Meetings, June 2012, created by the Best Practices Working Group for Online Shareholder Participation in Annual Meetings, which includes retail and institutional investors, public company representatives and proxy and legal service providers.(go back)

11See also EY SEC Outlook 2017: What public companies should expect.(go back)

Print

Print

One Comment

It is interesting to read this well done EY summary and analysis of the last proxy season. Adding a section on ” key board takeaways ” and questions for Boards to consider also distinguished this analysis from other descriptive summaries of the highlights of the season .

EY focuses year round on the importance of investor input to companies and how engagement between companies and investors is evolving .

Clearly EY understands the value of shareholder engagement both to companies and the markets.

Thus it is concerning to see EY play such a disengaged role as a member of the Business Roundtable ( BRT) which is so actively attacking the right of investors to file shareholder resolutions . The BRT is promoting what investors call a ” nuclear option” which would eradicate the ability of any investors who file resolutions to do so in the future. This tradition of shareholder engagement goes back to the 1940s but the BRT has decided it is led by special interest groups who have no stake in the markets and are pursuing issues that have no impact on a company’s bottom line.

Thus somehow both governance issues and climate change are seen as irritants to companies when investors file resolutions pursuing them rather than important business issues that often gain majority votes or votes in the 40% range.

Having followed this field for decades, EY understands full well the fatal flaw in the BRT logic . Yet as a prominent member of the 200 member BRT who pay sizable dues, they have not seen fit publicly to correct the BRT arguments . We believe membership in the BRT entails responsibility which should entail insuring EY’S experience and wisdom is shared with BRT leadership and that EY set the public record straight .

If the BRT has its way this will be the last proxy season EY is able to analyze since resolutions will be a thing of the past. With EY’s historical perspective they certainly know this is a tragic loss.